How can mechanical engineering companies monetize digital products and services? This question is top of mind for executives as companies ramp up the development of digital offerings and test new data-based business models. Digital offerings provide clear benefits, enabling customers to lower costs (by using energy and raw materials more efficiently, for example) and increase revenues (by improving product quality, for instance). Moreover, companies already have the technical capabilities required to develop value-adding digital offerings. But many have not yet “cracked the code” when it comes to pricing and marketing these products and services.

A new report by BCG and VDMA (Mechanical Engineering Industry Association, headquartered in Germany) offers guidelines for achieving profitable growth. The guidelines are based on an analysis of more than 20 case examples of successful digitization projects in mechanical engineering and related business-to-business sectors. The study points to four distinct types of digital offerings. For each type, we’ve identified the combination of pricing and go-to-market approaches that will maximize commercial success.

Significant Value and High Expectations

The size of the prize is impressive. Digital products and services address the needs of customers in markets that promise significantly stronger growth than mechanical engineering companies’ typical core businesses of machines and components. For offerings from mechanical engineering companies that relate to the industrial Internet of Things (IoT), BCG forecasts sales growth of more than 30% from 2018 through 2023. And growth of nearly 10% is expected for industrial software. By comparison, the expected sales growth of core mechanical engineering products is only 2% to 3%.

It’s no surprise, then, that the industry has high expectations for digital. A recent BCG survey found that approximately 15% of German mechanical engineering companies generate more than 5% of their revenues from digital offerings. However, approximately 30% want to generate more than 5% of their revenues from digital offerings by 2023. Another 40% want digital offerings to represent 3% to 5% of revenues by 2023, with significantly higher percentages targeted in the long term.

To meet these expectations, companies need to develop digital offerings that have a clear, customer-oriented value proposition. The value proposition could, for example, be to improve KPIs related to output, such as availability, cycle rates, throughput time, or quality. Such customer benefits must be concretely quantified during the development phase and used as the basis for well-considered approaches to pricing and marketing. Although there is no silver bullet, there are strategies that enable successful commercialization.

Four Types of Digital Offerings

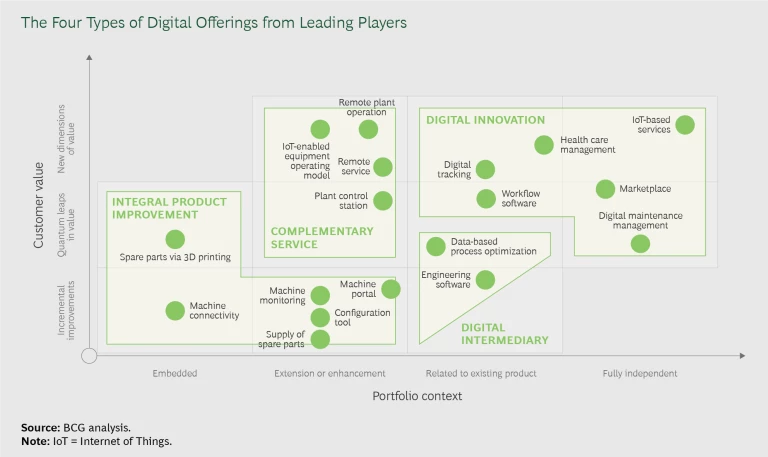

The spectrum of possible digital offerings in mechanical engineering is very broad, because they can be directly associated with the use of a company’s primary products or relate to those products.

To classify the types of digital offerings, we looked first at digital services in the context of a company’s portfolio and identified the following categories:

- Embedded. These services are integrated into primary products. A common example is machine connectivity.

- Extensions or Enhancements. These services augment existing products. They are not integrated, but they can be used only in connection with a company’s products. Examples are a proactive remote service that is digitally supported and an IoT-enabled equipment operating model.

- Related to an Existing Product. These services can be used independently but have a connection to existing products. An example is engineering software.

- Fully Independent. These services can be used independently of specific products. Two examples are marketplaces and IoT-based services.

Next, we assessed possible digital offerings in terms of customer benefits, identifying them as follows:

- Incremental improvements of existing KPIs

- Quantum leaps in the existing dimensions of value

- New dimensions of value

Applying these classifications to the successful case examples that we analyzed allowed us to identify four types of digital offerings. (See the exhibit.) Each type has a distinctive recipe for commercial success.

Integral Product Improvement. An integral product improvement is an enhancement that is embedded in a company’s existing products or that supplements an existing product. For example, a company can offer a service app with free basic functions, such as machine monitoring. The cost is covered by the primary product’s price. The service offers the customer at least incremental improvements, and, in the best-case scenario, it offers a clear additional benefit. However, the value of the benefit does not exceed a threshold that would allow for standalone monetization. The strategy for monetizing the improvement focuses on safeguarding the primary product’s current price level and creating a basis for the sale of complementary services.

Complementary Service. A complementary service supplements or expands a company’s offerings by adding standalone digital services. Examples include condition-monitoring systems and equipment operating models supported by the IoT. If used in connection with a company’s existing products, these offerings provide customers with significant additional benefits. The pricing for a complementary service can be set up to let customers pay up front or in installments, depending on whether the degree of customer benefit can be measured and whether target customers prefers classifying costs as capital expenditures or operating expenses.

Digital Intermediary. A digital intermediary is a nonintegrated digital service that has clearly measurable benefits for a company’s customers. Examples include engineering software and data-based process optimization. The service is necessarily related to a company’s primary products and business. However, the service can also be used with competitors’ products, complementary peripherals, and other services, which helps to stimulate sales. The monetization strategy emphasizes locking in existing customers and upselling from the core portfolio. The digital intermediary should be offered free of charge. If a price is charged, customers will no longer perceive the service as an intermediary, which will impede market penetration. It is essential to have a dedicated distribution team that shares leads with the regular distribution unit.

Digital Innovation. A digital innovation is a service or business model, often relating to software, that has no direct relationship to a company’s primary services and can be marketed as a standalone service or model. An example in the health care context is a data management solution that processes data from various types of peripheral medical equipment for inclusion in a patient’s digital record. This type of offering represents a major diversification for the mechanical engineering industry. The billing model should be entirely based on usage or performance. Because rapid dissemination in the market is decisive for success, the barriers to entry must be as low as possible. A dedicated distribution team should be set up to act within an open network of digital partners to support rapid market penetration. As a result, a company should focus its digital innovations on the areas of the partner ecosystem in which it can achieve a leading position.

Think and Act Strategically

To successfully monetize digital offerings, mechanical engineering companies must take a number of strategic steps. Broadly, these include the following:

- Design a digital portfolio so that it is aligned with the company’s existing hardware portfolio and its digital ambition. The most basic step in portfolio design is developing integral product improvements and complementary services. Creating digital intermediaries and digital innovations represents a more advanced stage of diversification. The various elements of a digital portfolio must reflect its scope of service, and the timing of the release of the elements must be coordinated with one another.

- Define a customer-centered value proposition for each new digital product or service. The ability to precisely articulate a customer benefit is an essential prerequisite to successful commercialization. The valued added by the product or service should be clear to the customer and deliverable by the commercialization model.

- Establish the right organization and culture to support the digital business. Because digital business models are highly dynamic, a willingness to continuously change and adapt is needed throughout an organization. The organizational and cultural enablers must be established upfront or hand-in-hand with the creation of the digital offerings—they cannot be pursued as an afterthought.

Companies that proceed strategically and display endurance will be well positioned to grow a digital business sustainably and profitably. The full report, available in German, provides a comprehensive discussion of the challenges and opportunities. An English translation is in development and will be shared here soon.