Is technology a silver bullet for improving quality management? New technologies have emerged to address the challenges of quality management at the same time that quality has gained importance on the corporate agenda. The list of high-profile incidents involving poor-quality products keeps getting longer. Such incidents, in some cases resulting in fatalities or serious injuries, may have catastrophic consequences for companies, including bankruptcy. To protect public safety, governments have intensified their regulatory scrutiny, leading to higher costs for companies as they try to comply with laws and regulations and reduce exposure to risk.

A recent study by BCG, in partnership with ASQ and Deutsche Gesellschaft für Qualität (DGQ), sought to better understand technology’s role in addressing the imperative to transform quality management. The study focused on the opportunities and challenges arising from Quality 4.0—the application of Industry 4.0’s advanced digital technologies to enhance traditional best practices in quality management. (See “About the Study.”)

About the Study

About the Study

In February and March 2019, BCG, in collaboration with ASQ and DGQ, conducted an online survey to assess the current status and future impact of Quality 4.0 initiatives. The survey’s participants consisted of executives and quality managers from 221 companies representing 18 producing industries in major sectors: consumer goods, industrial goods, and medical technology and pharmaceuticals. Most participants were based in Germany or the US. Others were based in one of 14 other European countries, China, or Japan. The survey sought to evaluate participants’ views on Quality 4.0 today and in 2024, to understand the most important use cases, and to identify major challenges and skills needed to implement a transformation. The study team also interviewed numerous experts to gain insight into industry benchmarks, the impact of use cases, and best practices. The interviews gave experts the opportunity to elaborate on key survey findings and offer insight into executive-level implementation challenges and success stories.

Quality 4.0 is among the many developments that are giving rise to the “ factory of the future ,” in which digitally enhanced plant structures and processes increase productivity and flexibility in the factory and throughout the supply chain. Digital technologies can help improve quality in various ways. For example, companies can monitor processes and collect data in real time and apply analytics to predict quality issues and maintenance needs. Digital tools also enable people to do their jobs faster, better, and at reduced cost.

The study confirmed that technology is only one piece of a broader quality transformation that must also focus on people and skills. Although companies recognize that Quality 4.0 can create substantial value, few have defined a detailed strategy and launched an implementation program. Participants in a survey conducted as part of the study identify a shortage of skills as the main impediment. Notably, participants regard soft skills (such as change management, communication, and teaming) as the most critical skills for success, even as they acknowledge the need to improve their analytics and big data skills.

Taken together, the findings point to the need for companies to accelerate their adoption of Quality 4.0. Success requires a multifaceted approach that addresses the full range of strategic, cultural, and technological issues. Companies that master the challenges will be rewarded not only with lower defect and failure rates but also with competitive advantage in the form of greater customer satisfaction and improved operational efficiency.

Success requires a multifaceted approach that addresses the full range of strategic, cultural, and technological issues.

Quality 4.0 Drives Improvements Across the Value Chain

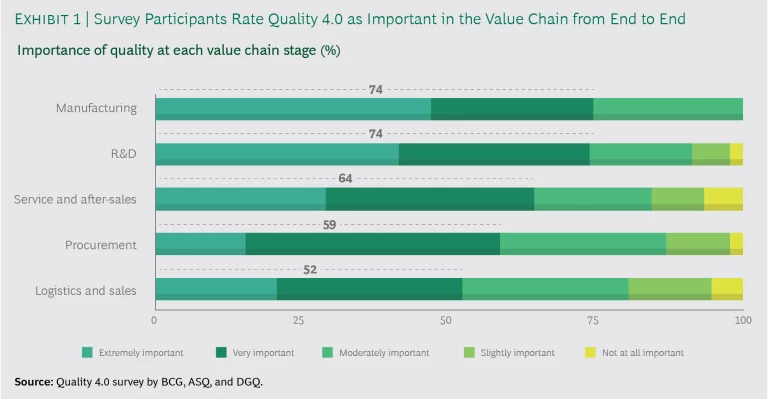

Survey participants acknowledge the importance of Quality 4.0 at all stages of the value chain. (See Exhibit 1.) Nevertheless, they see manufacturing and R&D as the areas that will benefit most from improved quality. The perceived importance to manufacturing reflects the visibility of value created on the shop floor. Participants also recognize the benefits of applying Quality 4.0 in R&D to improve design and embed quality into new products, and they understand the opportunity to capture quality-related improvements in value chain steps that are traditionally viewed as being outside the scope of the quality function, such as logistics and sales.

Participants point to predictive analytics, sensors and tracking, and electronic feedback loops as the most important technologies for driving impact. More than 60% say that predictive analytics will significantly affect quality performance and the bottom line within five years, compared with only 16% who cite a significant impact today. The expected increase in importance suggests that investments in predictive analytics for quality management will be a major source of competitive advantage.

Other high-impact technologies include digital twins (digital replicas of physical objects and processes) and simulation testing. By allowing companies to gather and aggregate data continuously, these technologies enable preventive maintenance and optimized production, thereby reducing the likelihood that a company will inadvertently release poor-quality products.

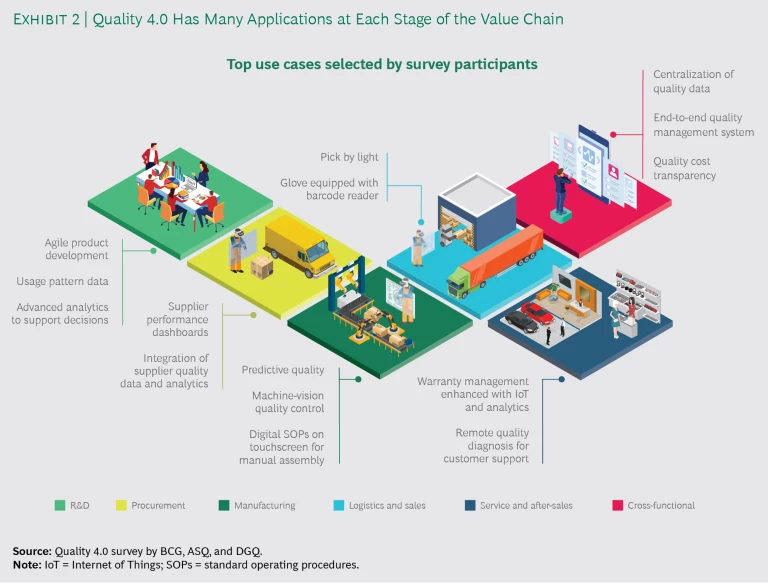

In the subsections that follow, we discuss the top use cases that survey participants have identified in each area of the value chain. (See Exhibit 2.) Successful implementation will entail improving data quality and management as well as analytics technologies and methodologies. Because some use cases enhance existing approaches, such as supplier dashboards, companies can implement them quickly. In these instances, digital enhancements will boost quality performance through improvements in visibility and through insights derived from connected data, as well as by extending control beyond the four walls of the factory.

Manufacturing. Survey participants consider predictive quality, machine vision quality control, and digital standard operating procedures (SOPs) to be the most important use cases in manufacturing. Predictive tools give manufacturers unprecedented power to analyze massive amounts of data and discover correlations between critical variables. These insights enable companies to address the root causes of problems preemptively—before quality issues occur. Indeed, one expert observed that intensified regulatory scrutiny has made implementing this use case an imperative. “It’s no longer okay just to fix things,” he explained. Compared with manual inspection processes, machine vision technologies are less expensive to use and more effectively verify quality or detect quality issues at early stages of the production process. For their part, digital SOPs ensure that workers have the most up-to-date instructions.

In addition to the top three use cases selected by participants, other significant manufacturing applications include automatic root cause analysis, machine-to-machine communication to enable self-adjustment of parameters, and real-time process simulations. These applications promote product and process quality while eliminating waste.

R&D. Companies can use Quality 4.0 technologies such as simulation testing and artificial intelligence (AI) to improve a design’s robustness. For example, AI supports failure mode and effects analysis. By enabling and improving preventive quality, this use case helps eliminate potential failure points in the design of a product or process. In addition, companies can work with usage pattern data that sensors connected to the Internet of Things (IoT) capture to improve the design of future products in ways that enhance quality by preventing failure.

Survey participants consider agile product development to be the most important use case in R&D. By replacing the traditional waterfall approach to development with an agile way of working, a company can achieve significant time and cost reductions in the development process. Because the agile approach facilitates cross-functional collaboration, it promotes more robust designs and improved quality outcomes. Digital tools for virtual design are important enablers of agile. They promote quality by accelerating test and validation cycles and making field data more accessible.

A major industrial goods company focused 90% of its Quality 4.0 investments on agile product development. Its goal was not only to deliver R&D projects on time and within the planned budget but also to improve the quality of the product at launch. The initiative owed its success to three building blocks: a well-crafted change management plan to promote organizational buy-in; top-management support; and external assistance in building capabilities. The impressive array of benefits included delivering projects within 50% of the traditional lead time, avoiding the typical 30% cost overruns, and boosting morale.

Service and After-Sales. Equipment in the field can communicate data regarding its condition to its manufacturer in real time via the IoT. By analyzing the data, the manufacturer can generate insights that serve as an early warning of potential breakdowns related to product quality that could trigger warranty costs. A manufacturer can also enhance customer support by remotely diagnosing quality issues. For example, an equipment manufacturer stores field data centrally and uses an AI system to identify potential failures before they occur, enabling its technicians to fix problems prior to a breakdown. Similarly, field technicians can use mobile digital solutions, such as field service software, to enhance preventive quality and upgrade the customer experience. Such tools help improve service quality by giving technicians access to equipment histories, information on recent failure points, and service manuals that streamline diagnosis times and quote processing.

Procurement. Digital dashboards that track supplier performance give visibility to data such as KPIs and quantities ordered and received. This use case was the only one that more than 50% of survey participants say they are already implementing. Companies can use data on supplier performance to assess where quality risks exist in the supply chain and to deploy supplier development resources as needed. They can also use the data in procurement negotiations and contracting to boost their bottom line.

Logistics and Sales. By applying big data analytics to planning, a company can improve its ability to forecast the production volume it requires and to enhance the quality of its service. The benefits arise from the greater accessibility of data and from the use of improved technologies to support data processing and make compelling presentations to decision makers.

A process known as “pick by light” (using shelf lights to guide picking for order fulfillment) and the use of gloves equipped with barcode readers simplify a company’s logistics and improve the quality of its performance by making the process more reliable and less subject to human error.

Cross-Functional. The most important use cases involving cross-functional collaboration, according to survey participants, are centralization of quality data, an end-to-end quality management system, and quality cost transparency. A company must combine data sets from the quality systems of multiple functions to generate insights and address critical pain points across functions. In many companies, achieving this objective will entail creating connections between quality systems that each function currently maintains separately.

The Status of Adoption

Nearly two-thirds of survey participants believe that Quality 4.0 will significantly affect their operations within five years. Most participants believe that, within the quality function, digital technologies will be important for quality governance, performance management, and training. Nevertheless, relatively few companies have made substantial progress toward adopting Quality 4.0 systems.

Nearly two-thirds of survey participants believe that Quality 4.0 will significantly affect their operations within five years.

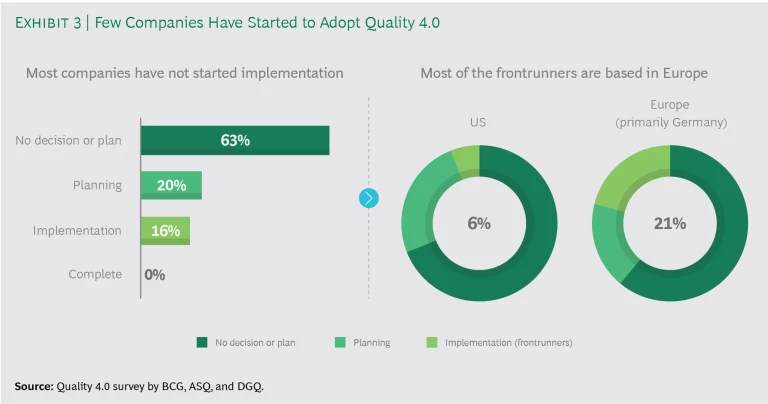

Among all survey participants, only 16% say that their company has started to implement Quality 4.0 (we refer to these companies as frontrunners); only 20% say that their company has started to plan for implementation, and 63% have not even reached the planning stage yet (we refer to these two categories of participants as followers). (See Exhibit 3.) European participants (primarily from German companies) are off to a faster start: 21% are frontrunners, compared with only 6% of US participants. One expert we interviewed attributed European companies’ faster start to the greater prevalence there of a “total quality management” culture, in which companies see initiatives to enhance quality as a long-term investment rather than as a short-term cost. In addition, German companies have been among the global leaders in developing and investing in Industry 4.0 as an overall strategy for improving operations.

Consistent with the slow start that we observed across the survey sample, relatively few participants say that their company is prepared to implement Quality 4.0. Only about one in four say that their company possesses a detailed digital transformation strategy and roadmap or has state-of-the-art knowledge about Industry 4.0.

Many organizations lack even the basic prerequisites of a quality culture. Although 57% of participants say that quality initiatives are part of their executive-level strategy, only 27% strongly believe that their company has clearly articulated its quality goals and objectives to all layers of the organization. Not surprisingly, only 14% of participants believe that individuals across the organization understand their roles in achieving quality goals, and just 6% strongly believe that the entire organization contributes to meeting quality standards.

Survey responses relating to skills reveal widespread unreadiness for implementation, too. Only one-third of participants say that they understand how digitization will change quality management roles and skills. Even fewer participants believe that their company has the right people in place to run a Quality 4.0 initiative (17%) or has a clear strategy for attracting Quality 4.0 talent (5%).

About half of all survey participants say that they dedicate less than 2% of their quality management full-time equivalents (FTEs) to Quality 4.0 initiatives. In contrast, best-in-class companies dedicate 10% to 20% of such FTEs to Quality 4.0 initiatives, according to the experts we interviewed. Participants acknowledge the need to commit more resources: three in four say that they plan to increase the number of FTEs that they dedicate to Quality 4.0 by up to 20% over the next five years. Some companies, especially in Europe, have more ambitious plans. Nearly one in three European participants plan to increase the number of dedicated FTEs by more than 20%, compared with only one in five US participants.

The Size of the Prize

Why are companies implementing or considering Quality 4.0? Survey participants selected improvements to three quality topics as their top reasons: performance, responsiveness (that is, the ability to react quickly to quality problems and changes in consumers’ preferences), and productivity. Participants’ top three metrics for assessing improvements are manufacturing quality (for example, first-pass yield, scrap rate, and rework), the impact of poor quality on customers (for example, rejects, complaints, and warranty claims), and the monetary cost of poor quality.

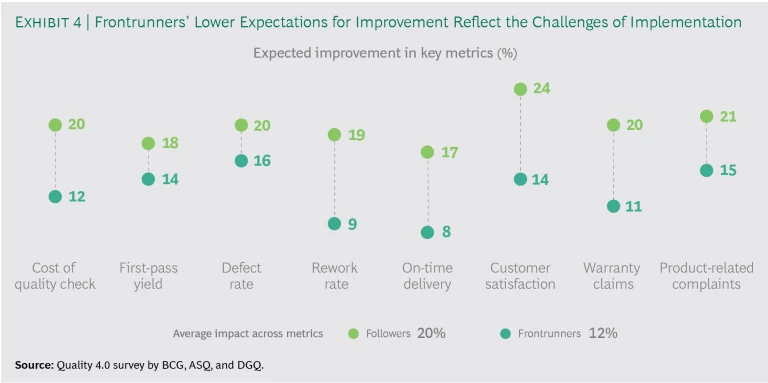

Participants recognize that Quality 4.0 can promote significant improvements in key quality metrics. Notably, however, we found that frontrunners tend to have lower expectations about the magnitude of such improvements than followers do. (See Exhibit 4.) This finding likely reflects the fact that frontrunners have bumped up against real-world challenges to implementation.

In addition to discussing the effects of the metrics that the survey considered, the experts we interviewed cited the potential to reduce staffing requirements by 10% to 15%. They also suggested that participants may not fully appreciate the benefits of sustaining high quality when evaluating the potential return on investment. As one expert put it, “The risk of poor quality is grossly underestimated.”

Overview of the Challenges

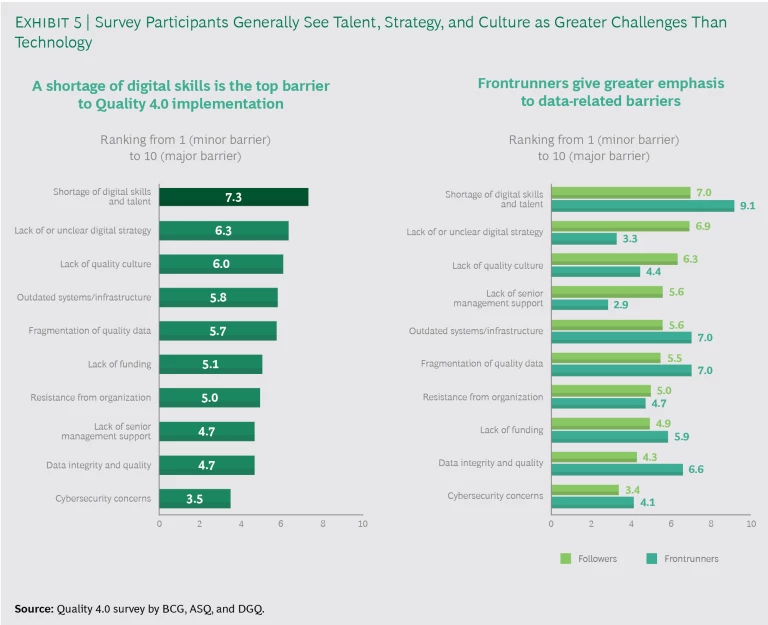

Survey participants identified factors unrelated to technology and data as the most significant challenges to implementing Quality 4.0. (See Exhibit 5.) A shortage of digital skills and talent ranked as the top challenge. This shortage leads to fierce competition for digital specialists, both within the company and externally. An unclear digital strategy ranked second among the most important barriers to implementation, and lack of quality culture ranked third.

Frontrunners and followers differ in their opinions about the biggest challenges. Although both groups cite a shortage of digital skills and talent as the number one challenge, frontrunners see this factor as a more significant barrier. The next three most important barriers for frontrunners relate to technology or data: outdated systems, fragmentation of quality data, and data integrity and quality. In contrast, followers identify the next three most important barriers as an unclear digital strategy, lack of quality culture, and outdated systems. These differences in appraisal suggest that technology- and data-related challenges become more visible to companies as they move forward with implementation. Meanwhile, roadblocks related to strategy and culture discourage followers from attempting implementation at all—evidence of the importance of establishing a strategic roadmap and a quality-centered culture as enablers of technological transformation.

Cybersecurity ranked lowest among the challenges that the survey asked participants to consider. Evidently participants do not recognize the great extent to which expanding the use of digital technology, including AI , exposes their systems to cyber threats. As an expert observed, “In reality, cybersecurity is probably a greater challenge, but companies tend to underestimate it or throw it over to IT.” Indeed, the fact that major cyberattacks continue to occur despite efforts to prevent them indicates that companies must carefully assess the vulnerabilities that Quality 4.0 initiatives create and must work with experts to address the resulting exposure.

Spotlight on People and Skills

“Companies that are winning are investing in people first,” observed one expert. The survey responses fully support the idea that successful Quality 4.0 implementation depends on empowering people in the right roles and developing the right skills.

Not surprisingly, the analysis shows that leaders of the quality management function are crucial to enabling the success of Quality 4.0, both today and in five years. The most important skills for quality management leaders in five years, according to survey participants, will be communication, change management, and strategic and long-term planning. These skills reflect leaders’ essential role in creating a quality-centered culture across the organization. As one expert put it, “Quality needs to be driven cross-functionally, with all functions having ‘skin in the game.’”

Survey participants also see C-suite executives, the IT function, and internal quality auditors as having important roles. “A company needs hand-in-hand collaboration between the C-suite and quality management to drive a transformation,” an expert explained.

In addition, participants see high value in data scientists, although the survey found that these specialists are part of the quality management function in only 19% of companies today. Frontrunners assign higher value to data scientists than followers do, probably because they are more aware of the digital capability challenges they face. Quality inspectors and testers are the roles most likely to become less important in the next five years, participants say—an opinion that reflects companies’ expectation that their reliance on analytics and automation will soon increase.

When asked to identify the most important skills for driving the overall success of Quality 4.0, participants pointed to soft skills such as communication, teamwork, and change management. Stressing the importance of communication skills, one expert explained that Quality 4.0 requires “storytelling with data.”

When asked to identify the most important skills for driving the overall success of Quality 4.0, participants pointed to soft skills such as communication, teamwork, and change management.

Participants also consider skills related to analytics and AI to be important—and as needing the greatest improvement in proficiency. One expert characterized the gap this way: “The data is there, but the people who analyze the data are not.” Many participants also ranked expertise related to project and process management and statistics among the top three skills that will be needed across roles in five years.

Experts noted that frontrunners struggling to achieve their expected return on investment may have failed to consider the skills needed to maintain and improve the technologies they have implemented. Best-in-class companies understand and develop the most important capabilities while actively rolling out digital use cases.

Best-in-class companies understand and develop the most important capabilities while actively rolling out digital use cases.

To build the required capabilities, the survey found, companies are focusing primarily on upskilling and reskilling current employees. The emphasis on training current employees reflects the difficulty they have had in recruiting people with appropriate digital skill sets, whether from universities or from other companies, to work in quality management. “Quality needs to be a viable career path to attract the right talent,” explained an expert.

It is possible to create a virtuous cycle. If Quality 4.0 becomes a competitive advantage that drives business value, quality careers will become more attractive. Quality specialists will then benefit from additional resources, cross-functional responsibilities, and more competitive wages.

The Winning Moves

To effectively implement Quality 4.0—the technological as well as the nontechnological aspects—companies should take a structured approach that includes the following elements:

- Prioritize pain points. Identify quality-related pain points in operations that the company can address by applying digital solutions. Clearly define how specific pain points are impeding business imperatives and blocking opportunities to create value (such as through improved operations, enhanced customer service, and better product designs). Determine which pain points to address first on the basis of potential to unlock value and reduce risk.

- Identify, test, and scale up use cases. Identify use cases to resolve the prioritized pain points. Begin implementation with proof-of-concept (PoC) pilots that focus on high-value use cases. In each pilot, a multidisciplinary team should use agile development methods to quickly develop a minimum viable solution and to improve it through rapid iterations. Solutions successfully tested and refined in pilots can then be launched at scale.

- Develop a vision and roadmap. While achieving early wins with PoC pilots, develop a clear vision and roadmap focusing on the most valuable use cases. In defining the vision and roadmap, articulate how Quality 4.0 promotes the company’s overall business strategy and how it contributes to creating a sustainable competitive advantage. Ensure that quality is a priority on the leadership agenda and a major component of the business strategy.

- Establish technology and data enablers. Ensure that the technology and data enablers of Quality 4.0, including the IoT infrastructure and data architecture, are put in place. Identify and address deficiencies in the company’s data, and anticipate how data issues could impede the scaling up of use cases.

- Build the required skills. Determine the skills and scale of resources needed to implement the digital use cases and to sustain them over time. Define a digital talent strategy that addresses how to close skill gaps—whether by upskilling or retraining the current workforce or by recruiting digital specialists.

- Manage the changes. Prepare for changes across the enterprise, including the implementation of a comprehensive digital strategy. Craft a change story that builds momentum in all departments. Establish an activist program management office to manage and oversee the implementation of digital technologies and data architecture.

- Foster a quality culture. Recognizing that technology alone will not achieve a breakthrough in quality performance, foster a culture in which all employees take ownership of quality . Everyone in the organization, not only those in the quality function, should be accountable. Make the necessary changes to the context in which people work, addressing topics such as metrics and incentives, role mandates, and organizational structures.

Ultimately, Quality 4.0 is about much more than technology. It is a new way of managing quality in which digital tools enhance the organization’s ability to consistently give customers high-performing products. As our study demonstrates, Quality 4.0 in no way diminishes the role of people in assuring quality. Indeed, giving people the skills to apply digital tools and to tell data-driven stories will be an essential part of ensuring quality in the factory of the future. Across manufacturing industries, the companies that win in the 2020s will be those that use digital to redefine the meaning of quality excellence.