European banks have struggled in recent years to achieve returns that exceed their cost of equity. This is partly because, while focusing on restructuring and regulation since the global financial crisis of 2007–2008, they have collectively failed to price products and services effectively. That may be a source of regret, but it also provides a catalyst for a return to sustainable performance.

To pull themselves out of the slump, banks should shift their focus to the opportunity that pricing represents. Excellent pricing can generate an uplift in revenues of 5% to 15%, which, in the absence of additional costs, goes straight to the bottom line. Better pricing can also offset the impact of regulation, and it can help banks tailor their propositions more effectively to client needs, increasing sales and improving relationships.

Better pricing can be achieved through a strategic approach that leverages data and analytics to incorporate risks and sensitivities. In practice, that means abandoning traditional ways of working informed by cost-based calculations and gut instinct, instead adopting an alternative based on a four-step framework: identification of opportunities that drive value, development of a target pricing model, the building of capabilities, and a practical plan for implementation.

A Challenging Environment

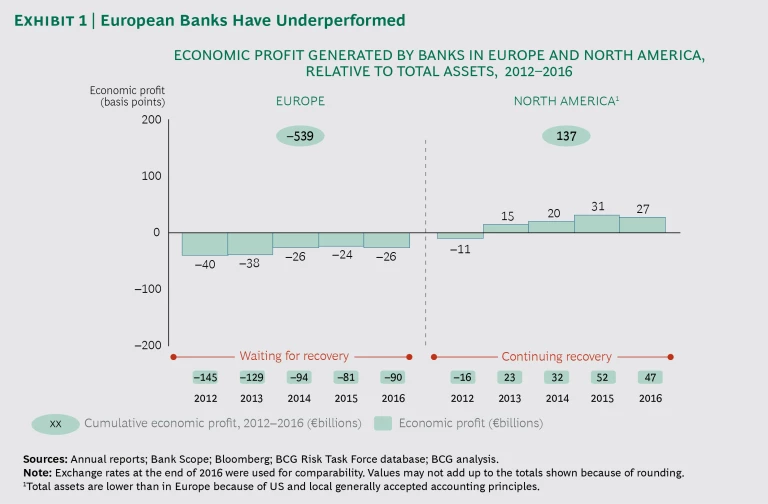

European banks lost money every year from 2012 through 2016. (See Exhibit 1.) In 2016, the average cost of equity for European banks was 12.8%, while the average return was a disappointing 4.1%.

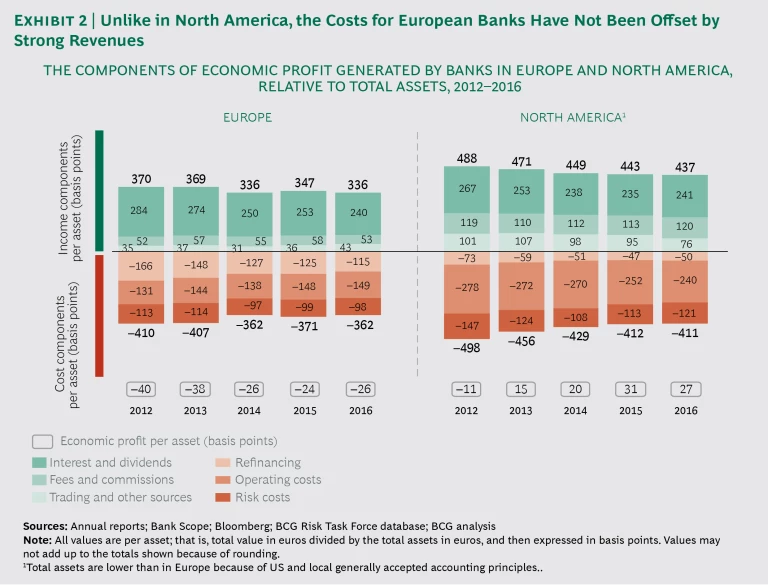

A direct comparison of European banks with their North American peers makes sorry reading for the Europeans. North American banks have priced more effectively, cut risk exposures, and reduced operational and financing costs. (See Global Risk 2017: Staying the Course in Banking , BCG report, March 2017.) European institutions, meanwhile, have operated in a more challenging margin environment in which costs have remained generally high, with only a slight mitigation. Their average combined refinancing, operating, and risk cost per asset in 2016 was 362 basis points, compared with 410 basis points in 2012. (See Exhibit 2.) Most of the reduction came from a decline in financing costs, but that was offset by weaker revenues, which fell to 336 basis points per asset in 2016 from 370 basis points in 2012. North American banks, by contrast, saw costs fall more sharply than revenues.

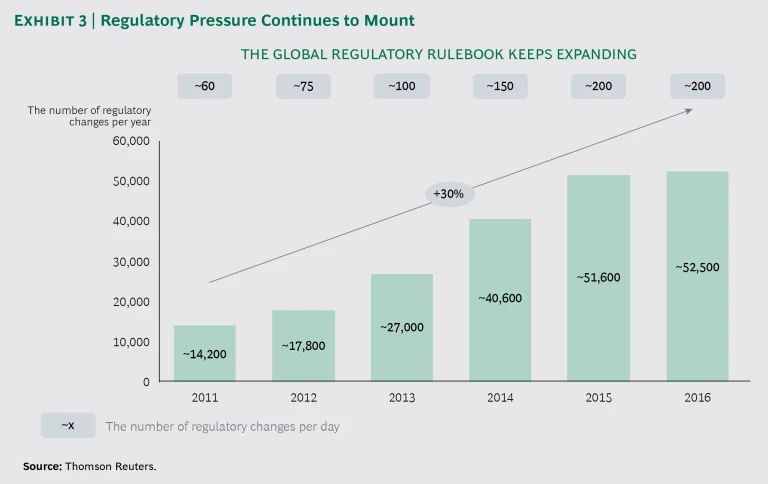

What’s more, European regulatory costs remain significant and are likely to rise. The number of global regulatory changes per day has more than tripled since 2011, and, under the Basel III framework, banks face higher core capital requirements, caps on leverage, and a variety of new derivative rules. (See Exhibit 3.) The latest Basel III revisions, published in December 2017, introduce a new risk-sensitive output floor (which will impact corporate and mortgage lending portfolios) and restrictions on internal models. Both are likely to increase risk-weighted assets and, therefore, capital needs. The Markets in Financial Instruments Directive II (MiFID II), which came into force in Europe in January 2018, will result in more pre- and posttrade transparency and a likely reduction in higher-margin over-the-counter business. According to a German banking association, the cost of implementing MiFID II for local banks will be around €1 billion.

European banks have also faced the challenge of persistently low interest rates. The three-month Euro Interbank Offered Rate (Euribor) contract has been in negative territory since April 2015, and a flat yield curve has produced limited opportunities for maturity transformation. Banks have struggled to pass negative rates on to clients, leading to compressed net interest margins that have become a painful Achilles’ heel for the industry.

Finally, banks must take into account the growing segment of nonbank price providers, such as peer-to-peer lending platforms and fintechs, and adapt to an evolving competitive landscape driven by direct banking and price comparison websites that offer customers an easy way to shop around.

The challenging environment and the failure of European banks to control costs in the face of scant revenue opportunities have meant the difference for many between profit and loss. The result is that the business of banking in Europe has become theoretically unviable, at least in the short term. Furthermore, remediation efforts have failed to convince investors to put up funds: broad measures of European bank equities priced in recent trade are still around the same level they were 20 years ago.

Harnessing Pricing to Value

BCG research suggests that, to close the ROE gap and pay for new regulation, banks must raise the prices of key products, such as corporate loans, by 130 to 220 basis points (depending on the product) over the next two to three years. By 2025, when Basel IV capital requirements will be fully in force, prices will need to rise by another 40 basis points, on average. Many executives, however, are not convinced that pricing is a viable performance lever and suspect that higher prices will erode their competitive position.

What’s more, banks seldom fully understand how pricing impacts individual customers. As a result, a common current practice is to set prices according to customer segments and risk ratings. However, this one-size-fits-all approach is often undermined by leakages—a failure to achieve agreed price levels—or by an inability to respond to changing market conditions.

Banks seldom fully understand how pricing impacts individual customers.

These factors have created inertia, and many European banks are stuck in the analog age. While other industries, such as airlines and telecommunications, have moved to data-driven pricing models, the pricing for bank loans is often left up to a relationship manager’s (RM’s) discretion. In addition, a typical loan pricing formula sets a minimum margin on the basis of a cost-plus strategy, ignoring variables such as the lender’s market position, the borrower’s price sensitivity, and specific product features. The result is wide disparities in prices (up to 300 basis points for similar loans to similar clients) and diminished profits.

BCG sees three key shortfalls impeding banks’ progress in pricing:

- Banks fail to leverage data that would enable them to tailor pricing on the basis of willingness to pay and would lead to increased volumes or higher margins, depending on the price sensitivity of the customer (segment).

- Frontline employees are not provided with the tools, guidance, and coaching necessary to set prices more effectively.

- Clients often feel let down on pricing because the offering either fails to meet their needs or does not include elements they are willing to pay for

Four Steps to Better Pricing

Better pricing does not necessarily mean higher prices, but it does require the ability to differentiate on the basis of customer needs and sensitivities. That means moving away from approaches that include one-size-fits-all, an RM’s instinct, and cost-plus pricing. Instead, a new pricing structure must be built on a systematic definition of opportunities; development of a target pricing model; the building of capabilities; and a sensible plan for implementation.

1. Define the Opportunities

Banks should design new pricing frameworks that are based on a definition, calibrated by the organization’s priorities, of the opportunities likely to drive value. Insight can be gained through a diagnostic and planning process comprising three steps:

- Understand the current position. Banks must see the big picture, understanding how their pricing compares with that of competitors not only in absolute terms but also on the basis of structures and approaches. They should fully appreciate the different ways in which pricing decisions are made and implemented, and the types of data and analysis that are applied.

- Evaluate strengths and gaps. Banks must bring together executives and sales teams to accurately pinpoint areas of strength and weakness, discourage RMs from focusing on volumes, and develop an approach centered on individual products and circumstances.

For example, one bank discovered an unappreciated strength when it was able to add 50 basis points to consumer loan prices without any impact on market share. When another bank set rigidly high prices for RMs in small and midsize enterprises, RMs responded by escalating nearly all of their offers to the regional or headquarters level. Because RMs were incentivized by revenues, they negotiated to get the best prices for clients, rather than the best prices for the bank. The bank resolved the situation with a smart pricing tool that set specific prices for individual clients, with a clear limit on negotiation by RMs and no process for escalation.

- Set a target. It’s important from an early stage to set a goal that reflects an appreciation of the size of the opportunity and to identify levers to reach that goal in each product and segment.

Better pricing does not necessarily mean higher prices, but it does require the ability to differentiate on the basis of customer needs.

2. Develop a Target Pricing Model

Banks with the best pricing capabilities are willing to take their time and develop a strategic approach backed by research and reflection. A successful pricing framework defines sensitivity to prices and willingness to pay and is necessarily underpinned by insight into both the customer and the relationship. Banks should leverage internal and external data (such as conversion data, competitor data, and structured and unstructured client and market feedback), as well as market research, in order to provide an empirical basis for their understanding and develop a target pricing model.

Before launching a new pricing model, it makes sense to run deep dives and analyses in order to optimize inputs and create scalable solutions. The data from pilots, along with qualitative feedback from employees and customers, should be fed back into models to improve the price and proposition structure. In one example of a successful pilot, a leading European bank equipped 15 RMs with the prototype of a new pricing model, which they ran for three months. The results of that trial were then used to evaluate impact and fine-tune the model, the tools, and the processes. In an environment with relatively fixed prices, such as consumer lending, banks may set up a controlled environment using A-B testing to compare a new model with current practices.

Over time, models and processes can be refined, leading to directed investment, training programs, and, eventually, improved realization. (See the sidebar.) In addition, if banks effectively measure and communicate pilot results, they stand to benefit from improved stakeholder buy-in, which often leads to a quick financial rebate that can help fund a larger pricing transformation.

Three Levers to Maximize Pricing Value

Banks can use three levers, either independently or in combination, to maximize pricing value.

Optimize the Price and Proposition Structure

Product price and proposition structures should reflect customers’ perception of value. In designing these structures, banks should make efforts to:

- Understand their own and competitors’ pricing structures (including costs, risks, and the role of all price components in customer value perception), as well as customers’ willingness to pay for products and features.

- Calibrate proposition pricing to value, adding or removing features according to willingness to pay.

- Use a product lineup, bundling, or both, and offer fixed or variable rates depending on the bundle. Daily banking and investments are prime areas to focus on.

- Optimize alignment between price and value on the basis of market research and modeling to understand variations in client needs and behaviors.

For example, a German bank wanted to improve the profitability of its daily banking client base. Rather than raise prices across the board, it decided to incentivize customer behavior, which carried less risk of churn. The bank designed a new product range, offering premium products at a lower price to customers exhibiting “premium” behavior (i.e., based on customer segment, number of transactions). A nonpremium variation was offered at a higher price. In addition, the bank adjusted a number of secondary fees, perceived as less important by core client segments. The new proposition helped the bank cut costs (resulting from fewer expensive ATM transactions, for instance) and stimulated activity among core clients, driving revenue growth and client satisfaction.

Differentiate Prices to Maximize Revenues and Profit

Not all clients are equally price sensitive, and marginal costs and contribution margin vary by product and client. For example, transaction size is often correlated with price sensitivity—generally the larger the transaction, the more sensitive the customer. Segmentation based on sensitivity, sometimes down to the level of the individual, is key.

- Banks that understand marginal costs and the elasticity of demand can optimize pricing, enhancing profit at constant volume or vice versa. Generally, a higher price generates wider margins and lower volumes, while a lower price has the opposite effect. But there is always an optimal price, which will vary by customer segment.

- The challenge is complex because elasticity may be impacted by several factors, including transaction size, maturity, risk class, region and client characteristics. Banks should leverage market research and historical customer data to predict price sensitivity and improve pricing grids, particularly when pricing consumer loans, mortgages, and term deposits, which are most susceptible to these variables.

For example, a southern European bank wanted to optimize pricing in its consumer lending business. It first identified five relevant dimensions of its pricing grid that would impact contribution margin, elasticity, or both, using conversion analysis and conjoint research to determine elasticity per grid cell. The results were applied to develop a model that set prices for each cell in the grid, aiming to achieve maximum profit at a given volume ambition. The bank was able to achieve a 4% uplift in revenues.

Improve Realization

Banks must turn intention into action, realizing prices through more effective discounts and promotions and improved billing discipline. A key element is to minimize technical and commercial leakage, often driven, respectively, by systemic issues and entrenched ways of working.

- Tackling commercial leakage is a change management challenge. Banks can ensure that sales forces act differently through various means, including more robust guidance on discounting (better processes, tools, training, and monitoring), adjusted incentives, and discount capping. A one-off repricing may also be necessary. Tools can suggest negotiating steps, target price, and profitability by product, as well as the cross-sell required to balance discounts.

- Banks should ensure that existing schemes are billed and complied with on the basis of product or service eligibility. A common example in this context is the 30-year-old client who still enjoys the terms and conditions offered to students. Often there are no processes to check that what should be billed is billed.

For example, a Benelux institution that wanted to improve pricing in commercial banking developed a new pricing model on the basis of market prices rather than a cost-plus approach. Inputs included quantitative assessment of historically realized prices and qualitative insight from experienced relationship managers. The new pricing model and process were tested through pilots, which resulted in an additional spread of 20 basis points on newly originated loans. Relationship managers said the new model also provided better guidance and boosted their confidence in negotiating with clients.

3. Build Capabilities and the Team

Banks must invest in the right tools and methodologies to make pricing decisions. They should also develop organizational structures and governance to support the pricing function as a strategic partner for the business.

Excellent pricing is predicated on a willingness to adopt advanced analytics that offer insight into price realization, willingness to pay, elasticity, competitive intensity, and leakage. Where banks adopt a price recommendation engine for mortgages, for example, they can leverage analysis of quote-to-conversion data to determine price elasticity. With this information, they can make an informed tradeoff between price and volume and optimize across the pricing grid, increasing prices where elasticity is low and cutting prices where elasticity is high.

Excellent pricing is predicated on a willingness to adopt advanced analytics.

Banks should use internal and external data to continuously improve models and processes, and to help machines “learn” to improve decision making and processes. From an organizational perspective, they should be clear on decision-making frameworks, including identifying who makes the decisions, how frequently they are made, and what information informs them. As part of that effort, a dedicated pricing team is critical. An effective team can formulate strategy, lead decision making on pricing dimensions, sharpen pricing capabilities, and bring expertise to complex decisions. The team should also provide checks and balances for the sales function.

For the pricing team to be successful, it must be given defined roles and responsibilities and have access to the processes and technologies required to prepare, make, and track pricing decisions. The four fundamental building blocks for such a framework are as follows:

- Structure. The structure must take into account the required degree of centralization, the organization’s operational structure (pricing can be aligned with a product, business, customer type, region, or activity), and reporting, which, for example, may comprise lines to the CEO, sales executives, or the finance department.

- Decision Rights and Influence. Management must ensure that decision rights are transparent and based on cross-functional inputs. If cross-functional teams cannot make a particular decision, then appropriate escalation paths should be defined.

- Skills and Capabilities. The pricing function requires hard skills to gather and analyze data and soft skills to understand client motivations and to communicate and engage with internal stakeholders, such as sales, marketing, risk, and finance. Training programs that adopt a “learn, do, teach” approach are optimal. In such programs, pricing specialists master models and techniques, eventually becoming pricing coaches who can transmit their knowledge to the broader organization. Sales teams that understand pricing and its impact, and dare to price at the right level, will find that they are better able to have more informed conversations with clients, thus helping to build long-term relationships.

- Size. Banks must identify the right size of the pricing team, which will be contingent on the number of active business lines and their revenues, channels, and markets. BCG’s benchmarking studies indicate that successful pricing organizations have at least two to three full-time pricing employees per $1 billion in revenues, split between the pricing team and business lines. (See “Building a Strategic Pricing Organization,” BCG article, July 2017.)

4. Roll Out Across the Organization

Banks should roll out new pricing frameworks incrementally; full implementation is likely to be contingent on starting position and a realistic assessment of implementation timelines. However, first steps are critical—a move in the wrong direction can lead to expensive U-turns or lost credibility in the value of the pricing lever. Conversely, a sure first step increases the chance of long-term success. Experience suggests that successful change programs align infrastructure upgrades with the evolving capabilities of teams, delivered product by product rather than all at once.

Banks must put in place the right governance, processes, and infrastructure to support diagnostics and decision making. They must provide training, ensuring that people’s skills are continuously upgraded, and they must secure a clear commitment from the C-suite to engage on an ongoing basis, so that pricing becomes a key and transparent element of the business process.

Developing pricing expertise will help European banks restore returns on equity to sustainable levels. However, the path to transformation is challenging and requires a dedicated and strategic approach. Banks must develop a deep understanding of their current capabilities and the wider market, and conduct rigorous design and piloting of potential solutions. By doing so, they can make the right investments in tools and organizational capabilities, so that pricing enables revenue growth and delivers more value for clients.