Establishing an item’s authenticity and ensuring that it was sourced properly have become exponentially more difficult as supply chains grow, as online marketplaces proliferate, and as the ability to produce clever facsimiles matures. The luxury goods industry lost a total of $30 billion in revenue to counterfeiting in 2017 and 2018, and the global cost of fraud and counterfeiting across all industries exceeds $1 trillion annually, according to the 2018 Global Brand Counterfeiting Report. Consumers are growing frustrated—in addition to core health and safety concerns about fraudulent or substituted goods, many consumers want assurance that the organic and fair trade products they are buying—and paying a premium for—are the real deal, and labeling practices don’t always provide the certainty needed.

For these reasons, blockchain-enabled counterfeit prevention is attracting increased corporate and investor interest. Blockchain platforms are distributed, shareable databases on which information can be recorded, stored, and made instantly visible to all participants. Data recorded on the blockchain cannot be altered, rendering transaction histories virtually tamperproof. As a result, blockchain is often referred to as a “single source of truth.”

The visibility, traceability, and immutability of blockchain platforms make the technology well suited to a host of anticounterfeiting applications. Blockchain platforms allow authorized participants to view the entire history of a good or part from source to the point of sale. Digital labels and smart tags can be used to record an item’s unique identifiers, allowing sellers and customers to quickly distinguish legitimate from counterfeited goods. They can also help producers, distributors, consumers, and regulators determine where an item is at any point along the value chain. Instead of relying on the word of others to determine if a part was procured, assembled, and labeled correctly, participants can simply go to the blockchain and determine an item’s provenance and journey for themselves. In addition, blockchain solutions enable automated reporting, which can significantly ease the compliance burden by making documentation more accessible, more accurate, and cheaper to manage.

Given the potential, it’s little wonder that investment in blockchain-related counterfeit prevention has soared. However, while blockchain’s use in stamping out fraud holds great promise, use cases vary, and none is a panacea. This article, the second in a series dedicated to helping investors understand how blockchain can deliver value , describes what companies and investors need to look for in specific use cases and how to evaluate potential downstream benefits.

Understanding Where Blockchain Can Add Value

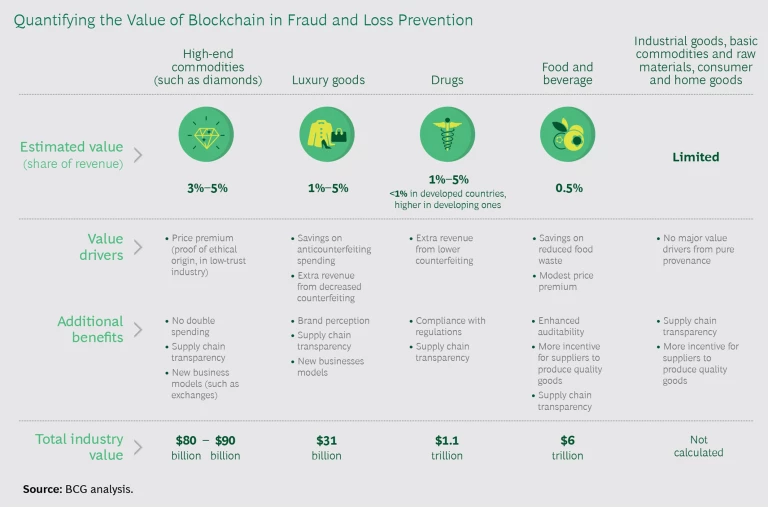

Blockchain-enabled anticounterfeiting solutions are most relevant—and thus valuable—when authenticity and ethical sourcing are essential to an item’s worth. (See the exhibit.) A customer in a jewelry shop needs to know if the diamond he’s considering is genuine, from a reputable mine, and therefore worth the amount being charged. Pharmacies need to know that medicines have been compounded correctly given the potentially fatal consequences of error, and a designer brand needs to know that fake lookalikes haven’t been substituted for its products at some point along the distribution cycle.

Mislabeling is another issue, one that is particularly rife in the food and restaurant trade. A 2018 study by the New York State Attorney General’s office found that 27% of all seafood sold in the state was tagged under the wrong product name. Food categories that command premium pricing, such as Kobe beef, extra-virgin olive oil, and organic foods, are frequent targets of fraudulent labeling. Medicines are also highly vulnerable to fraud. The World Health Organization estimates that trade in counterfeit medicines is worth about €73 billion annually. Improper substitutions and defective parts create enormous risks for companies and buyers alike. In addition to the health and safety issues posed, breakdowns in provenance and procurement can result in lawsuits, customer disaffection, and costly and disruptive product recalls. The expansion of global supply chains has created an even wider ripple effect. Stakeholders across the supply chain need assurance that goods have been stored and maintained in the right conditions. In 2016, a recall of sunflower seeds due to possible listeria contamination affected hundreds of products across dozens of brands.

Blockchain solutions have the potential to bring much-needed relief in each of these areas, protecting customers and businesses from the risks associated with counterfeit products, mislabeling, and substandard storage and manufacturing. Smart digital tags can establish provenance, and track-and-trace capabilities can scour transaction histories to validate sourcing end to end. Internet of Things (IoT) sensors connected to blockchain platforms can automatically transmit and record temperature, humidity, and other data, assuring stakeholders that items have been properly housed and transported.

However, knowing where blockchain can help is just the first step in assessing value. To understand the total value relative to other opportunities, investors need to consider specific use case applications and assess the potential for additional downstream benefits and adjacencies.

Not all Use Cases Are Created Equal

Broadly speaking, the value of a blockchain-enabled provenance solution for a particular item correlates with its ease of authentication, the importance of its sourcing journey, and its pricing power.

The ability to attach a unique identifier to a single unit of a good allows blockchain applications to record an item’s provenance and trace its journey along the supply chain. The easier it is to attach these unique identifiers to, say, a shoe, an electronics component, or an automotive part, the quicker the path to value. A diamond, for example, has unique, easily ascertained visual characteristics that allow it to be individually tagged, whereas a vegetable’s unique characteristics might require DNA analysis. More involved solutions, such as those that combine blockchain with IoT to authenticate cashless transactions or establish voter eligibility, may take slightly longer to test, build, and scale. Yet, these systems could generate significant long-term value once established.

In addition, traceability must confer a material benefit: Is it a “nice to have,” as in the case of a certified-organic label, or is it a “must have?” In general, the greater the need for traceability, the greater the value.

Finally, the product or brands involved should command strong pricing power to justify the cost of building a blockchain network and the large adopter base needed to make the platform usable. The higher the premiums involved—a designer sneaker, for instance, versus a mass-market brand—the more value there is in confirming a good’s legitimacy. Concentrating on select, high-value areas can allow the cost of developing the blockchain network and operating the algorithms to be spread across the user base. In situations that involve component parts or nonpremium brands, manufacturers may need to look at more creative ways to employ blockchain, such as using IoT tags that can add a unique identifier to products.

Investors Must Look Beyond Short-Term Benefits

Companies and investors should not limit their valuation analyses to the immediate investment thesis. Adjacent applications and new markets created within three to five years could deliver significant benefits, the value of which could eclipse that of the initial business case. Each potential solution needs to be evaluated on a holistic basis, considering first-, second-, and third-order benefits, in order to select the most promising opportunities.

- First-Order Benefits. To assess the immediate value potential, investors should focus on what the blockchain application is specifically designed to do and the direct problem it is looking to solve. Homing in on those questions can help investors evaluate how effective the solution is likely to be and how large a market it can attract.

- Second-Order Benefits. Next, investors should consider what additional sources of value the blockchain solution could deliver. The UN World Food Programme, for instance, is developing a blockchain platform to make it easier for refugees to access and use food vouchers. In time, the same blockchain engine could be used to support financial transactions, giving refugees who lack access to formal banking systems a way to access cash and build savings.

- Third-Order Benefits. Finally, as blockchain platforms and their underlying protocols evolve, new features and solutions can be added. Some of these may exist, but others may spring from as-yet unknown innovations that could be built on top of existing infrastructure. Investors need to consider whether the solutions being evaluated could serve as an anchor for marketplaces yet to be conceived.

The blockchain platform Tracr illustrates how these benefits could play out. Developed by De Beers, Tracr is intended to bring greater transparency to provenance and sourcing in the diamond industry. The first-order benefits are the premium that people might be willing to pay for a diamond that is guaranteed to be both legitimate and ethically sourced. These benefits are likely to be considerable in their own right. But the platform could also deliver significant second-order benefits. Right now, for instance, the lack of a reliable way to identify and authenticate diamonds at scale could allow fraudulent actors to use the same stone as collateral for multiple loans. A platform like Tracr that records each diamond by its unique identifier could allow banks and lenders to identify such “double spending.” Potential third-order benefits could include the platform’s ability to connect all diamond industry suppliers on a single, standardized platform. Doing so would allow rapid, seamless communication between parties, enabling the easy transfer of money between countries and the trading of assets without middlemen. Taken together, these first-, second-, and third-order benefits could dramatically change the long-term ROI potential of the blockchain investment, information that could help private equity players place smarter bets.

To select the most promising opportunities, companies need to consider the first-, second-, and third-order benefits of each blockchain solution.

Potential Barriers to Blockchain’s Success

While blockchain’s use in combating counterfeiting has extraordinary potential, certain factors can slow momentum if poorly managed.

The first is the question of proof. Blockchain may serve as a single source of truth, but that implies that relevant stakeholders agree on what constitutes proof. Is it a purchase order, a letter of credit, or a certificate of authenticity from an approved body? A government contractor might accept a supplier’s invoice as proof that parts were manufactured in an approved jurisdiction, but government auditors may require more detailed documentation that lists where the underlying components were purchased. For blockchain to work effectively, all parties must share a common definition of the truth.

Regulatory concerns can be another issue. Use cases related to heavily regulated sectors such as financial services and health care could be subject to more stringent requirements. While the impact is likely to be minimal in most applications, regulators may want participants in blockchain applications that involve money transfers or the use of a diamond or other asset as collateral for a loan to abide by banking compliance provisions. Similarly, in health care settings, regulators will want to know that core consumer protections around data privacy and medical records will also be upheld.

Finally, investors need to be satisfied that the company leading the blockchain effort has the necessary resources and clout to bring key players together. Building a successful platform requires industry peers to set aside their competitive differences and work together. Managing that “coopetition” paradox takes strong leadership skills. Investors need to know that the company or its key partner have sufficient authority to drive the effort and that the right incentives are in place to attract other important stakeholders. For instance, Walmart failed with its first attempt at a supply chain platform because it sought to manage it as a proprietary system. Suppliers balked because joining the platform would have required managing a second set of books. Recognizing the issue, Walmart repositioned the platform as a single, industrywide model, giving suppliers and customers greater incentive to join. Managing stakeholder collaboration effectively is a critical success factor.

Blockchain technology has the potential to prevent fraudulent actors from profiting off counterfeit parts and goods, addressing a longstanding issue that cuts across industries, exposes consumers to health and safety risks, and results in billions of dollars in lost sales. However, blockchain-enabled counterfeit prevention tools are still in their nascency and value can vary widely. To make informed decisions, companies and investors need to assess first-, second-, and third-order benefits on a use case basis and ensure that initiatives have the ability to gain critical mass and satisfy regulatory and other criteria. By focusing on opportunities where blockchain can relieve persistent pain points and on use cases where sourcing is key to value and pricing is strong, investors can help lower their risk and accelerate the path to value.