This article, the second in a two-part series, explores how medtech companies have fared at integrating value-added services into their offerings. It also examines how these companies can accelerate growth by pulling through product sales and offering broader solutions for health care providers. The first article, “Profiting from Product Services in Medtech,” looks at how medtech companies can reignite growth by improving and expanding the product-related services they offer.

Long used to strong growth and high margins, medtech companies are learning to adapt to a new normal. Since 2011, industry sales have grown at about 3% a year until more recently, when the growth rate reached the mid-single digits, and margins have been continuously under pressure. Health care providers, meanwhile, are looking for more bang from their medtech buck.

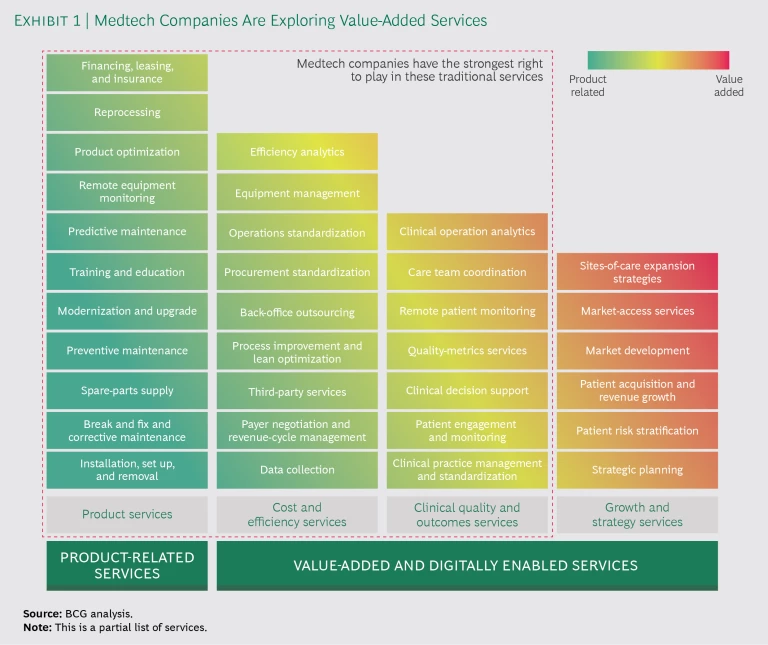

Expanding the product-related services that medtech companies offer customers is one part of the solution. (See “Profiting from Product Services in Medtech,” BCG article, December 2018.) Medtech companies have also been experimenting with value-added services, striving to help their provider customers achieve better patient outcomes and operate more effectively while generating new revenue streams for themselves. Market leaders, in particular, have attempted to take advantage of the industry shift to solutions, their scale, and their close relationships with customers—along with their clinical knowledge, digital platforms, and the data captured by their devices—to adapt existing services and develop new ones. (See Exhibit 1.)

Value-added services can supplement health care procedures and add value along patient care pathways. But the investments can be significant, and for medtech companies themselves, unlocking real value means scaling up service-based businesses by driving service revenues and profits. This requires a different approach than the traditional focus on product sales.

Medtech companies have yet to truly crack the code for integrating value-added services into their core businesses. Here’s how companies should think about building their portfolio of value-added services and capabilities.

A Value-Added Opportunity

Value-added services in medtech have a shorter history than their product-related brethren. Most companies started experimenting with value-added services only in the past decade or so. And while many medtech players enjoy reasonably high market penetration for their product services, few have found successful business models for their value-added services.

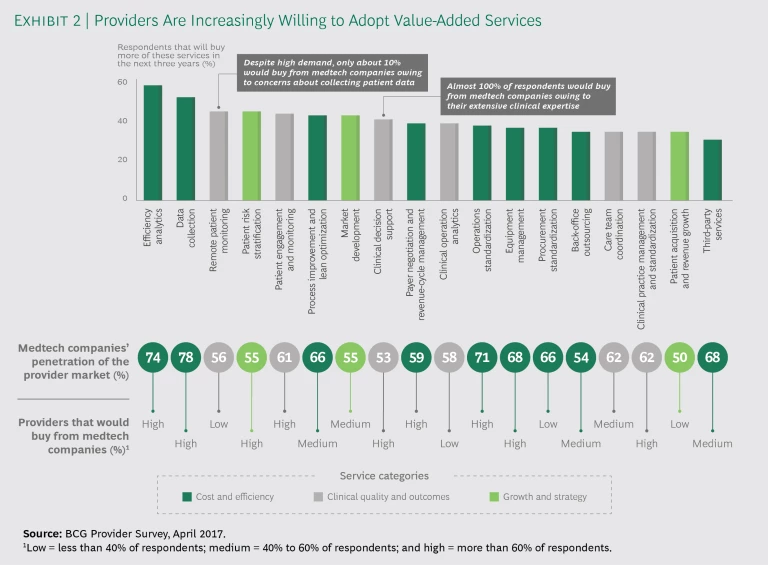

The door remains open, however, and the opportunity is larger than some companies may realize. Our research indicates that about 35% to 60% of health care providers plan to contract for value-added services over the next three years in at least 15 areas, including efficiency analytics, data collection, patient engagement, and clinical decision support. A substantial percentage of providers say that they will contract with medtech companies for at least a dozen of these services. (See Exhibit 2.)

Services is a large market—about $60 billion—and it is expected to expand at 10% a year through 2021, when it will approach $90 billion. The biggest part of the market is product-related services, but value-added services is the fastest-growing segment. Some categories are seeing annual growth rates approaching 50%. For example, the cost and efficiency services segment, which includes efficiency analytics, equipment management, and process improvement, is growing at 40% to 45% a year. In the clinical quality and outcomes segment, some services, such as outsourced management of clinical services, remote patient monitoring, and clinical decision support, are seeing generally strong growth rates of up to 15% or more. The margins are attractive as well. Value-added services provide not only high growth rates and margins but also access to new revenue pools. Additionally, these services carry the greatest opportunity for pulling through product sales, which we believe will continue to be the real driver of success for medtech companies in the medium term.

Where to Play

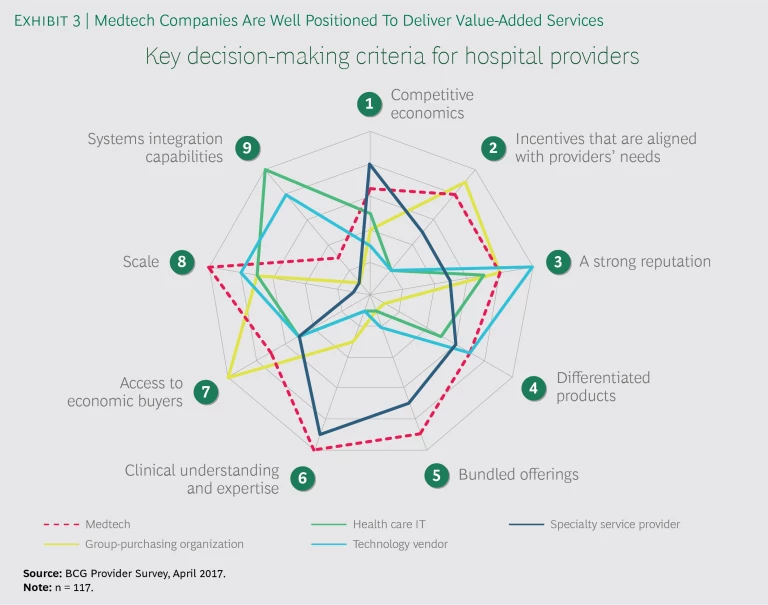

BCG’s most recent survey of health care providers found that hospitals and hospital networks are most concerned about three service categories: cost and efficiency, clinical quality and outcomes, and growth and strategy. We also found that medtech companies are positioned as well as, or better than, competitive service providers (such as group-purchasing organizations and technology vendors) to meet hospitals’ purchasing criteria, which includes having a strong reputation, differentiated products, the ability to bundle offerings, clinical understanding and expertise, and scale. (See Exhibit 3.) Medtech companies have a strong right to play in value-added services.

Although they are credibly positioned, medtech companies need to be thoughtful about which services to offer and the new capabilities required to deliver them. In particular, medtech players should consider how each service supports a solution or improves a patient outcome and how the services offered link back to their company’s core portfolio of products. These two factors, more than any others, will determine the overall success and profitability of a medtech service offering.

Most medtech companies already offer a portfolio of services in one or more of the value-added categories, the result of well-intentioned investments, acquisitions, and attempts at decentralized, organic business development. But at many companies, these service offerings have also developed in an ad hoc and fragmented fashion with little strategic purpose.

With a few exceptions, success in many service areas requires scale and clout, leveraging a company’s position as a market leader, and amortizing large investments in such areas as digital platforms and analytics capabilities. But scale and clout are difficult to achieve without a concerted corporate commitment, resources, and cultural investments. Delivering outcomes as well as making money require making choices that are in line with a service-oriented business model. The right moves, which will differ for each company depending on its product and service mix, can transform a traditional product business into a true solutions-oriented one that partners with clinicians, provider networks, and payers to deliver meaningful patient outcomes. Focusing on solutions, in turn, can push medtech companies to new levels of success, but it may also require a different set of skills, culture, and operating model.

The Key Determinants of Success

We have identified eight factors that determine a medtech company’s likelihood of success with a value-added service offering. The more factors that apply to a particular company and its specific products or procedures, the more successful the company and the service are likely to be. A combination of four or more of these determinants materially increases the chance of success.

- Services That Are Closely Related to the Company’s Products. The more closely related a company’s services and products, the greater the “market permission” for the company to play in the respective areas. Close proximity also improves the chances that services will pull through device sales and that customers will increasingly use the products and replace the parts.

- Services That Provide Links to Patients Beyond Episodes of Care. Leveraging smart devices and digital technologies to offer services—such as remote patient monitoring and data collection—can extend the traditional parameters of care, adding value for patients, providers, and the medtech company.

- Deep Clinical Expertise in a Disease State Where Devices Are Core to Patient Therapy. Particularly for disease states for which an implant or a device are the primary component of patient therapy, medtech companies that have clinical expertise can supplement that of the clinicians or offer services that are embedded in products, creating true solutions for patients.

- A Leading Market Position and Scale for Some or All of the Products in a Portfolio. Companies that are market leaders with scale can develop services and platforms that involve products across their portfolios to address customer pain points in ways that smaller or weaker competitors cannot.

- Patient Care Pathways That Are Fragmented. Care pathways that are fragmented across multiple sites or facilities create the need to coordinate, track, and monitor patients; companies that offer devices with digitally enabled services are potentially well positioned to solve some of the inherent frictions in these circumstances.

- Devices That Represent More Than 20% of the Overall Cost of a Procedure. The greater the role of a medtech device in a treatment or procedure—and the device’s cost as a percentage of an overall cost is a good proxy for determining this—the more the provider looks to the medtech device partner for related clinical assistance or a risk-sharing solution linked to outcomes, particularly in the context of value-based care.

- Services That Can Help Improve Outcomes. Services that enable therapy selection, standardization of clinical practice, or compliance can shape patient outcomes. For example, medtech partners can help hospital systems standardize how surgeons perform specific procedures or manage patient rehabilitation and compliance after surgery, having a significant impact on the success of the procedure.

- Products That Can Benefit from Clinical Differentiation. Services can help differentiate a product in a crowded marketplace, improve outcomes by producing results that the product alone cannot achieve, and provide access to profit pools along the continuum of care that are not available from product sales alone.

Consider the example of a large orthopedic device manufacturer that incorporated many of these factors to build an industry-leading professional services business. The company used its expertise in a particular product and medical procedure, as well as its access to the operating room, to develop a professional services team that works with clinical staff to standardize and optimize patient care. This team supplements its innovative product portfolio with services that help doctors and hospitals improve outcomes across the continuum of care, from preoperative planning and perioperative efficiency through postoperative follow-up, in both inpatient and outpatient settings. The company has expanded its offering to include an online patient engagement platform that uses advanced data analytics to shape care plans and sustain results over time.

This value-added service offering has helped the company’s customers improve outcomes and reduce costs, while it increased its implant share in hospitals that used its consulting service. Since 2014, the company has experienced organic sales growth of more than 5% and seen its share price outpace that of its relevant peers by more than 50%.

Capturing the Value of Value-Added Services

For medtech suppliers, seizing the opportunity in value-added services is mostly a matter of commitment. The market is waiting; customers need and want the help. Medtech companies already have, or can gain access to, the knowledge and capabilities that they need.

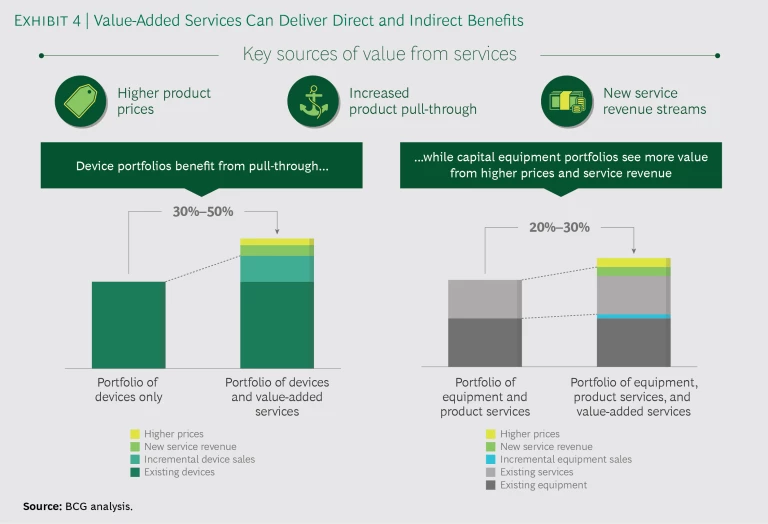

With the proper business model in place, value-added services can deliver both direct and indirect benefits to medtech companies in three ways: realizing higher product prices, pulling through product sales, and creating new service revenue streams. (See Exhibit 4.) We estimate that the combination of all three can result in revenue increases of 30% or more in the relevant areas of the product portfolio. Extracting maximum value requires closely linking all the components of the business model, ensuring that choices about the enabling services are consistent with the overall product portfolio strategy and commercial effort. Deploying a service dimension as part of a broader solution requires end-to-end consideration of the patient journey and using services to address clinical workflow and patient engagement with product and platform design.

Medtech companies need to determine where they are best positioned to play and back their initiatives with the visible support of top management, the requisite financial resources, and the necessary organization realignments. Delivering services—especially value-added services—requires a very different business model than product development and sales. Services can lead to new sources of growth, but the transition from current, long-successful models could be wrenching, and organizations resist. Half steps may be worse than none at all. But companies that set ambitious goals and move decisively to achieve them will establish an advantage.