Most retailers are nowhere close to delivering the personalized experiences that their customers expect. The vast majority have not even taken the essential first step of defining what personalization means to their customers and businesses. And many retailers are unclear about which capabilities to build to create a truly personalized experience. A few companies are pulling ahead, but the race is far from over.

To help retailers advance their efforts, Boston Consulting Group has developed an innovative approach that companies can use to assess and elevate their level of personalization maturity. This is defined as the extent to which companies enable personalization across communication channels with advanced tactics and support it by investing in personalization capabilities. Opportunities for improvement abound. Retailers can raise their level by, for example, partnering more effectively, boosting targeted advertising, and improving their use of data to make real-time customer recommendations.

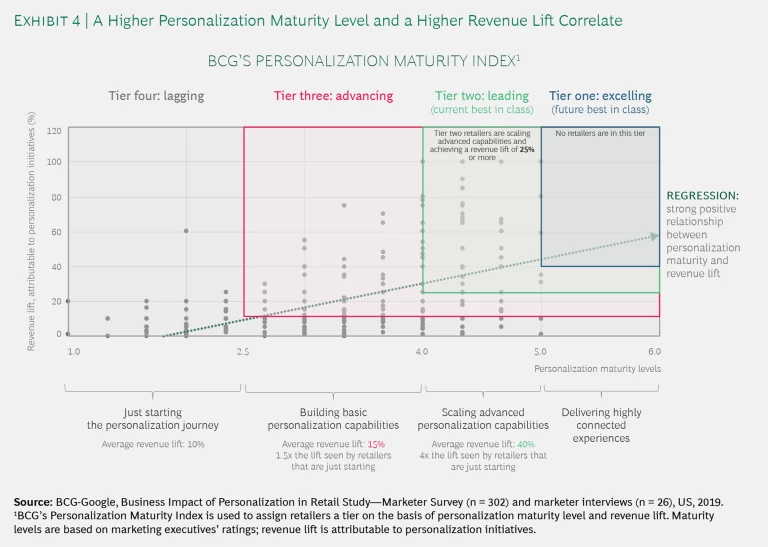

Our approach also enables retailers to quantify the business impact of reaching the next level. BCG’s research shows that personalization maturity levels vary widely across companies and retail segments. It also shows that companies that implement personalization initiatives and become best in class in delivering personalized experiences can quadruple the revenue lift they receive from their personalization initiatives. (Best-in-class retailers are those that are in tier two in BCG’s Personalization Maturity Index. No retailers qualified for tier one, the highest level. See “About Our Research.”)

ABOUT OUR RESEARCH

ABOUT OUR RESEARCH

To better understand the personalization opportunity for retailers, Google commissioned Boston Consulting Group to research and analyze customers’ opinions and behaviors, as well as marketing executives’ strategies and activities, across five retail segments: mass merchant, specialty, pure play, consumer electronics, and telecommunications.

BCG conducted three key research initiatives: a broad survey of 3,144 retail customers, a targeted survey of 302 marketers, and in-depth interviews with 38 senior marketing and technology executives from 26 leading retail organizations. The study asked marketers to rate their companies’ personalization maturity in detail—their use of personalization across communication channels, their use of personalization tactics, and their investment in personalization capabilities. BCG distilled this complex personalization maturity model into four summarized maturity levels. Marketers’ detailed responses were then used to place retailers at one of the four maturity levels:

- Level One. Companies were delivering highly connected experiences (the most advanced level).

- Level Two. Companies were scaling advanced personalization capabilities.

- Level Three. Companies were building basic personalization capabilities.

- Level Four. Companies were just starting the personalization journey (the least advanced level).

Next, to determine each company’s personalization maturity performance, BCG created the Personalization Maturity Index. This tool uses two data points—the retailer’s personalization maturity rating and the revenue lift that retailers reported receiving as a result of their personalization efforts—to categorize companies into one of four performance tiers:

- Tier One. Retailers are delivering highly connected experiences and achieving a revenue lift of 40% or more; no retailers met this criteria.

- Tier Two. Retailers are scaling advanced personalization capabilities and achieving a revenue lift of 25% or more; the retailers in this tier are defined as best in class and account for 19% of the participating companies.

- Tier Three. Retailers are building basic personalization capabilities and achieving a revenue lift of 10% or more; the retailers in this tier account for 40% of the participating companies.

- Tier Four. Retailers are just starting the personalization journey; the retailers in this tier account for 41% of the participating companies.

In addition, BCG created the Personalization Value Calculator. This tool identifies the key steps that companies in the five retail segments can take to advance to the next tier and quantifies the impact on future sales for those that do so.

Best-in-class retailers are using personalization to make the shopping experience as easy, fast, intuitive, and seamless as possible across touch points. In most cases, success requires building personalization capabilities, which is critical for maximizing the value of the vast amount of data that is available on individual customers’ preferences. But success doesn’t necessarily mean developing a unique experience for every customer at every step of the way—an undertaking that can be very costly. Rather, the goal for leaders is to use technology to personalize critical touch points in a way that best drives value for the customer and retailer.

The size of the personalization opportunity varies depending on a retailer’s current personalization capabilities. Even if a retailer has significant capabilities, however, its growth potential can still be substantial. All retailers—even leaders—should make advancing to the next personalization maturity level a strategic priority.

Customers Respond Positively to Personalization

According to a study conducted by BCG and commissioned by Google, customers increasingly prefer a shopping experience that’s easy and fast and that helps them make purchase decisions. Customers think less about personalization per se than they do about the benefits it can provide. By contrast, retailers are increasingly focused on personalization and what it means. We define it as continually tailoring the shopping experience to individual customers by using a combination of first-party customer data (which a company collects from its customers or audience) and third-party customer data (which is collected by external organizations that are not the original sources of the data).

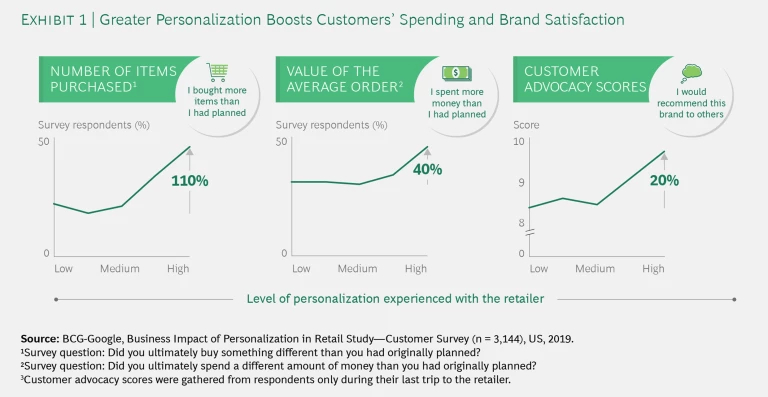

Although customers are not inclined to consider personalization as an end in itself, our customer survey suggests that personalization done well can result in significant benefits to the retailer. For example, when the shopping experience was highly personalized, customers indicated that they were 110% more likely to add additional items to their baskets and 40% more likely to spend more than they had planned. Moreover, when asked to rate a particular retailer, customers who experienced a high level of personalization provided customer loyalty scores that were 20% higher than those of customers who experienced a low level of personalization. (See Exhibit 1.)

Privacy continues to be top of mind for customers. “Keeping my payment information private” ranks as the number one issue among customers surveyed, with “keeping my personal information private” coming in as a close second. Yet customers are increasingly willing to share personal data with trusted brands in exchange for tangible benefits, such as an easier and faster buying process. As one senior executive at a leading consumer electronics retailer pointed out, “We opted to only leverage personalization where it truly streamlined the customer experience or was a response to a clear indication of interest, rather than push products and offers; we’ve been very cautious in our use of customer data out of respect for customer privacy.”

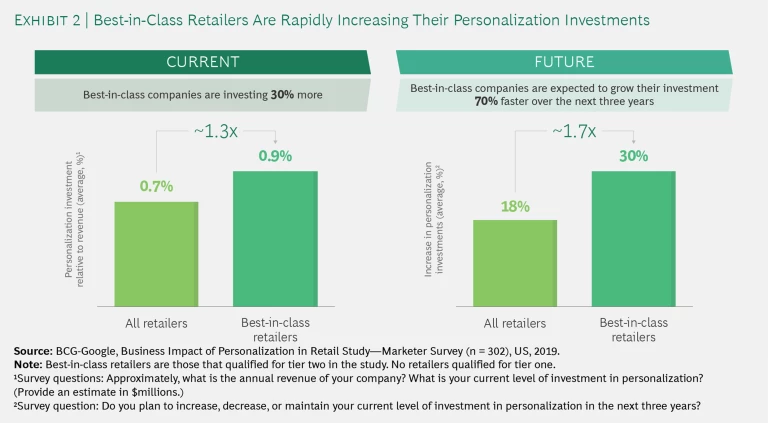

Retailers are recognizing that personalization will prove increasingly important, and they are adjusting their personalization investment plans accordingly. Currently, retailers are investing, on average, 0.7% of their revenues in personalization. However, best-in-class retailers are investing 0.9%, on average, or about 1.3 times

Personalization Is Still in the Early Stages

Personalization is key to achieving what surveyed retailers said were their top business objectives: raising the rate at which they convert shoppers into customers and increasing the lifetime value of

Rating Personalization Maturity. As part of the study, retail marketers were asked to rate their companies’ personalization maturity by assessing their use of various channels to personalize the customer experience, their use of various tactics to personalize that experience, and their investment in infrastructure to enable personalization.

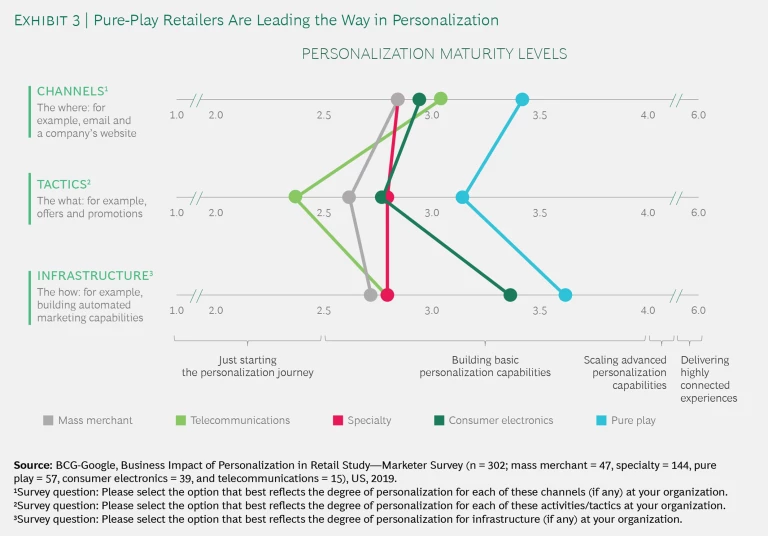

Retail marketers predominantly gave their companies low marks in all three areas, and particularly in their use of personalization tactics. These assessments held true generally across retail segments. When rating their maturity overall, though, marketers at pure-play retailers (which rely exclusively on the internet to sell their goods) tended to rate their companies as more mature than marketers in other segments rated their companies; marketers at mass merchant retailers (which sell a wide range of products online and in physical stores) rated their companies as the least developed. (See Exhibit 3.)

Specialty retailers (which focus more on category selling with an omnichannel approach) fell somewhere in between. Specialty retail marketers rated their companies as more mature than mass merchant marketers rated their companies, but less mature than pure-play marketers rated theirs. Consumer electronics marketers rated their companies (which are similarly focused on categories) as more mature than either mass merchant or specialty retailer marketers rated their companies, but less mature than pure-play marketers rated theirs.

These ratings come as no surprise. Pure-play retailers are generally younger, faster-growing companies that have been digital from the beginning, with personalization approaches embedded in their business models. Most of these companies are smaller, though of course there are also large pure-play retailers, such as eBay. Regardless of size, pure-play retailers typically launched their growth trajectory by using technology and personalization to address particular customer pain points and to disrupt traditional retail models.

Unlike smaller pure-play retailers, mass merchant companies tend to be older, larger, and more complex organizations that need to modernize legacy technology, personalize their in-store experience, and break down the digital and analog silos. Frequently, these initiatives require cultural change and new talent.

Assessing the Key Challenges. All retailers, regardless of their segment, grapple with certain technological challenges. The hurdles cited most frequently by retail marketers were poor data centralization and the failure of their company’s technology to support one-to-one communications with customers. (Each of these barriers was cited by 14% of the respondents.) Nearly as many (12%) said their company’s technology wasn’t sufficiently

Organizational issues can also create roadblocks that are equally formidable to overcome, if not more so. The marketing executives we surveyed cited limited resources and insufficient budgets most often (18% and 17%, respectively). Marketers at smaller pure-play retailers in particular cited these as key issues that often affected their company’s ability to scale its long list of initiatives. Moreover, owing to a lack of scale, smaller pure-play retailers often don’t have sufficient data to power the algorithms needed for automating product recommendations effectively. For larger retailers, by contrast, inadequate cross-functional coordination tends to be the biggest

Additionally, most retailers haven’t sufficiently addressed the risks associated with poor customer data management. Data breaches can permanently damage a brand and erode customers’ trust, reducing their willingness to share information about themselves. In the face of customers’ concerns and new regulations, such as the General Data Protection Regulation (GDPR), many retailers are increasing their focus on protecting customer data. Although complying with GDPR is critically important, it can be an intensive effort, requiring companies to divert critical resources from other important personalization initiatives. “Complying with GDPR took substantial resources—20 people over the period of a year,” the operations head of an online retailer said. “It’s definitely been a focus for the company, but it’s diverted resources from other critical initiatives, including personalization efforts.”

Most retailers haven’t sufficiently addressed the risks associated with poor customer data management.

Some Retailers Are Leading the Way

As discussed earlier, to assess retailers’ performance, we used BCG’s Personalization Maturity Index, which categorizes companies in one of four tiers on the basis of their personalization maturity levels and the revenue lift their personalization initiatives are providing. We found that a small number of participating retailers, which we dubbed best in class, are in tier two. Companies in this tier have evolved over time, focusing their efforts on scaling advanced personalization capabilities to make the buying experience easier, faster, and more intuitive for customers. Tier two was the most advanced level achieved by participating retailers; no retailers met the criteria for tier one, the highest level.

Best-in-class retailers surpass their peers in a variety of ways. In particular, they use mobile, paid display, and paid search marketing to activate more channels more frequently. By contrast, tier four retailers tend to use fewer channels, mostly the company website, email, and other company-owned channels.

Best-in-class retailers also use more personalization tactics, including personalized merchandizing and loyalty and reward programs. In addition, these retailers deploy more sophisticated personalization capabilities by building infrastructure that unlocks value. For instance, such infrastructure enables companies to implement predictive algorithms (which help retailers make personalized product recommendations and offers) and to access integrated customer data in real time (which helps them develop deep insights into customer behavior and respond quickly).

An example of a best-in-class company is a pure-play retailer that used personalization to create a disruptive business model to enhance customer value and increase revenue. To acquire the right customers, the company used look-alike modeling, among other capabilities, to help identify the best prospects for paid ads. Then it employed targeted marketing tactics to turn prospects into customers. To retain customers, the company deployed an algorithm that provided product recommendations on the basis of customers’ individual preferences. Over time, the company increased the level of automation and refined the algorithm. By taking these steps, the retailer was able to scale more efficiently and deliver better product recommendations in real time, without human assistance. Through A/B testing, the retailer estimated that eliminating the algorithm would put more than 10% of its total revenue at risk.

Best-in-class retailers use more channels and personalization tactics than their peers.

A best-in-class specialty retailer used in-store digital experiences to engage customers while they interacted with the products. The company collected data on personal preferences from these interactions and used it to engage customers on topics of interest and to generate highly targeted product offers. The retailer used online video to bring the playfulness of the store environment to its mobile channel. Display ads and email delivered targeted product offers to prompt customers to visit the website, where they could discover, and ultimately purchase, additional products. Customers could also use the website to schedule appointments and classes, attending both in the retailer’s stores. The retailer experienced an increase of 10% to 20% in the value of the average order and in purchasing frequency. The retailer attributes these results to its in-store digital engagement and targeted marketing efforts.

Significant Benefits Can Result from Personalization

As noted above, personalization done right can pack a powerful punch. In our experience, companies that use advanced personalization methods can realize an improvement of 20% or more in their customer loyalty scores. In addition, these retailers can see productivity gains of 6% to 10% and incremental revenue growth of 10% or

Our research provides additional evidence that investing in personalization maturity pays off. According to BCG’s Personalization Maturity Index, retailers at tier two—companies that are scaling advanced personalization capabilities—realize, on average, four times the revenue lift from their personalization efforts, compared with retailers with rudimentary capabilities. In addition to being at this advanced maturity level, best-in-class retailers consistently realize a revenue lift of 25% or more from their efforts. (See Exhibit 4.)

Additional confirmation is provided by BCG’s Personalization Value Calculator, which identifies not only the key steps that companies need to take to reach the next tier but also the value of doing so. Viewed in conjunction with BCG’s Personalization Maturity Index, the Personalization Value Calculator underscores the connection between personalization maturity and superior business performance.

The Next Steps for Improving Maturity Performance

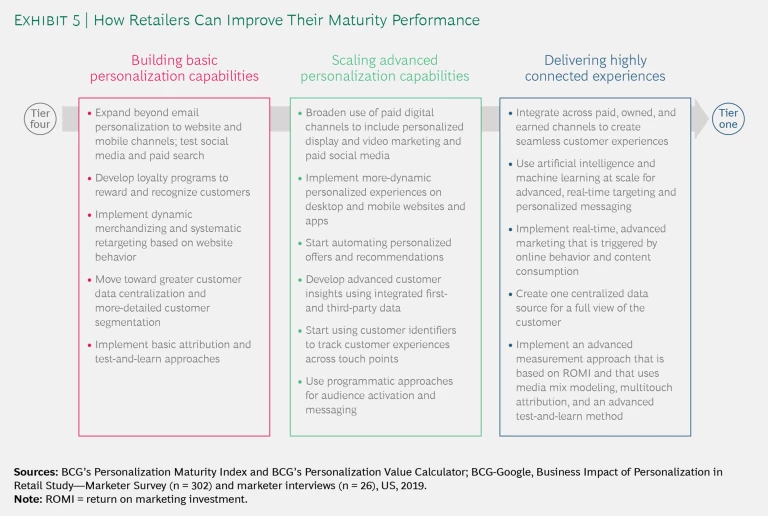

Retailers can take steps to improve their capabilities and personalization maturity performance. To advance from the rudimentary capabilities of tier four to tier three, for example, companies need to build basic personalization capabilities. This step requires expanding beyond email and putting a greater focus on the website experience—enabling customers to have consistent experiences across their mobile devices and personal computers. Equally important, it means implementing the basics of paid search marketing, rewarding and recognizing loyal customers, implementing dynamic merchandizing, and rolling out retargeting—all while building the necessary data foundation. (See Exhibit 5.)

With the basics in place, retailers can move from tier three to tier two and begin scaling advanced personalization capabilities. This undertaking includes acquiring the technologies and forging the partnerships that are essential for deploying integrated first- and third-party data, the backbone of more-personalized offers and recommendations. Companies also need to create more dynamic personalized website experiences. Additionally, they should use advanced paid media tactics to enable targeting: by placing the right advertising in the right channel at the right time, they can reach the right customers to elicit the desired response. Advanced paid media tactics come in many forms. For example, companies can use dynamic search ads (which automate ad creation at the time of delivery by pulling in real-time web information), implement automated display remarketing ads (which target offers to potential customers on the basis of their web behavior), and hire influencers to promote video ads to customers.

Scaling advanced personalization capabilities requires creating more dynamic personalized website experiences.

A leading pure-play apparel retailer aiming to move from tier three to tier two exemplifies how companies can use advanced paid media tactics to acquire more customers and bring them to their websites. The apparel retailer used paid advertising, carefully deploying the right kinds in the right channel at the right time to acquire customers. To target its audience better, the retailer used look-alike modeling, augmenting first-party data with third-party data. Machine learning was useful for testing variations of the same ad at scale to identify which ones worked best. Multiple paid ad formats—including search, display, and online video—enabled the retailer to deliver ads in a format that was preferred by its prospects, inducing them to visit the website.

When prospects visited the retailer’s website, it provided strong membership-based shopping incentives, such as price discounts if they were a VIP prospect and points for shopping or for registering and logging in. Shoppers who logged in received a very dynamic and personalized experience that highlighted the most relevant products and promotions. The retailer then tracked shoppers’ behavior after their initial purchases and used automated algorithms to identify customers whose shopping behavior was deviating from their typical patterns, indicating that there was a high risk of losing these customers. The company sent these high-risk customers special communications and offers to entice them to make additional purchases.

To move up to tier one—something no company has yet done, though Amazon, Sephora, Stitch Fix, and Wayfair are close—retailers must be able to provide highly connected experiences across various channels and various phases of the shopping journey. To offer this type of experience, paid media messaging must be coordinated with the messaging and experiences on company-owned channels, and mobile experiences must be connected with those on the desktop and in physical stores. Companies also must be able to use artificial intelligence and machine learning algorithms to analyze and act on data in real time, while systematically measuring results across the entire marketing funnel to identify the key drivers of sales.

Preparing for a More Personalized Future

Increasingly, retailers that want to get ahead will have to be able to personalize the shopping experience. To move to tier one, retailers will need to provide truly personalized and highly connected experiences throughout the customer journey. By doing so, companies will drive their core business objectives, including building their brands, engaging customers, increasing the number of customers that respond to marketing messages, and maximizing their customers’ lifetime value. As a marketing executive remarked, “Once acquired, it’s all about retaining the customer with a focus on lifetime value.”

Each retailer will have to tailor its approach to becoming a tier one company to its particular vertical market, business model, customers’ buying behaviors, and personalization maturity level. But, as our research demonstrates, retailers across all segments should keep several principles in mind. These guidelines are not new, but retailers should ask themselves if they are truly following them.

- Are we nurturing customers at every stage of the marketing funnel? “We put the customer first” is the motto of every company. Yet most retailers are still organized around product and channel silos that push offers to customers without regard for what they actually want. The most valuable and loyal customers are bombarded with marketing communications, while newer customers are practically ignored. A truly customer-centric approach uses personalization to provide a retail experience that is tuned to the needs of each individual customer and seamless throughout the buying journey. “Personalization at our company is very clear,” noted a marketing executive at a top specialty retailer. “It’s about the continuity of the customer experience and how it moves fluidly across touch points without losing place.”

- Do we understand the strategic importance of personalization, and have we created a roadmap to realize this goal? Although most retailers understand the strategic importance of personalization, they often don’t have a vision of what personalization means to their businesses or a plan to support personalization initiatives. They also typically lack the three- to five-year business case that spells out the upside of personalization and the technology and people investments required to achieve it. Determining the optimal degree of personalization—from less personalized (one-to-many) to highly personalized (one-to-one)—across customer segments and touch points is critical for creating value for the customer and the company alike.

- Are we using strategic partners effectively? Retailers should also determine which capabilities to build in-house and which to build with partners. It’s usually a mistake to try to do everything internally, particularly if speed is of the essence. In our study, vendors with large marketing platforms and providers of large cloud platforms were selected by retail marketers as being extremely important partners 34% and 31% of the time, respectively. Specifically, these vendors help retailers glean insights from data faster, enabling better predictions with artificial intelligence and driving more dynamic customer

experiences.6 6 BCG-Google, Business Impact of Personalization in Retail Study—Marketer Survey (n = 302), US, 2019. “We partner by sharing our data and getting access to tons of third-party data on customer behavior and intent to help measure response,” one executive explained. “This is critical for our personalization strategy to drive outcomes.” - Are we investing intelligently in the building blocks of personalization? Advancing technologies are creating more and more opportunities to personalize the customer experience. Retailers must ensure that they have high-quality integrated customer data, advanced analytics, and automation technologies to deliver personalized experiences across the various stages of the shopping journey. Personalization engines are often used to recommend products, but they can also help develop customized messaging and creative work, select the best channels for delivery, and personalize pricing and promotions for a particular customer. “Our key capability is the algorithm for matching product with customer preferences,” a marketing executive at an online apparel company said. “We found the algorithm is usually right and so are guiding people to rely on it more.” When building a technology stack to personalize the customer experience, retailers should follow a few key practices. As noted in a recent BCG article, companies should try to get all they can from the technology that is already in place; focus on integrating the minimum amount of data that is required to enable the next wave of personalization use cases, rather than making huge investments to develop the perfect data lake; invest adequately in the intelligence layer that powers the personalization engine; use best-of-breed external solutions (often software-as-a-solution platforms) instead of developing technology in-house; and move quickly to build analytics at scale in the cloud. In addition, they should make sure that when personalization capabilities are deployed, they are able to track customer behavior so that the right things can be measured systematically.

When building a technology stack, retailers should invest adequately in the intelligence layer that powers the personalization engine.

- Are we breaking down organizational siloes to create new ways of working? Implementing effective personalization requires new ways of working that will depend on an organization’s ablity to align the objectives of internal teams and foster collaboration among them. Retailers must bridge organizational silos—including disconnects between digital and traditional marketing, online and brick-and-mortar stores, and product development and marketing—to find ways to work together more effectively to deliver more personalized, integrated customer experiences. Cross-team collaboration can be fostered in many ways. For example, companies can collapse functional boundaries, create dedicated cross-functional personalization teams, locate team members together, and encourage pilot programs and experimentation to learn what works quickly. As teams learn some new ways of working, they may need to unlearn others. The latter can be as challenging as the former, but both are critical for a retailer to advance its personalization maturity. We’ve seen some retailers become very skilled at creating lists of target prospects and building manual offers and propensity models, but they have difficulty adjusting to an environment where automation and artificial-intelligence technologies have taken over much of the manual work.

- Are we monitoring the customer experience in real time and responding quickly? It’s important for retailers to clarify the metrics that they will use to assess the impact of their personalization initiatives and then evaluate their efforts, provide rapid feedback, and adjust continually. Instead of testing ads and shopping experiences on an ad hoc basis, for example, companies need to develop a systematic approach to test tactics across channels and use rapid feedback loops to inform decisions and further tests. Speed is critical: retailers that wait one to two weeks for each test campaign’s results will be left behind. In addition, at the top of the marketing funnel, companies should measure brand awareness and consideration regularly; at the bottom of the funnel, they should measure the volume and quality of leads generated, ideally in real time. The volume of website traffic, rate of converting shoppers into buyers, value of the average order, purchase frequency, and rate of customer retention should be monitored. Most important, retailers need to measure the return on marketing investment by campaign, channel, and media type to ensure that they are getting results from their personalization efforts and optimizing media investments.

- Are we enlisting the right senior executives to lead the way? Developing solid personalization capabilities is daunting. It requires strong leaders who understand digital and personalization, who are willing to make the required investments, and who can drive the transformation across their organizations. If leadership doesn’t make personalization a priority, it won’t happen.

Developing the capabilities to deliver a highly personalized and connected shopping experience cannot be done overnight. It’s a huge undertaking with many moving parts, so retailers would be well advised to take a step-by-step approach. Every step to advance personalization maturity delivers value.

Most important, retailers must act now, or they risk being left behind as the best-in-class companies rapidly grow their lead and the race to earn the loyalty of increasingly demanding customers heats up. Before long, advanced personalization capabilities won’t just be a way to win the retail race—they’ll be essential for staying in it.