Companies that don’t make use of augmented reality technologies may soon find themselves unable to compete, argue Sarah Willersdorf, Christine Barton, and Pierre Dupreelle.

Picture this: It’s 2020, and Andrea, a 22-year-old student about to graduate from a top-tier school on the West Coast, has a summer internship FaceTime interview scheduled with a prestigious private equity fund for which she’s been preparing for weeks. Ahead of the call, she styles her hair, washes her face, and puts on a navy-colored silk blouse and small gold hoop earrings.

But rather than applying equally business-appropriate makeup, she whips out her phone and begins to choose from a virtual palette of base, concealer, blush, lip gloss, and more. Once she dials into her video interview, her virtual makeup will appear within seconds.

As an early member of the founder generation (those born since 1997), Andrea has never known life without a smartphone and is incredibly well versed in the use of face filters on Instagram Stories, Snapchat and TikTok, her favorite social media platform. Like many founders, she buys most of her makeup and other personal-care products online and so was an early adopter of augmented reality (AR) makeup apps to experiment with and choose the products she wanted to buy. Once virtual makeup tools for phones became available, using one for her summer internship interviews was subsequently a natural progression. If she gets called in for a final interview in person she will of course wear “real” makeup, but it, too, will be makeup that she bought after virtually trying it on via an app.

As Marc Andreessen famously theorized, software is eating the world, and beauty is no exception. In present-day 2019, the list of shopping tools in the beauty and skin-care world, which includes everything from mobile payments to shoppable social media content, grows longer by the day.

That list includes AR for beauty, in the form of makeup try-on apps both in stores as well as on mobile phones, and—sooner than later—virtual makeup for use in video chat applications like FaceTime and Skype. Conferencing software Zoom already offers a “Touch Up My Appearance” feature that softens the focus to smooth out wrinkles and minimize blemishes.

Currently, however, just 23% of consumers are even aware that there are makeup try-on apps available outside of stores. That’s according to a survey of 1,216 US women who buy prestige beauty products (which are not mass market but not necessarily luxury, either) that Boston Consulting Group conducted with beauty trade organization Cosmetic Executive Women Inc. But once they learn about those AR-based beauty apps, more than half (52%) use them. When it comes to women of the Founder generation, that number jumps to over 70%.

In the meantime, as more and more consumers shop using their smartphones, conversion rates are declining, at times to as low as a third of desktop and tablet conversion in some apparel and beauty categories. The use of AR—not just in beauty, but in categories such as sneakers, jewelry, and a host of others—could help reverse that trend.

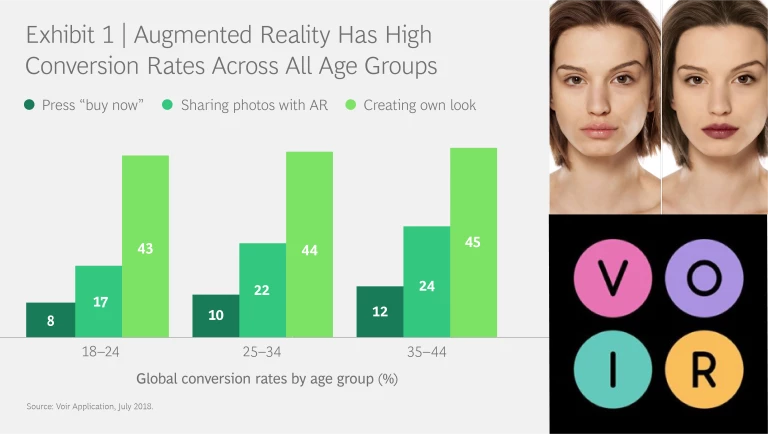

As with many new technologies, however, consumers often don’t know a good thing until they are actually using it. To gauge the potential usage of AR apps in beauty, we were fortunate enough to gain access to data from a new AR beauty application, called Voir, which to date has some 2.5 million downloads and 15,000 paying subscribers. Its data shows that between 8% and 12% of shoppers ages 18-44 who test beauty products in a mobile AR app hit the “buy” button—compared to average conversion rates of between 1% and 3% for many websites. (See Exhibit 1.) Even assuming some drop off from the hitting of “buy” to an actual sale and this could be transformational for digital commerce.

Combine that with the opportunity for additional growth in beauty—among the female prestige shoppers we surveyed, 40% said they planned to spend more over the subsequent 12 months, and of that 40%, 8% to 9% were planning to spend significantly more—and it becomes clear that to capture share of this planned increase in spending, beauty brands and retailers need to make AR a core feature of the experience they offer consumers now. But first they have to understand where their target audience shops, and how that differs by generation—in particular for founders and millennials, whose awareness and usage of shopping technology like AR is the highest and from whom most of the growth will come from.

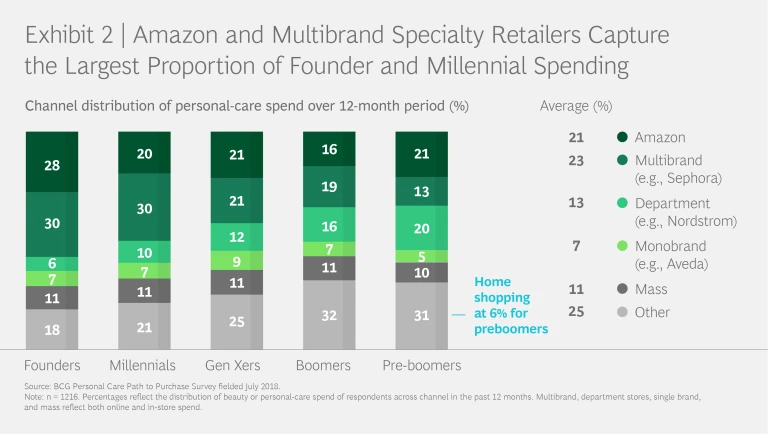

When it comes to beauty, nearly half of the new spend will take place online, most of it on Amazon via Prime. Among founder and millennial (born between 1981 and 1996) prestige beauty shoppers, Amazon, along with multibrand specialty retailers like Sephora and Ulta, account for more than 50% of personal care product purchases. (See Exhibit 2.) AR offers one way for all brands and retailers to compete with Amazon, not just those focused on beauty. That’s because it can not only drive conversion by offering consumers an immersive experience, but by making that immersive experience wholly personalized.

What is going to drive the acceleration of AR? A couple of notable brands or one big retailer that embraces it through partnership with, or ownership of, a cutting-edge AR provider. In beauty, there are already some notable brands investing in this technology of tomorrow. For example, in November 2017, Japanese multinational beauty and personal care maker Shiseido said it had bought Giaran, an award-winning, data-driven startup with leading AI platforms for mobile, tablets, and smart mirrors to offer consumers a way to apply and remove makeup virtually so they can see how they look before making purchases. And in March 2018 L’Oreal acquired AR platform Modiface, the first time the global cosmetics brand had ever bought a tech firm.

Meanwhile, new AR applications like Voir are offering a myriad of products and features to an audience ready to click and buy directly. It’s a potent combination, producing enviable levels of retention and early conversion rates well above those typically experienced today.

This new (augmented) reality, led by founders and millennials, is already changing the way beauty products are sold—and helping brands and retailers sell more of them. But AR’s uplift won’t be limited to beauty alone. Any category where consumers seek to try on product will benefit from it. Those categories that don’t already make use of AR, or are taking steps to, will quickly find themselves unable to compete.

This commentary was originally published in The Business of Fashion .