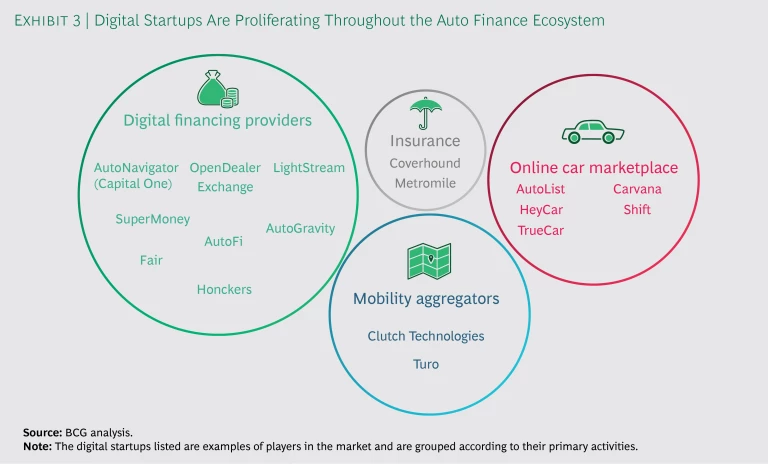

Innovative digital startups are reshaping the challenging car shopping and financing process into a quick and easy experience for customers. The changes, which have already started to take root, will create an auto finance ecosystem in which digital aggregators increasingly control the sales and financing process and specialized players occupy the various parts of the value chain.

These developments will have major implications for the existing order—car dealerships, banks, and original equipment manufacturers (OEMs) and their financing subsidiaries. As the balance of power shifts in favor of aggregators, incumbents will need to embrace digitization or risk being left behind.

The Twilight of Analog Car Buying

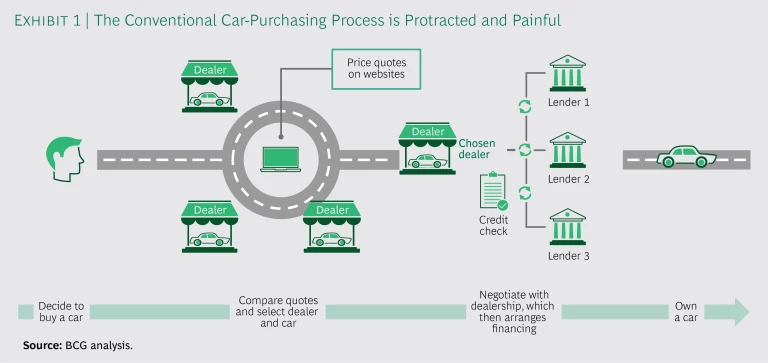

For many people, buying a car is a series of hassles. It requires scouting a car at a dealer, getting a first quote, and comparing it with quotes from other dealers and websites—then returning to the dealer and negotiating again. Once the price is agreed upon, there’s financing to arrange. The dealer sends the specifications out to a few lenders and waits to hear back. When the offers come in, the dealer selects the one that’s most profitable for the dealership while meeting the consumer’s minimum requirements. (See Exhibit 1.)

More than 90% of auto finance transactions go through this protracted process. With 85% of new cars and 50% of used cars currently purchased with financing, that adds up to a great many cars.

The advent of digital tools that include platforms, application programming interfaces, and authentication technologies may soon make that process a thing of the past. Aggregator platforms are developing direct-to-consumer channels that will allow buyers to shop online for loans and get them approved before going to the dealership. And fintech lenders and peer-to-peer lending platforms provide new financing options that range from personalized interest rates and variable terms to completely new ownership models such as shared leasing and car subscriptions.

Seizing the opportunity, digital startups have already begun making their mark across the value chain. Bolstered by some $17 billion from investors, many are setting their sights on the financing space.

Established players, too, are getting into the act. Ford, for example, is developing the platform Ready.Shop.Go. to move the entire buying process online. Prospective customers will be able to find a car, view pricing and incentives, schedule a test drive, apply for financing, estimate trade-in values, and lock in a deal—all before ever setting foot in a showroom.

In this accelerated customer journey, credit approvals will take minutes instead of hours or days.

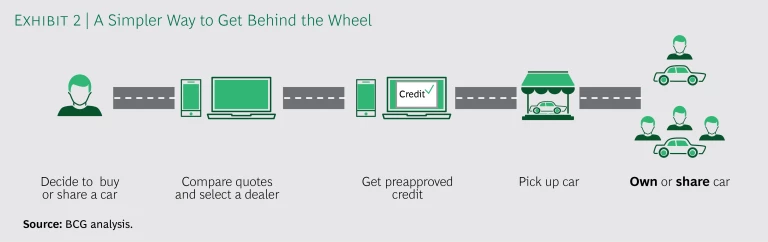

All this activity will translate into a more transparent and streamlined car-buying process that eliminates obstacles such as insufficient information and long wait times. (See Exhibit 2.) In this accelerated customer journey, credit approvals will take minutes instead of hours or days. And finalization will take place via smartphone, with limited risk of financial fraud or identity theft.

Redefining the Balance of Power

The new auto finance ecosystem will affect the position of each group of incumbents differently, while providing opportunities for new entrants. Here, in our view, is how this shift will play out among the major stakeholders.

Dealerships

As car buyers increasingly begin their purchase and financing journey with new aggregator platforms, dealerships will lose profits in both the sales and the financing of cars. Dealer groups and large individual dealerships can still succeed, but only if they build their own digital direct-to-consumer sales channels and team up with aggregator platforms. This will likely get them more qualified leads, to the disadvantage of the many smaller dealerships that lack their own digital sales channel. The more cars these large dealerships arrange financing for, the larger their commission from the bank or financing company that is providing the loan.

Even for dealerships that successfully make these adjustments, significant challenges remain. If car purchases move to online channels and auto platforms, traditional dealerships will come under serious threat. This is a real possibility, given that Ford and other OEMs, including Mercedes and BMW, are planning to build their own direct-sales models.

Banks

In all likelihood, aggregators will ultimately drive down lenders’ margins. Given how difficult it is to fight aggregators, teaming up with them is clearly the easier option for banks. Aggregator platforms will allow banks to increase or decrease sales volumes as they wish. Using a few platforms is a much more flexible way of managing portfolio size than moving the sales force in thousands of branches.

Although it may be difficult to negate the power of aggregators, banks have an important weapon at their disposal: data, which they could leverage to develop a proprietary sales channel. This strategy would require them to build a platform with flexible interfaces to provide customers with a seamless process. Capital One’s Auto Navigator is a good example. Its proprietary platform enables customers to prequalify and personalize their auto financing in minutes and purchase a car at one of more than 12,000 participating dealers.

Moving online, however, is unlikely to be a panacea for banks. It requires significant investment in new technologies. At the same time, it can greatly expand the potential reach of regional midsize players, which would increase competition and margin pressures in some markets: the more banks that follow this path, the lower the chance of success.

OEMs and Captive Banks

Car manufacturers and their finance subsidiaries are in a better position than banks to prosper in the new landscape. Unlike other lenders, these captive banks have contact with the customer at the point of sale. They also have more data, which allows them to develop a deeper understanding of their customers. Assuming they develop sufficient analytic capabilities, they can analyze patterns to identify follow-on and cross-selling opportunities and to manage attrition. In addition, the aggregator platforms that threaten their business can actually be of service to captive banks by providing visibility into financing offers from competitors. For the first time, captives can use this information to convert customers.

Captives have another advantage: flexibility. They don’t have to finance loans all the time, just when it best supports the OEM’s sales targets. If the manufacturer is able to sell most of its cars with low leasing or low loan costs, the captive can use financing opportunistically, as a customer acquisition tool. From an OEM’s perspective, a large captive balance sheet is not necessarily desirable because it can have a negative impact on the OEM’s credit rating and create a regulatory burden as well. Instead of financing loans itself, the OEM can provide financing through a third-party lender. Alternatively, it can use funding from the sales function to lower the car’s cost of financing.

Despite these advantages, captives still need to develop new approaches if they want to be prepared for changes in the auto financing landscape. Not that they need convincing: they have already felt firsthand the effects of the rise of ride sharing and electric vehicles.

Ensuring a Position in the New World of Auto Finance

Much about how the emerging auto finance ecosystem will actually work remains to be seen. In our view, the major catalyst will be new aggregator or direct-player platforms, which are likely to replace dealerships as the initial interaction point for customers. (See Exhibit 3.) Regardless of whether the platform is focused on loans, car leasing, or used cars, we’re likely to see only a few winners and many losers in each part of the value chain.

No matter where they sit in the ecosystem, dealerships, banks, and captive banks need to rethink key elements of their business models or risk disintermediation. These incumbent players must address three critical issues: what their role will be in the new ecosystem, how they will create value for long-term success, and what platform strategy will work best for their business.

No matter where they sit in the ecosystem, dealerships, banks, and captive banks need to rethink key elements of their business models.

Determine Your Role in the New Ecosystem

Every player will need to adapt or at least fine-tune its current position. These decisions will depend in part on the company’s current capabilities, its customers’ expectations, and, importantly, how much it is able to invest.

Ecosystem gatekeeper is, of course, the most desirable position because it means having greatest control over the process and the client relationship. Traditionally, OEMs held this position in the value chain. To keep it in the face of aggregators and other digital attackers, they will need to adapt to shifting customer behavior (by expanding their offerings to include car sharing, for example). This means they must continue to aggressively move toward becoming mobility players by investing in car sharing, ride hailing, and self-driving taxis, among other things.

A traditional bank won’t be able to satisfy the new gatekeeper requirements because it lacks broad customer access. But it can try to expand its position and power by making itself central to the car-buying process. To improve access to clients, banks will need to become part of established digital platforms or set up their own (with dealership networks, for example, or online platforms) and comprehensively enhance their digital and analytical capabilities.

The options for dealerships will depend on their size and digital capabilities. Larger, digitally savvy dealerships may be suitable as gatekeepers for clients about whom they have data. This role would allow them to meet the needs of those customers better than other players can. Some dealerships may be better suited occupying a smaller spot in the ecosystem—such as the place where people pick up their cars.

Determine How to Create Long-term Value

Each company needs to identify the part or parts of the value chain it realistically wishes to occupy in the future. Only companies that create compelling value for customers in the long term will succeed. Data is the key. Each player needs to consistently collect, process, and use data to better understand its customers and to automate and digitize processes as much as possible.

As the type of data available will vary among industry players, the value provided by that data will vary as well. OEMs and large dealerships have data that enables them to address customer needs throughout the buying process and manage the overall client relationship, which might allow them to occupy large parts of the value chain. Banks have a better view of the credit risk of clients who have used other banking products, such as mortgages, which enables lenders to create value in the financing process itself. This data might also allow banks to offer more individualized pricing on car loans.

Develop a Platform Strategy

Incumbents will need to decide whether to build their own digital platform or join an aggregator. There is no clear-cut best option—it will depend on the company’s strategic goals, current capabilities, and investment priorities.

For OEMs, digital platforms provide a way to build client relationships and increase sales. Some OEMs are already launching direct-sales models on in-house platforms.

Large dealerships will be able to build their own direct-to-consumer channel because of the size of their client base. This is likely not an option for smaller dealerships, which should consider teaming up with startups that can help them increase sales volumes and finance commissions.

For banks, working with aggregator platforms provides greater flexibility and reach while avoiding the costs and risks of developing their own. However, banks could see their margins compromised should those aggregators develop strong negotiating power.

Preparing for the New Environment

Although it’s difficult to predict the pace of change or what the new auto finance ecosystem will look like, no company is likely to emerge unscathed. This makes it critical for all players to think through what the new dynamics will mean for them.

To adapt to the fast-changing environment, companies need to become as flexible as possible. They must have a department or task force focused on digital initiatives separate from the rest of the company—in the form of an incubator, for example. Whether this department is developing its own startup, setting up an aggregator platform, or undertaking some other innovative venture, it needs to make use of all the tools available, from agile collaboration to digital technologies.

Of course, companies must also continue to focus on their day-to-day business processes, such as credit approvals and risk management. The goal here should be to improve operational efficiency as much as possible. Standardized and optimized processes will ensure the cash flows needed to support and finance the parts of the business focused on innovation.

While the fate of the various players in the auto finance value chain is yet to be determined, we can be sure of one thing: customers will benefit enormously from the changes now underway. With a streamlined and transparent process in place, finding, purchasing, and financing cars will be much faster and easier.