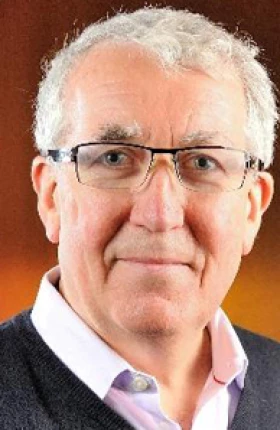

Dave, thank you for joining us today. I’m really looking forward to this conversation.

It’s great to be back. Thanks for inviting me.

You inherited a very high-performing organization. What were the priorities you set? How did you deliberately step into taking this organization to the next level?

First, I had to reposition our core assets. We had some outstanding assets, but we were underinvested in the United States. We didn’t have enough of a growth mindset. We didn’t have a growth platform. So we repositioned some assets out, and we made a large acquisition in the United States. That provided a growth platform in US wealth management that we are very excited about. Second, under what I called Vision 2025, we had to reimagine what it would look like to be a mass consumer and commercial bank in the future, a future that includes disruptive platform effects and a digital consumer that you must connect to. Third, I needed to focus on a cultural transformation.

So, Dave, let’s go back three years to the fall of 2016. You made the decision to take on a major company cultural transformation. Can you talk a little bit about what was behind that?

It was a period of time when we were very successful. And when you examined all the reasons we were successful, my concern was that it might not be sustainable. I thought that the drivers that had supported our success in the past were not the same drivers that we needed to be successful in the future. I felt we needed more ambition. We needed urgency, and we needed vision to take on more. Therefore, we went through a change in the organization to liberate capacity, to bring in new leaders with a different mindset and new hard skills.

Three years later, what’s been the lasting impact?

We’ve unlocked a new group of leaders in the organization. We’ve introduced a new leadership model where we ask leaders in clear language to set and articulate more ambitious goals and to lead in a more ambitious way. We have encouraged them to be even more fallible, to say to their teams, “We’re not going to get it all right” and allow the space to fail. And what I’m maybe most proud of is that we used this opportunity to do a complete reset on diversity and inclusion in the organization. Of the senior roles that we replaced, 50% or more went to women. And for us, it was a tangible demonstration of a reset on diversity and inclusion. Our client satisfaction results have never been better. All our core metrics including TSR have benefited from this transformation.

How were you able to cross that gap between knowing that culture is important and actually doing something about it?

I think part of the reason for our success was that we shocked the organization. We stopped and said, “We’re going through a change—one that potentially involves 800 employees leaving the company.” And employees did stop and listen. The reaction was “Whoa, this is not the same day-to-day noise. This is a fundamental transformation.” That led them to ask questions like “Why are we doing this? What’s the purpose?” If we had tried to do this by just talking about leadership models while everybody continued to run as hard as they could to make plans around servicing customers, building technology, and all the things that we do, it would have been lost in the noise.

What advice would you give other CEOs who know culture is something they need to deal with, yet the day-to-day operational and strategic challenges just seem to crowd out dealing with it?

You have to be able to write [the new model] down on half a piece of paper and have someone read it, and you can explain it to someone who doesn’t know your company. I think that’s part of it, right? The magic of the leadership model was that you could read three columns of information and you knew exactly what we wanted from you. It was simple, it was brilliant in its design, and it was easy to communicate. That plain language, that design, made a massive difference because someone could take that material and read it on a train, at home, or at their desk, and they knew what we wanted. If it’s so complex that management must explain it over and over again, then you’re not going to get traction.

The context for banks, globally, is changing. There are a lot of headwinds. The environment is getting tougher. What are the major forces that you think you need to particularly prepare for?

Our role as an intermediary is changing in senior markets. So we have a whole set of challenges there that we’re dealing with, and we have a very creative team on both the markets and investment banking side that’s repositioning our business. You go to the other end of the scale and you look at the challenges that the retail, consumer, and commercial bank is facing, and they’re just as fundamental, but it’s the platform challenge. It’s a model that relied on us being an intermediary and moving and distributing cash in society, having branches with vaults on every corner so we could store and move cash. Over time that came to include having ATMs, and then telephone banking, and then digital banking. All that revolved around us being at the center of a customer’s life. But now we’re moving from a world where we had dominion over client needs, where we were central because we had built the rails to the economy, to a world where customers broadcast their needs to the world and live on very different platforms. The challenge for us as an industry, and for us as a company, is to connect to a new digital customer living in a very different world.

What do you have to get absolutely right as the head of RBC over the years to come?

One of the challenges for every CEO leading in this environment is balancing the short term and the long term—what’s known as the CEO’s dilemma. This means answering the question “How much performance do you give the market in the short term versus how much do you invest to build and transform your organization for the next 100 years?” You attract the investors you ask for based on how you communicate around those issues with the marketplace. It’s really incumbent upon CEOs to be very clear in how they plan to strike that balance and be open about where the journey is going.

Dave, thanks for coming. It’s great to see you again.

Well, it’s great to catch up, and thanks for your partnership and support through this exciting journey we’ve had.