Automotive original equipment manufacturers are under unprecedented pressure. They face a softening macroeconomic environment and the continued shift by consumers toward mobility services as the technologies for shared autonomous electric vehicles mature. Together, these trends will place increasing pressure on OEMs’ top lines and ultimately hurt their operating leverage. Meanwhile, to keep pace with technological trends, OEMs will be forced to make capital-intensive investments in next-generation technologies, including advanced driver-assistance systems, hybrid and electric powertrains, and in-vehicle infotainment. These expenditures will place downward pressure on margins and strain OEMs’ balance sheets. Lastly, as vehicles begin to increasingly resemble today’s consumer technologies, customers will expect that fresh products are brought to market at a faster pace than ever before.

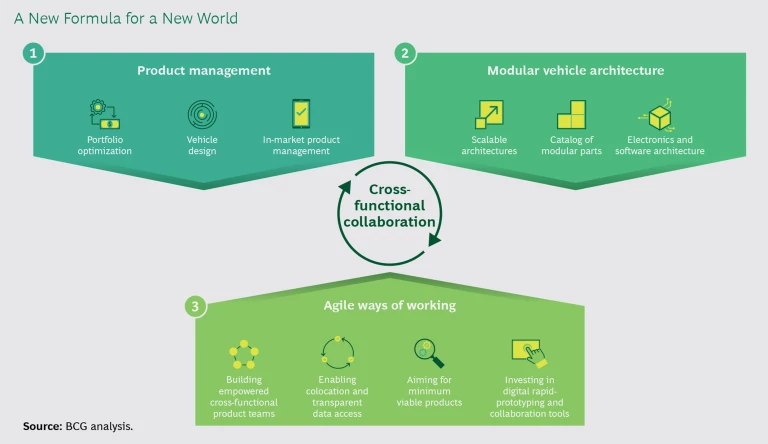

To survive, automotive companies need to move aggressively in three areas. First, they need to channel the voice of the customer into all product decisions and effectively respond to rapidly evolving tastes. Simultaneously, companies must adopt a modular vehicle architecture to efficiently leverage capital and resources across their portfolios and shift investment toward software-based features that customers are increasingly demanding. Finally, OEMs need to implement agile ways of working. Agile can help not only balance the inherent tradeoffs between diverse customer demands and portfolio efficiencies but also accelerate the vehicle development cycle by enabling more efficient and effective decision making.

Companies that take steps in all three areas simultaneously, embracing what we call agile product-life-cycle management, can garner significant rewards. These OEMs can improve their ability to spot new, untapped growth opportunities. They can improve profit per vehicle by 5% to 10% and slash both engineering and capital costs per vehicle by as much as 30%. Perhaps most critically, OEMs can shorten development cycles by as much as 40% and respond rapidly to customer demands by providing over-the-air software updates.

A New Formula for a New World

Many traditional OEMs still take a functional approach to their businesses. For example, marketing defines the customer’s needs, engineering designs the vehicles, and operations builds the network to produce and deliver the vehicles.

This approach drives functional excellence, but it does so at the expense of agility and effective decision making. When a hard line is drawn between functions, companies can unintentionally create organizational silos and foster a culture of defensiveness and mistrust, often leading to two problems. First, given the frequency of handoffs across the development cycle, rework becomes the norm, as each function questions the inputs of the previous function. Second, each individual function optimizes for what it knows and how it is measured, often at the expense of the enterprise at large. The net result: slow, suboptimal decision making.

In a world where capital is scarce and OEMs must make better bets, squeeze costs, and maximize market share, a new formula is required. To help automotive OEMs navigate this new era, we have identified actions in three areas that are critical to success. (See the exhibit.)

Product Management: Channeling the Voice of the Customer Through the Life Cycle

With today’s customers demanding more from their vehicles than ever before, all product-life-cycle decisions made by automotive OEMs must be grounded in a robust understanding of buyers’ needs and wants and what they are willing to pay.

By taking a demand-centric view, OEMs can gain insight into customers’ priorities and reduce the guesswork behind product design and engineering.

To connect the voice of the customer to product decisions, OEMs must first construct a demand map, which identifies each customer segment in the automotive sector. They should then conduct a detailed analysis of the technical, functional, and emotional needs of customers in each segment, a process that creates a robust and actionable picture of the customer. By taking this demand-centric view , OEMs can gain insight into customers’ priorities—such as performance, cargo capacity, and connected features—and reduce the guesswork behind product design and engineering. This comprehensive look at customer segments will enable automotive companies to answer a critical question in three key areas:

- Portfolio Optimization: How can our company position both existing and potential new products in the most attractive customer segments? OEMs that have a clear understanding of how customer segments stack up in terms of economic attractiveness, competitive dynamics, and their company’s “right to win” can determine how to position existing vehicles and where untapped white-space opportunities exist. This information helps OEMs make more informed investment allocation and prioritization decisions, such as where they can attack competitors’ vulnerabilities, better address customers’ unmet needs, and defend existing brands’ strengths.

- Vehicle Design: How can the company optimize vehicle design to maximize margin and market share while minimizing complexity? Armed with detailed customer profiles for each segment, automotive companies can design their vehicles to deliver what customers value most. This approach can mean upgrading features and attributes that matter more to customers and downgrading those that matter less yet add to product costs. Companies can also use these insights to tackle a common challenge: increasing product complexity. As customer demands rapidly change, it is often tempting to broaden the array of optional features available in an ill-informed bid to win share. But this increase in complexity wreaks havoc on capital budgets and can make the marketing, manufacturing, supply chain, and sales functions less efficient. Truly understanding customer preferences will help OEMs pinpoint which options drive additional revenue.

Truly understanding customer preferences will help OEMs pinpoint which options drive additional revenue.

- In-Market Product Management: How can the company respond with agility to real-time market dynamics in order to drive incremental margin and market share? Amassing detailed sales and inventory data at the dealer level using the customer segmentation tool can provide another valuable source of insight for OEMs. By using this information, automotive companies can optimize production mix, dealer allocation, and market incentives on an ongoing basis. Such actions have proved to drive significant near-term volume and margin gains. Moreover, this targeted, frontline approach can provide an effective closed loop of information to inform future portfolio and product decisions.

Overall, we have seen that companies that effectively put customer demands and needs at the center of product management can increase profits by 5% to 10% per vehicle while also uncovering new growth opportunities.

Modular Vehicle Architecture: Efficiently Leveraging Capital and Resources Across the Portfolio

Putting meaningful customer insight to use is not enough. Companies must also adopt a modular vehicle architecture to ensure that capital and resources are leveraged efficiently across the enterprise to meet customer demands. When fully embedded in the operating model of an organization, a modular vehicle architecture can minimize costs across the engineering, manufacturing, and supply chain functions, while preserving the flexibility to bring a wide variety of products to market.

A modular vehicle architecture comprises three components: scalable architectures, a catalog of modular parts, and a single electronics and software architecture.

Scalable architectures are combinations of core vehicle parameters around which products are designed. Scalable architectures are typically aligned around three configurable parameters: the powertrain (with an internal-combustion engine or an electric motor), the drivetrain (configured for front-wheel or rear-wheel drive), and the chassis (constructed using a unibody or body-on-frame design). Combinations of these parameters can be scaled to various vehicle lengths, heights, and widths. Currently, OEMs that have embraced a modular vehicle architecture use roughly five scalable architectures, enabling them to reduce parts complexity and maintain common tooling lines in a plant facility.

When the scalable architectures are established, a catalog of modular parts can be created. This catalog contains all approved variants of vehicle parts—including braking systems and instrument panels—that are available for use by product developers. Engineers can then pick and choose from this catalog of variants to assemble new products, ensuring that OEMs avoid the investment required to develop and tool new parts for each and every vehicle. In our experience, modular parts can account for up to 70% of a vehicle’s cost and still allow for the development of vehicles that cover a wide variety of customer needs and price points.

A single electronics and software architecture enables more-seamless software deployment and updates across a full fleet of vehicles. With the increasing importance of software, OEMs need to standardize on such architecture and ensure that it and the off-board infrastructure support new levels of functionality in order to deliver differentiated customer experiences and enable new types of business models.

Certainly, some OEMs have created scalable architectures and catalogs of modular parts and have begun to standardize on a single electronics and software architecture. But even those who are ahead of the industry in both areas often do not reap the full benefits. To unlock the full potential of a modular vehicle architecture, companies need to fundamentally change the way they operate:

- First, manufacturers need to develop the scalable architectures and a catalog of modular parts independent of any individual vehicle and with input from all functional stakeholders. This will ensure that components are designed to deliver on customer feature requirements that apply across an automaker’s entire product portfolio, while minimizing engineering and tooling investment.

- Second, companies must take a systems engineering approach to developing modular parts while maintaining a focus on the demands and preferences of the customer. As software-based features increase in importance to customers, OEMs need to channel more investment toward them. Conversely, less capital should be allocated to developing the parts of the vehicle that are not priorities for customers, freeing up additional funds for development of software-based features. Ultimately, the catalog of modular parts should be designed not only with technical range in mind but also with an eye toward future customer demands.

- Third, OEMs must design their electronics and software architectures to accommodate an exponential increase in the quantity and speed of vehicle data and centralize the control of vehicle data and analytics. In addition, they must decouple the software from the hardware to allow more frequent over-the-air updates to all electronic control units in the vehicle.

- Fourth, product developers need to adapt how they engineer vehicles. Instead of building cars from the ground up, developers need to use the modular vehicle architecture as a set of preselected building blocks with fixed attachment points (borrowing best practices for the development of application programming interfaces from the software industry). This process will not only reduce engineering costs but also accelerate development cycles. That’s because predesigned architectures and modular parts are taken off of the vehicle’s critical path, enabling a shorter overall time to market.

Product developers need to use a modular vehicle architecture instead of building cars from the ground up.

- Fifth, the manufacturing and supply chain functions will need to reconfigure the plant network and adjust supplier relationships to take advantage of the economies of scale afforded by a modular vehicle architecture. Now, rather than making individual investments in each unique vehicle, capital can be allocated across multiple vehicles, with less total investment.

- Sixth, companies must adjust their financial systems to reinforce the changes created by adopting a modular vehicle architecture and lock in cost savings. This adjustment should include setting aside investment dollars to fund structural investments in the scalable architectures, modular parts, and electronics and software architecture. In addition, individual vehicle development budgets must be stripped down to reflect the new levels of efficiency.

Companies that fully embed a modular vehicle architecture in their operations can generate as much as a 30% reduction in both engineering costs and tooling capital requirements per vehicle while cutting product development times by 20%.

Agile Ways of Working: Balancing Tradeoffs and Improving Decision Making

Channeling the voice of the customer while efficiently leveraging capital and resources across the portfolio can often be at odds with each other. Developing a strategy that balances the demands of both constraints, and that integrates the views and goals of disparate functions into a single enterprise view, is no easy task. But it is critical, because ongoing internal debates across siloed functional teams can hamper the performance of those teams, leading to slow and suboptimal decision making.

To balance these demands, automotive companies can adopt practices from the software industry. Software developers are the pioneers of agile and have established a consistent track record of bringing innovative products to market in an efficient and effective manner. OEMs can adapt agile to the automotive world by embracing four best practices:

- Building Empowered, Autonomous, Cross-Functional Product Teams. To break down organizational silos and reduce bureaucracy, OEMs must set up teams comprising a product owner and members from all relevant functions, including marketing, analytics, design, engineering, purchasing, and manufacturing. These groups need to be empowered and incentivized to make decisions that not only drive the success of their product lines but also optimize the performance of their individual functions.

- Enabling Colocation and Transparent Data Access Across Functions. It is important for companies to bring critical decision makers together in one place and ensure that they are all working from a common knowledge base. By colocating these agile teams and enabling transparent data access, companies can break down the very real, and often physical, silos that exist among functions. Most important, colocation reinforces the feeling of being on one team, instilling in its members an affinity for their cross-functional purpose, rather than for their individual function. The result of this trust and affinity across silos is better and faster decision making.

- Aiming for Minimum Viability, Not Perfection. To cope with the increased pressure to deliver products faster, OEMs must align internally on the requirements of a minimum viable product. The guiding principle for this practice is simple: initial product releases must meet this definition of minimum viability with the understanding that future releases or real-time updates can be accelerated to continually improve the product over time. This mindset simplifies and speeds execution by minimizing any disruptions that occur when new information surfaces in the middle of a development cycle.

- Investing in Digital Tools That Enable Rapid Prototyping and More Effective Collaboration. Digital tools allow OEMs to create more advanced and refined digital prototypes than in the past. By investing in such tools, companies can speed up new product development and resolve more critical issues before moving to a more expensive physical prototype.

In our experience, embracing agile ways of working can cut development time by 20%. When that is added to the reduction that’s possible through the adoption of a modular vehicle architecture, companies can slash 40% off their development times.

Implementing Agile Product-Life-Cycle Management

OEMs that embrace agile product-life-cycle management will develop the formula they need to win in the challenging years ahead . But, deploying this new approach requires a systematic effort. We have identified three steps to getting started.

Benchmark Current Performance

Companies should benchmark performance across the industry and then use that information to establish key metrics. There are three areas to benchmark: engineering costs, tooling costs, and product development cycle times. These areas must be measured for lead products developed on new architectures as well as both major and minor derivatives of these lead products.

Collectively, these benchmarks will provide meaningful insight into performance. For example, if an OEM’s derivatives are more costly than those of its competitors, it is likely that the company’s application of a modular vehicle architecture has room for improvement.

Take a Health Check

After benchmarking their performance, companies should turn their attention to assessing where, when, and how to make improvements. We recommend organizing this “health check” around the core elements of agile product-life-cycle management by asking these questions:

- How refined is our understanding of the customer for each segment of the demand map? Does the voice of the customer inform decisions related to the portfolio, product design, and complexity?

- Have we established a set of scalable architectures? What percentage of each vehicle can be assembled from modular parts? Is a modular vehicle architecture truly embedded in the operating system of the company?

- Are cross-functional product teams in place and supported by agile ways of working?

Launch a Change Effort

After using the health check to develop a list of priorities, OEMs can launch a transformation that delivers near-term wins while ensuring long-term structural change.

To build early momentum, companies should start with pilots on vehicle programs to test product-life-cycle management, a modular vehicle architecture, and agile concepts. In parallel, companies need to drive broader structural change initiatives to close the major gaps identified in the health check. These initiatives can include building new customer capabilities, reorganizing around product lines, and overhauling performance management systems.

In the face of monumental shifts in the automotive industry, OEMs must better target and deliver on customer needs, squeeze product costs, stretch capital further, and react more quickly to change. To accomplish these goals, OEMs should invest in gaining a deep understanding of the customer, embed a modular vehicle architecture into their operating model, and create empowered cross-functional product teams that use agile ways of working. Taking these steps together will ensure that automakers bring the right products to market faster and at lower cost.