The firms topping BCG’s 2019 Value Creators rankings demonstrate that it is possible for companies to achieve superior performance over the long term, despite their having to endure multiple cycles of volatility and disruption. For the past 21 years, BCG has been ranking companies on the basis of total shareholder return (TSR), a long-term metric that reflects the true bottom line for a company’s shareholders.

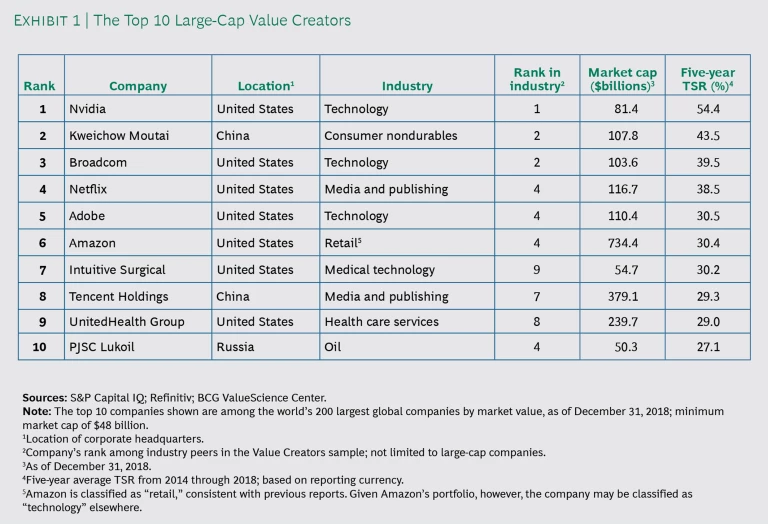

In several respects, this year’s rankings show a reversion toward historical norms. Whereas technology and media companies dominated the large-cap top-ten list last year, this year’s list is somewhat more diverse. On the basis of their average TSR over the five years from 2014 through 2018, technology and media companies claimed 6 spots in the large-cap top 10 and 8 spots in the large-cap top 20—down from 9 spots and 13 spots, respectively, in last year’s rankings. Medical technology and health care services companies occupy 4 of the top 20 spots, up from 3 last year.

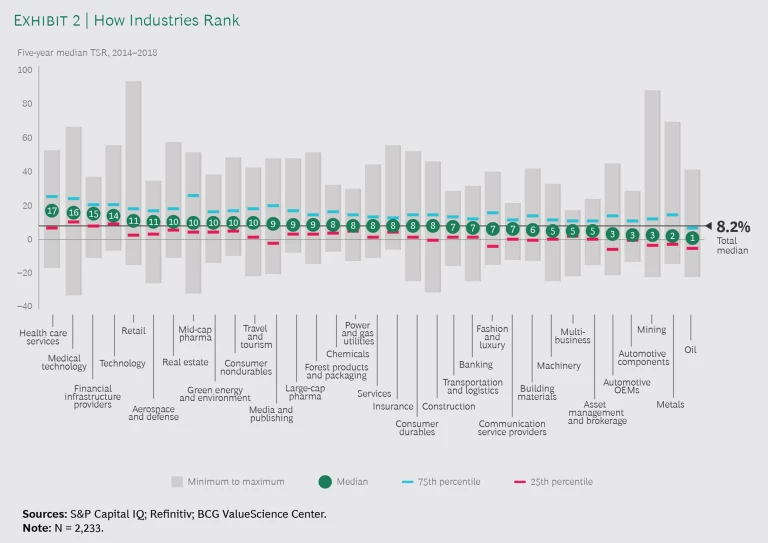

Not surprisingly, the industries that the top-ranking companies represent are also at or near the top of the industry rankings. Among the 33 industries included in those rankings, the health care services industry leads the charge with a median annual TSR of 17%—more than twice the median for all companies in our database. Medtech is close behind with a median annual TSR of 16%, and the next two finishers are financial infrastructure providers (at 15%) and technology (at 14%). Technology and medtech were top-performing industries last year as well, ranking third and fifth, respectively, among the 33 industries. In contrast, health care services was an also-ran last year, placing thirteenth. The most stunning reversal involved the precipitous drop of automotive components, which fell from second in last year’s ranking to thirtieth this year.

In our list of the world’s 200 most valuable companies, Nvidia, Broadcom, and Netflix hold three of the top five positions, for the third year in a row. In our latest rankings, Adobe Systems joins the top five, while Tencent Holdings drops to eighth place. Facebook plunges from number 5 last year to number 33 this year—no surprise given the company’s steep decline in value during the market correction in the fourth quarter of 2018. Kweichow Moutai, a Chinese consumer nondurables company, vaults from tenth place last year to second place this year. PJSC Lukoil, a Russian oil company, takes the tenth slot in its first appearance in the large-cap rankings.

The top 10 value creators delivered an average five-year TSR of 35% from 2014 through 2018, spanning a range from 27% to 54%. The median TSR for all of the more than 2,200 companies in the database was 8.2%, which is in line with long-term global capital market returns. In contrast, the median TSR of 15.6% in last year’s sample, covering 2013 through 2017, reflected the strong bull market throughout that five-year period.

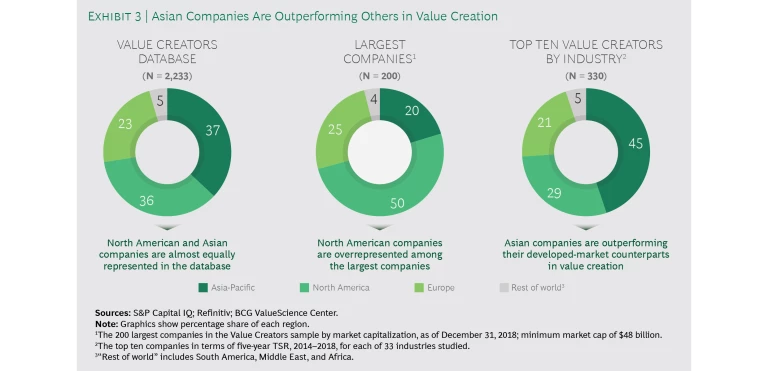

Overall, 7 of the top 10 large-cap value creators and 11 of the top 20 are based in the US; 2 of the top 10 and 5 of the top 20 are based in Asia. This disparity reflects the disproportionate number of North American companies that rank among the largest companies by market capitalization. (See Exhibit 3.) North American and Asian companies each represent slightly more than one-third of the overall sample of more than 2,200 companies. Among the 200 largest companies by market cap, however, 50% are based in North America and only 20% are based in Asia.

Intriguingly, when we consider five-year TSR performance beyond the top 20 large-cap value creators, a much different picture emerges. Among the top 100 performers, 28% are North American and 55% are Asian. Similarly, among the 330 companies ranking in the top 10 in their industry, 29% are North American and 45% are Asian. In other words, Asian companies are catching up to and in some cases surpassing their longer-established North American counterparts in value creation.

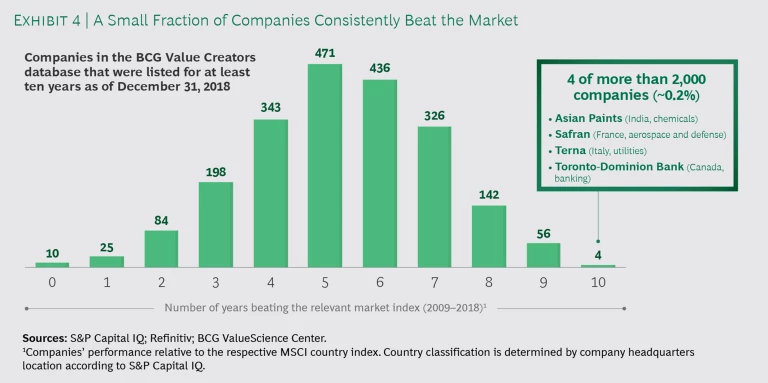

Many companies ride a wave of success in specific market cycles, but it is very rare—and an even greater accomplishment—for a company to achieve strong performance year after year. Among the more than 2,000 companies in our database that were publicly listed during each of the ten years from 2009 through 2018, only four (that is, approximately 0.2%) outperformed their respective local market index every year. (See Exhibit 4.) And when we looked at a broader set of more than 5,700 companies that have in excess of $1 billion in market capitalization, we found that a similar extremely small percentage (approximately 0.3%) of them achieved this feat each year over that period.

Clearly, the headline numbers don’t tell the whole story. The interactive format allows you to delve deeper into the TSR performance of the top 50 large-cap companies in our 2019 rankings—including examining their performance since we initiated our Value Creators series in 1999—and into the TSR performance of companies across the 33 industries included in it. The interactive presentation also disaggregates the TSR performance of individual companies into its key components.