For telecom companies , undertaking a digital transformation is especially challenging. These businesses are usually large and complex. They have legacy products and IT systems. And they have cultures and skill sets that often harken back to a predigital era. Yet, telecom companies have an especially strong need to transform. With a median five-year annual TSR of 10% from 2013 through 2017, the telecom industry trails far behind most others in our study.

The 2018 TMT Value Creators Report

- Digital Natives Lead the Battle for Value Creation

- Technology: The Engine of Digital Transformation

- Media’s Unassailable Castles and New Business Models

- Telecommunications: Breaking Through the Bottlenecks

- Unlock Value Creation Through Digital Enablers

Many operators continue to face an array of challenges. Chief among them is customers’ ever-increasing data usage without a commensurate increase in average revenue per user for operators. The imbalance is especially acute in mobile, where globally, data traffic is expected to quadruple from 2017 through 2021. Telcos need to invest—and then continue to invest—in greater capacity, but in a more surgical, narrowly focused way. They need to transform their customer experience, their networks, their IT, and their ways of working. And, they need to find new paths to growth and value.

The best performers are discovering how to meet these challenges. They’re actively seeking new growth opportunities, both inside and outside their core businesses. They’re using digital technologies to improve the customer journey. And they’re finding ways to put their two main strengths—infrastructure and relationships with large numbers of customers—to new and profitable use.

These steps are important for all telecom operators. But for every company, success will depend on its ability to monetize to some extent customers’ increasing data usage and its capacity to develop the right enablers to spark, spur, and steer a transformation. A telco’s regulatory environment can have a significant impact on its path forward as well.

Time to Stop Treading Water

While other industries are stepping up their value creation game, telecommunications is straining to maintain a steady course. When we look at the full spectrum of industries analyzed in the overall BCG Value Creators study, telecommunications ranks 30th of 33 industries. That represents a drop of 13 places from the previous report, which covered the period from 2011 through 2015. Perhaps even more telling is that among all TMT companies, Charter Communications—a top-three performer in two consecutive reports (2016 and 2018)—ranks only 49th overall.

Clearly, many other industries are doing a better job of finding ways to boost performance. Across industries, median annual TSRs increased by an average of 4 percentage points between the two five-year periods. Yet the telecom industry’s median annual TSRs dropped by 1 percentage point. High-performing companies have stories that shed light on what others can do to generate value. But at the same time, market structure—and how regulation influences it—has a big impact on value creation as well.

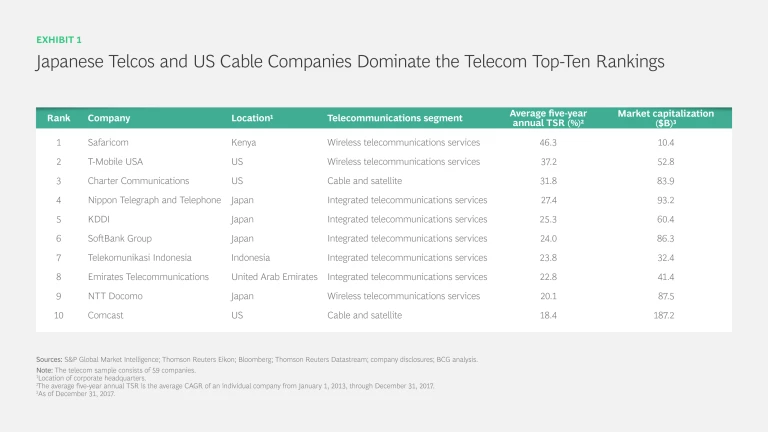

Within the top ten, Japanese telcos have four spots, and US cable companies have two. (See Exhibit 1.) In a way, this isn’t surprising: Japanese operators have benefited from a relatively favorable regulatory environment, as reflected by their expanding valuation multiples. And as a technology, cable is still highly competitive. As in our previous report, most of the top ten positions are occupied by operators in mature markets, which by now have reached penetration rates that aren’t likely to go much higher. Signing up new subscribers and paying dividends have historically been value drivers, but top performers are also seeking other value-creation opportunities. This willingness to shake up the business helps to explain why emerging market players have not been outperformers. In these markets, subscriber growth has waned as well, but operators have been slow to transform. Meanwhile, the entry of radical players with disruptive business models, such as Reliance Jio Infocomm in India, has exacerbated the challenge for incumbent players.

To be sure, the success of the industry’s top performers is not quite at the level of the TSR titans in tech and media. But in the face of continuing market challenges, some historical incumbents have managed to protect their positions in their local markets and deliver new value. Orange has an average five-year annual TSR of 17.2%, which enabled it to jump from 39th place in the previous report to 12th. Deutsche Telekom and Telenor Group follow closely, with average five-year annual TSRs of 16.2% and 14.9%, respectively.

A Customer-Centric Approach to Improving Experiences and Networks

Performance can rarely be attributed to any single factor. For a telecom company, financial outcome is shaped by capital investments, productivity, complexity management, and customer and regulatory strategies, to name just a few inputs. But one particularly potent factor is customer centricity. Orange’s Essentials2020 initiative, for example, is examining every type of company-customer interaction and assessing how it can be simplified and improved. This kind of initiative can have a two-part payoff: a better experience for the customer and greater cost efficiencies for the company.

Digital is a powerful way to improve the customer experience. At Orange, a variety of technologies are being deployed, including self-service apps and AI-empowered chatbots, which allow the company to focus human intervention on value-adding interactions.

Customer centricity also facilitates a more focused approach to network investment. Instead of taking the traditional—and unsustainable—approach of trying to build everywhere for everyone (a one-size-fits-all model that typically sees telcos “overshooting” their capital expenditures), operators can target key customer segments and needs, building out networks in a more selective and differentiated manner. They can focus on particular regions and deploy specific technologies in a way that better correlates investment with value. Advanced analytics plays a key role here, helping operators identify usage patterns and, in turn, understand what matters most to customers. Then telcos can direct their investments accordingly. (See How Telcos Can Put Their Money Where Their Customers Are , BCG Focus, July 2016.)

Digital is a powerful way to improve the customer experience.

Some telcos are already prioritizing network investments on the basis of a customer-centric approach. For instance, Orange used this tack to identify scenarios—such as commuting—where demand for superior network quality was especially strong. The company then focused its capital expenditure spending on meeting these needs. For example, it has been upgrading infrastructure in high-traffic urban areas. This enabled the company to support its premium position in France—and increase its share in a highly competitive market.

An understanding of what customers value can also steer operators to new features and services that differentiate their networks. Comcast’s X1 platform was created in response to emerging preferences and habits, such as the trend toward time-shifted on-demand viewing and the increasing importance of seamless and intuitive navigation and discovery. Significantly, the X1 platform helps Comcast compete against nontraditional players.

Strengthening the Building Blocks of B2B

In the B2B space, the challenges keep growing. Telcos’ core market of enterprise mobile and fixed connectivity is slowly declining, and competition is fierce in every customer segment. Global technology companies and information and communication technology (ICT) players are winning over large B2B customers. B2C players are wooing smaller enterprises. Shifts to IP-based communication, software-defined networking, and the cloud have ratcheted up the heat, putting even more pressure on pricing and margins.

So what’s the solution? Savvy telcos are shoring up every building block of their B2B model, including the customer experience, service offerings, operating processes, and capabilities. For B2B service offerings, telcos can play to their historical strengths—such as infrastructure and access to customers—to expand into adjacencies (areas that are close to core businesses), such as ICT services, content generation, and advertising.

NTT Communications and Verizon are two examples of telcos that are pursuing such expansion. NTT Communications is now one of the five largest data center operators globally. Verizon’s recent acquisitions—the $4.4 billion takeover of AOL in 2015 and the $4.5 billion purchase of Yahoo!’s core internet business in 2017—have given it access to digital advertising platforms and technology that could help the company generate additional revenue.

Some operators are casting their net even further. BT, for example, has invested heavily in cybersecurity and is now one of the world’s largest providers in that space. In 2016, its managed security services and cyberconsulting businesses generated an estimated combined $500 million in

The New Frontiers of Diversification

Two-thirds of the acquisitions and investments made by major telcos from 2012 through 2016 were in adjacencies and so-called new frontiers. (See Exhibit 2.)

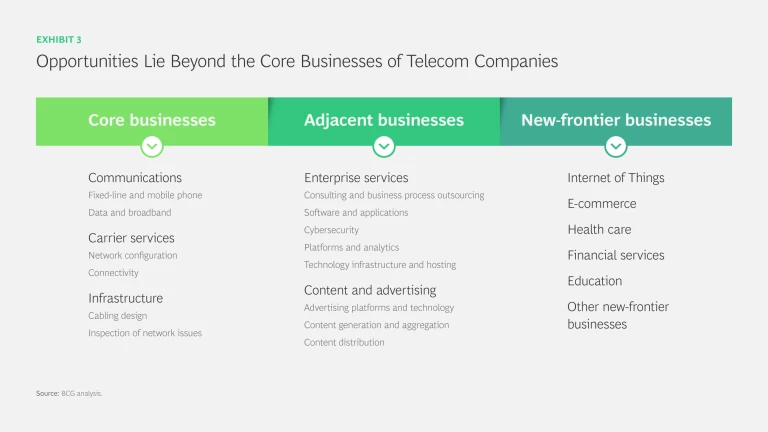

Although adjacencies are natural extensions of a telco’s business, new frontiers can take operators quite far from the core. These areas include solutions focused on specific industries, such as health care or education, as well as the Internet of Things (IoT). (See Exhibit 3.) Within the telecom industry, these areas have generated a fair measure of excitement. But as telcos move further from their comfort zone, they should proceed with caution—and a well-crafted strategy.

In IoT, for example, telcos need to be sharp about constructing value propositions. They need to identify the right market (or markets) to enter, whether it be logistics or manufacturing or another area. They need to decide where along the technology stack they should own assets and where they should partner with others. Beyond the core, there are few safe bets. Even moves into content—such as European and US operators spending big for exclusive sports rights—have sometimes resulted in value destruction, with a company’s market capitalization taking a hit.

As telcos contemplate diversification, a smart strategy is to identify businesses that can grow fast and wide: data centers, advertising, and security, for instance. Otherwise, telcos may find that it takes years for a new revenue stream to account for a significant portion of revenue. During that time, momentum and funding for transformative initiatives can wane.

Telcos should also consider fostering opportunities that give them an advantage because they are a local incumbent. In many adjacent and new-frontier markets—such as media, health care, and even security—local ties are important. Many countries, for example, see security as a sovereign issue, and customers prefer to buy security services from local providers. This sets the stage for partnerships between local telcos and global technology companies. The collaboration between Deutsche Telekom and Microsoft in Germany is a good example.

M&A and the Regulation Wildcard

Diversification strategies run the gamut from relatively safe bets, such as in-market consolidation, to bold moves, such as investing in an array of high-growth areas. Across that gamut, M&A has been an important strategy.

Some operators are pursuing horizontal integration to broaden their customer base and leverage the benefits of scale. Telefónica Germany purchased E-Plus Group in October 2014, Telia Company acquired Tele2’s network in Norway in 2015, and Vodafone merged its subsidiary in India with a local operator, Idea Cellular, in a $23 billion deal in 2017, creating the country’s largest mobile carrier.

Other telcos are using an M&A strategy to gain entry into adjacencies and new frontiers. In December 2017, T-Mobile agreed to acquire Layer3 TV, with plans to use the company’s video platform to help launch its own subscription TV service. Verizon has pursued multiple deals in the IoT space, for example, acquiring companies that are involved in fleet management and smart cities.

But M&A is a lever that telcos aren’t always able to apply. The wildcard is regulation. In the telecom industry, regulation can have a significant impact on value creation. The impact varies by country or region, however. In Japan, for instance, the regulatory environment sparked multiples changes, because it encourages telcos to take the kind of actions that create value: invest in next-generation infrastructure and new technologies, such as 5G, and partner with other players. NTT Docomo is an example of a company that is doing the latter, having established partnerships with Ericsson, Nokia, and others.

In Europe and the US, regulators are sending a more mixed message, as some acquisitions—particularly the larger horizontal deals—have been opposed. In May 2016, the EU Commission blocked the proposed £10.5 billion Three-O2 merger in the UK. In November 2017, the US Department of Justice filed suit to block AT&T’s blockbuster $85 billion bid for Time Warner—pushing the companies to extend the deadline for the merger to mid-2018.

And sometimes a win can come with a catch. The remedy regulators imposed in the €20 billion merger of Italian telecoms Wind and H3G in 2016 allowed a new provider to enter the market. New entrants can have a significant impact on price realization and market size, driving down overall value creation. They also can take significant market share, dampening the benefits of consolidation. In India, Reliance Jio Infocomm captured approximately 14% of the market within a year of starting operations in 2016.

The uncertainty of regulation’s impact makes it even more important for telecom companies to think and work in new ways. Telcos had a good run with the tried and true. But to spark growth and generate more value, they need to shake things up—in their core business and, increasingly, beyond it. The winners aren’t playing their greatest hits: they’re singing remixed and new tunes.