With an increasingly wealthy population, expanding institutional participation, and faster-than-expected regulatory change, China offers foreign

asset managers

extraordinary potential. The nation’s household wealth is set to increase by about $14 trillion by 2023, reaching $35 trillion, as the number of high-net-worth individuals—those with investable assets of at least $850,000—surges by 44%.

These figures offer significant incentive to get involved. Furthermore, the previous mix of regulatory policies is being replaced by a more conventional and accessible framework that should make it easier to do business.

As China’s economy continues to grow and liberalize, we expect the country’s asset management market to more than double by 2025, becoming the second largest after the US, with technology playing a critical role. There are risks associated with jumping in, but, given the upside of first-mover advantage, the risks associated with hesitating increase with each passing month.

To determine the best way forward, asset managers can consider a variety of possible legal structures, partnership arrangements, and investment propositions. The choices they make will depend on their particular level of ambition, strategy, and capability. In every case, however, amid increasingly sophisticated and technology-driven local competition, the cultural task is significant. In that context, how should international players set out their stalls?

The bottom line: there are no short cuts. Non-Chinese asset management firms need to do the hard work, build trust, expand their infrastructure, and hone their skills to meet local needs. If they do things right, they will have a chance of leveraging their capabilities to create a genuine cutting edge.

As China’s economy continues to grow and liberalize, we expect the country’s asset management market to more than double by 2025.

Assets Under Management Are Rising Fast

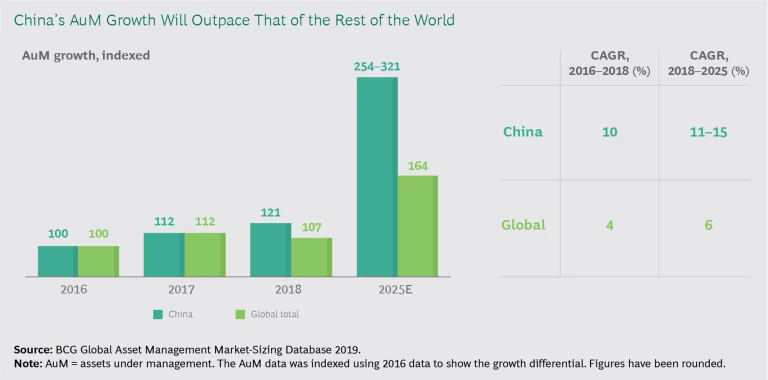

From 2018 through 2025, China’s AuM will see a compound annual growth rate (CAGR) of 11% to 15%, according to a BCG estimate. (See the exhibit.) Global AuM, by contrast, is set to grow by about 6% annually over the same period. We expect China’s outperformance to be supported by significant expansion in the institutional segment, as pension assets will likely increase fourfold by 2025. Growth will be driven by government pension reforms and an aging population—partly the result of the country’s one-child policy, which ended in 2015. The proportion of the population aged 60 or older will rise from 12.4% in 2010 to 28% in 2040, according to official estimates.

Another growth driver in the institutional space is benchmark redesign. Several major index providers are reweighting toward China, which is likely to fuel foreign investment inflows. In March 2019, for example, MSCI took a first step in a process to quadruple the weighting of China’s A, or domestic, shares in its global benchmarks. Two months later, Bloomberg added Chinese RMB-denominated government and policy bank securities to the Bloomberg Barclays Global-Aggregate Total Return Index.

In the retail segment, we expect AuM to grow at a CAGR of about 15% through 2025. The key driver will be increasing personal wealth as the economy continues to expand. There were 1.7 million high-net-worth individuals in China in 2018, the second-highest number after the US. We estimate that that group will swell by approximately 8% per year through 2023. Retail investors will likely buy more pension products, such as target date funds. As investors’ confidence in financial assets increases, the market will become more professional and more transparent, and we should also see a shift away from, for example, traditional brick-and-mortar investments.

Regulatory Doors Are Opening

Chinese policymakers have accelerated moves to open wealth and asset management markets to overseas players. The following are among 11 measures aimed at opening up the financial sector and encouraging foreign investment that the State Council’s Financial Stability and Development Committee announced in July 2019:

- Allowing foreign firms to set up or take stakes in bank wealth management subsidiaries

3 3 A bank wealth management subsidiary is a dedicated unit set up to offer asset management services. - Permitting foreign managers to set up majority-owned wealth management companies as joint ventures with subsidiaries of Chinese banks and insurance companies

- Enabling foreign institutions to set up and take stakes in pension management companies

- Allowing foreign entities to hold stakes of more than 25% in Chinese insurance asset management companies

- Advancing, from 2021 to 2020, the termination of the cap on foreign ownership of securities, mutual-fund, and futures firms

These measures significantly loosen restrictions and promote opportunities for non-Chinese players. In response, some firms have moved quickly. In August 2019, JPMorgan Chase confirmed that it had won a bid to take a majority share in China International Fund Management, its joint venture with Shanghai International Trust, becoming the first foreign firm to act under the new rules.

The 2019 measures are the most recent in a string of announcements. In 2018, the People’s Bank of China, China Banking and Insurance Regulatory Commission, Chinese Securities Regulatory Commission, and State Administration of Foreign Exchange published guidelines requiring financial institutions to standardize their asset management businesses and invest higher proportions of funds in assets such as bonds and money market instruments than in nonstandard securities such as trust loans and accounts receivable.

The rules also require institutions to stop providing implicit guarantees against investment losses and channeling client funds to other companies to bypass regulations.

The industry is moving closer to a more widely accepted definition of “asset management,” providing significant reassurance to foreign managers seeking to get involved.

As a result of these changes, the Chinese market is being transformed. Previously, it was common to see investment strategies dominated by regulatory arbitrage as firms attempted to move money across an uneven financial playing field. Now, the dominant model focuses on fiduciary advisory services. The industry is moving closer to a more widely accepted definition of “asset management,” providing significant reassurance to foreign managers seeking to get involved.

New Distribution Channels Are Creating Opportunities

Banks still dominate distribution in China, but the role of digital is gaining importance, particularly for younger cohorts. Digital players in many cases have evolved from simple online marketplaces into full-service wealth advisors. These advisors offer accessible mobile functionality that, in many cases, is packed with analytics that help customers manage their finances, invest, and save. Their business models are based on significant data resources and extensive networks, so they are benefiting in the following areas:

- Customer Acquisition. Internet giants such as Ant Financial—an affiliate of Alibaba Group, a Chinese e-commerce giant—and Tencent Licaitong are at the forefront, converting hundreds of millions of users of their payment and chat apps. Combined, their $390 billion of AuM accounts for 57% of the online wealth management market.

- Engagement and More Personalized Service. Ant Financial and other digital leaders are leveraging big data analytics for customer profiling and targeted marketing. Recently, they have been applying their know-how in gaming to boost investor education on retirement funds.

- Advisory Services. Chinese banks and digital giants are leveraging technology to provide advice, many of them launching robo-advisory services to improve the customer proposition and reduce the cost to serve. Most, however, are still new to this.

Partnering with internet giants can be a game changer for global asset managers. A local manager, Tianhong Asset Management, saw its AuM grow from $2 billion to $80 billion in less than a year after it partnered with Ant Financial. The company’s AuM dropped after Ant opened its platform to other managers, but, in AuM terms, Tianhong remains the country’s top asset manager.

In the retail segment, many banks are transitioning from relationship-based to advisory models. One way that they make that change is by equipping themselves with high-quality fund products. Owing to the required separation of wealth management and asset management, banks—small banks in particular—will be more amenable to third-party providers. These dynamics present prima facie opportunities for foreign players.

Partnering with internet giants can be a game changer for global asset managers.

A Maturing Market with Strategic Challenges

Regulatory initiatives, shifting channel dynamics, and infrastructure improvements give non-Chinese asset managers the green light to ramp up their activities in China, but these asset managers should not underestimate the challenge. In many respects, China remains significantly at odds with other markets and requires a strategic approach tailored to local conditions.

Differences can be seen across both customer segments and products. Retail is the largest segment in China—unlike in Europe and the US—accounting for about 60% of AuM. It will likely remain dominant and is notoriously difficult to penetrate, requiring strong distribution networks that are tough to initiate and develop. One way to make a start is through liaisons with local retail and private banks. However, these banks are accustomed to building their businesses through their own relationships: breaking in will be no mean feat. The high-net-worth-individual market is especially competitive, and distributors and investors have big expectations for returns and levels of service. Mass retail customers, meanwhile, have become accustomed to guaranteed-return investment products. Although these products are now banished, the market retains elements of those expectations. Pursuit of star portfolio managers and hot industry trends is the norm.

While retail presents challenges, retirement funds sold through banks or tech partners offer opportunity. These are being supported through preferential tax policies that are currently being piloted. Foreign managers’ mature product suites and marketing expertise—relating to investor education in particular—may have an advantage in capturing this growth.

Meanwhile, the institutional segment, which is maturing fast in terms of both size and sophistication, may be a natural target for new entrants. We see two key drivers:

- The mandate process in the institutional segment is relatively standard and more transparent than in the retail segment, in which local players retain a strong grip.

- Pension funds and insurers are increasingly sophisticated and are seeking asset managers with strong asset allocation and risk management capabilities. Still, to make their mark, managers will need a good track record in specific strategies or asset classes.

In China, active strategies dominate the product landscape, accounting for 87% of mutual fund and exchange-traded fund (ETF) AuM (excluding money market funds), according to Simfund data. One reason for this is that the marketplace remains relatively inefficient and focused on the short term. Individual manager knowledge can pay big dividends. Still, as the market develops, growing numbers of local managers are moving toward fundamental analysis and realizing that a disciplined investment approach can produce consistent returns. For that reason, foreign players that can demonstrate their risk management and investment process expertise are likely to be able to open doors more easily.

Foreign players that can demonstrate their risk management and investment process expertise are likely to be able to open doors more easily.

By the same token, investors are beginning to see value in passive investing. More institutions are using ETFs for asset allocation. Inflows into ETFs and other passive products have seen CAGRs of 13% over the past five years, bringing total passive AuM to about $104 billion, according to Simfund data. Here too, foreign managers with experience in ETF marketing and in building ETF ecosystems are ideally positioned. Solutions and multiassets also show promise, with products such as outsourced investment management for institutional investors, liability-driven investing, and target date funds attracting a small but growing group of adherents.

While the potential for ETFs and solution-based products is significant, idiosyncrasies in the Chinese market are worth bearing in mind, particularly relating to innovative product use. Many state-owned enterprises, for example, use ETFs to reduce holdings of specific stocks or baskets of stocks, thereby circumventing regulatory disclosure and avoiding block trade discounts. Foreign asset managers that can respond to these kinds of dynamics will likely put themselves ahead of the competition.

How to Win

The Chinese asset management market is set for outstanding growth over the coming years, offering foreign firms significant opportunity. With that in mind, they must have a clear idea of how and where they can add the most value. (See the sidebar, “What’s the Best Legal Structure?”) We see standout opportunities in investment process capabilities, technology, international perspective, and branding. Still, there are challenges in securing local talent, navigating the regulatory playing field, and establishing a reputation. Partnership is an essential step in building distribution capabilities and accessing the wider ecosystem, particularly when combined with a shared vision of how to build the business. The following strategic themes should sit high on the C-suite agenda:

What’s the Best Legal Structure?

What’s the Best Legal Structure?

There is no single preferred legal structure for operating in China. Each firm must tailor its approach on the basis of its own ambitions, proposition, and strategy. Any choice is likely to require tradeoffs, involving, for example, costs, control, and the relative attractions of partnerships. The following may serve as a starting point for discussions:

Wholly Foreign-Owned Enterprise. Since 2016, China has allowed wholly foreign-owned enterprises (WFOEs) to manage private securities investment funds. Although WFOEs are not permitted to operate in the mass-retail segment, the structure is useful for firms that intend to serve institutional investors and high-net-worth individuals. An obvious additional upside is that the structure allows maintenance of full control and is the most cost-effective way to enter the market.

Mutual Fund. Starting in April 2020, foreign firms will be allowed to take a 100% share in mutual fund companies. Advantages include the ability to offer funds to retail investors and the relative ease of taking on mandates from pension funds and financial institutions. Still, operating costs may be high, given that operational outsourcing is restricted in China, suggesting higher overall levels of risk. Firms can go it alone, but partnerships, which can help with the securing of talent and with distribution, are worth considering. An important precondition, however, is that both parties in a partnership share the same mission.

Securities Asset Management. Caps on foreign ownership will be scrapped in 2020. These vehicles have a scope similar to those of WFOEs. However, that may change in the future. The setup process is more complex than for a WFOE.

Bank Wealth Management Subsidiary as a Joint Venture Minority Shareholder. The advantage of taking a minority stake in a bank subsidiary is that it presents a route to retail distribution through the bank channel and is relatively permissive in terms of the universe of investible instruments. Furthermore, foreign ownership of this type of structure apparently has solid government support after being specified in July 2019 rule changes. On the flip side, the requisite minority shareholder could leave foreign firms exposed to conflicts with the majority shareholder.

Insurance Asset Management and Pension Asset Management. In 2019, Chinese policymakers removed the 25% cap on foreign ownership of insurance asset management compa-nies and allowed foreign managers to set up or take stakes in pension management companies. The companies may manage only insur-ance or pension assets, but the mandating process is probably easier than finding a bank partner to take on the retail market.

- Investment and Risk Management Capabilities. Many foreign firms boast rock-solid investment processes and mature risk management frameworks. For success in China, the key will be the ability to adapt these to local conditions. To that end, firms must focus on securing local talent who can help them manage the transition. Given an excess of demand over supply, they should expect intense competition. In addition, they will need to find a good model for building the local team while maintaining a consistent global way of working, particularly in critical areas such as research and investment. Partnering is the most logical solution, but firms must be willing to nurture a cultural environment that works for all.

- Governance and Regulation. The governance and organization setups of many global asset managers are more mature than those of some Chinese counterparts. This can be advantageous in terms of nurturing talent and may encourage local firms to partner. Still, firms should be ready to balance their established approach against the need to be nimble. A key challenge is determining how to build a global operating model while ensuring compliance with local regulations focused on, for example, data and cyber security. There are similar issues related to devolving power to local managers. Finally, in China’s fast-changing regulatory environment, global players should expect to liaise closely with regulators, including the China Securities Regulatory Commission, the local finance bureau, and industry associations, perhaps leveraging their strong brands to get a seat at the table.

Firms should be ready to balance their established approach against the need to be nimble.

- International Reach and Perspective. Foreign managers’ international reach and global perspectives can be valuable assets. However, these managers may find that they do not enjoy the same profile in China as they do at home. A distribution partner with a strong local brand can help, but there are no guarantees: firms must be realistic about the chances of securing a local banking or digital partner amid significant competition.

- Data and Analytics. Many foreign firms’ capabilities in data and analytics are more advanced than those of some Chinese counterparts. Still, they will find it more difficult to access data in China than in other jurisdictions. And the data might be less transparent. Leaders need a strategic agenda for data acquisition and for showcasing how their risk management, performance attribution, and customer-facing capabilities can add value in a Chinese context. Related potential value-added activities are in back-office operations and risk management technology, areas in which some Chinese firms still trail their international peers.

In considering each of these points, it’s important to remember that there is no one-size-fits-all blueprint. The right approach depends on individual circumstances, mission, and expertise. There is one common requirement, however: leaders need a strong strategic vision for how they plan to engage and grow.

Global asset management firms have an opportunity to expand their businesses in China, amid rising personal wealth, digital innovation, and a changing regulatory environment. To succeed, they need to make choices that focus on the best legal structures, partnership approach, channel strategy, and investment proposition. Sooner rather than later. Even more important, they need to show that their participation will accrue benefits to all stakeholders and the wider Chinese economy.