This is the first in a series of articles by Boston Consulting Group and Daimler Mobility discussing the concept of forward-looking financial steering. Here, we introduce the concept and explain how companies can use it. Subsequent articles will address implementation challenges related to people and technology. The insights are derived from Daimler Mobility’s successful deployment, with BCG’s support, of forward-looking steering in its global operations.

People don’t steer their cars solely on the basis of what they see in the rearview mirror, yet that is essentially how most business leaders steer their companies: they look backward to decide how to move forward. This method makes it hard for companies to cope with the ever-increasing levels of uncertainty in today’s business environment. To keep up to speed, companies need an approach to financial steering that permits rapid and effective course corrections in anticipation of future developments. Companies should spend far less time developing detailed plans and far more time taking action to counter threats and capture opportunities.

To make that happen, the paradigm for steering must fully shift its focus from backward looking to forward looking. Backward-looking steering entails analyzing deviations between plan targets and actual performance. Forward-looking steering entails comparing targets with forecasts of how KPIs will evolve over specific time horizons. To truly adopt forward-looking steering (as described in this article), a company must use algorithmically derived forecasts.

Although it is common for companies to produce forecasts manually, few companies use algorithms. Algorithmically derived forecasts allow the focus to shift from periodically reporting results to accurately forecasting the development of KPIs—faster and with less effort. Armed with foresight into how conditions will change, companies can take action to preempt unfavorable outcomes and promote competitive advantage.

Armed with foresight into how conditions will change, companies can preempt unfavorable outcomes and promote competitive advantage.

Adopting algorithm-based, forward-looking steering is not easy, however. A company must enrich its traditional manual processes with a data-driven, automated approach to generating forecasts and performance reports. Among the many challenges are assembling a team that has statistical capabilities, setting up a new technical infrastructure, and building people’s trust in technology.

“To master the digital transformation, a company must take a comprehensive approach to algorithm-based forward-looking steering,” says Stephan Unger, Daimler Mobility’s Chief Financial Officer (CFO). “This includes not only advanced analytical methods, new technologies, and the right expertise, but also an engaging approach to change management.”

What’s Wrong with Backward-Looking Steering?

BCG’s CFO Excellence Index, a benchmarking survey of more than 200 companies, found that “excellence in forecasting” is a key differentiator of top-performing finance functions. The survey also found that forecasting capabilities are an important factor in promoting both efficiency in the finance function and satisfaction with the function across the broader organization.

Yet despite these recognized benefits, most finance functions have not adopted a state-of-the-art forecasting approach to their steering processes. At the same time, the processes that they use in preparing their annual budget and in reviewing their midterm plan tend to be long and cumbersome. (See “The Steering Process at BackwardCo.”) For half a year, organizations devote significant resources to collecting numbers. In many instances, the derived targets are already outdated by the time a company completes the process.

The Steering Process at BackwardCo

The Steering Process at BackwardCo

To understand the shortcomings of the traditional paradigm for steering, consider a company we call BackwardCo. It spends nearly a year creating a very detailed plan that documents its stakeholders’ agreement on the expected results for the upcoming fiscal year or years. Then it uses this plan during the ensuing year as a reference to assess performance. Here is how this approach plays out for 2020:

- Detailing Targets Through an Elaborate Bottom–Up Process. Planning for 2020 begins in February 2019, when BackwardCo makes its first revisions to the existing long-term plan. It revises the midterm plan over the course of 2019, to achieve alignment across the organization from the bottom up and to make adjustments to reflect market changes or the board’s higher ambition for EBIT. Often, however, it makes last-minute changes through broad-stroke adjustments to the top-level targets. This approach disrupts the alignment between the top-level targets and detailed plans. The board approves the 2020 midterm plan, despite its flaws, in late November 2019.

- Steering on the Basis of Plan-to-Actual Comparisons. Starting in January 2020, BackwardCo assesses monthly performance by comparing its monthly actuals with the corresponding proportional values from its midterm plan. The company uses plan-to-actual comparisons to verify whether the company is on track and to provide quarterly guidance to capital markets. But it remains unclear whether deviations have occurred because the market evolved in unexpected ways or because the company’s actual performance is better or worse than its expected performance, as reflected in the plan’s proportional values. Just twice a year (in April and September), BackwardCo verifies whether approved targets will be reached or require adjustment.

- Catching Up with Reality. If actual performance exceeds the expectations reflected in the plan, BackwardCo has higher-than-expected EBIT. Although this may seem desirable, the company may have missed good investment opportunities that it could have pursued if it had recognized sooner how strong its 2020 performance would be. If actual performance falls short of the proportional values, BackwardCo must consider how to salvage its performance going forward. But because BackwardCo attempts only twice a year to verify whether it will achieve its annual targets, the countermeasures it takes may come too late to be effective.

If quarterly performance does not meet capital market expectations—on either the upside or the downside—capital market investors will be unpleasantly surprised. Because the announced targets establish investors’ expectations, BackwardCo will need to upgrade or downgrade its quarterly guidance to investors.

Subsequent performance reviews look backward, making proportional comparisons of static financial KPIs for the month, quarter, half-year, or year with the midterm plan. A plan that is developed through this process reflects individuals’ personal biases and becomes obsolete as soon as the ink is dry.

How Forward-Looking Steering Creates Value

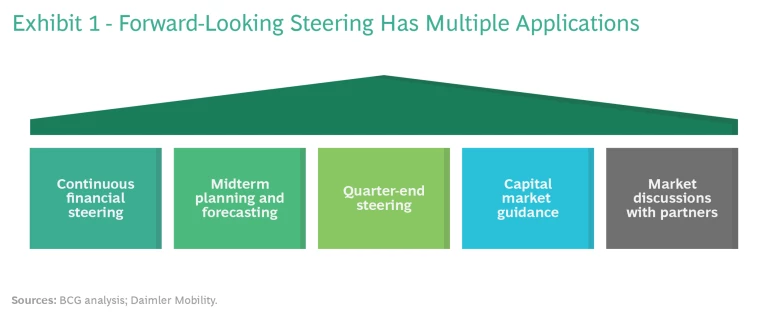

Forward-looking steering entails analyzing algorithmically derived forecasts and defining and deciding on course corrections. (See “The Steering Process at ForwardCo.”) It provides early guidance on the likely development of KPIs under different scenarios and on the corresponding impact on future results. Decision makers can use this foresight to assess the attractiveness of alternative pathways that the company might take. This enables them to make decisions to exploit opportunities and to avoid adverse developments much faster than their competitors can. The model allows leaders to address several types of steering activities. (See Exhibit 1.)

The Steering Process at ForwardCo

The Steering Process at ForwardCo

Each month, a company we call ForwardCo produces an algorithmically derived forecast for the next 18 months. Here is how the company uses those monthly forecasts to derive a midterm plan for 2020 and to conduct forward-looking steering throughout the year:

- Setting High-Level Targets. In September 2019, ForwardCo uses the current monthly forecast to develop its high-level midterm plan for 2020. This plan provides a sufficient basis for subsequent discussions and reconciliations.

- Steering on the Basis of Comparison of Forecasts with Prior Forecasts and High-Level Plan Targets. Throughout 2020, ForwardCo compares each monthly forecast with the forecast generated in the prior month and reviews the trajectory to find the root causes of changes. It also compares each monthly forecast with the high-level plan targets for year-end 2020. The monthly comparison verifies whether the quarterly and annual targets will be achieved or have become unrealistic. The algorithmic forecast provides an unbiased baseline. ForwardCo encourages its employees to use the forecast without adjustments, but they may adapt it to incorporate objectively verifiable information (such as regulatory changes) that the data fed into the algorithm did not capture.

- Conducting Future-Oriented Discussions. ForwardCo’s executive management team receives timely information for steering, and it benefits from the greater accuracy of the forecasts over time. If the forecast improves, ForwardCo decides on the best way to invest the additional funds that will become available going forward. If the forecast deteriorates, the company conducts simulations to identify which actions are likely to be most effective in preventing the forecast from materializing and decides which actions to pursue. It can also decide in a timely manner whether to maintain, upgrade, or downgrade its guidance for investors.

The initial inputs to the forward-looking model are the company’s historical actuals, which accurately reflect the level, trend, and seasonal pattern of each KPI. Users can enrich these inputs with market data, macroeconomic indicators, or any other metric series that correlates to the KPI being forecast. Uncertainty decreases over time as more monthly actuals arise and go into the model. If subsequent forecasts point in a similar direction, the organization gains confidence in the projected quarterly and year-end results.

The company relies on a series of drill-down analyses to understand the key drivers responsible for forecast fluctuations and to identify their root causes. An organization can use local business know-how to confirm the validity of the drivers. By automating and digitizing the process, companies can rapidly generate information about the future development of the most important KPIs.

The forward-looking model enriches the backward-looking model in the following ways:

- It provides a view of future KPI development, including their probabilities.

- It pairs with graphical tools to enable in-depth analyses, and it has simulation capabilities for assessing alternative courses of action.

- All relevant stakeholders (including representatives of markets, regions, and functions, as well as data scientists) participate in its creation, which maximizes buy-in.

- It is highly automated and generates information in real time, so the workforce can focus on analyzing numbers rather than on collecting them.

- It provides user-specific information for making decisions and taking action.

The company uses the insights to determine the most attractive options available to it. In case of adverse developments, this means deriving and taking corrective action to preempt the realization of an unfavorable forecast.

It is important to note, however, that the quality of the insights generated depends on the quality of the source data. Moreover, an algorithm forecasts KPIs at specific levels of probability—not with absolute certainty. For these reasons, the business decision on the right path forward should remain with the leadership.

Daimler Mobility’s Comprehensive Approach to Implementation

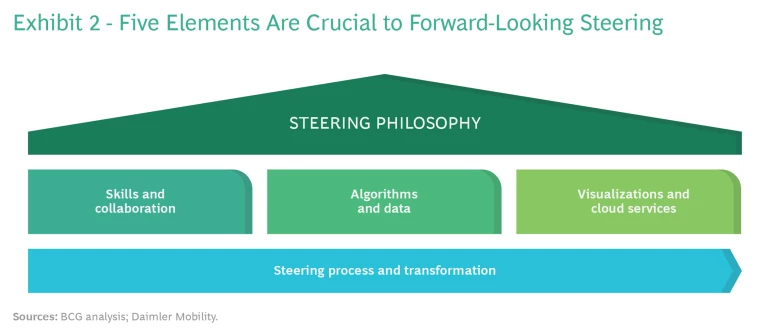

In their efforts to modernize steering processes, companies all too often fall into the trap of buying or developing a new digital tool without suitable support. They then deploy it in the organization without changing the philosophy of the steering model, building the necessary organizational capabilities, or taking people along on the journey. Relying solely on tools usually results in failure. To avoid this trap, Daimler Mobility has taken a comprehensive approach to forward-looking steering that includes five elements: steering philosophy, skills and collaboration, algorithms and data, visualizations and cloud services, and steering process and transformation. (See Exhibit 2.)

Steering Philosophy. Daimler Mobility has laid out the central philosophy of its enhanced steering model in a set of guiding principles, which it communicates to the broader organization. These guiding principles make several critical commitments:

- Steering will be forward looking. It will be based on future development of financial KPIs and lessons learned from actual performance.

- Predictions will be available very quickly and will be offered to everyone at the same time—with very little human effort and intervention.

- Forecasts will be updated as soon as new data is available, to ensure that decision making is based on the most recent information.

- Forecasts will consider local knowledge, to account for information not included in the data and to improve acceptance of predictions.

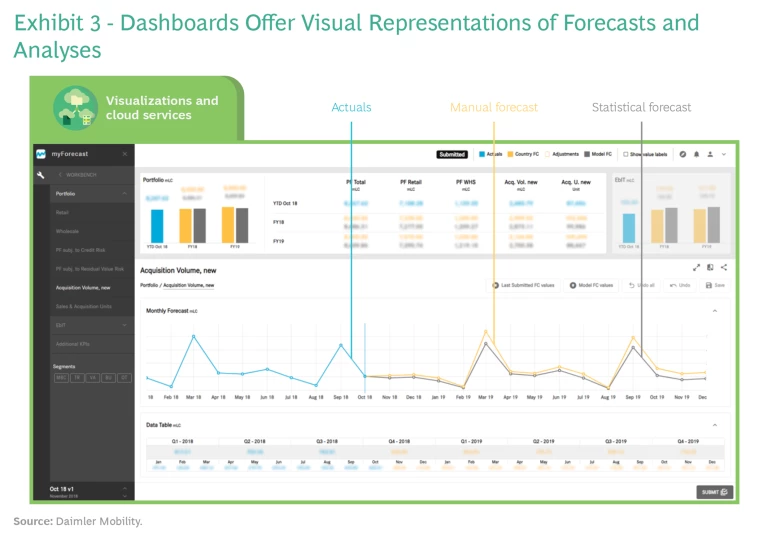

- Dashboards with drill-down capabilities will enable leaders to identify root causes and conduct ad hoc analyses.

- Simulations will enable business leaders at different levels to assess different scenarios and then commit to a course of action.

Skills and Collaboration. A central pillar of transforming the steering approach at Daimler Mobility has involved the building of an analytics team with capabilities to develop, run, and maintain the algorithms. Because most data scientists do not have a financial background, the company needed a way to transfer financial knowledge quickly and efficiently. One innovative approach it used was to conduct a series of weekly question-and-answer sessions. In each session, which lasted two to three hours, an expert elaborated on a specific business topic, such as a business model and its respective data flows.

Daimler Mobility has strongly encouraged collaboration between teams of business controllers, IT experts, and data scientists. Controllers help data scientists gain hands-on experience in daily financial operations, and they establish channels of communication that enable the scientists to guide the business. Data scientists help controllers understand how algorithmic forecasts support their daily work, encouraging them to view the forecasts as effective tools rather than as a threat to their influence in the organization.

Algorithms and Data. Many algorithms for forecasting KPIs are available, but choosing which algorithms to use can be a daunting task because the information available to feed into them evolves over time. Daimler Mobility’s calculation engine (named “Merlin,” after the legendary wizard) incorporates a multitude of algorithms and decides on its own which to use—whether one algorithm or a combination of algorithms. The engine applies machine learning to generate a fully data-driven, unbiased forecast that presents the best possible predictions. Whenever new monthly data is available, Merlin produces millions of forecasts for selected KPIs and automatically validates the forecasts by comparing them with past performance. On the basis of this comparison, it selects the best algorithm or combination of algorithms for a particular KPI. To ensure continuous calibration, Merlin repeats this process each month and whenever the company introduces a new KPI.

Choosing which KPI-forecasting algorithms to use can be a daunting task because the information available to feed into them evolves over time.

As a rule of thumb, data preparation comprises up to 80% of the development time of an algorithm. The source data often includes outliers—data points in a time series that have extremely high or low values. Outliers are especially problematic because they can significantly distort forecast results. Daimler Mobility has developed a model that detects outliers and automatically makes appropriate value adjustments to avoid distortions.

Visualizations and Cloud Services. Daimler Mobility employs a number of tools to effectively communicate and apply insights. For example, it uses dashboards to present forecasts, deviations over time, and root-cause analyses to specific users at the corporate, regional, or country level. (See Exhibit 3.) The country-level forecasts are visually displayed in an application called MyForecast. The application also gives controllers basic analytical support, such as the ability to compare forecasts for different time periods or under different exchange rate regimes. To promote organizational acceptance of statistical forecasts, each function allows controllers at the country level to adjust the forecast to reflect their views on how KPIs will evolve. The application also displays these adjustments.

The business leadership uses simulated scenarios to discuss possible options and decide on any necessary action. A storytelling feature in the visualization application allows presenters to facilitate their discussions by bookmarking specific information on dashboards; the presenters can then tell management the most important aspects of their story by navigating through the logical sequence of these bookmarks. Presenters can easily deviate from the story and delve into details when discussions demand a deeper look.

The business leadership uses simulated scenarios to discuss possible options and decide on any necessary actions.

Daimler Mobility runs forecast algorithms and subsequent information processing for dashboards on cloud services that can execute many calculations simultaneously.

Steering Process and Transformation. The enhanced steering process that Daimler Mobility implemented is faster than the traditional steering approach, and it involves more stakeholders. On the fifth working day of each month, the organization receives the actual KPI data for the previous month. On the same day, it generates more than 5,000 forecasts. Two days later, it derives implications and makes decisions. This process includes accounting for one-time-only events that the actual financials do not reflect and that the engine cannot detect or learn. In the final step of the process, the executive team meets in a videoconference to discuss the factors that determine future results, to consider what-if scenarios, and to identify the most promising paths forward. The executive team then makes a joint decision regarding the way forward.

“To successfully transform toward the enhanced steering approach, employees must understand its benefits,” says Daimler Mobility’s CFO Stephan Unger. “Predictions from rolling forecasts allow our experts to focus on value-added tasks and provide a quick, unbiased basis for decision-making by the executive team.”

Transitioning the organization to this enhanced steering approach and mindset has been no easy feat. One success factor has been frequent communication to the relevant stakeholders about how the enriched process differs from the traditional process. This effort includes highlighting new or changed activities and their sequence, as well as noting new or changed roles and responsibilities. Another success factor has involved convincing all stakeholders of the viability of an algorithmic approach and the accuracy of the forecasts. To achieve this result, the company has retroactively compared forecasts to actual developments.

What Are the Main Challenges?

Daimler Mobility’s experience highlights several challenges that a company must meet in order to transition to a forward-looking steering model:

- Build capabilities and teams. Although analytics experts have superior statistical skills, the company needs to develop their business understanding and their capabilities to adopt new ways of working. Moreover, to retain talent over the long term, a company needs to establish attractive career models and paths, both within and outside the finance analytics organization.

- Leverage data and technical infrastructure. The company needs to establish a flexible, stable, and scalable forecast engine, and it needs to create a readily accessible repository of consistent historical data. Difficulties in this area include automating data cleaning and scaling up sufficient computing power.

- Understand the benefits. The company must ensure that employees develop trust in the accuracy and stability of the algorithm and the related processes. It also needs to reassure employees that forward-looking steering creates benefits for them. These benefits include reducing the number of tedious manual tasks and enabling people to focus on value-add activities. Moreover, the company benefits from greater speed and accuracy. To fully appreciate the enhanced approach, employees also need to be aware of its limitations, including those noted earlier relating to the quality of source data and the probability (not certainty) of forecasts. Leaders should assure employees that their views will be included in the forecasts, if appropriate. Because of these limitations, business decisions will continue to be a human prerogative.

A company needs to establish a flexible, stable, and scalable forecast engine, and create a readily accessible repository of consistent historical data.

In the next articles in this series, as well as in a video presentation, we will explore in greater depth how Daimler Mobility overcame these challenges, and we will discuss the lessons that other companies can learn from its experience.

Daimler Mobility’s algorithmically generated forecasts predict performance for the next 18 months for more than 50 business entities, each with approximately 100 KPIs. In 70% of the predictions, the statistical forecast has proved to be the same as or more accurate than experts’ judgment—and it achieved these results faster and with far less effort than the experts did. This success comes from a forecasting engine managed by data scientists, as well as from a rigorously designed and executed transformation. The effort has yielded an important reward: foresight that enables the company to shape the future by preempting negative outcomes and exploiting new opportunities.