Through no fault of their own, Europe’s life insurance companies and their customers find themselves in uncharted territory. They are likely to be stuck there for years. Negative interest rates in many of the continent’s biggest economies—among them France, Germany, and Switzerland—have rendered the savings and retirement vehicles that millions have looked to for decades nonfunctional. Handwringing in the halls of insurance headquarters has begun, but although the model is clearly broken, the search for solutions has yet to gather speed.

Less Than Zero

The prospect of negative interest rates has been of academic concern to Europe’s economists and financiers for a while. Now the reality is biting. In seven of the ten largest life insurance markets, government bonds with maturities of up to ten years are today delivering negative yields. What does it mean when the bank no longer pays you for a deposit, and you must pay the bank? Or when your life savings are no longer secure and growing, but instead the pool of money you carefully put aside for the future is being eaten away, with little prospect for a reversal of fortune?

What does it mean when the bank no longer pays you for a deposit, and you must pay the bank?

While some point to the benefits of negative rates—the bank could pay you to take out a mortgage, for example—the impact on the middle and upper-middle classes, which together represent the vast majority of Europe’s population, is at best confusing and potentially devastating.

What are consumers—and the financial institutions they rely on—supposed to do? The options are limited.

Ordinary Savers

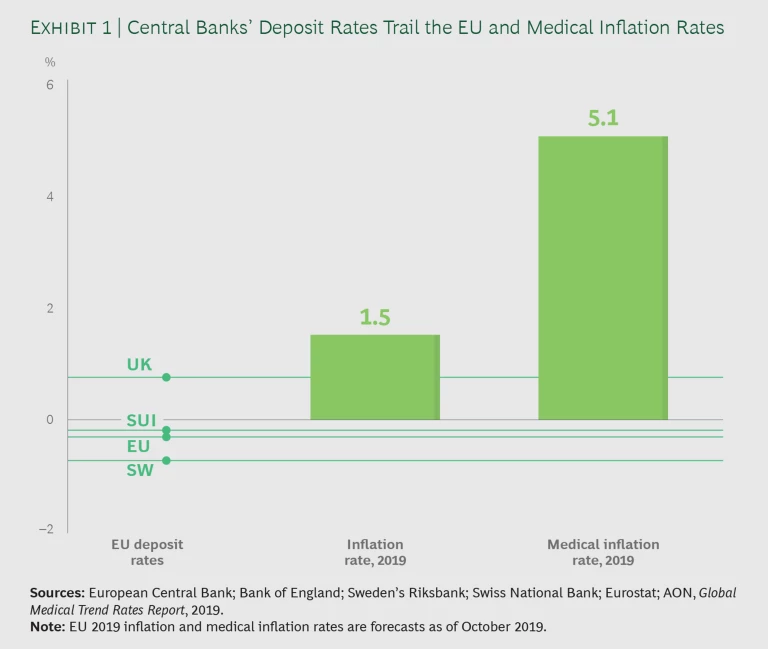

For most people, the cost of retirement is going up while their savings (mostly in bank accounts) are stagnant or shrinking. Consumers are losing money in real terms as inflation runs at 1% to 2%—and higher in some major categories, such as medical expenses. (See Exhibit 1.) Many assume that the state will somehow sort out their retirement shortfall. But will it? In August 2019, the Guardian reported that some 5% of the elderly in the UK are living in “extreme poverty,” up from less than 1% in 1986.

Ordinary savers are hesitant to move their money into higher-yielding vehicles, as they often have no other financial assets through which to spread the risk. They tend to hold onto existing life insurance contracts, as evidenced by still-falling lapse ratios. Demand is rising for unit-linked products, which offer simple multi-asset exposure with the feel-good factor of an insurance contract.

The industry is experiencing a flight to quality, with a rising correlation between solvency and new-business growth. A new class of “zombie” life insurers is emerging—companies that are nominally open for new business but are not attracting new customers. Overall, ordinary savers are disoriented. They are unlikely to act on their own initiative; agent relationships and work site engagement are critical ways to reach them.

The Mass Affluent

Wealthier consumers have more options, but they too face fundamental questions. They own real assets, so they have been benefiting from the substantial increase in the value of homes, shares, and funds over the last ten years. Many are on corporate pension schemes, and their (re)employment outlook is strong. But how do they invest their excess liquidity? How secure is their lifestyle as they move toward old age? Will they be able to fund this lifestyle for 30 years of retirement? Will they be able to live in the home of their choice and provide for the next generation?

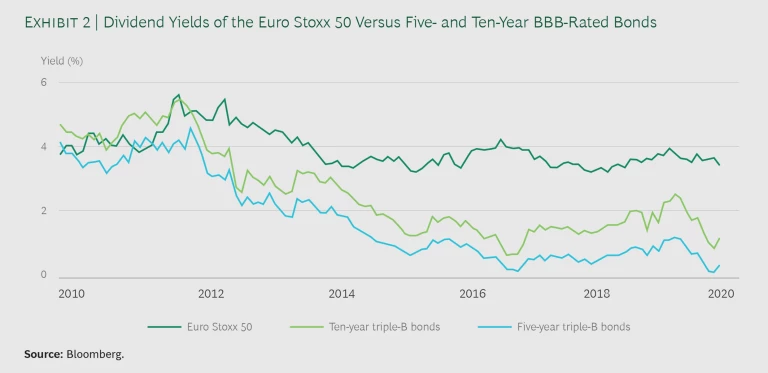

A big problem for these consumers is the paucity of savings and investment options. Two of the “go to” investments historically—bank accounts and bonds—pay nothing. And while mortgage rates are low, property is pricey—real estate prices in some of Europe’s tier 1 cities have more than doubled since 2008. Despite a mixed economic outlook for most economies, company valuations are high. Equities still shine—the average dividend yield on the Euro Stoxx 50 today exceeds that of BBB-rated debt. (See Exhibit 2.)

Life insurance, too, has it attractions. Buyers can secure some yield (2% and more) by “buying into” insurance companies’ back books, which contain older, higher-yielding bonds. Single-premium policies are popular. Life gross written premiums rose approximately 9% in Germany and 3% in France in the first half of 2019, for example. But this strategy is not inexpensive and further declines in book yields may make it short lived.

Little surprise that financial and investment advisors are seeing strong demand for their services. Robo-advisors, which are popular in other markets (such as the US), have yet to catch on in Europe. Valuations for firms offering personal advice (St. James’s Place in the UK, Banca Mediolanum in Italy, MLP in Germany, and VZ Group in Switzerland, for example) are high. But the experts must navigate the same landscape of limited options as their clients.

What Can Life Insurers Do?

Insurers face a dilemma. Their traditional business model no longer works in a negative-rate environment. Guaranteed insurance products that provide simple retirement income are unsustainable under current EU solvency regulations. Companies’ own returns on capital and price-to-book ratios are nearly at all-time lows. At the same time, customers are clamoring for new answers as they are forced to invest in a low-yield, high-volatility environment and take on the longevity risk themselves

Insurers must increase their ability to leverage technology to deliver new propositions at low cost.

Insurers can resolve this dilemma for themselves and their customers, but bold action is required. Companies first need to get closer to their customers and provide guidance and advice to help them navigate the complexity. From a product point of view, new (capital light) investment solutions that provide yield in accumulation and income and low volatility in retirement are essential. These require new investment capabilities in multi-assets, real assets, and novel solutions that smooth volatility and generate income in retirement. Insurers must also accelerate their ability to leverage technology to deliver new propositions at low cost so as not to erode already thin returns and maximize value to customers.

At a corporate level, life insurance companies should use this moment to review their strategies. As a prerequisite, though, it’s critical that management teams reject the usual incremental approach to strategic planning and consider steps such as the following:

- Make the review a topic for the CEO and the board.

- Confront candidly the fact that management is not always incentivized to pursue bold strategies. Indeed, for some, a low-risk path of slow decline is the preferable course.

- Work with scenarios that extend beyond the current capital market consensus (such as spikes in rates or lapses, normalization of credit spreads, or exits from the Monetary Union).

- Put all options for improving the economics and balance sheet of the in-force business on the table. These include buying out legacy contracts and up- or cross-selling capital-light products, deferred annuities, pure savings, and loans. Consider closing the general account for new business to lock in earnings and protect solvency.

- Use financial muscle to support business transformation. Acquire businesses in attractive adjacent sectors. Strengthen distribution, service, and data capabilities.

- Play to their balance sheet strengths. These include ample long-term funding, superior liquidity, strong quality of capital, independence of capital markets for funding, and the ability to invest a part of the assets in illiquid or alternative assets.

- Make a step change in productivity, reviewing all options to outsource pieces of the value chain, address overheads, and simplify the IT architecture and legacy tariffs.

- Stretch the thinking on the new business. Question the basic assumptions in the current commercial strategy, such as target segments (Are “young families” really the sweet spot?) and product mix (Are complex, high-charging, long-term lock-in contracts still a good core proposition?).

- Upgrade efforts to improve customer relevance and engagement, including better capturing and converting of leads, personalized, pre-underwritten offers, and providing digitally enabled advice and guidance.

- Explore opportunities for diversification toward health, wealth, and beyond.

Negative rates are the defining investment attribute for the foreseeable future in Europe. For the benefit of their customers as well as their shareholders, life insurers need to develop new strategies for a new reality now.