If you want to understand what sets digital champions apart from digital laggards, take a look at their investment priorities. Champions invest aggressively in digital efforts, devoting a sizable proportion of funds to building a world-class technology/IT function. They dedicate a significant percentage of their workforce to digital projects—and have ambitious plans to expand their digital talent base and upskill their existing workforce. And they invest in pushing digital efforts to scale, with what is now an increasing focus on scaling up in data and AI .

These insights are among the findings of BCG’s third annual survey on digital maturity. The study made use of our Digital Acceleration Index (DAI) to understand how companies across industries and regions stack up in terms of their digital evolution. We asked decision makers at more than 1,800 companies in Asia, Europe, and the US to assess the digital maturity of their company along 35 dimensions, with those inputs used to derive an overall digital maturity score. (See the sidebar, “Our Methodology.”)

Our Methodology

Our Methodology

For our 2019 study, we surveyed 1,817 organizations across 27 countries in Asia, Europe, and the United States to estimate their digital maturity on a scale of one to four in 35 dimensions. To ensure comparability of responses, we described the stage of maturity of each dimension in terms of specific practices and capabilities. We aggregated these raw scores and converted the resulting values to a 0 to 100 scale. We then weighted the scores for each dimension equally to determine each company’s overall performance on the DAI. We also calculated a DAI score for individual dimensions and for groups of dimensions that we call “blocks.”

Companies with a DAI score of 67 to 100 qualify as champions, while those with a score of 43 or less are considered laggards. Champions have an average maturity level of at least three out of four on all dimensions, whereas laggards report an average maturity level of less than two in 66% of the dimensions and an average maturity level of three in 33% of the dimensions. In this most recent study, champions had an average DAI of 77, while laggards scored 28 on average.

We examined eight industries—automotive, consumer and retail, energy, financial services, insurance, manufacturing, technology, and telecommunications—as well as the public sector. Our respondents were primarily senior leaders—22% were C-level and 35% were division leaders—and general managers (43%).

Our findings this year shed light on which industries and regions of the world are ahead in digital and illuminate how champions are positioning themselves to expand their lead. Companies aiming to improve their digital maturity should carefully study how digital champions have honed their competitive advantage and where they are currently directing their investment firepower.

Digital Maturity by Industry and Region

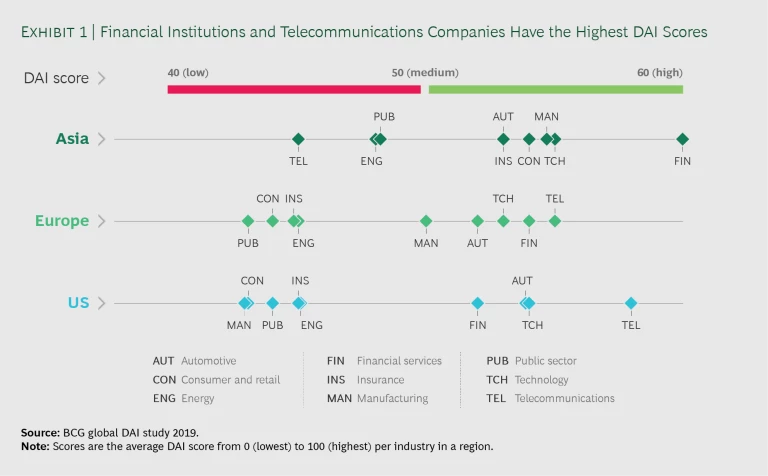

The 2019 survey revealed that financial services and telecommunications are the most digitally advanced industries, with more than 25% of companies qualifying as digital champions. In contrast, energy and the public sector trail behind, with more than 40% of organizations qualifying as digital laggards. In the middle are companies in technology, automotive, manufacturing, insurance, and consumer and retail, in order of declining DAI score.

Our analysis also included an assessment of industry performance across regions. In Asia, the best-performing industry is financial services, while telecommunications is the leading industry in both the EU and the US. (See Exhibit 1.) The strength of Asian financial services companies is not surprising given that many players are digitally native and that digital banking companies such as WeChat are subject to less stringent data privacy restrictions than competitors in other parts of the world.

Some industries that are low scorers in other regions are high performers in Asia. Consider consumer and retail. Although the industry ranks second to last in terms of digital maturity in Europe and the US, its DAI score in Asia is roughly 10 points higher. In the retail sector, online players in Asia, such as Alibaba, are shaping the shopping space more than their peers in other regions, thanks to their innovative digital offerings. A similarly big spread can be observed in insurance, where insurers’ DAI score in Asia is 8 points higher, on average, than in Europe and the US. This disparity is due to the fact that Asian insurers have been more technologically innovative , such as in digitizing the customer journey.

In contrast, Asian telcos show comparatively low digital maturity—a surprising finding given that the telecommunications industry has one of highest DAI scores worldwide. Some 38% of telecom companies in the US and 32% in Europe qualify as digital champions, while only 13% in Asia do. The below-par performance of these companies in Asia likely stems from regulations that have not incentivized Asian telcos to upgrade legacy technology—a gap that is now inhibiting digitization efforts.

Champions Apply Digital Boosters

Digital disruption affects every company throughout the world. So the question is, Why do digital champions digitize faster than their competitors?

We have identified three levers, or “boosters,” that digital champions have adopted to a much greater degree than laggards have—and the improvement in digital maturity that they enjoy as a result. (See Exhibit 2.)

- Digital champions devote more than 5% of operational expenditures (OPEX) annually to digital. Those that invest at this level have a DAI score that is, on average, 16 points higher than the score of laggards that do not.

- They focus more on digital talent, with more than 10% of full-time-equivalent (FTE) employees serving in digital roles. The DAI score of champions that have achieved this level of digital staffing is 11 points higher than that of laggards that have not.

- Digital champions are able to scale up pilots and use cases to realize the benefits of these digital solutions. Such companies have a DAI score that is 9 points higher than that of laggards without this ability.

While 72% of digital champions devote more than 5% of their OPEX to digital, just 50% of laggards do. Interestingly, a larger share of US champions (89%) are making these necessary investments than their Asian (75%) and European (65%) counterparts. These companies are investing primarily in data, technology, and new-business growth.

When it comes to the second booster—building a digital workforce—Asian companies lead, with 54% hitting the 10% level of employees in digital roles. The US is second at 51%, and Europe comes in third at 44%. Strong performance here is a major reason that Asian companies boast the highest score for the group of dimensions that concern new ways of working, including agile at scale and digital culture and leadership.

The third booster—moving beyond use cases and pilots to scale up digital solutions—is essential for a digitally mature company. Here again the US leads, with 48% of champions reporting that they have scaled up pilots into fully operational solutions, compared with 35% in Europe and 32% in Asia.

Beyond their weakness in terms of the digital boosters, laggards fall behind in executing their digital strategy. These companies have an average DAI score of 38 in the group (or “block”) of dimensions we call “business strategy driven by digital.” (See the sidebar for a fuller explanation of blocks.) But their average DAI score is much lower, at just 28, for the five blocks that are central to executing a digital strategy: digitizing the core, building new digital growth opportunities, changing ways of working, leveraging the power of data and technology, and integrating into ecosystems. This divergent performance is consistent for laggards across all regions. Digital champions, in contrast, have comparable scores for the strategy and execution blocks—a sign that they are able to both devise and implement a digital plan.

Champions Direct Their Spending to Tech and IT

Champions understand the importance of investing aggressively in digital—and, in particular, the need to direct a significant portion of those dollars to building world-class technology and IT capabilities.

Our survey found that the average digital maturity of champions across all relevant dimensions of technology and IT, including DevOps, cybersecurity, and Internet of Things, is 78—far ahead of the average score of 29 for laggards.

We also found that champions are positioning themselves to expand that lead. They are directing 22% of their digital investments to technology and IT, while laggards are investing just 16%, on average. That relatively low level of investment could come at a price, as our analysis found that laggards that make the most progress tend to focus on both technology and data.

From a regional perspective, US, Asian, and European champions have comparable levels of digital maturity—79, 78, and 77, respectively—across all dimensions of technology and IT. But while European and Asian champions are spending 25% of their digital budget on technology and IT, US champions are investing just 20%. That means the lead US champions enjoy today is likely to narrow as other regions work hard to catch up.

Investment in technology and IT also varies by industry. The technology industry leads, directing 29% of the total digital budget to technology and IT, with telecommunications (23%) and financial services (20%) rounding out the top three. Lagging industries, including energy (12%), insurance (15%), and consumer and retail (15%), are spending substantially less.

Champions Broaden and Deepen the Talent Pool

Many champions have more than 10% of their workforce in digital roles, but their ambitions are clearly much greater.

Some 77% of champions plan to expand their digital workforce by 20% or more over the next three years. Just 43% of laggards have similarly ambitious plans. Given that laggards are starting from a low level—82% have less than 10% of their staff in digital roles—the talent gap will widen over the coming years.

Companies do not rely solely on hiring, of course, to build digital talent. They also invest in upskilling their current workforce. And here, too, champions are looking to expand their competitive advantage. More than half (51%) report that they are planning to upskill in excess of 20% of their current workforce, while only 29% of laggards have plans to do the same.

Asian champions have outsized ambitions when it comes to both hiring and upskilling. More than 93% of these companies plan to expand their digital staff by more than 20%. Just 68% and 65%, respectively, of champions in the US and Europe have that target. Meanwhile, 58% of Asian champions plan to upskill 20% or more of their workforce, compared with 44% of champions in the US and 47% in Europe.

Champions Scale Up Data and AI Capabilities

Digital champions are already in the lead when it comes to scaling up digital efforts to transform themselves into truly data-driven companies. Now they are putting resources behind reaching scale in the increasingly critical areas of data and AI.

Data, in particular, is an area where there is generally much room for improvement. When we rank all 35 dimensions of digital maturity globally, “data strategy” comes in at a respectable number 5. But "data governance, which is a major driver of a successfully executed data strategy, ranks much lower, at 21 in Asia, 23 in Europe, and 34 (second to last) in the US.

Laggards are especially far behind in data governance: an average score of just 20, compared with 79 for champions. This 59-point difference is the widest gap between champions and laggards in all the dimensions of digital maturity. There are also large gaps in other data-related dimensions, including "digital and data platforms," where the difference is 55 points. To stay in the lead, champions must continue to invest in data-related capabilities, which enable such core dimensions of digital maturity as personalization, end-to-end customer journeys, and digital supply chains.

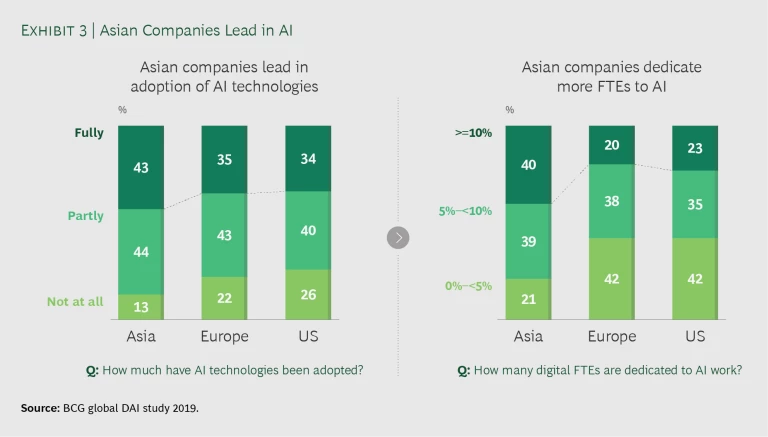

Excellence in these areas is also a prerequisite to success in deploying AI. Here champions are well ahead. These companies are not only talking about AI, they are deploying it aggressively. While 63% of champions have adopted AI technologies—meaning they have rolled out the technology and leveraged its potential—only 23% of laggards have done so. Some 35% of laggards have not even started thinking about potential use cases for AI.

Regionally, 43% of Asian champions have adopted AI, compared with 35% of their European and 34% of their US peers. (See Exhibit 3.) Interestingly, we likewise found a regional maturity gap when we looked at the three dimensions that enable AI: data strategy, data governance, and digital and data platforms. Asian companies score an average 6 DAI points higher than US and European companies in these three areas.

Another important factor is the availability of AI experts. Many companies are making the development of AI pilots and the conversion of those pilots into viable business offerings a high priority. To do this, companies need employees who are savvy in data and analytics. Here, too, Asian champions are ahead, with 40% having more than 10% of their digital FTE employees dedicated to AI. (See Exhibit 3.) Meanwhile, only 23% of champions in the US and 20% of champions in Europe dedicate more than 10% of their digital FTE employees to AI.

Globally, it is clear that laggards are likely to fall further behind, with only 13% of companies dedicating 10% or more of their digital FTE employees to AI.

Becoming a Champion

Digital champions have mastered the transition from a digital vision to digital reality. Certainly the road to success will be different depending on a company’s industry and starting point. But all those with digital ambitions should take lessons from the champions in three areas:

- Aim for a world-class technology function. Companies should steer sizable digital investment dollars toward building a leading tech/IT function. That will not only position them to leverage new technologies like AI, the Internet of Things, and blockchain to support new digital business models, it will also create major efficiencies in the core business—savings that can help fund the digital journey.

- Build a digital talent engine. Companies need a talent strategy that reflects the demand for new roles and skills, including data scientists and agile coaches. They should develop a focused digital recruiting strategy and a blueprint for upskilling their current workforce to ensure that they have the right talent—in terms of both technical skills and the capabilities needed to build and manage digital businesses.

- Transform into a data-driven company. Companies must invest in data capabilities in order to digitize the customer journey and develop personalized offerings, adopt powerful new technologies such as AI, the Internet of Things and blockchain, and cultivate powerful ecosystems. Those that up their game in data stand to capture new revenue pools and drive a true digital transformation.

Success in digital demands a clear and focused investment strategy. Companies that are able to develop such a strategy can drive a successful digital transformation—and put themselves on the path to emerge as champions.