Two critical US policy initiatives aimed at the automotive sector could fundamentally disrupt the industry’s value chains in North America and beyond. The first is the Trump Administration’s effort to renegotiate the North American Free Trade Agreement (NAFTA). The second is an investigation under Section 232 of the Trade Expansion Act of 1962 that could determine that the US trade deficit in autos represents a national security threat.

The combined impact of the two initiatives would be massive. Stringent new content requirements under a renegotiated NAFTA could force automotive OEMs and their suppliers into costlier facilities at a time when capacity utilization is near historic highs. At the same time, calculated on the basis of 2017 trade flows, tariffs as high as 25% on imported cars and auto parts under the Section 232 action would cost the industry more than $60 billion per year. And should automakers pass on the tariff costs, the impact on consumers would also be significant. In 2017, US production met only some 53% of total domestic sales of 17 million light vehicles. The price of a US-built car with typical features would rise on average by $2,000, while the price of an imported car would leap by $5,800, according to the American Automotive Policy Council.

The new rules will hit the North American facilities of all industry players—those headquartered in the US as well as elsewhere. Exactly how and to what degree the changes will affect them depends on the companies’ manufacturing and supply base footprints. That means that these policy moves will directly change the relative competitiveness of automotive OEMs and suppliers. It is, therefore, imperative that automotive company leaders understand these two actions and how they could interact to shape the future of their industry in North America.

Furthermore, the US automotive manufacturing base will likely suffer knock-on effects. The higher costs of parts and materials due to tariffs could make the US a less attractive location for export production. The US trade actions will also almost certainly invite retaliation by other nations, diminishing the competitiveness of US-built products abroad. Already, we have seen this in the retaliatory responses of key trading partners to the US imposition of tariffs on steel and aluminum.

In addition, the US is pursuing these two automotive policy initiatives against the backdrop of an escalating trade war between the US and China. Even though US-China automotive trade is dwarfed by trade in sectors such as electronics and machinery, both countries have included auto products in their tariff lists. This article does not analyze the effects of this dynamic, but they should be considered by automotive companies whose products rely directly or indirectly on US-China trade flows.

The Impact of NAFTA Changes

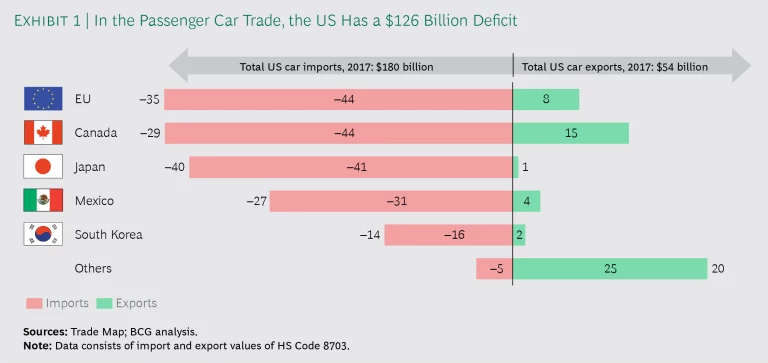

The US registered a $126 billion trade deficit in the passenger vehicle trade, primarily with the EU, Canada, Japan, and Mexico. (See Exhibit 1.) This is why the automotive sector has been one of the thorniest topics, ever since NAFTA talks among the US, Canada, and Mexico began in August 2017.

Soon after the talks began, the US proposed that only vehicles with 50% US content by value be allowed to enter the US duty-free. Under current NAFTA rules, vehicles with at least 62.5% “regional value content” (RVC)—content from any NAFTA country—enter the US duty-free. For automotive parts, the RVC requirement is 60%.

The US dropped that demand after months of firm resistance from Mexico and Canada. Now, Mexico and the US have agreed on a complex set of proposed rules that would raise the RVC from the current 62.5% to 75%, determined on the basis of specific classes of components, and would stipulate that a certain percentage of the RVC must be produced in facilities where workers earn relatively high wages—namely, $16 per hour. Autos and parts that fail to meet these content thresholds would not be allowed to move among the NAFTA countries duty-free and would instead be subject to tariffs.

The NAFTA talks are taking longer than many people expected. The three countries have missed several self-imposed deadlines for concluding negotiations in 2017 and in the spring of 2018. After pausing for the Mexican national elections of July 2018, the US and Mexico resumed negotiations. At the end of August, the US and Mexico announced an agreement, and Canada was to return to the talks.

As the negotiations have moved along, the firmness of Canada’s resolve has surprised some observers. Prime Minister Justin Trudeau went as far as to say, “No NAFTA is better than a bad deal, and we’ve made that very clear to the president.” On the US side, there is still a possibility of no deal: President Donald Trump has said repeatedly that if US negotiators cannot get an agreement he likes, he will pull the US out of NAFTA. Indeed, following the August announcement of the agreement with Mexico, President Trump said he would try to initiate the revocation of NAFTA.

For the North American automotive industry, fallout from the tough new trade rules or US withdrawal from NAFTA might not—by itself—be that serious. Because all three countries belong to the World Trade Organization (WTO), they would, in theory, apply so-called most-favored-nation tariffs on noncompliant autos and parts. These are the tariffs that each member country charges all other WTO members. But the three NAFTA countries have very different WTO tariff levels for vehicles: Mexico assesses a 31% import duty; Canada, 6%. The US assesses a duty of only 2.5% on passenger vehicles but on light trucks, including pickups, 25%. In other words, if an OEM or supplier finds that, from a supply chain perspective, it’s too complicated or expensive to comply with the new RVC rules for passenger cars and most parts, it would simply have to pay a 2.5% duty to continue supplying the US market from its Canadian or Mexican factories. But for light trucks, the 25% penalty would be significant. (See “ Winners and Losers in a Post-NAFTA World ,” BCG article, January 2018.)

Adding the Impact of the Section 232 Investigation

The situation would get more complicated should NAFTA changes be combined with new US policies that result from the Section 232 investigation. Section 232, a previously little-used part of US trade law, allows the US to impose tariffs on products deemed essential to US national security to protect domestic sources of supply for military production. A healthy auto industry, under this argument, is an essential element of the defense industrial base. When, early in 2018, the Trump Administration used this provision to impose tariffs of 25% on steel and 10% on aluminum, many observers assumed that the required US Department of Commerce investigation would determine that these metals were not essential to national security—or that Canada, Mexico, and the EU would be exempt because they are long-time allies that pose no threat to the US. Those assumptions proved wrong. The US imposed the tariffs on steel and aluminum, and now companies throughout industrial supply chains are feeling the second- and third-order effects. (See “ What the Trump Tariffs Mean for Global Business ,” BCG article, March 2018.)

It’s still possible that the Department of Commerce could conclude that the US has sufficient automotive production capacity to meet any imaginable defense need. In fact, the US produced 11 million passenger cars in 2017, and 2 million of them were exported. It is also possible that Commerce could decide that no auto tariffs should hit Canada and Mexico because they are allies and because they are elements of an integrated North American automotive manufacturing supply chain. But because neither of these arguments prevailed in the case of steel and aluminum, we think it important to consider the likelihood of higher US tariffs on Canadian and Mexican cars and auto parts.

Exactly what the new tariff regime would look like is not yet clear. But President Trump has consistently stated that he would like to see tariffs of 20% or 25% on autos and that he does not like that WTO tariff rates are not reciprocal among member countries. Reciprocity would mean a US tariff of 31% on autos from Mexico, 6% on those from Canada, and 10% on those from the EU. The impact of double-digit tariffs would be significant throughout the value chain. Imported vehicles and parts would be affected almost immediately. OEMs and their tier one and tier two suppliers would be under pressure to shift sources of supply and manufacturing locations. Car buyers wanting to stay within their budgets would face a choice: paying higher sticker prices for their vehicles or choosing vehicles that are less expensive or are fitted with less optional equipment. Their choices will, of course, have second-order effects on auto dealerships, lenders, and others in the value chain.

Four Scenarios for the Auto Industry

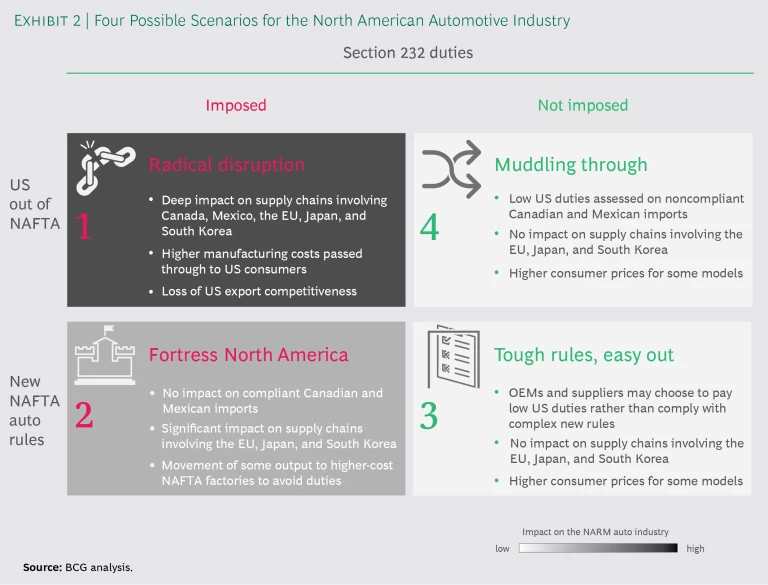

We have developed four scenarios that illustrate the potential impact of changes along two dimensions of the US automotive trade regime. The two dimensions: NAFTA is renegotiated with new auto rules, compared with the US pulls out of NAFTA; and Section 232 tariffs are imposed (reciprocal or fixed at 20% or 25%), compared with Section 232 tariffs are not imposed because the Department of Commerce concludes that insufficient domestic automotive production capacity is not a threat to US national security. (See Exhibit 2.)

Scenario 1, which we call radical disruption, combines high tariffs under Section 232 and the elimination of the possibility of avoiding tariffs by complying with NAFTA rules. This outcome would prove most difficult for the industry. The policy hammer would deeply and quickly hit supply chains because, in their effort to avoid paying the tariffs, OEMs and parts vendors would race to comply with the new content rules. The global nature of the Section 232 tariffs would also affect vehicles and parts flows from critical non-NAFTA auto-trading partners, such as the EU, Japan, and South Korea. Higher US manufacturing costs would translate into higher car prices for domestic consumers and would weaken US competitiveness in export markets.

We call Scenario 2 fortress North America. It assumes that there is a Section 232 action but that Canada and Mexico are exempt from auto tariffs because they accept stricter NAFTA rules related to RVC and other provisions. Compliance would be difficult for the auto industry under this scenario, and some production would move to higher-cost factories in order to avoid tariffs. But overall, it would not be as much of a challenge for the North American industry because most OEMs and tier one auto suppliers have manufacturing facilities in all three countries. Moreover, much of that current production already complies with the proposed new NAFTA auto rules. Vehicle and parts flows from the EU, Japan, South Korea, and all other countries would of course be affected.

Scenario 3, “tough rules, easy out,” assumes that the Section 232 tariffs are not imposed but that NAFTA is renegotiated along the lines of the US proposals outlined above. Under this scenario, a fairly high percentage of autos currently traded within North America would still meet the new RVC requirements, and the US would levy its WTO tariff only on passenger cars that are not in compliance. As we noted above, rather than alter their supply chains to meet the content requirements, some automakers could simply decide to pay the low 2.5% tariff on passenger vehicles—or, generally, even lower tariffs on auto parts—and move on. This, of course, would not achieve the Trump Administration’s stated policy objectives of substantially narrowing the US trade deficit with Mexico and Canada. This scenario represents no change from the status quo for trade flows from other nations. But it will lead to higher US prices for some car models.

Under Scenario 4, “muddling through,” we assume that President Trump pulls the US out of NAFTA but that the Section 232 action is unsuccessful and high duties are not imposed. The US would be left with no legal grounds for imposing tariffs higher than those under its WTO commitments. Although worse than the current status quo, because only low US tariffs under the WTO would apply to cars and auto parts, this scenario would be less damaging to the passenger car industry than the others. The story for pickups and other light trucks would be quite different, as mentioned above. OEMs such as GM, Chrysler, and Toyota all have significant pickup-truck assembly operations in Mexico that mainly serve the US market. Light trucks imported from those assembly plants would face the 25% US WTO tariff. A broader risk with this scenario is that the US would not achieve its policy objectives: even if pickup production were to shift to the US, there would still be a huge US trade deficit in passenger cars, and there is a significant risk that the US would attempt to impose additional trade restrictions—even disregarding rules of the WTO, an organization that President Trump has often criticized. US consumers would pay higher prices for some models.

When to Expect Real Change

With the US and Mexico having reached a tentative agreement, there is no question that the trade rules for autos will change. When the new rules will be implemented remains unclear, given the new Mexican administration and the new US Congress that will result from the midterm elections in November 2018.

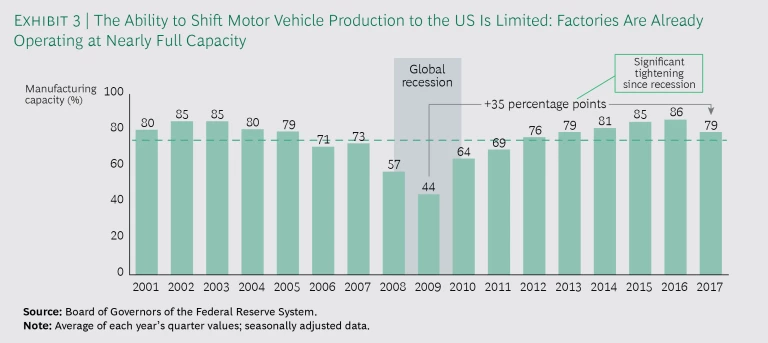

What is questionable is whether these policies can translate into sharply higher US automotive production and employment increases. OEM vehicle assembly facilities and the automotive supply base are operating at nearly full capacity. In recent years, in fact, utilization has been running at levels similar to the peak prior to the 2008–2009 recession. (See Exhibit 3.)

There are also labor constraints. In the aggregate, US unemployment has been hovering around 4%, a level generally not seen since the 1960s. That, according to many economists, is essentially full employment. So even if plant capacity were available in the automotive supply chain, there would be few available workers to increase production. The combination of these capacity and labor constraints would make it very difficult for car and parts manufacturers to quickly shift production to the US.

Automotive Manufacturers Should Prepare

Given the impending policy changes and the limited available capacity in the auto industrial base, companies must get ready quickly. (See “ Three Things CEOs Should Do Now to Prepare for the New NAFTA ,” BCG article, November 2017.) Companies should take the following actions:

- Assess the value chain to identify risks and opportunities. Automotive manufacturers must take a hard analytical look at not only their own manufacturing and supply footprints but also those of their competitors. Given each OEM’s and supplier’s footprint and supply chain, abrupt trade policy changes will shift the competitive landscape through the differentiated impact they will have on each company. Thus, it is essential for companies to understand not just the absolute impact of policy changes on themselves but also the relative impact vis-à-vis key competitors and suppliers.

- Develop a response playbook. Prepare an action plan for each scenario and be ready to move quickly. The policy outcomes we’ve described should be built into strategic and operational plans. Companies that identify critical signposts will know when it is time to execute contingency plans. Companies’ boards, investors, customers, and suppliers will all be asking how ready the companies are to deal with these changes. Those that can demonstrate solid analysis and planning will boost their stakeholders’ confidence.

- Work to influence policy. Many companies are more actively expressing their concerns to decision makers and key stakeholders as the reality of the new trade order settles in. Companies should not be restrained in their outreach. Furthermore, they should seek like-minded allies with whom they can join forces. The fact base compiled by assessing value chains will provide critical background for framing economic and political discussions with key stakeholders.

As we have argued, there is little merit in wait-and-see approaches. Whether the issue is NAFTA, escalating rounds of new tariff challenges by the US and China, tense rhetoric between the US and the EU, or the recently renegotiated US–South Korea free-trade agreement, the automotive sector will always be on the table of new US trade initiatives. Indeed, President Trump has said, “You know, the cars are the big one…. We can talk steel. We talk everything. The big thing is cars.” It is clear that the Trump Administration is on a mission to change the status quo—fast. We believe that as the rules of the game continue to shift, only automotive companies that take a proactive approach will be positioned to preserve and enhance their long-term competitive advantage and ability to create value.