In an industry defined by constant change and innovation, technology companies have sparked tremendous value creation. The tech industry leads the TMT sector in TSR and ranks fourth among the 33 industries in the overall BCG Value Creators study. Tech companies hold five of the top six spots among the more than 2,000 companies analyzed in terms of absolute value created from 2013 through 2017.

The 2018 TMT Value Creators Report

- Digital Natives Lead the Battle for Value Creation

- Technology: The Engine of Digital Transformation

- Media’s Unassailable Castles and New Business Models

- Telecommunications: Breaking Through the Bottlenecks

- Unlock Value Creation Through Digital Enablers

Perhaps even more significantly, tech businesses are the engines of digital transformation. They develop the tools—such as cloud solutions and analytics platforms—that help companies in all industries plan and execute a digital transformation. And they lead by example. Tech companies are the first to adopt, master, and prove these tools on a broad scale. They also originate many best practices, such as agile methodologies and DevOps, which drive success. Indeed, to study the industry’s top performers is to take a master class in how to use the capabilities and strategies that fuel value creation.

The Titans of TSR

Value creation in the tech industry stands out from both relative and absolute perspectives. The industry’s median five-year annual TSR of 21% from 2013 through 2017 represents a jump of 7 percentage points since our previous report, which covered 2011 through 2015. The recent year-over-year increase has been particularly impressive: in 2016, the median annual TSR was 12%; in 2017, it was 37%. Tech’s momentum has outpaced nearly every other industry. In the 12-month period from October 2016 through September 2017, tech had the second-largest jump in TSR among all 33 industries.

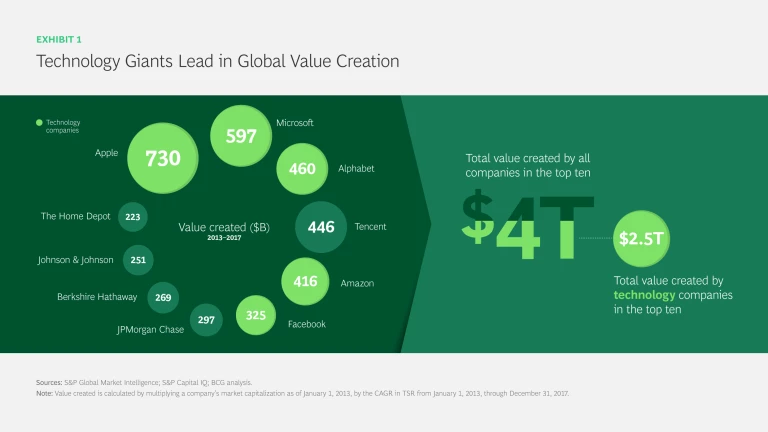

Absolute value creation has been even more eye-catching. The tech companies we analyzed accounted for almost two-thirds of the $8.4 trillion in value that TMT industries created from 2013 through 2017, dwarfing the amount contributed by media and telecommunications companies.

Large-cap companies, those with valuations exceeding $50 billion, are driving the industry’s performance. Although these players made up less than one-third of the analyzed tech companies, they generated more than three-fourths of the tech industry’s total absolute value. The impact of the tech giants—Alphabet, Amazon, Apple, Facebook, and Microsoft—was even more pronounced. These big five, boasting the largest market capitalizations in the industry, created $2.5 trillion in value—nearly half the industry total—from 2013 through 2017. (See Exhibit 1.) Currently, several of these tech companies are flirting with an unprecedented $1 trillion market capitalization. That tech companies are the only contenders in the race to be first is particularly

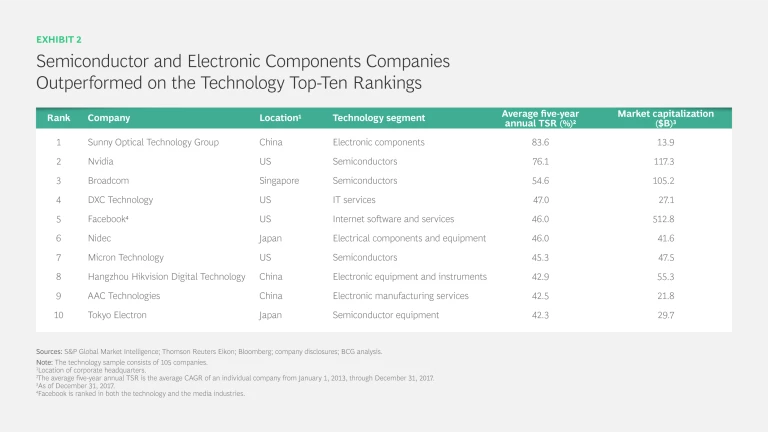

Large-cap companies lead in relative value creation as well, with Nvidia, Broadcom, and Facebook taking three of the top five positions on the industry’s TSR leaderboard.

Thwarting Volatility with Reinvention

Tech’s strong performance comes with a caveat: tech has long been among the most volatile industries in the economy. Indeed, over a period of 16 years, from 2001 through 2016, only the basic materials industry saw more volatility than tech in terms of annual TSR.

To keep volatility at bay, tech companies need to continually reinvent themselves. (See “ Value Creation and Corporate Reinvention ,” BCG article, December 2017.) Reinvention isn’t easy, but some companies have done it well. Microsoft, for instance, has successfully transitioned its focus from on-premises software to cloud-based offerings, having built a strong portfolio of software-as-a-service, platform-as-a-service, and infrastructure-as-a-service solutions. But a particularly insightful how-to story comes from Nvidia, the company with the second-highest TSR among tech companies. Its average annual TSR was a staggering 76.1%.

Slowing PC sales posed a potential threat to Nvidia’s bread-and-butter business: selling graphics processing units that are designed for computer gaming. So the company explored bringing its graphics processing technology to emerging, high-potential markets. To find the right areas, Nvidia adopted a more customer-centric approach to product and portfolio development. Traditionally, semiconductor companies have viewed these activities from a technical perspective and asked themselves, what can we build? But Nvidia asked, what should we build? The latter helped the company understand the uses and applications that resonated with customers. Then it built products that filled those needs. (See When Chip Makers Look Through the Value Lens , BCG Focus, April 2017.)

Reinvention isn’t easy, but some companies have done it well.

This customer-centric approach led Nvidia to the AI space. Like gaming, AI requires the rapid completion of repetitive tasks. Nvidia’s graphics processing units could be adapted to meet emerging needs and seize new opportunities. Meanwhile, partnerships with companies such as Baidu, Google, and Toyota boosted Nvidia’s prominence within the emerging AI ecosystem.

Broadening Portfolios and Horizons

Within the tech industry, the performance of two segments stands out. The semiconductor segment has an outsized median five-year annual TSR of 31%; four companies in this segment have spots on tech’s TSR top-ten list. (See Exhibit 2.) The electronic components, equipment, and manufacturing services segments have a median five-year annual TSR of 23%; companies in these segments also have four spots on tech’s TSR top-ten list.

For some star performers, demand was strong from traditional sources. China’s Sunny Optical Technology Group and Taiwan’s Largan Precision profited from the continuing robust demand from manufacturers of advanced smartphone cameras. Other players—such as memory chip manufacturer Micron Technology—saw demand from a broadening array of customers, including manufacturers of AI and IoT solutions. Demand from such nontraditional customers is expected to only grow. The market research firm IDC estimates that the installed base of IoT devices—including the security cameras, baby monitors, smart appliances, and digital assistants that are making their way into homes—will increase from 15 billion in 2016 to 30 billion in 2020.

While some companies, such as Nvidia, are pursuing organic growth in emerging markets, others are exploring potential M&As to plant stakes in new ground. Intel acquired Mobileye, an Israeli company active in the autonomous driving and IoT spaces, for $15 billion in August 2017. Samsung purchased US-based Harman International for $8 billion in March 2017. Among other things, Harman builds connected car solutions, including navigation and driver-assistance systems. Overall, the tech M&A market is booming. In 2016, tech deals totaled more than $700 billion and accounted for nearly 30% of the overall M&A market. (See The Technology Takeover , the 2017 BCG M&A report, September 2017.)

Driving Digital Innovation

By its very nature, the tech industry is at the forefront of innovation, supplying the technology infrastructure and software that increasingly powers the economy. It provides many of the tools that help companies in all industries transform for a digital world. These tools include an array of cloud-based services, such as storage, computing, and applications; cybersecurity solutions; and data platforms. And because tech companies are not only creators of these tools but also users, they’ve been able to adapt to a rapidly changing digital landscape.

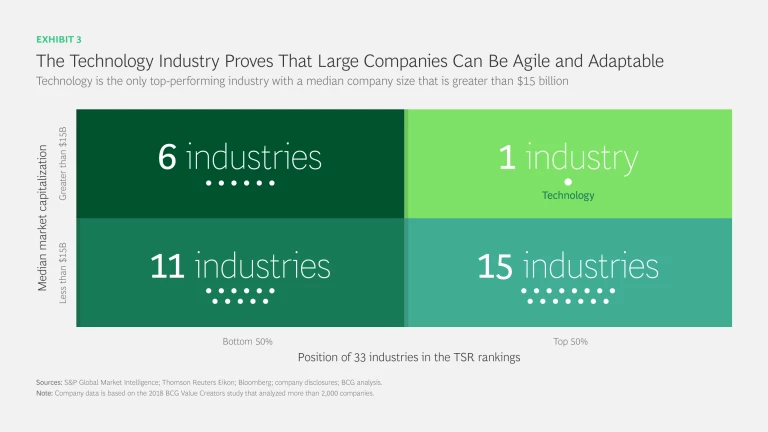

Tech companies have also introduced some of the most important practices for boosting flexibility and speed. Agile methodologies, now used in a host of fields including financial services, are perhaps the best known. But while other industries are only beginning to implement these practices, the best performing tech businesses have mastered them. This helps explain the strong showing of large companies on tech’s TSR top-ten list. Conventional wisdom holds that as companies grow larger, they become less agile and adaptable and can have a harder time maintaining high TSR. But in the tech industry, large companies’ returns have challenged that notion. (See Exhibit 3.)

Digital giants, such as Amazon and Facebook, have understood and benefited from “hyperscale.” (See “ Borges’ Map: Navigating a World of Digital Disruption ,” BCG essay, April 2015.) As the technology stack becomes increasingly modular and interoperable, three layers in particular can benefit disproportionately from scale: Platforms, such as social media, and their network effects can lead to winner-takes-all monopolies. Infrastructure, such as the cloud, can create true global scale. And data—the increasing types as well as the higher volumes—can lead to better inferences in, for example, facial recognition.

The lessons from the high performers, such as the importance of reinvention and agility, are especially crucial for those companies further down in the tech industry rankings. Even though tech as a whole is doing well, strong performance is not guaranteed. Indeed, the value created by companies in the top quartile was three times greater than the value generated by players in the bottom quartile.

Companies trailing far behind the leaders can find themselves to be an acquisition target. Or they can be the target of activist shareholders, as is the case with more than 70% of companies in the bottom quartile. In fact, activist shareholders have had a dominant presence across the tech sector. Although many companies have been highly innovative and created tremendous value, many other companies have mature core offerings and haven’t sufficiently pivoted to new technologies and business models.

Instead of having a digital transformation imposed on them, tech companies need to make the commitment to drive it themselves. They need to bet sufficiently on new paradigms while reducing exposure in their declining core.

That’s no small task, and it requires companies to strike the right balance between seeking new areas of growth and revitalizing—or even reimagining—the core. But by applying the right levers and enablers, all tech companies can transform and reinvent themselves. They can accelerate innovation, change, and growth. Companies in every industry are racing to transform themselves, but tech companies have a special advantage: they’re writing the playbook.