M any of today’s business leaders came of age studying and experiencing a classical model of competition. Most large companies participated in well-defined industries selling similar sets of products; they gained advantage by pursuing economies of scale and capabilities such as efficiency and quality; and they followed a process of deliberate analysis, planning, and focused execution.

The traditional playbook for strategy is no longer sufficient. In all businesses, competition is becoming more complex and dynamic. Industry boundaries are blurring. Product and company lifespans are shrinking. Technological progress and disruption are rapidly transforming business. High economic, political, and competitive uncertainty is conspicuous and likely to persist for the foreseeable future.

Accordingly, in addition to the classical advantages of scale, companies are now contending with

new dimensions of competition

—shaping malleable situations, adapting to uncertain ones, and surviving harsh ones—which in turn require new approaches. And the stakes are higher than ever: the gap in performance between the top- and bottom-quartile companies has increased in each of the past six

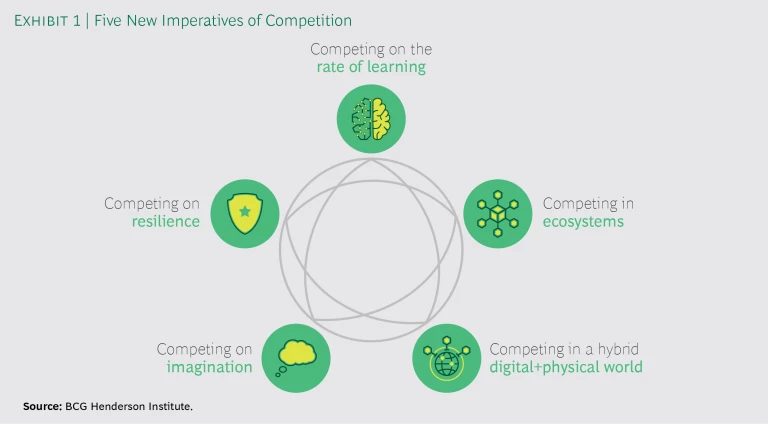

Today’s business leaders are dealing with complex competitive concerns in the short run. But as the 2020s approach, they must also look beyond today’s situation and understand at a more fundamental level what will separate the winners from the losers in the next decade. We see five new imperatives of competition that will come to the forefront for many businesses (See Exhibit 1):

- Increasing the rate of organizational learning

- Leveraging multicompany ecosystems

- Spanning both the physical and the digital world

- Imagining and harnessing new ideas

- Achieving resilience in the face of uncertainty

In short, the logic of competition has changed—from a predictable game with stable offerings and competitors to a complex, dynamic game that is played across many dimensions. Leaders who understand this, and re-equip their organizations accordingly, will be best positioned to win in the next decade.

Competing on the Rate of Learning

Learning has long been considered important in business. As Bruce Henderson, BCG’s founder, observed more than 50 years ago , companies can generally reduce their marginal production costs at a predictable rate as their cumulative experience grows. But in traditional models of learning, the knowledge that matters—learning how to make one product or execute one process more efficiently—is static and enduring. Going forward, it will instead be necessary to build organizational capabilities for dynamic learning—learning how to do new things, and “learning how to learn” by leveraging new technology.

Today, artificial intelligence, sensors, and digital platforms have already increased the opportunity for learning more effectively—but competing on the rate of learning will become a necessity by the 2020s. The dynamic, uncertain business environment will require companies to focus more on discovery and adaptation rather than only on forecasting and planning.

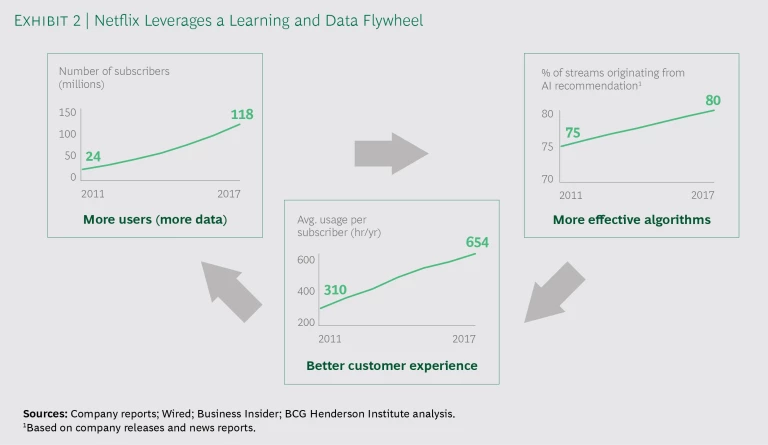

Companies will therefore increasingly adopt and expand their use of AI, raising the competitive bar for learning. And the benefits will generate a “data flywheel” effect—companies that learn faster will have better offerings, attracting more customers and more data, further increasing their ability to learn.

For example, Netflix’s algorithms take in behavioral data from the company’s video streaming platform and automatically provide dynamic, personalized recommendations for each user; this improves the product, keeping more users on the platform for longer and generating more data to further fuel the learning cycle. (See Exhibit 2.)

However, there is an enormous gap between the traditional challenge of learning to improve a static process and the new imperative to continuously learn new things throughout the organization. Therefore, successfully competing on learning will require more than simply plugging AI into today’s processes and structures. Instead, companies will need to:

- Pursue a digital agenda that embraces all modes of technology relevant to learning—including sensors, platforms, algorithms, data, and automated decision making.

- Connect them in integrated learning architectures that can learn at the speed of data rather than being gated by slower hierarchical decision making.

- Develop business models that are able to create and act on dynamic, personalized customer insights.

Competing in Ecosystems

Classical models of competition assume that discrete companies make similar products and compete within clearly delineated industries. But technology has dramatically reduced communication and transaction costs, weakening the Coasean logic for combining many activities inside a few vertically integrated

As a result of these forces, new industrial architectures are emerging based on the coordination of ecosystems—complex, semifluid networks of companies that challenge several traditional business assumptions. Ecosystems blur the boundaries of the company: for example, platform businesses such as Uber and Lyft rely heavily on “gig economy” workers who are not direct employees but rather temporary freelancers. Ecosystems also blur industry boundaries: for example, automotive ecosystems include not just traditional suppliers but also connectivity, software, and cloud storage providers. And they blur the distinction between collaborators and competitors: for example, Amazon and third-party merchants have a symbiotic relationship, while the company competes with those merchants by selling private-label brands.

A few digital giants have demonstrated that successfully orchestrating ecosystems can yield outsized returns. Indeed, many of the largest and most profitable companies in the world are ecosystem-based

Many of the largest and most profitable companies in the world are ecosystem-based businesses.

The playbook for how to emulate these ecosystem pioneers has not yet been fully codified, but a few imperatives are becoming increasingly clear:

- Adopt a fundamentally different perspective toward strategy, based on embracing principles like external orientation, common platforms, co-evolution, emergence, and indirect monetization.

- Determine what role your company can play in your ecosystem or ecosystems—not all companies can be the orchestrator.

- Ensure that your company creates value for the ecosystem broadly, not just for itself.

Competing in the Physical and the Digital World

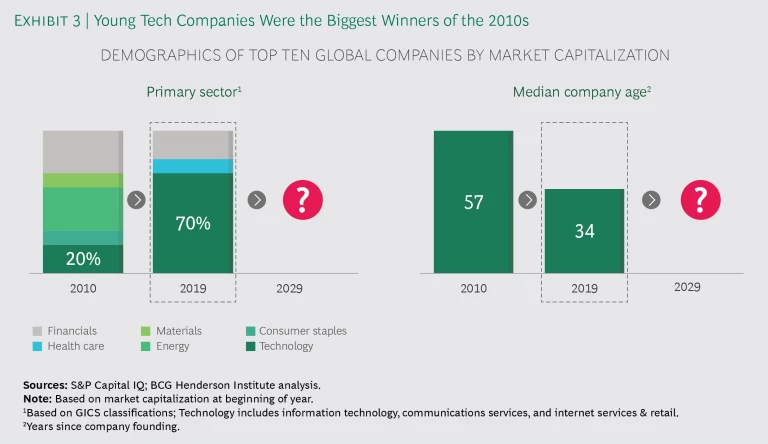

Today’s most valuable and fastest-growing businesses are disproportionately young technology companies, which operate ecosystems that are predominantly digital. (See Exhibit 3.) But the low-hanging digital fruits in consumer services, including retail, information, and entertainment, seem to have been plucked. New opportunities are likely to come increasingly from digitizing the physical world, enabled by the rapid development and penetration of AI and the Internet of Things. This will increasingly bring tech companies into areas—such as B2B and businesses involving long-lived and specialized assets—that are still dominated by older incumbent firms.

Early signs of “hybrid” competition at

the physical-digital intersection

are already emerging. Digital giants are moving into physical sectors: for example, Amazon has opened new retail stores in addition to its acquisition of Whole Foods, while Google has entered automotive and transportation through its Waymo subsidiary. Meanwhile, incumbent companies are furiously pursuing digitization. For example, John Deere has invested heavily in IoT technology by adding connected sensors to its tractors and other equipment. The company collects and analyzes data from each machine, using the insights to provide updates to its equipment or suggestions to users. “Our roadmap is calling for machine learning and AI to find their way into every piece of John Deere equipment over time,” said John Stone, the senior vice president for Deere’s Intelligent Solutions

These trends point to a new battle between younger digital natives and traditional physical incumbents. But unlike in the past decade, in which upstarts unseated many legacy leaders with purely digital models, the next round is likely to be a more balanced contest. Technology companies no longer have a limitless social license; in the next decade, they will have to navigate thorny issues like user trust, data privacy, and regulation, which will likely be even more critical in the context of hybrid competition. And incumbents will still have to fight against institutional inertia and the long odds of disruption , but they will be able to better leverage existing relationships and expertise in the physical world. Therefore, the next wave of “natural selection” in business is likely to test both digital natives and incumbents—and winners could emerge from either group.

The next wave of “natural selection” in business is likely to test both digital natives and incumbents — and winners could emerge from either group.

What will make the difference? To succeed in hybrid competition, companies will need to:

- Build strong relationships with actors on both sides of the ecosystem—customers and suppliers.

- Rethink existing business models in order to win the battle for new hybrid markets.

- Adopt good practices for governance of data and algorithms to preserve users’ trust.

Competing on Imagination

Companies can no longer expect to succeed by leaning predominantly on their existing business models. Long-run economic growth rates have declined in many economies, and demographics point to a continuation of that pattern. Competitive success has become less permanent over time . And markets are increasingly shapeable, increasing the potential reward for innovation. As a result, the ability to generate new ideas is more important than ever.

However, creating new ideas is challenging for many companies. Inertia increases with age and scale, making it harder to create and harness new ideas: our analysis of companies around the world shows that older and larger companies have less vitality , the capacity for sustainable growth and reinvention. (See Exhibit 4.) And business and managerial theory has emphasized a “mechanical” view—dominated by easily measurable variables like efficiency and financial outcomes—rather than focusing on how to create new ideas.

To overcome these challenges, companies need to compete on imagination. Imagination lies upstream of innovation: to realize new possibilities, we first need inspiration (a reason to see things differently) and then imagination (the ability to identify possibilities that are not currently the case but could be). Imagination is a uniquely human capability—artificial intelligence today can make sense only of correlative patterns in existing data. As machines automate an increasing share of routine tasks, individual managers will need to focus on imagination to stay relevant and make an impact.

How can companies compete on imagination?

- Focus on anomalies, accidents, and analogies, rather than averages, in order to spark inspiration.

- Enable the open spread and competition of ideas—for example, by limiting hierarchy and empowering employees to experiment and make imaginative proposals.

- Become a “playful corporation” that is able to effortlessly explore new possibilities.

Competing on Resilience

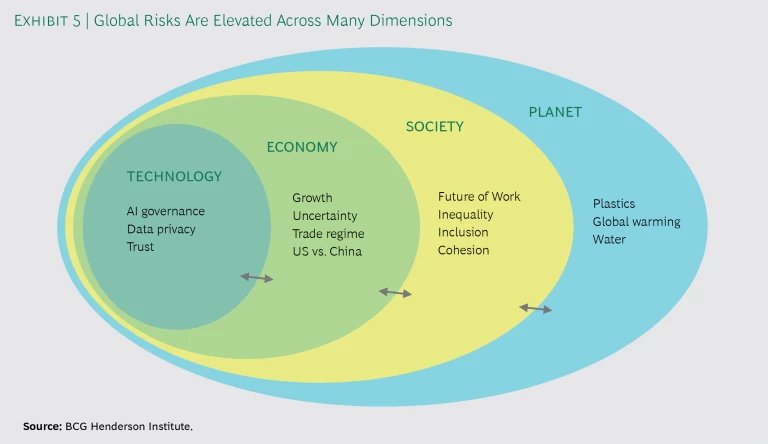

Looking ahead to the 2020s, uncertainty is high on many fronts . Technological change is disrupting businesses and bringing new social, political, and ecological questions to the forefront. Economic institutions are under threat from social divisions and political gridlock. Society is increasingly questioning the inclusivity of growth and the future of work. And planetary risks, such as climate change, are more salient than ever.

Furthermore, deep-seated structural forces indicate this period of elevated uncertainty is likely to persist: technological progress will not abate; the rise of China as an economic power will continue to challenge international institutions; demographic trends point toward an era of lower global growth, which will further strain societies; and social polarization will continue to challenge governments’ ability to effectively respond to national or global risks. (See Exhibit 5.)

Under such conditions, it will become more difficult to rely on forecasts and plans. Business leaders will need to consider the larger picture, including economic, social, political, and ecological dimensions, making sure their companies can endure in the face of unanticipated shocks. In other words, businesses will effectively need to compete on resilience.

Survival is already challenging for many businesses today . Building resilience is often at odds with traditional management goals like efficiency and short-run financial maximization. But to thrive sustainably in uncertain environments, companies must make resilience an explicit priority:

- Prepare for a range of scenarios to ensure that strategy is robust and risks are survivable.

- Build an adaptive organization that can rapidly adjust to new circumstances—for example, by constantly experimenting to identify new options.

- Proactively contribute to collective action on the biggest issues facing global economies and societies, in order to maintain a social license to operate.

The New Significance of Scale

These new forms of competition are highly intertwined. For example, companies that orchestrate ecosystems will have an advantage in competing on learning, because ecosystems are a rich source of real-time data and digital platforms facilitate experimentation. Many companies will integrate physical and digital assets by leveraging partnerships in hybrid ecosystems. Machine learning and autonomous action will increase humans’ need for and ability to focus on imagination. And those shifts will collectively create further unpredictability for business, necessitating strategies for resilience.

These five emerging aspects of competition point to a new logic for “scale.” No longer will scale represent only the traditional value of achieving cost leadership and optimizing the provision of a stable offering. Instead, new kinds of scale will create value across multiple dimensions: scale in the amount of relevant data companies can generate and access, scale in the quantity of learnings that can be extracted from this data, scale in experimentation to diversify the risks of failure, scale in the size and value of collaborative ecosystems, scale in the quantity of new ideas companies can generate, and scale in resilience to buffer the risks of unanticipated shocks.

The capabilities that companies need in order to compete in the next decade will not come automatically. Instead, leaders need to create them by designing the organization of the future—for example, by building autonomous, algorithmic learning loops, by synergistically combining humans and machines, and by rethinking the role of management and leadership. In the next installment of our series on winning the ’20s , we will expand on how to build this new organizational model to succeed in the future.