Telecom operators haven’t been shy about extolling 5G, for good reason. For consumers and businesses, 5G will be unlike any previous kind of mobile technology. And for telcos, too, 5G will be unlike anything that has come before it. New 5G networks will foster a host of innovative uses—and for operators, new business models.

But there are some catches. Those use cases won’t all be ready at the same time. They won’t be equally applicable to, or profitable in, all markets. And each will require a different kind of 5G network to work best.

This means that the usual approach to launching a network—first roll out the technology, then design the offers—won’t cut it. Instead, telcos will have to think about the use cases for monetization right from the start. The commercial functions will need to take the lead, working with the network and finance functions to define the right use cases and the right network requirements on a granular, microregional level.

This cross-functional, surgical approach to launching a network will be uncharted ground for many telcos. But it’s an approach they’ll need to embrace and master to ensure that the business case for 5G stacks up—and to realize its full potential.

The Necessity and Challenge of Near-Term Monetization

When it comes to 5G, the best is yet to come. The 5G that is deployable today, known as nonstandalone 5G New Radio technology, requires LTE as an anchor. Its main advantage over existing networks is speed—a little more or a lot more, depending on how telcos implement the technology.

Realistically, the more novel capabilities of 5G won’t be available to customers until 2022 or 2023, as they rely on a second-wave, “standalone” version of 5G technology that doesn’t piggyback off existing LTE networks, as well as on a new 5G core. These capabilities include end-to-end network slicing (allowing for the creation of highly customized “virtual” networks within a single physical network), ultra-low latency (reducing delays in getting information from one place to another), and the ability to reliably and efficiently connect vast arrays of devices on the Internet of Things (since a single 5G cell can support many more connections than a single LTE cell can).

For telcos, this means that many 5G-enabled business models—particularly in the B2B space—are some years out. Yet most operators don’t have the luxury of waiting until all the technological elements are ready. The reason goes beyond the usual worry about what the competition is doing. Building 5G networks is expensive and requires long lead times, so telcos will need to find additional revenues to fund their efforts as they go along.

To put it simply, telcos may focus their aspirations on 5G’s long-term potential, but they should focus their attention on its near-term monetization. The idea is to use 5G’s first phase to anchor a new price point for enhanced offers and to fund the 5G rollout.

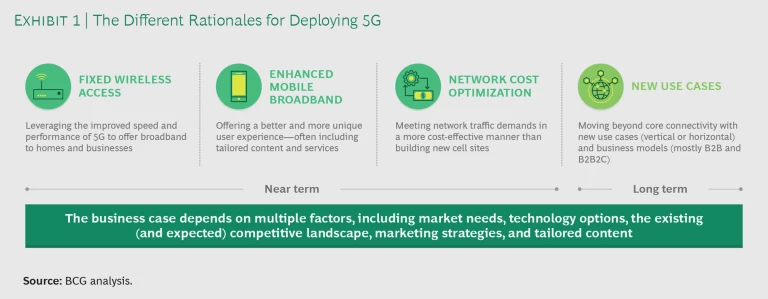

In the near term, 5G use cases will be limited to those that can work over the nonstandalone version of 5G. These boil down to two main options: enhanced mobile broadband (eMBB) and fixed wireless access (FWA). Note, too, that even in the absence of a compelling use case, telcos may have another rationale for deploying 5G in the near term: network cost optimization . This isn’t so much about making money as saving it by more cost effectively increasing capacity as network traffic grows. (See Exhibit 1.)

But the business case for each option depends on many variables. For FWA, for example, these include customer density, existing infrastructure (of both the telco and its competitors), the availability and pricing of wholesale telecom services, and the overall competitive environment. And that’s just to name a few. So a telco is likely to find that the potential for each option will vary—perhaps significantly—from one microregion to another.

No One-Size-Fits-All 5G

Complicating matters further, nonstandalone 5G can be deployed in two ways, each with its pros and cons.

In the first approach, telcos can leverage existing mid-band radio frequencies and dynamic spectrum sharing. This is a relatively fast and inexpensive way to deploy 5G, but one that provides only a modest speed boost over LTE networks (roughly a 10% bump). As some telcos have discovered, this humble gain risks disenchanting customers by providing an experience that doesn’t quite match their expectations. And disenchanted customers may not be so willing to pull out their wallets when the next wave of 5G use cases is ready for primetime.

In the second approach, telcos can use new high-band spectrum, which provides massively higher speeds. (With both approaches, latency is slightly decreased, though only future versions of 5G will provide a further reduction in latency.) But those speeds come at additional cost and effort, because high-band spectrum is typically deployed along with new antenna equipment, and it potentially requires a denser network grid as well.

With all of these factors and tradeoffs in play, the calculus involved in choosing which deployment rationale to pursue (eMBB, FWA, network cost optimization, or none of the above) in which markets using which technologies and marketing strategies can be complex. To get a sense of just how complex, consider the nuances of the three near-term 5G options.

Telcos may focus their aspirations on 5G’s long-term potential, but they should focus their attention on its near-term monetization.

Enhanced Mobile Broadband

The idea here is that faster speeds and lower latency can provide a better experience on smartphones—or, for that matter, on any connected device (think augmented-reality goggles and cloud-gaming hardware). Telcos would typically target a densely populated coverage area, such as where people work, in order to leverage a large customer base and capitalize on the ARPU uplift. But that uplift assumes that customers are willing to pay more for an enhanced experience, and by themselves, improved speed and latency are not likely to be enough (especially as more operators upgrade their networks and higher speeds are commoditized). So telcos will typically need to offer tailored content and additional services that take advantage of the 5G improvements.

As for what those offered features might look like, we see a few prime candidates. Some telcos are experimenting with augmented reality (AR). For consumers, they’re including AR features around sporting events and concerts (for example, when users select or zoom in on a player, they’ll see statistics and other information). For businesses, some telcos are pursuing AR features around training, construction, and maintenance work (imagine, for instance, workers receiving live instructions on a visual overlay on their phone or via goggles). Telcos could also include access to a mobile, cloud-based gaming platform (along the lines of Google Stadia or Microsoft’s Project xCloud). Or they could add features—like replays and multiple camera angles—designed to enhance a stadium or home streaming experience for sports or music events. All of these options would require dedicated investments from telcos and probably new partnerships as well.

One other thing to keep in mind: if the “enhanced” experience isn’t quite enhanced enough, the disenchantment risks can quickly materialize. So while the eMBB option can be rapidly deployed via existing spectrum, telcos might want to think about how they can incorporate new high-spectrum bands.

Fixed Wireless Access

In this scenario, telcos would leverage the improved speed and performance of 5G networks to offer broadband to a fixed location (such as a home or business) via mobile networks. In effect, mobile network operators could, under certain circumstances, be a viable alternative to fixed broadband providers (and the only option in locations that aren’t serviced by fixed networks). Significantly, telcos would target a very different kind of service area for FWA than for eMBB. Instead of a broad, highly populated area, they’d focus on a more localized, less densely populated location.

FWA rollouts are also highly dependent on the available spectrum. In Europe and South Korea, for example, the currently available high-band frequencies (3.4 to 3.8 GHz) allow—again, under certain circumstances—for a coverage radius of one to three kilometers of a site. That’s enough to cost-effectively provide broadband to a rural village. In the US, by contrast, some currently available bands are of higher frequencies (24 to 28 GHz), which have less reach but more capacity. So here, an FWA rollout would more likely bridge the last 100 meters in a suburban area.

Either way, FWA requires new high-band spectrum, which can get pricey to roll out and isn’t likely to affect as many customers as an eMBB-focused rollout. So telcos need to be strategic about where and how they pursue this monetization option.

Network Cost Optimization

In service areas where network traffic demands exceed—or where telcos expect them to exceed—the capacity of existing networks (and where telcos have already pulled all the levers to boost that capacity, such as using more spectrum, upgrading antennas, and retiring 2G or 3G), it will be cheaper to deploy 5G on existing sites than to build new sites. The caveat is that telcos will likely need to wait a while for a significant payoff, since the amount of traffic they can offload to 5G will depend on 5G handset penetration. And many operators have yet to pull all their available congestion-dampening, capacity-boosting levers.

Market- and Operator-Specific Variables

The one common thread across all of these options is that their applicability—and manner of execution—depends on the answers to five key questions.

What Are the Specific Market’s Circumstances and Needs?

The business case for each option depends on many factors that are market specific. For example, if there are a large number of users in a particular service area, that could move the needle toward an eMBB-focused rollout. An insufficient fiber footprint could work in favor of FWA. Rapidly growing network demand—combined with a lack of options to cost-effectively meet it—would support the case for network cost optimization.

The list goes on but the key point is this: since the potential for each use case (or network cost optimization) will vary on a microregional level, telcos need a deep understanding of the demographics, usage patterns, and customer needs within each region. Then they have to ask themselves how these factors align with the three rationales for deploying 5G in the near term.

What Technology Options Are Available—and at What Cost?

With 5G, the deployment rationale you choose will help determine the network you build. Yet the analysis isn’t as simple as matching each option with a certain kind of network. Indeed, the optimal network is likely to be a nuanced one, where available spectrum, backhaul, equipment, and other technical levers are carefully considered (for both efficiency and cost) and applied.

For example, consider an eMBB rollout in a large, densely populated area like Paris. Rolling out high-band spectrum throughout the city will provide very high speeds for customers, but at a high cost to telcos—perhaps too high, considering the potential revenue uptick. So one strategy might be to roll out high-band spectrum in selected areas and use mid-bands elsewhere. Smartly implemented, this could help telcos strike a more cost-effective balance between speed and coverage.

What Is the Competition Offering or Planning?

A competitor’s moves and anticipated plans will also affect the business case for 5G. Is your rival focusing on specific use cases? Or is the emphasis more on time to market and positioning (that is, the ability to say it is first with 5G, no matter what that 5G actually looks like)? And if you pursue a certain strategy, how might your competitor respond—and how quickly? What countermoves might you have?

What Is Your Own Marketing Angle?

For many telcos, this early flavor of 5G represents an opportunity to claim technological leadership in a given market. But telcos should tread carefully, especially when deciding when to display the 5G logo on a handset. If operators are transmitting over existing spectrum at speeds just slightly faster than LTE, customers might see that logo and be underwhelmed. And dissatisfied customers tend to have long memories, hindering any second chance once a telco upgrades to a “better” 5G. On the other hand, if operators wait until they widely roll out new high-band spectrum and can deliver significantly faster speeds, they risk letting competitors get a jump on 5G positioning.

What Kinds of Tailored Content and Services Could Be Offered (and Potentially Bundled)?

This question is particularly relevant for eMBB. Historically, superior speed has not been a sustainable differentiator; ultimately, those higher speeds get commoditized. So to sustain price premiums, telcos should consider what else they can add to the mix. One idea is to offer (and potentially bundle) tailored content and services that take advantage of 5G, such as cloud-based gaming or augmented video-streaming experiences.

Since the potential for each use case will vary on a microregional level, telcos need a deep understanding of the demographics, usage patterns, and customer needs within each region.

Some South Korean operators, for example, offer additional services for their 5G products, such as multiple angles for baseball games and 360-degree views of Korean idol band performances. They also built their own AR/VR studios and produced exclusive content ahead of their 5G launches.

Adding this kind of content comes at a cost, of course, beyond the upfront financial investment. It takes telcos outside their traditional line of business, entails lead time, and likely requires the formation—and management—of new strategic partnerships.

With 5G, the deployment rationale you choose will help determine the network you build.

A Cross-Functional Approach

That’s a lot of questions to analyze and tradeoffs to understand. And crucially, telcos need to ask and understand it all up front, as the answers will determine the business case for 5G and the network that enables it.

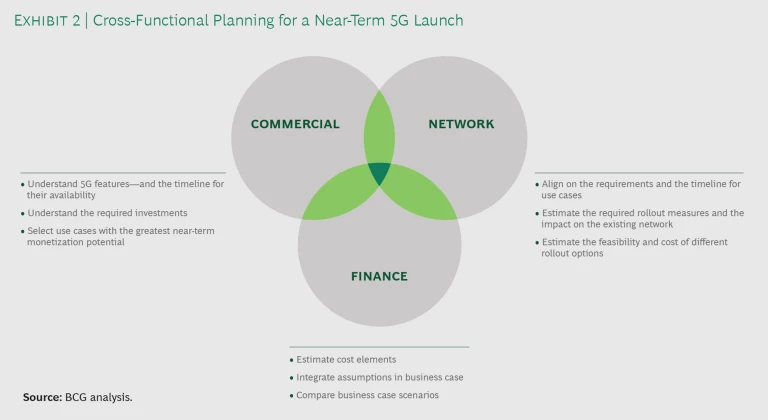

One clear takeaway is that telcos can no longer delegate rollouts to their network department. Instead, they need to bring together stakeholders from throughout the company—from the start—to determine which monetization option makes sense in which service areas, using which network technologies and marketing strategies.

In our experience, the best way to do this is to adopt a cross-functional model: one that brings together—and regularly co-locates—stakeholders from the commercial, network, and finance functions. This kind of collaborative and integrated way of working may be commonplace in other industries, but many telcos will find it unfamiliar. So how can telcos quickly and smartly adopt the model and leverage it to launch 5G?

We have found that a “ campus approach ” can be particularly effective. The idea is to bring together all relevant decision makers each week for one to three on-campus days. Week by week, the group jointly builds a common understanding of the timeline of 5G capabilities , aligns on the deployment rationale and monetization strategy, analyzes technical options and costs, and develops the business case to fund the 5G rollout. (See Exhibit 2.)

Typically, a telco’s department heads—for network, IT, marketing (both B2B and B2C), finance, and strategy, among other areas—would have a full presence in the campus and be empowered to make decisions. C-suite executives would attend a readout at the end of each campus day to come up to speed on options, tradeoffs, and developing positions and have a chance to weigh in. These recap sessions give these executives a chance to encourage or halt specific actions, but they also help maintain momentum. If the campus team feels a decision is above its pay grade, senior leaders can make the call and keep things moving.

New 5G technologies will, in time, offer telcos a chance to pursue innovative and compelling new business models. But while the best opportunities may be down the road, telcos need to open the door to them now. That means focusing on near-term deployment strategies—and monetization potential. And it means no longer handing off launches to the network department, but getting the ball rolling on rollouts together.

Acknowledgments

The authors thank Christian Bartosch, Thomas Bumberger, Valeriy Elbert, KJ Lee, Francesco Torelli, and Xi Zhang for their contributions to this article.