Today’s leading businesses are facing many near-term challenges in an uncertain economic and political environment. More than ever, though, they also need to focus on the long term, because the keys to success in the next decade will be different from today’s. Business leaders need to reinvent their companies for the future while ensuring strong performance in the present.

In other words, businesses need to maintain vitality—the capacity to reinvent the business and grow sustainably. To identify vital companies, as well as the factors that set them apart, we developed the Fortune Future 50 index in partnership with Fortune magazine. This year’s index demonstrates that some companies remain vital in turbulent times—and points to how all leaders can make their organizations more vital.

The Vitality Imperative

Companies can create value in many ways, including pursuing efficiencies, streamlining assets, and raising investors’ expectations, but in the long run sustainable revenue growth is essential to value creation. Over periods of at least a decade, top-line growth accounts for three-quarters of the best-performing companies’ total shareholder return.

But growth is becoming harder to achieve, as long-run economic growth has declined (and is expected to continue declining as a result of demographic headwinds). And even for companies that grow rapidly for a short while, outperformance is increasingly difficult to sustain. As the pace of business accelerates and new models are exhausted more quickly, the speed at which the fastest-growing companies fade to the average has doubled in the past three decades. Past performance is less and less a predictor of future success.

To sustainably thrive, businesses need to build capacities for continual innovation and reinvention. This is especially difficult for large, established companies: complexity and inertia build as businesses age and grow, inhibiting the ability to drive change and renew advantage. Compounding the challenge, the most commonly used metrics for business (such as growth, market share, and profitability) measure only what has happened—which is no longer a strong indicator of what will happen. To look forward, leaders need to measure, and manage, vitality.

The most commonly used metrics for business measure only what has happened—which is no longer a strong indication of what will happen.

Vitality in Adversity

It may seem naive to focus on the long term given the adverse conditions that businesses face today. Macroeconomic signals are deteriorating; policy uncertainty has reached all-time highs; digital leaders are facing a backlash against technology; investors are becoming more skeptical; and there is widespread concern about the environmental and social externalities created by business.

However, there is still plenty of opportunity to grow in times of adversity. Our research shows that even during economic downturns, revenue growth (not cost cutting) is the primary driver of financial outperformance, and companies that grow faster during downturns tend to continue growing faster after them. Additionally, companies that take a long-term perspective on strategy perform better than those focused narrowly on short-term issues. Finally, turbulent conditions are likely to increase competitive volatility—which means greater rewards for the companies that most effectively reinvent themselves.

Even during economic downturns, revenue growth (not cost cutting) is the primary driver of financial outperformance.

For example, Amazon’s market share in US e-commerce stagnated at roughly 5% from 2000 through 2006, more than a decade after the company’s founding. But during the global financial crisis, Amazon maintained 25% annual growth even as the overall market slowed to a crawl, nearly doubling the company’s market share in a three-year span. Amazon has continued to outgrow the market significantly every year since—demonstrating that even when the external outlook is difficult, vitality can pay long-term benefits, even for large, established companies.

The Drivers of Vitality

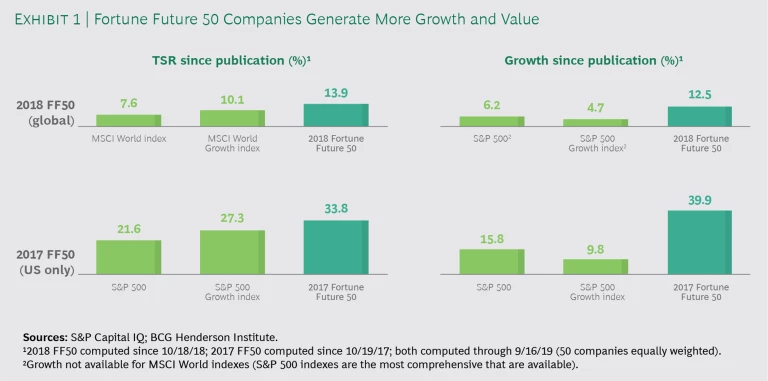

Our Fortune Future 50 index, now in its third year, aims to quantify the factors that contribute to corporate vitality and to identify the large global companies that are best positioned for growth. Vitality operates over long time periods, so it cannot necessarily be judged by short-term performance, but signs are positive so far: the companies from the 2017 and 2018 indexes have outperformed peers on both growth and TSR since publication. (See Exhibit 1.) Innovation and growth are of course risky, and several individual companies have not lived up to their promise. Nevertheless, in aggregate, vitality today has been a good predictor of growth tomorrow.

The index incorporates factors demonstrated to predict long-run success, organized into five pillars: market potential; strategy, technology, and investment; people; and structure. It draws on nonfinancial factors as well as financial data. For example, we tested various ESG scores, recognizing that sustainability and social value are increasingly intertwined with long-term performance. We consider gender diversity at several levels of the organization, finding (in line with prior research) that diverse companies are more innovative. And we use natural language processing methods to decode strategic orientation from SEC filings and annual reports, identifying companies that take a long-term perspective, serve a broader purpose, and embrace uncertainty and complexity in their strategy. (See “How We Measure Corporate Vitality.”)

How We Measure Corporate Vitality

How We Measure Corporate Vitality

Our index is based on two pillars. The first is Future Market Potential: the expectation of future growth from financial markets, defined as the present value of growth options (PVGO). This represents the share of a company’s market capitalization that is not attributable to the earnings power of existing assets and business models. This pillar accounts for 30% of the index.

The second pillar is Company Capacity: our assessment of the company’s ability to deliver on this potential. It comprises 19 factors, drawn from a larger group of variables and calibrated against historical data for their ability to predict long-term revenue growth, and accounts for 70% of the index. These factors are grouped into four areas:

- Strategy. From 30,000 SEC filings and annual reports, we used a long short-term memory neural network (a natural language processing model that incorporates word order and context) to characterize a company’s strategic orientation on three dimensions: long-term orientation, focus on a broader purpose beyond financial performance, and “biological thinking.” We also assess the company’s clarity of strategy articulation from earnings calls and use the company’s governance rating (according to Arabesque, a pioneer in ESG analytics).

- Technology and Investment. We assess the company’s capital expenditures and R&D expenditures (as a percentage of sales, compared with sector averages); the growth of a company’s patent portfolio (from a global database of patent filings) and that portfolio’s digital intensity (the share of patents in computing and electronic communication areas); and the quality of the company’s startup investment and acquisition portfolio (based on comparison with the best-performing global venture capital funds).

- People. We measure the gender diversity of the company’s management and larger workforce; the age of its executives and directors; its leadership stability (represented by the frequency of executive and director turnover); the geographic diversity of its directors; and the size of its board.

- Structure. We measure the age since company founding; size of the company (based on revenue); and growth track record (over prior three years and six months).

Companies were excluded from the Fortune Future 50 ranking if they had negative cash flow from operations over the prior three years on average, indicating elevated performance risk.

To survive the present and finance the future, especially in turbulent times, companies must also perform well enough in the present. Many of today’s high-growth companies are losing significant amounts of cash, in some cases triggering investors’ fears—which may increase if economic conditions worsen. Therefore, we have excluded from our ranking companies that have negative cash flow from operations, an indication that any growth potential may be fragile. Additionally, we also stratify our list to account for companies facing other significant risks that could derail their ability to thrive in the future.

Patterns of the 2019 Fortune Future 50

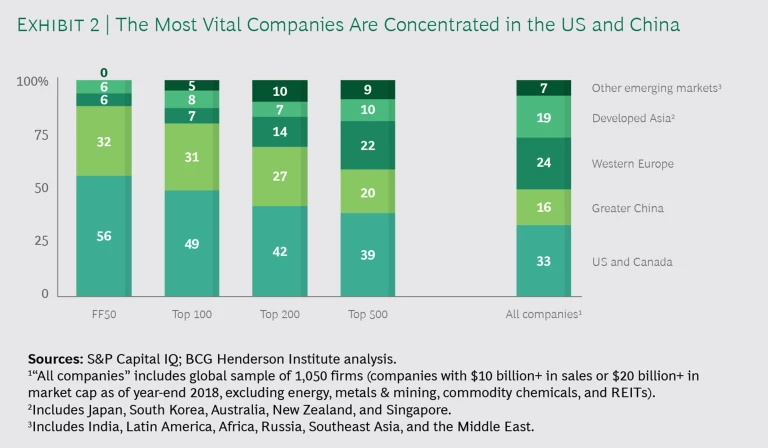

Our index reveals a bipolar landscape: 88% of the 2019 Fortune Future 50 are located in the US or China (mainly in California and China’s east coast). This distribution is in line with recent trends: more than 80% of the fastest-growing companies over the past three years also come from those two countries. Whereas last year’s ranking was split evenly between them, this year the US accounts for a majority of the top 50, reflecting the differential in economic momentum.

When expanding more broadly to the top 200 companies, however, a wider range of regions is represented. (See Exhibit 2.) Nevertheless, the patterns of vitality raise questions about the competitiveness of Europe in a bipolar technological world.

A majority of the top 50 companies are in technology and communications services—and several others are digital natives (for example, Alibaba and Amazon in retailing). This may seem counterintuitive, given recent signs of investors’ skepticism toward many tech companies and the emergence of a host of trust issues concerning technology. Indeed, the tech sector is coming of age, beginning to face many of the regulatory and social issues of more mature industries; some companies may not survive the transition unscathed. But the index indicates that, beyond potential short-term fluctuations, tech capabilities are continuing to reshape business in the longer run. For example, even if the recent hype around some technologies turns out to be a bubble that deflates, the investments already made may still lay the groundwork for the next generation of breakthrough business models.

But despite the tech industry’s prominence in the Fortune Future 50, the index displays a wide range of good and bad performance in every sector—only 10% of overall variation in vitality is explained by differences between sectors. One strong pattern in all industries is the negative correlation of vitality with age and size, reflecting the challenge of inertia and the necessity of reinvention. (See Exhibit 3.)

Another pattern emerging from our index is that the most vital companies outperform on gender diversity, which is the dimension of diversity best captured by today’s available data. One-quarter of executives at Fortune Future 50 companies are women, which is far from an aspiration of parity but significantly greater than the average of 17% for other large companies. Similarly, 18% of the top 50 companies have an executive team that is at least 40% female, a level reached by only 4% of their peers. These figures reflect the fact that diverse organizations are able to generate and harness a wider variety of ideas and are therefore better able to reinvent themselves for the future.

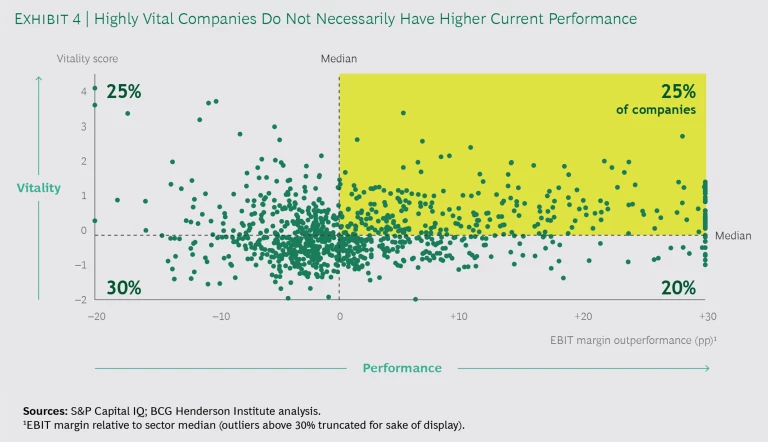

Finally, our index clearly indicates that the businesses with the greatest potential are not necessarily the ones with the highest performance today: of the companies with an above-average vitality score, exactly half are also above average in current performance (as measured by EBIT margin) and half are below. (See Exhibit 4.) What it will take to succeed in the future is likely to be different from what it takes to succeed today, so leaders need to both run and reinvent the business at the same time—what we call ambidexterity.

How to Increase Vitality

Vitality is hard to maintain in large, established organizations, but the index points to some ways they can beat the odds:

- Think differently about strategy. It can be natural for leaders to focus on the day-to-day issues of running their business, but to maintain vitality, they need to counterbalance this tendency with a long-term, exploratory perspective. They must also recognize that traditional approaches to strategy and execution, based on deliberate planning and top-down direction, are often insufficient in today’s business environment. Leaders instead need to master new strategic capabilities, such as adapting to shifts in the market, shaping the environment in which they operate, and renewing strategy when old models have been exhausted.

For example, graphics chipmaker Nvidia (number 26 of the 2019 Fortune Future 50) entered an industry that lacked a clear playbook; as cofounder Chris Malachowsky said, “There was no market in 1993, but we saw a wave coming.”

- Build the right capabilities. To deliver on their growth potential, businesses need to build a range of dynamic capabilities. These include technological excellence (even for companies that are not in traditional digital sectors), a diverse workforce with a culture that encourages the collision of ideas, and the organizational capacity to self-disrupt before being disrupted from the outside.

Visa (number 43) stands out as one of the oldest and most-established companies in the Fortune Future 50. It has maintained vitality in part by investing in a range of capabilities. To manage the transition to digital commerce, Visa has partnered with tech giants including Apple, Google, and Intel on payment apps and hardware, and it is internally investing heavily in AI for applications such as fraud prevention.

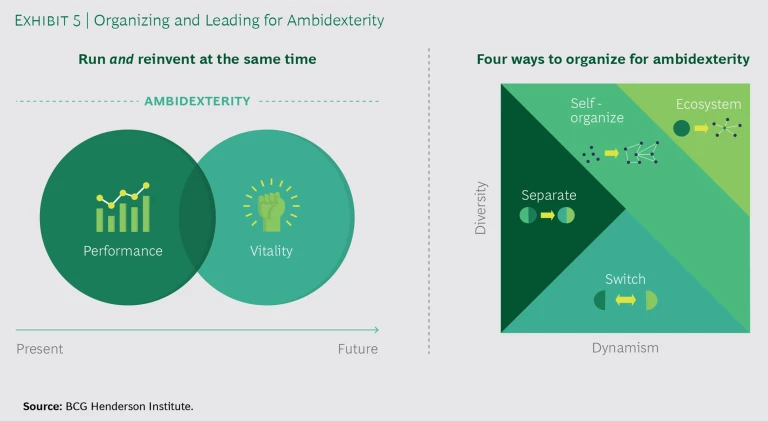

- Organize for ambidexterity. Vitality alone is not enough for incumbents to thrive sustainably; strong performance in the core business is also necessary in order to finance growth. However, running the business and reinventing it require different skills that are hard to balance—many companies fall into either the “success trap” (over-exploiting the current business, at the expense of tomorrow’s) or the “perpetual search trap” (over-exploring, at the expense of profitable commercialization).

Leaders can find an equilibrium by structuring their organizations for ambidexterity. This can be done in four ways, depending on the diversity and dynamism of a company’s environment: separating segments of the business according to their situations, so that each can adopt a different approach to strategy; switching strategic approaches over time; self-organizing so that business units can choose a variety of approaches; and tapping into ecosystems to benefit from partners that specialize in each approach. (See Exhibit 5.)

For example, Tencent (number 12) restructured its business in late 2018 for the first time in six years to align its organization with its strategic demands.

- Use forward-looking metrics. Past performance is no longer as likely to persist, yet businesses today tend to be managed with only backward-looking metrics. Leaders need to complement those with forward-looking measures to understand their company’s fitness for the future.

For example, Thornton Tomasetti, a leading engineering firm, has adopted methods to measure and manage its vitality. The company monitors the share of its projects that incorporate recent innovations, an indicator of its capacity to develop new growth options, and it has taken actions to improve on key components of vitality, such as the number, diversity, and velocity of ideas in the organization. As chairman and CEO Tom Scarangello said, “We see vitality metrics as a way to quantify that we’re doing what we need to do to achieve our goal of being the global driver of change and innovation in our industry.”

Business leaders face many short-term issues, but the need to reinvent their companies for the long term is more urgent than ever. By emphasizing vitality, as well as current performance, companies can thrive sustainably.

The BCG Henderson Institute is Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration from the Institute, please visit Featured Insights.