In today’s digitally obsessed world, retail banks are struggling to keep pace. Customers expect smart digital banking that is available across channels and tailored to their immediate needs. They want banking services to work like the payment, music, and shopping apps they use every day. But banks, on the whole, have failed to deliver.

The challenge for retail-banking leaders is to manage a shift away from a distribution paradigm that, in just a few years, has become almost obsolete. In many markets, people bank almost exclusively through phone apps, and many would probably go 100% mobile if the opportunity were available. The branch is increasingly an expensive, though sometimes still necessary, luxury.

We expect the branch-centered distribution model to evolve by 2025 in almost every country. That does not mean that there will be no branches. However, radically reformed branches that conduct in-person and remote relationships—along with customer contact centers and specialist sales teams—will play second fiddle to a digitally dominated proposition.

Customers want banking services to work like the payment, music, and shopping apps they use every day.

It won’t be easy for banks to change so quickly. But those that embrace disruption will get the highest payoffs, meeting customer needs and achieving operating-model efficiencies. The net impact, in our view, will be that profitability will increase as much as 25%.

Banks can use five levers to make this happen:

- Implementing the intelligent routing of customer requests between digital and assisted channels, yielding a profitability increase of 5% to 15%

- Shifting from contact centers to customer care platforms, 2% to 8%

- Embedding “distribution” on partner platform services through application-programming interfaces (APIs), 2% to 8%

- For most banks and in most markets, reducing branch networks while, at the same time, taking steps to optimize the remaining branches, 2% to 8%

- Harnessing the creativity and passion of frontline colleagues to meet customers’ needs, providing support for the four other levers

These five levers can make the difference between the building of a retail bank that meets the needs of the digital generation and a gradual slide into irrelevance. Many banks, under pressure from regulation, competition, and changing customer expectations, have progressed in the journey. The priority for most, however, should be to accelerate efforts immediately.

A New Distribution Model

Today’s customers expect to be able to access banking services on their own terms—when and where they want. They expect a pleasant digital experience and the offer of products, information, and advice appropriate to their needs. The origin of these expectations: their daily experience buying from other industries. Tech companies, in particular, have raised the bar on service, leveraging big data to offer customers a smarter, more relevant service that is helping them compete in areas including savings, payment, and credit.

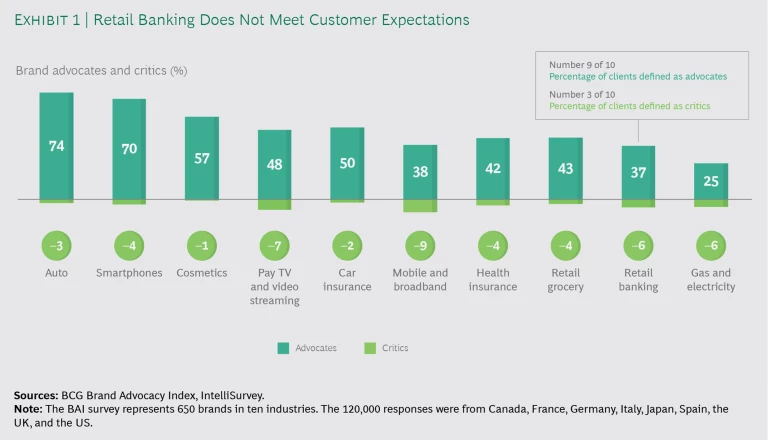

In an age of digital convenience, consumers are notably unimpressed by banks’ clunky processes. A BCG survey found that, in terms of customers’ willingness to advocate for banks’ services, retail banks rank ninth of ten industries. It is worth noting that in the banking cohort, the highest scoring are digital-only players. (See Exhibit 1.)

Digital capabilities across channels provide a route to personalized interactions, products, and pricing, enabling of high-volume solutions—mobile apps, websites, and robo-advisers—that allow for minimal manual intervention at a relatively low cost. Moreover, digital is essential for cutting distribution costs and boosting revenues.

We expect that by 2025, a new distribution model will be the norm—if banks act now. The new model will be more automated, channel agnostic, and capable of meeting individual needs. The human touch will still play a valuable role, particularly at certain critical moments, but it will recede into the background. Successfully implemented, the digital-first approach can catalyze a profitability boost of as much as 25%.

Key Trends

The new model will be built alongside, and in response to, six key trends that we believe will reshape the banking industry. As these trends become realities, the silos that currently define the banking business model will break down. In their place, a more flexible approach to distribution will emerge, reflecting more closely the way that people make decisions. It may be by making an offer when people are researching a purchase, budgeting for family expenses, or assessing pension options. By 2025, leading banks will be “ubiquitous,” engaging with customers much more actively and being sure to respond to each situation appropriately and in good time. Of course, they must guarantee the protection of customers’ data as they do so.

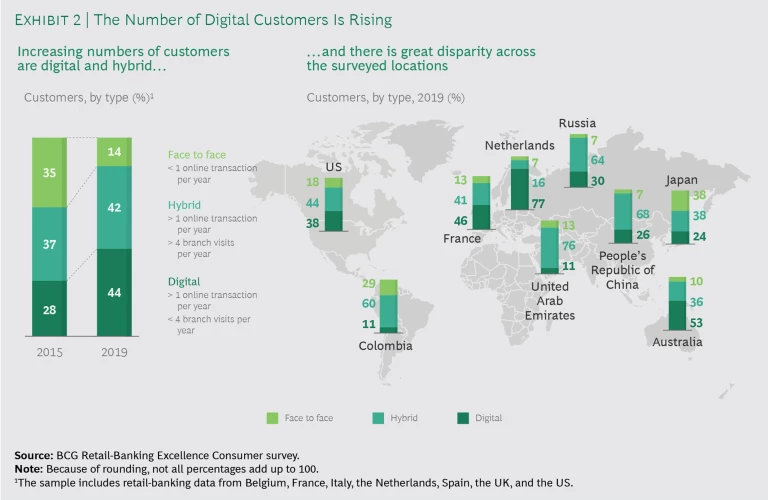

Multiple Customer Touch Points. Banks will connect with customers using a multitude of channels, modalities, and devices. They will leverage a broad array of tools, including mobile apps, the Internet of Things, APIs, aggregators, internet searches, and social networks. The absolute and relative volume of digital touch points will increase from year to year; they are already doing so. (See Exhibit 2.) A major Nordic bank, for example, has reported that, on average, its customers have physical meetings with bank personnel once every five years. However, the average customer uses the bank’s mobile solutions about once every two days. Still, we expect human contact will remain important, particularly at key moments in the sales process. In addition, banks of various countries will move at different paces as they transition away from face-to-face customer meetings.

Blurred Lines Between Humans and Machines.Analytics and artificial intelligence (AI), which increasingly will enhance decision making and communications, will blur the lines between man and machine. In many cases, however, the consumer will fail to see a difference. The most recent technology applications can respond to hundreds of thousands of emails a day, freeing up at least ten days a year for every relationship manager (RM). France’s Crédit Mutuel, for example, reported using IBM’s Watson solution to support 20,000 customer advisors in responding to 350,000 daily inquiries related to 200 products. Whenever Watson doesn’t have an answer, it does the next-best thing: it offers a suggestion to its human operators. Such capabilities will become sharper and more powerful over time, providing a more consistent and fluid customer proposition. Banks will be on customers’ radar every day, offering options that range from 100% digital self-service to face-to-face encounters informed by automation.

Analytics and AI will enhance decision making and communications, often blurring the lines between man and machine.

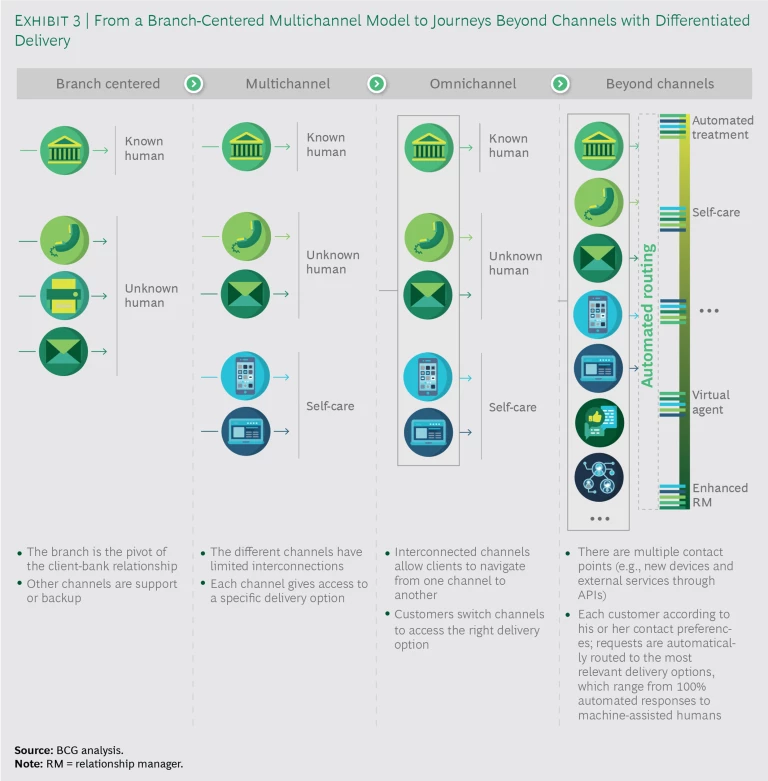

Multiple Delivery Options Across Channels. Channel decisions right now are singular and linear. A customer can go to a branch, speak to a call center, or chat online. However, the content of these interactions is rarely shared across channels. In the near future, these distinct offerings will be integrated. Customers will have access to information and advice through the most convenient channel. Banks will communicate using text, voice (human or automated, online or in person), and video. They will leverage AI, automatically routing a customer to the most relevant option, identified on the basis of cost to serve, the complexity and nature of the customer’s request, and client preference. The cost of distribution will continue to vary drastically among channels, emphasizing the need for a smart routing engine that can determine hierarchies on the basis of the nature of requests. This ability will, in turn, require omnichannel orchestration and mutualized channel management. Benefits will include faster service, higher conversion rates, and increased customer satisfaction. (See Exhibit 3.)

Service Model Differentiation Based on Customers’ Profiles and Preferences. Today’s banks offer too many products, many of which see little demand. By 2025, banks will present a much simpler proposition. On the one hand, that proposition will comprise a mass-market offering that is distributed digitally across channels and at low cost. On the other, it will consist of fewer, more complex products that target niche segments of the more affluent customers and are backed by human expertise as appropriate. Anything else will likely be unprofitable.

Mass Personalization. Customers’ demands for personalization are changing. Nearly two-thirds of millennials say that they are willing to share personal data in return for more personalized service.

In Poland, Bank Millennium is at the vanguard, having implemented personalization at scale on the basis of client behavior segmentation. The bank now sells almost half of its consumer loans through digital channels.

Extended Reach and Seamless Integration. In the future, banks will not only reach out to the world from their own branches, websites, and apps, they will also engage through a variety of touch points, including third-party offerings, ecosystems, and fintechs. The “conversation” will start even before the customer engages directly: banks will be alive to their customers’ priorities, interests, and activities. In the French market, nearly two-thirds of retail-banking product sales start with a Google search, a proportion likely to be similar across many markets.

Furthermore, they should act as enablers of behaviors rather than as providers of products in response to requests. As customers research mortgages, loans, and other products, banks must optimize the presence of their search engines and be ready to offer support across channels. Customers’ digital activity outside the banking system should drive engagement—when, for example, a customer accesses a mortgage calculator or makes inquiries at a real estate agency or car dealership.

Zillow, an online real estate database company, reports that in 2019 it has become a major distributor of mortgages through partnerships with banks and, more recently, on its own account. Data mining, which will inform knowledge related to life events such as the birth of a child or a residential move, will also make it possible for banks to detect potential changes in sentiment or the possibility of churn. Open banking and the growth of ecosystems will nurture this kind of awareness.

The old certainties are fading, and parts of the value chain are under pressure.

How Will Banks Drive Transformation?

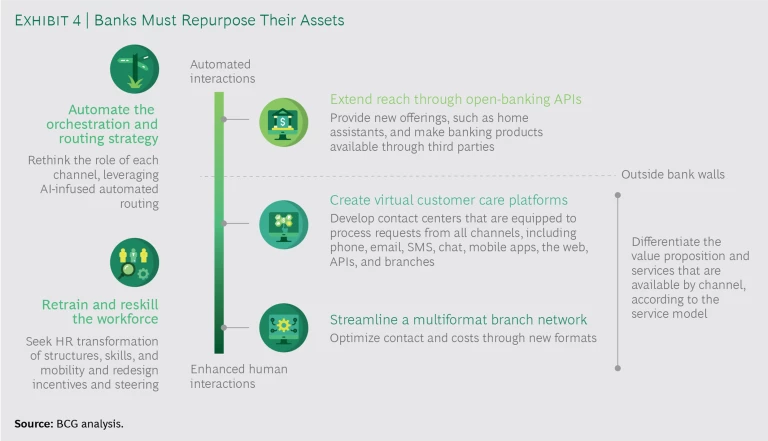

Retail banks have become accustomed to inhabiting competitive fortresses, where their strong brands, close relationships with customers, and high barriers to entry protect them. This has been evident in the industry’s extremely low levels of churn—generally, less than 5%. However, the old certainties are fading, and parts of the value chain are under pressure. As the six trends play out in the years leading up to 2025, banks should respond by focusing on distribution. They must be ubiquitous, personalize their services, and ensure that their offerings make economic sense. Many are already taking steps. Those that have been slow to move should act on five key imperatives. (See Exhibit 4.)

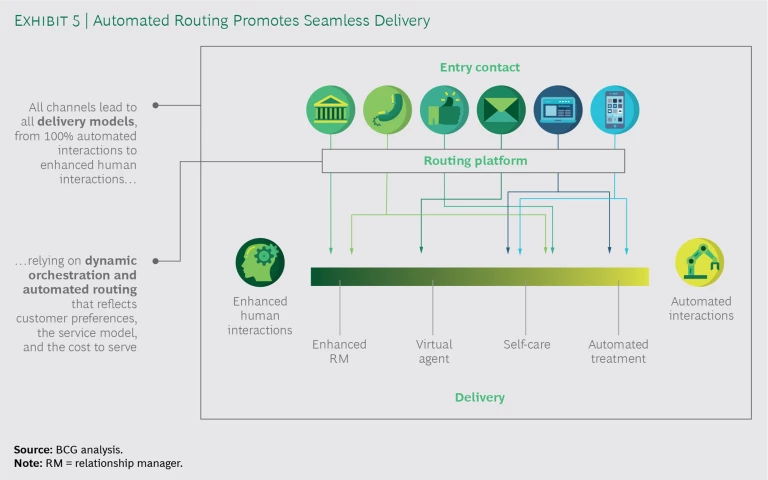

Automate the orchestration and routing strategy. Effective orchestration must be driven by automated-routing capabilities. So-called smart routing means banks should create seamless customer journeys and at the same time choose the best delivery option for each situation on the basis of customer potential, the nature of the request, and the capabilities available. The key is to offer customers any channel as an entry point and then to assign a contact on the basis of the analysis of existing or potential value, the product in question, the likely outcome, customer preferences, and cost to serve. (See Exhibit 5.)

The model, which is a far cry from current approaches, can be achieved only through profound transformation. The bank must be able to offer all products and services across channels—no matter how the customer makes contact. Routing among channels should be fully automated, but there should be the option of human contact when the cost to serve allows it.

Data collection is key, and banks must take in all interactions, including self-care channels and a variety of external sources. Customer recognition should be backed by microsegmentation, and requests should be automatically qualified on the basis of such factors as complexity, opportunity, and even emotional state. Learning mechanisms should be applied to requalify requests on the basis of past interactions.

Extend reach through open-banking APIs. Open banking is set to play a vital role in helping banks become members of extended ecosystems. By joining forces with third parties, banks can reap benefits including cross-selling opportunities, knowledge sharing, and access to new cohorts of potential customers. Partnership also reflects the Zeitgeist: in an ecosystem world, it makes sense to participate or orchestrate rather than go it alone. Banks can do this by embedding new functionalities or adding their services to third-party platforms. For example, a bank that shares data with a travel agency could easily imagine expanding its market for foreign-exchange services, both on its own and on the agency’s platform. One likely impact of this kind of initiative will be a stronger and more secure client relationship.

Wells Fargo has, for example, focused on ramping up its API capabilities. In 2018, the bank offered 13 public products—6 for payments and 7 for data services. The bank’s head of the API Gateway Channel reported that the bank views APIs as “the next step in distribution.”

APIs also generate opportunities to expand products and services, and several banks have launched API-driven products such as secure data validation, digital wallets, mobile dashboards, and treasury management services. Of course, banks must be sure to expand their capabilities while protecting their existing franchises.

Create virtual customer care platforms. As banks recalibrate their portfolios, they should aim to do a better job of reflecting digital lifestyles, offering customers seamlessly joined mobile, online, phone, and face-to-face services. We see three axes of transformation:

- Multiple Entry Routes to the Platform. These include phone, apps, chat, mail, and email, as well as social media and videoconferencing from home or from branches and contact with partners. The virtual customer care platform will also play a role in managing outbound activity, including, for example, loan distribution through third parties such as auto dealers or sharing live simulations of loan repayment.

- A Modern and Streamlined User Experience. The up-to-date user experience should transform the current contact center—slow, standardized, uninformed—into a fully integrated channel. Functionalities to streamline the customer journey will include visual interactive voice response technology that guides inbound callers to a web-based support experience, multichannel call back, wait time information, automated identification and authentication, natural-language processing and virtual agents (chatbots), smart pairing (linking customers’ devices to video systems), and next-best-action and sentiment analysis.

- An Enhanced and Expanded Care Platform. This should include, for example, e-signatures, selfie identification tools, and robotized email management to streamline the customer experience and increase self-care options. This will free up capacity for RMs to invest in higher-impact activities.

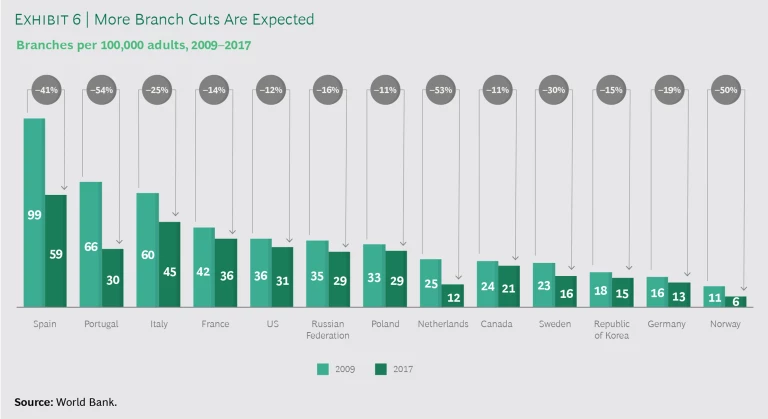

Streamline a multiformat branch network. Banks around the world have been shutting branches at a rapid pace. However, some countries have moved much further down the line than others. Norwegian banks, for example, closed half of their branches from 2009 through 2017. German banks, on the other hand, shut just 20% of their branches during the same period. The variation can be explained by a number of factors, including the country’s rate of digital adoption, entrenched frameworks (Germany historically has had a strong regional branch network), and economic and social pressure. Spanish banks, for example, saw mass closures as the banking system consolidated after the recent financial crisis. Outside Europe, the picture is equally patchy. Australian banks have enthusiastically cut branches. US banks have been less committed. However, we expect the pace of closures to accelerate. (See Exhibit 6.)

For branches that are retained, banks need to embrace new formats, offering a menu of channels and ensuring that customers have access to each. Simple measures such as branch hours of operation should be adjusted: new entrants in some markets are pushing hard, offering evening and weekend service. Modernized branches should meet the needs of local markets by including franchises, mobile branches, 24-7 digital-only branches, and partnerships with retailers.

Retrain and reskill the workforce. Transformational change requires adjustments to the strategic mindset. Part of that equation should be a dedicated talent strategy—an old-school skill that remains a critical cog for retail banks aiming to remain competitive over the coming years.

Digitization and automation should allow banks to operate leaner distribution networks. The accompanying shift in personnel requirements will free up RMs to engage in higher value and customer-facing activities. For their new roles, RMs will need new-skill training, backed by advanced analytics to aid marketing, pricing, and decision making.

Workforce evolution calls for dealing with three kinds of challenges:

- Optimization of the Service Network. Banks must be sure that their allocation of resources and skills evolves with network reorganization.

- Competency. The skill sets required for transformation and distribution (for example, remote-sales skills for RMs) must be identified early on, and training and hiring must address the specified needs.

- Timing. The complete transformation must be supported by well-orchestrated hiring, training, restructuring, and mobility.

Remuneration policy must reflect the new workforce roles and responsibilities, and performance targets must be aligned with standards and guidelines.

In an increasingly competitive, technology-driven, and dynamic banking landscape, the distribution models of the past no longer fit their purpose. Omnichannel banking is set to evolve into a flexible and fluid distribution model that situates banks so that they operate efficiently and are prepared to cater to individual customer needs. To achieve this, banks need clever, connected, and responsive digital offerings; smart routing; new customer care platforms; inspired branch strategies; and a constructive approach to partnerships. The most effective approach to implementation will likely be based on agile principles: banks will aim to leverage quick wins, building momentum and conviction. The prize for those that get it right is remaining competitive, serving customers better, and a significant boost to the bottom line.