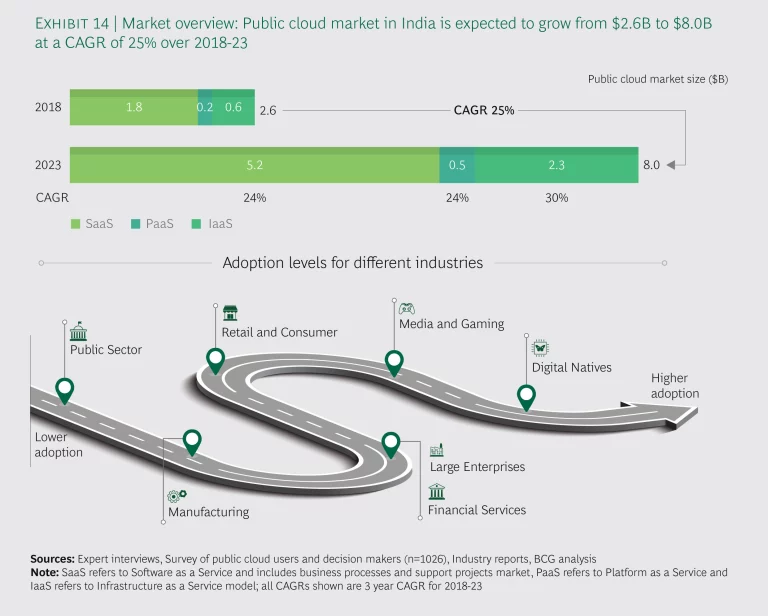

India is one of the largest public cloud markets in the APAC region, and one of the fastest growing, projected to grow from US$2.6 billion to US$8 billion with a CAGR of 25% between 2018 and 2023 (See Exhibit 14). The potential for deeper penetration of public cloud in India becomes all the more evident given that the market is still in an early stage in terms of public cloud and IT spending.

Even so, India has set global benchmarks in public cloud usage. Hotstar, an Internet streaming service provider, had 18.6 million simultaneous viewers for a live streaming of a cricket match in May 2019, the global record for viewership of a live program on streaming media. That kind of surge in viewership can be accommodated reliably only with the public cloud’s scalable architecture.

The SaaS model has been key to growth, with companies adopting public cloud to make basic functions such as collaboration, accounting, and human resources data analysis more efficient. SaaS currently accounts for just over 50% of the market, but as more companies seek to run their own systems, applications and platforms over the cloud, PaaS and IaaS use is picking up. IaaS is expected to be the fastest growing segment, with growth expected to be about 30% annually over the next five years.

Digital natives and media companies are driving public cloud adoption in India, with interest growing among retailers, financial services institutions, manufacturers, and large enterprises across industries.

Industry adoption

Digital native businesses have embraced the public cloud as a core enabler for a reliable, scalable infrastructure that allows them to expand rapidly within both domestic and international markets, all with lower upfront costs than they would otherwise have. India has over 20 tech startups that have achieved unicorn status, valued at US$1 billion or more by investors, and more than 80% of them have found IaaS and PaaS platforms integral to their success. Most are deploying some form of advanced application such as artificial intelligence or machine learning to embed such tools as market analytics, product recommendations and customer loyalty programs within their offerings. Unicorns in a range of businesses including transportation, food delivery, mobile learning, online grocery shopping, hotel booking, and mobile restaurant reservations are partnering with public cloud providers to deploy advanced analytics and grow their customer base through personalization.

The online travel company Ibibo Group used the public cloud to improve its service quality for travelers while at the same time developing faster collaboration tools for its nearly 500 employees (See Ibibo Group case study).

Another digital native business, a delivery platform, moved to the public cloud because its previous logistics system was not able to keep pace with the rapid growth in orders being placed, causing a negative impact to its customer experience and reputation. With an IaaS platform on the public cloud they were able to scale up instantly from zero orders to a million orders.

In the media industry, conventional print and broadcast companies are using the public cloud to engage their online customers in new ways such as targeted real-time news delivery. The cloud also enhances their internal productivity by transforming the editorial process.

However, it is the newer companies delivering streaming content that find the public cloud critical to their growth. Major streaming media players are using the cloud for content delivery and consumer research to enhance their customer experience. Most large content providers have scaled rapidly on the back of the public cloud infrastructure, using AI and ML to target audience programming.

Retail and consumer goods players are also increasingly exploring opportunities to digitalize and develop capabilities in AI and ML, enabled by the public cloud. While deployment of public cloud services is in its initial phases here, the retail industry offers significant growth potential. Traditional retailers looking to venture into e-commerce observe that they need heavy investments to create on-premise data centers, and hence the public cloud becomes an attractive option that also gives them the ability to scale up quickly to handle erratic loads during special campaigns or sales.

“We ran some campaigns that caused traffic to spike up to five times above the normal pattern. The public cloud supported these peaks with no reduction in performance or availability to our customers.” —CTO, Traditional fashion retail company

Others in the retail industry say that having data on the public cloud and leveraging tools has improved their overall decision making process.

In other large industry verticals such as manufacturing and financial services, the migration is slower. Manufacturing companies and many of India’s large enterprises tend to use the cloud for team collaboration and basic applications, partly because migrating legacy data would be cumbersome.

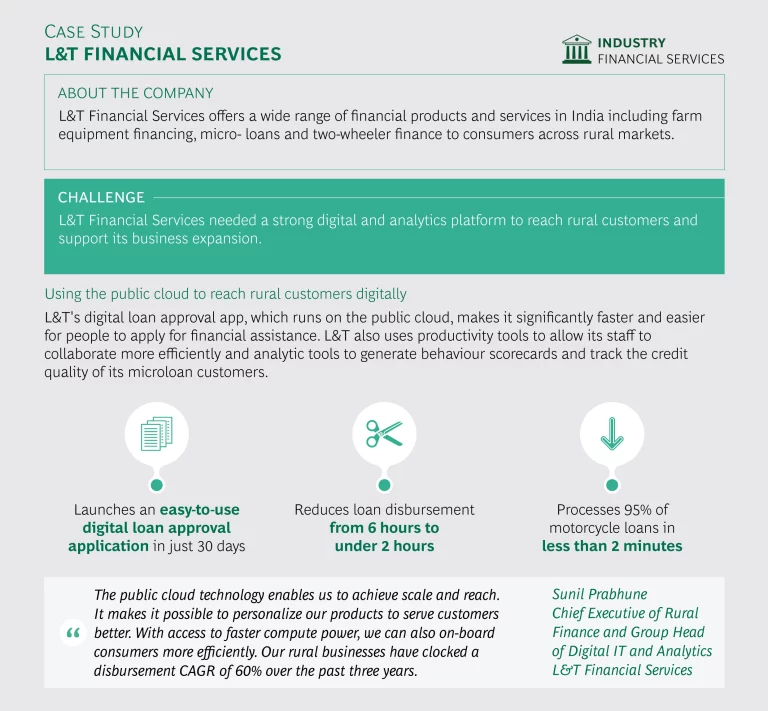

Financial services institutions are not yet migrating core applications onto the public cloud and have some concerns about government regulations and how they could impact their security configurations. Nevertheless, some segments of the industry, notably insurance, lending, and fintech, have taken steps to make the public cloud an important tool to adopt. L&T Financial Services, which has developed a base among rural customers who may be in remote areas, for example, has greatly accelerated the time it takes to process a loan by using the public cloud (See L&T Financial Services case study).

The Indian government has issued a cloud-first initiative aimed at requesting that government agencies adopt a government cloud for all new projects, the GI Cloud (MeghRaj), which is supported by various cloud service providers. The initiative is expected to help build awareness of cloud computing and how it can accelerate the delivery of e-services to citizens while increasing efficiency, scalability and standardization.

Key benefits

The key benefits identified by users of public cloud include:

Higher team productivity. As a CTO of a mass media company told us, the public cloud “allows developers to focus on what they need to do, which increases agility of team and makes them more productive.” Productivity tools have been the most common use cases of the public cloud; users appreciate the internal and external collaboration using such features as document sharing tools and communication apps, as well as the standardized platform for code development. The efficiencies the cloud brings allow the organization to focus on its core business issues.

Faster launch of new products and services. Digital native businesses need to test and launch new products and services quickly to stay competitive, and have seen that the public cloud gives them the ability to move fast in testing and fine-tuning prototypes and getting something new out to their markets quickly. The cloud also gives them easy access to analytics tools that they can use to broaden their geographic scope and cultivate international markets. When a business is selecting a cloud provider, a vendor with a global footprint is an important consideration if the business is expanding its own global reach.

Better security. Large enterprises are particularly aware of the security advantages of the public cloud, noting that hyper-scale cloud service providers can invest in security at a scale that isn’t available to even large multi-national corporations. Also, the providers can continually access the latest security technology and capabilities. Continuing education of users is needed, however, to strengthen the understanding of the security features of the public cloud among all users.

Key challenges

The key challenges identified by users of public cloud include:

Lack of clear understanding of data privacy features. While some of India’s businesses are recognizing that cloud service providers can enhance security, data privacy and security remain a concern across most industry verticals because users are not always familiar with the security measures that cloud service providers offer them. This concern is especially prevalent among public sector organizations and financial services institutions. Clearer guidelines on data classification that is interoperable with international standards would help mitigate this challenge. Some enterprises are starting cautiously, by moving smaller or non-critical applications onto the public cloud to test its security and build their own confidence in the way it works, and also to cushion themselves against any risk of having critical applications on the public cloud in the event of a sudden adverse change in regulations.

Lack of robust network infrastructure and understanding of product performance. India is expanding its telecom network coverage to connect more of its mobile network towers to fiber networks, to provide fast and reliable connectivity across the country. The slow connectivity of legacy networks often result in latency issues, thus raising concerns among businesses about the performance and reliability of the service, especially for critical applications.

A well-designed deployment of the public cloud can actually be helpful in mitigating these problems. Users can design architecture that minimizes the network load, with more processing handled by the cloud. For this reason, users look for vendors and partners that have a track record for reliability of performance.

“Most cloud players are very competitive on their offerings and pricing. While prices are important, we are also interested in the level of product and service reliability.” —CTO, Retail company

Legacy migration cost and risk. While DNBs have been able to start using the public cloud early on, and are benefitting from the way it enables them to scale up quickly, large enterprises across verticals have only recently started migrating. For the most part they have moved only their peripheral applications onto the public cloud because they struggle to transfer historical data and integrate their existing IT systems with public cloud systems. The process is complex and consumes a great deal of time and money, all of which is a further deterrent in a market where IT and cloud spend is already low.

The economic impact

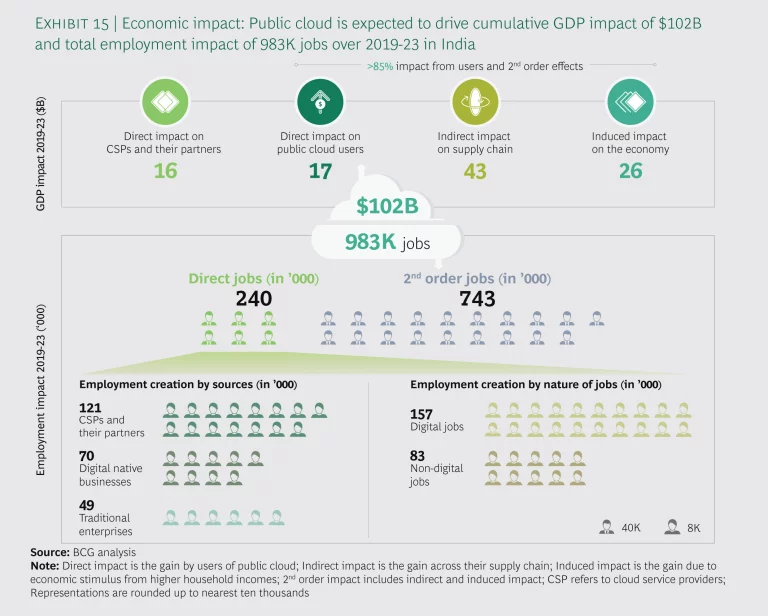

The overall cumulative impact from direct, indirect and induced sources between 2019 and 2023 is expected to be US$102 billion, if CSPs continue to launch new products and services, there is high traction in adoption in the market, and policymakers keep their existing stance on public cloud deployment (See Exhibit 15). When annualized, this is a sum equivalent to 0.6% of the annual GDP, similar to about 25% of the annual impact that now comes from the textile industry and 15% of the annual impact from the IT industry.

Approximately 85% of the impact will come from the gains to industry verticals such as digital natives, media, retail, and financial services, with only about 15% coming from the cloud service providers themselves.

Of the direct gains to industry, a major percentage will come from enhanced business revenues. A total of US$14 billion revenue uplift could be generated, while a further US$1.7 billion may emerge from productivity benefits, with US$1.4 billion value achieved as a result of IT-related cost reduction and avoidance.

Public cloud usage stands to create 240,000 direct jobs over the next five years, which is equivalent to 0.7% of all new jobs created in the previous five years. Though many of these jobs will require a certain amount of digital upskilling, about 83,000 of the direct jobs will be in non-digital roles such as sales, marketing, human resources, finance, logistics and operations. Another 157,000 will be jobs for digital and IT specialists, with around 121,000 roles within cloud service and IT system providers and another 36,000 with industry verticals, representing 3.8% of the current information and communications technology workforce.

The second order effects are expected to influence another 743,000 indirect and induced jobs, bringing the total potential jobs impacted due to public cloud deployment to nearly one million, which is 0.4% of the current workforce. A large proportion of these jobs will likely be taken up by members of the existing workforce who have been retrained and upskilled. Training the workforce on data science, artificial intelligence and machine learning will provide lasting benefits to the country's economy.

Two alternate scenarios

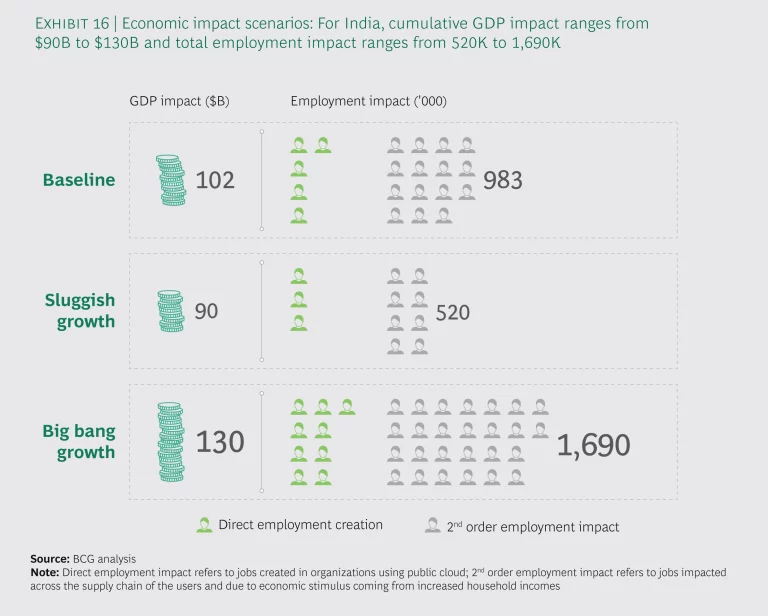

The economic impact we have assessed above is the Baseline Scenario, but we have drawn up two additional scenarios. The Big Bang Growth Scenario and the Sluggish Growth Scenario show the economic impact that would occur if the forces that shape the public cloud market cause growth to either speed up or slow down. If either of these scenarios were to unfold, the full cumulative economic impact of the public cloud could vary by a difference of US$40 billion between 2019 and 2023 (See Exhibit 16).

The Big Bang Growth Scenario. Faster growth is likely to ensue if industry and government step up their efforts to take advantage of the benefits of public cloud use. Traditional large enterprises would increase their use of the cloud as part of a complete digital transformation journey, while regulators would recognize the strong case for enacting cloud adoption and data policies aligned to international best practices. A collaborative effort on the part of organizations, service providers and government to boost the supply of digital talent would ensure that India has the expertise it needs for its rapid growth in public cloud deployment.

If these factors come together, a CAGR of 36% would boost the cumulative economic impact to as much as US$130 billion between 2019 and 2023, or 0.7% of GDP. About 425,000 jobs would result from the direct impact with another 1.25 million influenced by the second order effects.

The Sluggish Growth Scenario. A slowdown in growth would most likely stem from more protectionist policies that lead to cross border data flow laws that are less cloud-friendly. Less clarity on security standards, or standards that diverge from international practices, would also inhibit the ability of companies to migrate data and applications to the public cloud. Either of these would result in a more limited launch of new cloud products and slower traction among industries.

In this slower-growth scenario, we have estimated that the cumulative economic impact would be no more than US$90 billion, or 0.5% of annual GDP. At this level, the jobs that arise directly from public cloud usage would amount to around 143,000, with another 376,000 influenced from the indirect and induced impact, for a total of around 520,000 jobs—about half the total jobs that are expected to result from the Baseline Scenario and less than a third of the number that a Big Bang Growth Scenario could produce.

With digital native businesses and new media companies leading the way, India’s nascent public cloud market shows tremendous growth potential. As the connectivity infrastructure in the country improves, and government data and digital policies evolve, some of the existing challenges the users face can be mitigated which would drive higher engagement and adoption from many more businesses as they embark on their digital transformation journey and adopt advanced technologies. The impact of a more public cloud-centric approach would be dramatic, particularly as an influence for more than 1.6 million jobs in total.