This article describes the seventh annual study by BCG and IRI of growth leaders in the US consumer packaged goods industry.

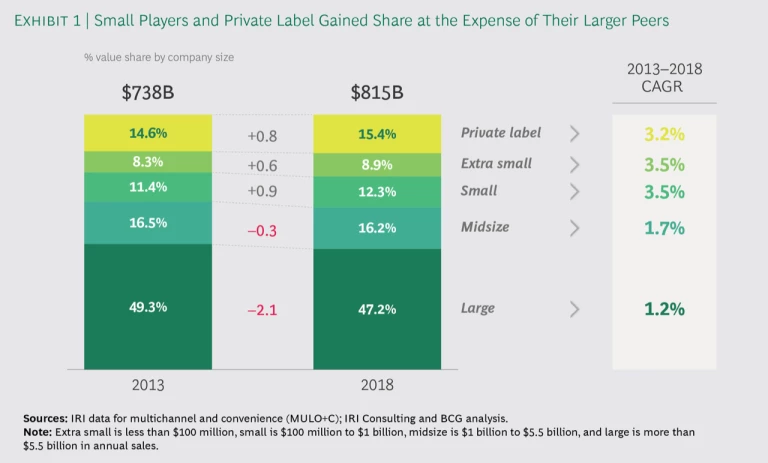

Growth in the US consumer packaged goods (CPG) industry accelerated slightly in 2018, reaching 2.0%, compared with 1.4% in 2017. Pricing (price per unit) and assortment (more premium products) underpinned the uptick for the second straight year. Meanwhile, growth continued to be propelled by smaller players and private-label brands, at the expense of the larger and more established companies.

Against this backdrop of modest gains, however, certain companies thrived. They acquired brands that were already flourishing, which allowed them to enter new categories and add new capabilities. And they developed new products and packaging to bolster or renew interest in their legacy brands. They also found success by focusing their portfolios on emerging consumer trends. As a result, they were able to augment pricing growth with volume growth, instead of relying on pricing to make up for volume shortfalls.

Growth Shifts

The drivers of the US CPG industry in 2017 remained the same in 2018, according to the seventh annual Growth Leaders study by Information Resources, Inc. (IRI) and Boston Consulting Group. Together we evaluated the growth of more than 400 CPG companies with annual US retail sales exceeding $100 million. We generated three lists of growth leaders: small companies ($100 million to $1.0 billion in IRI-measured annual retail sales), midsize companies ($1.0 billion to $5.5 billion), and large companies (more than $5.5 billion). Our analysis, which covered both public and private companies, focused on what consumers actually buy in measured channels, as opposed to what factories ship. We ranked companies on a combination of three metrics: dollar sales growth, volume sales growth, and market share gains.

As was the case in 2017, growth in 2018 was spurred almost exclusively by price/mix, while volume growth remained limited, at just 0.2%. That combination stands in stark contrast to the situation in 2016, when half of overall growth was the result of volume and half was the result of price/mix.

Growth in 2018 was spurred almost exclusively by price/mix.

Emerging channels such as discounters and e-commerce continued to grow, changing dynamics within the CPG retail environment. At the same time, growth materially shifted to smaller companies (under $1 billion) and private-label brands, which together captured approximately $20 billion in sales from midsize and large players. (see Exhibit 1.)

Top-Performing Companies

Our growth leaders include a number of repeat players, as well as some newcomers. Among large CPG companies, Constellation Brands topped the list of growth leaders for the second year in a row, followed by returning 2017 growth leaders Monster Energy and Procter & Gamble. Danone, Mars, and Bimbo also made return appearances in the large-company top ten. E-cigarette maker JUUL Labs maintained a number one position, but moved to the midsize-company list from the small-company list the year before. It was joined on the midsize list by returning growth leaders L'Oréal and Blue Diamond, along with other former and new entrants from across a broad set of categories. (See Exhibit 2.) Meanwhile, growth of midsize and large players not included among the top ten either declined slightly or remained flat in 2018—on average, slipping 0.5% and 0.1%, respectively.

Among small players, the top ten notched growth of 50% over 2017, compared with average growth of just 1.3% for other small players. The growth leaders list for small companies was led by two first-time entries: (1) the sports supplements maker VPX (Vital Pharmaceuticals) and (2) the men’s shaving manufacturer Harry’s, which in 2018 shifted from a direct-to-consumer model to distribution in Target and Walmart. These companies were joined by several other players whose offerings touch on emerging trends.

Strategies for Boosting Growth

While small players registered the highest year-over-year growth, growth leaders of all sizes drove success beyond that of their like-sized peers by using two core strategies.

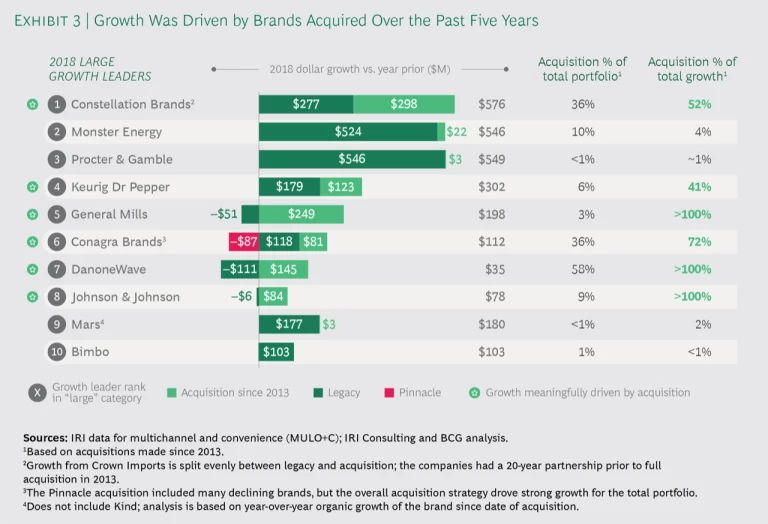

If they hadn’t made their acquisitions, some of the large-company growth leaders may have posted a decline in sales for 2018.

They continuously reshape their portfolios. For the top ten large-company growth leaders in 2018, roughly 40% of their growth came from brands they'd acquired over the previous five years. For six out of the ten growth leaders, recent brand acquisitions underpinned the lion's share of their growth. (See Exhibit 3.) Indeed, if they hadn’t made their acquisitions, some of the growth leaders, particularly in the large-company category, may have posted a decline in overall sales for 2018.

In addition to propelling growth, acquisitions allowed growth leaders to enter new categories and increase penetration by capturing new (usually younger) consumers and demographics—as Johnson & Johnson did with its purchase of natural dietary supplements maker Zarbees.

By adding new brands to their portfolios, growth leaders gained new, critical capabilities that they used to bolster their legacy brands. For example, when General Mills bought organic pasta and snack brand Annie’s, it not only boosted growth through Annie's existing distribution and sales strategy—sales rose from $212 million in 2014, the year the deal closed, to $363 million in 2017—but also acquired advanced digital capabilities, an enhanced test-and-learn mentality, and more robust sourcing and procurement skills.

They keep tapping into consumer trends. Growth leaders are investing across six key consumer trends: plant-based products, indulgence and better-for-you snacking, multifunctional beverages, simple and transparent packaging/ingredients, premium convenience, and self-care.

The trend of multifunctional beverages in particular has been on the rise for years, but in 2018 growth leaders focused on two key segments: hydration and energy. Drinks from small-company growth leader BodyArmor elevate hydration by offering a balance of electrolytes (potassium and sodium) that is different than that of its rivals. Large growth leader Danone, whose best-known brands include Evian water and its eponymous line of yogurt, entered the energy segment with its acquisition of cold brew coffee brand Stok.

Another emerging trend that growth leaders are strongly focused on is premium convenience. Within premium convenience, categories include the following:

- Restaurant Quality at Home: Restaurant-quality food in just one or two steps, such as offerings from Italian foods maker Giovanni Rana and sauce maker Rao's

- Premium at Home: Premium-priced options that provide at-home convenience and quality, such as the Steamfresh line of flash-frozen vegetables from Birds Eye

- On the Go: Meals and snacking items for consumers to “grab and go,” such as items from Bob Evans Farms, which also owns a line of restaurants

Rao's has found success in premium convenience by doing two things: expanding its reach into new product areas (pesto, alfredo, and pizza sauces) and taking an integrated approach to marketing, making use of not just traditional PR but also social media and influencer events.

By reshaping their portfolios and continuing to tap into consumer trends, most growth leaders maintained or increased volume. Constellation Brands, for example, a growth leader among large players in 2017 and 2018, propelled the lion's share—8.3% out of 9.8% total growth—from volume. The top ten midsize growth leaders used volume to generate growth of 12.2%; an additional 0.2% was due to price/mix. Meanwhile, other midsize players reduced overall volume by 2.1% and used price/mix to make up for some of the shortfall.

After a year in which large US CPG companies notched small gains, their ability to grow continues to be challenged in 2019, especially in brick-and-mortar channels. To stimulate growth, companies must take a creative approach and think beyond their current position in the market. When considering acquisitions, they should ensure that the potential targets are poised to continue growing over the long term, so that the required return on investment can be maintained.