Electricity is poised to emerge as the dominant fuel for automotive transportation in the decades ahead. However, in order to meet the demand for power that transportation electrification (TE) will create, utilities must perform a tricky balancing act. They need to invest in upgrading the pipeline for that fuel—the transmission and distribution system (or grid)—without triggering excessive upward pressure on consumer electric rates.

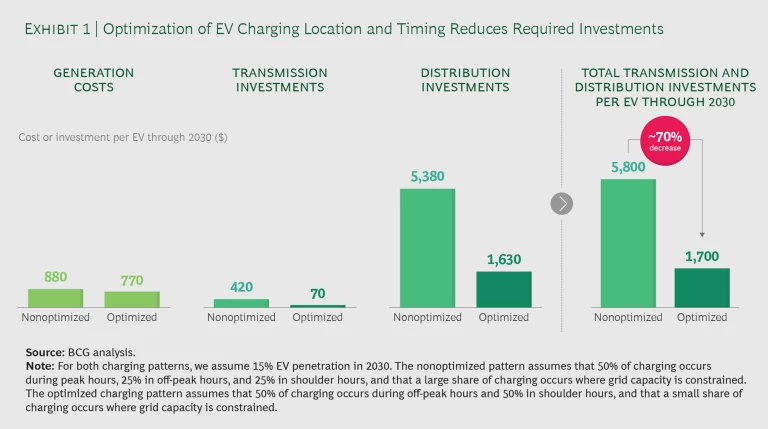

How exactly can utilities manage the tradeoffs? To understand the dynamics at play, BCG developed a detailed model of revenues, costs, and retail-rate impacts for a “representative” utility with 2 million to 3 million customers. (See the sidebar, “Modeling the Impact of Electric Vehicles.”) We found that the representative utility, depending on charging patterns, will need to invest between $1,700 and $5,800 in grid upgrades per electric vehicle (EV) through 2030. Given that these grid investments will largely be covered in the rate base, the cost of the investments will ultimately be passed on to ratepayers. In the majority of scenarios considered in our model, ratepayers will see some upward pressure on rates. At the high end, rates could increase 1.4 cents per kilowatt-hour (kWh), or 12%, from an assumed baseline rate of 11 cents per kWh.

Modeling the Impact of Electric Vehicles

Modeling the Impact of Electric Vehicles

Our modeling work is based on what we define as the “representative” utility—a utility with an initial system capacity of 12 gigawatts, baseline electricity sales of about 40 million megawatt-hours (MWh), and wholesale prices that range from roughly $23 per MWh during off-peak times to $34 per MWh during peak periods.

The first input for our model was the EV penetration rate through 2030 that we assumed. On the basis of that assumption, we calculated the number of EVs within the utility’s service area and projected EV-related electricity and power demand. These projections drove our estimates of both EV-related generation costs as well as transmission and distribution costs. Transmission costs include transmission lines and substations. Distribution costs include distribution substations, transformers, circuits, and switches. The total grid investment required and the resulting rate impact in each of our nine scenarios reflect our assumptions about the time of charging and existing capacity constraints on the grid.

The actual tally of required transmission and distribution investment, of course, depends on the specifics for an individual utility, including its current capacity and the amount it needs to add, the physical layout of the grid, and the overall density of areas that require investment in terms of buildings, roads, and the like. Such factors determine not only the overall investment required by the utility but also the ultimate impact on ratepayers’ bills.

To head off that sort of hit to ratepayers, utilities—while still encouraging the adoption of EVs—need to develop a plan for transmission and distribution updates that minimizes the investment required in the grid. The plan should include shaping consumer behavior, deploying technology to minimize the strain EVs will put on the grid, and creating a blueprint for investments and other actions that drive TE.

Quantifying the Grid Costs of EVs

There’s no denying it— EVs are going mainstream . BCG expects that, by 2030, EVs (mild and full hybrids, plug-in hybrids, and battery EVs) will account for 50% to 60% of new-car sales and 21% to 27% of all light-duty vehicles (such as passenger cars and SUVs) on the road. And the vehicles that will impact utility operations the most—plug-in hybrids and battery EVs—will account for 20% to 30% of new sales and 7% to 12% of all cars and trucks in use.

The growing electrification of mobility creates significant opportunity for utilities

The growing electrification of mobility creates significant opportunity for utilities . The most significant is the opportunity to upgrade and enhance the electric grid.

The Impact of EVs on the Grid. Although the widespread adoption of EVs will require a significant increase in grid capacity to handle certain locations and time periods of high charging demand, the impact on overall energy load will be less dramatic.

To understand why, imagine a fleet of 200 public-transit buses charging simultaneously. If they were all to charge overnight using an 80-kilowatt (kW) charger, which charges at a relatively slow rate, they would demand 16 megawatts (MW) of grid capacity. However, if even 20% of those buses needed to charge quickly during the day (using 450 to 500 kW chargers for roughly 10 to 15 minutes), they would require 18 MW of grid capacity. That is the same amount of capacity demanded by roughly 3,000 homes at their peak capacity needs.

To ensure that the grid can handle this demand, utilities must invest in new and upgraded distribution assets to carry electricity from the transmission system to EV chargers. Although increased demand will initially put the most strain on distribution circuitry and substations, utilities will eventually need to make investments in transmission lines and substations as well.

The additional revenue from electricity sales for EV charging will offset some of those investments. However, utilities will likely need to recoup part of their investment through higher retail rates. In addition, investment costs—and therefore the pressure on rates—will be magnified as EV adoption ramps up. That’s because investment costs increase exponentially as penetration increases, given the need for more expensive equipment and a larger number of new assets.

Utilities will likely need to recoup part of their investment through higher retail rates.

Modeling the Impact. How quickly EVs are adopted, as well as where and when people charge them, significantly impacts the projected grid costs of EVs. Consequently, we modeled nine scenarios for a representative utility. These scenarios are based on three different levels of EV adoption for the light-duty fleet within the utility’s territory—10%, 15%, and 20%—and three different patterns of charging by customers. The charging patterns are as follows:

- Optimized: 50% of charging occurs during off-peak hours and 50% during shoulder, mid-, or partial-peak hours. Overall, a significant portion of charging activity occurs where grid capacity is not constrained.

- Moderately Optimized: 33% off-peak charging; 33% shoulder, mid-, or partial-peak charging; and 33% peak charging. Some charging occurs in areas with capacity constraints.

- Nonoptimized: 25% off-peak charging; 25% shoulder, mid-, or partial-peak charging; and 50% peak charging. Significant charging occurs in areas where grid capacity is constrained.

Our base case scenario assumes that EV penetration will gradually increase from about 1% in 2019 to roughly 15% in 2030, with a moderately optimized charging pattern. Under this scenario we can project transmission and distribution costs and energy consumption:

- Transmission and Distribution Costs. Given 1.1 million EVs in service by 2030, our model estimates that the representative utility will need to make cumulative transmission and distribution investments of $2.8 billion through 2030, for an estimated grid capacity upgrade cost of $2,600 per EV. That’s a meaningful sum given that a US utility of this size tends to spend about $1 billion annually on transmission and distribution capital expenditures. As noted earlier, most of these costs are from investments in distribution assets; transmission assets account for only $110 per EV in costs, or less than 5% of the total investment costs.

- Energy Consumption. We assume that, on average, an EV in the light-duty fleet within the utility’s territory will consume about 2,960 kilowatt-hours (kWh) per year from 2019 to 2030.

Charging patterns will have a major impact on both transmission and distribution costs and energy costs. If customers embrace optimized charging, less investment in higher-voltage and more-expensive transmission circuits and new transmission substations will be required. On the distribution side, optimized charging would limit the number of substations that must be upgraded as well as the number of substations, circuits, switches, and service transformers that must be added.

In addition, given that the wholesale cost of electricity generally varies throughout the day according to demand, energy costs will be lower if utilities can incentivize customers to adopt optimized charging behaviors. At the same time, such charging patterns can minimize the need for new power generation investment.

Energy costs will be lower if utilities can incentivize customers to adopt optimized charging behaviors.

Managing the Costs of Grid Enhancements

The degree to which utilities succeed—or fail—at optimizing both the timing and location of EV charging will determine whether customers see big rate hikes.

Charging patterns determine costs and investments. Our model quantifies how different charging patterns impact total costs. On the generation cost side, we assumed wholesale costs of $23, $29, and $34 per megawatt-hour (MWh) for the off-peak; shoulder, mid-, or partial-peak; and peak charging periods, respectively. Given those costs, the cumulative generation cost (per EV) to the utility from 2019 to 2030 will vary from $770 to $880, depending on the charging pattern.

Looking at transmission and distribution investments, the optimization of both timing and location would allow a decrease of roughly 70% in transmission and distribution costs per EV through 2030—from $5,800 in the nonoptimized charging scenario to $1,700 in the optimized scenario. (See Exhibit 1.)

Demand from EVs can put upward pressure on rates. For customers, the best-case scenario in our model results in rates that are essentially flat. However, in most of our scenarios, rates rise—in some cases significantly—as utilities meet increased demand from EVs.

To model this dynamic, we look at the impact on both costs and revenues. The cost impact includes both the cost of generating or buying electricity and the investment required in transmission and distribution. This cost impact is offset by new revenues from EV charging. Without changes in the retail rate, these new revenues may not compensate the utility for all of its costs. The difference between the cost and revenue impacts is the rate impact—the change in rate required for the utility to fully recoup its investments and the increase in electricity costs.

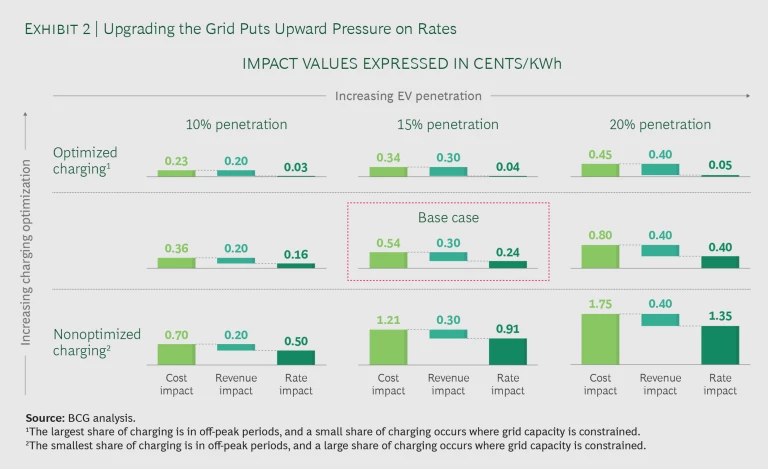

Across our model scenarios, we estimate that increased generation costs and transmission and distribution investments will increase retail rates from 0.03 cents to 1.35 cents per kWh, which equates to an increase of less than 1% to 12% on the initial rate of 11 cents per kWh. The range reflects the implications of the nine scenarios, which differ in the level of EV adoption by 2030, and the optimization—or lack thereof—of charging, as described earlier. For a given level of EV penetration, the rate increase shrinks as the timing and location of charging are increasingly optimized. (See Exhibit 2.) At 15% penetration, for example, the rate impact drops from 0.91 cents to 0.04 cents per kWh as timing and location are optimized.

In our base case (15% EV penetration by 2030 and a moderately optimized charging pattern), we estimate that retail rates will rise by 0.24 cents per kWh, an increase of roughly 2%. That increase will occur despite significant boosts in revenue from EV charging. In the optimized charging scenarios, and especially at low levels of penetration, the revenue hike nearly offsets higher costs and leaves rates essentially unchanged.

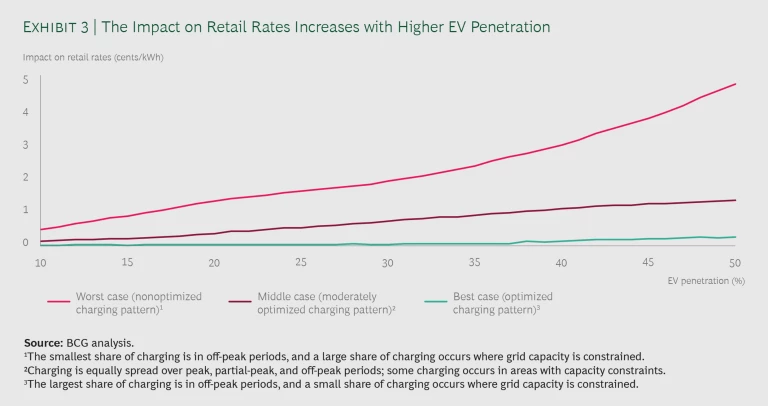

The equation changes quite a bit as EV penetration increases. Notably, the difference in the impacts on retail rates between grids with optimized charging and those with nonoptimized charging widens. That’s because, as noted earlier, the equipment and other investments required to upgrade the grid become more expensive as EV adoption advances. At 50% EV penetration, for example, the rate impact in a nonoptimized charging scenario is roughly 4.75 cents per kWh—almost 20 times the rate impact of 0.25 cents per kWh under an optimized charging scenario. (See Exhibit 3.)

The Game Plan for Utilities

To minimize the costs to ratepayers, while maintaining their ability to capture a share of the value for upgrading the grid for EVs, utilities need to take action in three areas.

Plan ahead. Utilities should build a roadmap of programs that will enable them to enhance the grid to meet EV demand at a reasonable cost. After all, customers won’t be happy waiting years for a distribution upgrade so that they can deploy EV chargers.

To do this, utilities should use their detailed network maps to identify the sites where they anticipate material demand for EV charging infrastructure. They should then segment the sites into those that would require minimal or no grid upgrades and those that would need substantial grid upgrades. On the basis of that insight, utilities can develop a plan that both minimizes the extent of grid upgrades required at all sites and meets the requirements of the sites that are in need of major upgrades.

Regulated utilities in particular should prepare to make a series of regulatory filings that will allow them to recoup their investments in upgrading the transmission and distribution system. This will put them in a position to help fuel future EV growth.

Deploy new technology. Utilities should adopt new technologies to limit the strain that EVs put on the grid. Doing so includes investing in infrastructure improvements such as advanced electricity metering technology, which allows them to charge different rates for electricity depending on the time of charging. Utilities should also invest in improvements to that technology that will allow differential pricing on the basis of location, in order to incentivize charging in some locations and discourage it in others.

Utilities should adopt new technologies to limit the strain that EVs put on the grid.

In addition, most utilities should deploy controlled demand response systems that automatically shift EV charging to the right times and places on the basis of pricing signals from the grid. These systems can, for example, actively manage when specific chargers are allowed to charge EVs. The systems can make these charging decisions by leveraging information from devices that update the utility on a vehicle’s battery status. At the same time, utilities should actively manage traditional sources of power demand, such as air conditioning, heating, and ventilation. Such efforts can help ensure that overall demand—including that from EV charging—can be met with existing grid capacity.

Moreover, utilities can help deploy battery storage at charging stations. These systems allow batteries to be charged during off-peak hours so that customers can use batteries, instead of the grid, to charge EVs during peak periods.

Shape customers’ charging behavior. As they strive to minimize the extent of grid upgrades, utilities can employ their new tools and technology to encourage EV charging during off-peak periods and discourage it in parts of the grid that are already capacity-constrained.

They should design rates in a way that dissuades customers from charging at times of high demand for grid capacity; techniques include time-of-use rates, hourly pricing, and demand charges. As the technology that enables differential pricing by location matures, utilities should also introduce rates that help direct where EVs charge.

At the same time, utilities need to determine which costs should be spread across the rate base and which should be borne by particular customers. After all, the additional grid enhancements will not necessarily benefit all customers equally. Utilities may want to work with regulators to come up with ways to pass the investment cost along to customers in proportion to the benefit they receive from those investments.

EV market growth is just beginning, and it has the potential to create a win for both utilities, who aim for profitable growth, and regulators, who look to promote cleaner sources of energy. Nevertheless, a grid that can handle the demand from EVs will come at a cost. The task for utilities is to develop a strategy that supports EVs but minimizes the costs to customers.