For people suffering from rare diseases, a new drug often can offer help—and a chance at survival—that never existed before. Such drugs can also provide a major growth opportunity for the company that develops them. Soliris, from Alexion Pharmaceuticals, is one example. Developed to treat paroxysmal nocturnal hemoglobinuria, a blood disease, the blockbuster drug is now used for multiple indications.

But launching a rare-disease treatment is a much more challenging undertaking today than it was even just a few years ago because of increased competition, pricing pressures, stakeholder demands, and patient expectations. To overcome these challenges, companies need to think differently about their launch strategies, from the broad brushstrokes of the overall plan to the granular details of the supply chain. Ultimately, success will depend on early preparation, a tailored launch strategy, adequate digital capabilities, and robust interaction with all of the stakeholders.

Assessing the Opportunity

Altogether there are approximately 7,000 rare diseases, which the US defines as those that affect fewer than 200,000 Americans, according to the National Institutes of Health. Some 85% of these conditions are very serious or life-threatening. Yet only 500 have approved treatments. For the rest, there are no therapies in the market, and for many, none even in the pipeline.

To encourage development, US and European regulatory agencies have given the designation “orphan” to rare diseases that lack an approved treatment. This classification guarantees drugs that treat such diseases seven years of exclusivity in the US market and ten years in the European market, as well as reduced development fees (for regulatory activities) and an accelerated timeline for regulatory review.

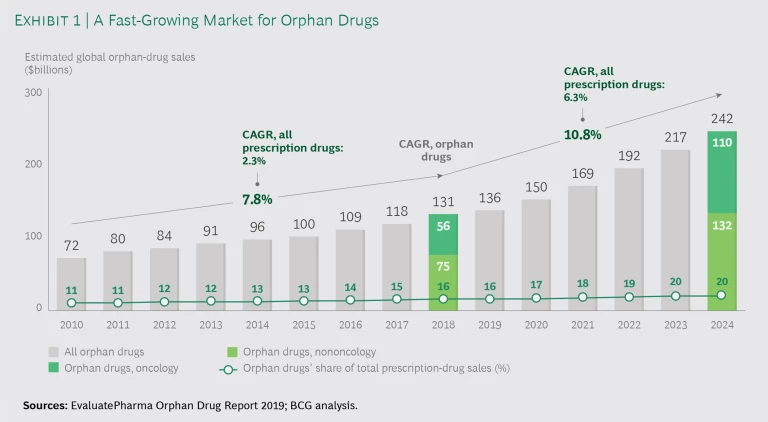

The overall orphan drug opportunity is large. Currently valued at $131 billion, the global orphan drug market is projected to grow almost 11% annually to about $240 billion by 2024, nearly double the growth projected for all drugs. (See Exhibit 1.)

As the Opportunity Grows, So Do the Challenges

In the past, launching an orphan drug was relatively straightforward. But three overarching trends have made it far more challenging to bring an orphan drug to market over the past few years.

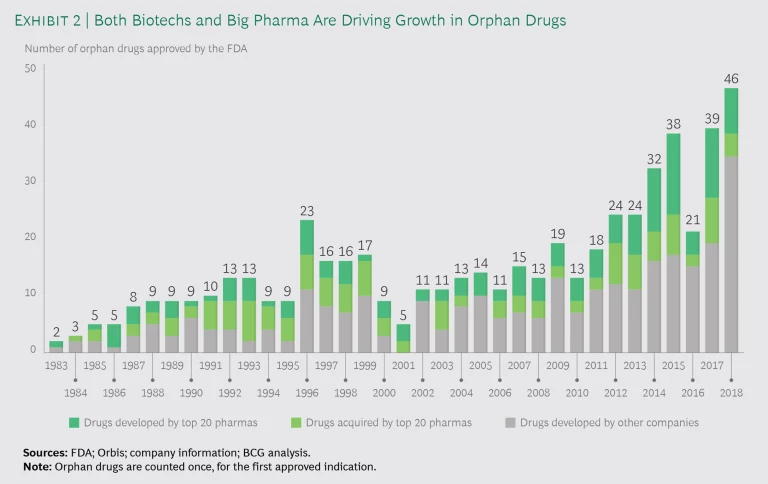

Competition and pricing pressures are rising. Companies are making a push into orphan drugs, and it’s not just small biotechs: by 2018, Big Pharma had developed or acquired about half the new drugs approved by the US Food and Drug Administration for orphan indications. (See Exhibit 2.) And in early 2019 alone, Roche, Ipsen, and Biogen announced plans to acquire orphan drug startups.

Companies that produce generics and biosimilars (cheaper forms of biologics) are also getting into the act as the patents of older orphan treatments expire. As a result, a number of treatments for some indications are now available from several manufacturers. In addition, some treaments with expired patents, such as rituximab, are being used off-label for certain orphan indications. Originally approved as a cancer drug, rituximab is now being used to treat neuromyelitis optica spectrum disorder, an autoimmune condition. All this competition is pushing orphan drug prices down.

That’s not all. Pricing and reimbursement agencies are scrutinizing drug prices more than they did in the past, which is forcing companies to negotiate more with payers, lower launch prices, and provide significant discounts for drugs in order to get approval for additional indications.

Regulators and payers demand more evidence of therapeutic value. In the past, companies that developed a treatment for rare diseases could secure market access simply on the basis of the drug’s effectiveness in clinical trials if it offered the only hope for patients in need. But today, regulatory authorities and payers are imposing greater requirements on the data collected—mandating, for example, that studies be larger and longer. They’re also requiring companies to prove things that they didn’t have to prove before—such as the therapy’s value for patients and how that value compares with the standard of care or with rival treatments—when justifying the high pricing in health technology assessments. Pharma companies are also being asked to continually collect and provide evidence, even after launch.

Patients are more globally connected. Patients with rare diseases have always connected with fellow patients in their communities in an effort to better understand their disease. Thanks to technological advances, patients are now more connected than ever—learning about their disease and communicating online with others around the world and even proactively reaching out to people with similar symptoms. Patients’ desire to take part in their therapy decisions is having a decided impact on treatment choices. As a result, companies need to navigate carefully to attract support from patient communities and avoid making mistakes in one country that can tarnish their reputation globally.

Six Ways to Boost the Chances of a Successful Launch

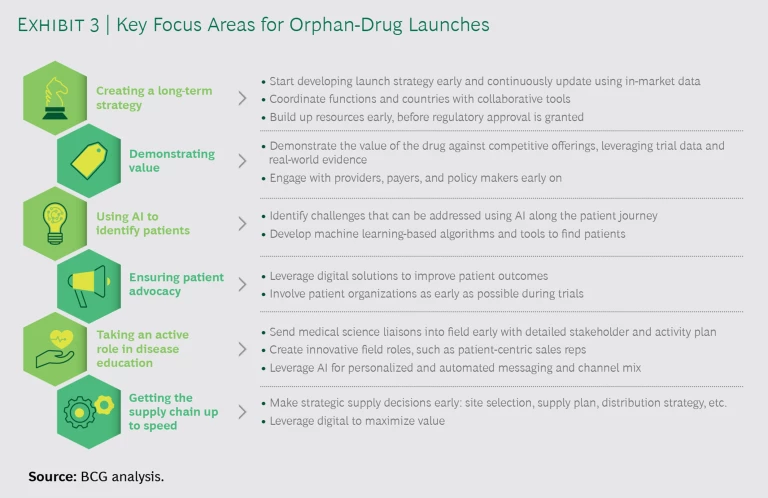

The launch of an orphan drug has become a much more complex undertaking in recent years, with greater potential for early mistakes that can irreparably damage a new drug’s prospects for long-term success. Companies that don’t plan carefully risk incurring untold costs later. To maximize the likelihood of success, we recommend placing more emphasis on six areas in particular. (See Exhibit 3.)

Create a holistic, long-term launch strategy. Previously, companies tended to plan the launch of rare-disease drugs with a focus on winning in the big markets, especially the US, without factoring in the potential for other indications. Today, while firms try to launch additional indications over time to increase the number of patients who can potentially benefit from the drug, products are no longer launched across all markets because of restrictions (for example, on reimbursement). To be successful, companies need a long-term, multinational launch strategy that considers regulatory requirements and other local factors in all potential markets. The strategy should also include all company functions early on in the launch planning process.

The launch of an orphan drug has become much more complex, with greater potential for early mistakes that can irreparably damage a new drug’s prospects.

Demonstrate value compellingly. A convincing value strategy has always been important for orphan drugs given their high price. The emergence of competitor drugs has made it even more vital to demonstrate with evidence a drug’s value in a way that resonates with every stakeholder. The value strategy needs to reflects drug’s costs and benefits for the health system, caregiver and support systems, and providers and patients. Although medications for a common disease like heart failure might have a larger cost to the health care system as a whole, rare drugs often get more public attention because they cost much more per patient.

The emergence of competitor drugs has made it more vital to demonstrate with evidence a drug’s value in a way that resonates with every stakeholder.

One example is Vertex’s Orkambi, a cystic fibrosis drug. The treatment was approved in Europe but is unavailable to patients in parts of the UK because government stakeholders believe it is not cost-effective at the current price. Discussions about the drug's value have been going on for three years with no agreement on a price.

Use advanced analytics to improve patient identification. Maturing digital technologies, growing amounts of data, and new analytical capabilities create new ways to interact with and support patients. Artificial intelligence can help identity the types of patients who are most likely to benefit from a drug. Those insights can then be used to help physicians diagnose patients earlier, enabling faster treatment and even preventing progression of the disease. (See the sidebar “Putting AI to Work in Patient Identification.”)

Putting AI to Work in Patient Identification

Putting AI to Work in Patient Identification

Advanced analytics can be leveraged to identify, for example, small sets of disease predictors that help physicians make faster diagnoses; early indicators of disease progression that help physicians prevent and manage progression or relapses; and subgroups of patients least likely to experience serious side effects from a drug.

Several companies are already developing algorithms and tools to support their products’ positioning and value proposition. In some cases, this has led to shifts in treatment paradigms, with the new drug replacing an older one. It has also resulted in approvals of cleaner labels and agreements with payers to sell the drug at a higher price.

To engage in such an effort, companies should start with a proof-of-concept phase, in which datasets are tested for use cases. A machine learning-based algorithm is then developed and tested on additional datasets, supporting the identification of the use cases. A simple decision tool is developed on the basis of the outcome. In a second incubation phase, the tool is tested and refined as a solution in real-world settings, with an emphasis on scalability and value.

Ensure strong patient advocacy. In the past, a new drug was often the first of its kind for patients with a particular disease, so patient advocacy happened naturally at the time of the launch. But as competition increases, it’s less common for a new orphan drug to be the first to market. It’s therefore important to set up support programs before the launch (in coordination with patient organizations) and make use of digital tools and apps to engage patients throughout their journey. (See the sidebar “A Digital Boost for Patient Support and Engagement.”)

A Digital Boost for Patient Support and Engagement

A Digital Boost for Patient Support and Engagement

Digital tools can help companies support and engage with rare-disease patients. Most tools currently on the market target patients with “standard” diseases. But some of them, from unregulated apps to regulated devices, could provide value to patients in a number of ways, including:

- Patient Symptom Tracking. A digital journal or some other structured method for patients to record their symptoms or thoughts can give physicians better visibility into their condition. This is especially useful when the period between treatments is lengthy.

- Remote Medicine. Video-calling services such as Skype make it easier for patients to consult with experts between physician visits.

- Patient Monitoring. Digital monitors allow health care providers to more easily determine whether an escalation in care is called for, such as when a patient on an immunosuppressant gets cold-like symptoms that could reflect a more serious infection.

When preparing a digital solution for rare-disease drugs, companies should conduct regular reviews with patients and patient organizations to ensure that it will meet their needs. They must also find the right business model. In some cases, for example, a solution tied to one product or one indication may work best. In others, a better solution might be a platform that other companies can also leverage to work across indications.

Take an active role in disease education. Creating global and local awareness of a disease and the importance of developing drugs to treat it is even more vital than in the past. Many rare diseases currently have few or no treatments. In some cases, people don’t even know about a disease, let alone any treatments, so companies need to take an active role in shaping perceptions, leveraging key opinion leaders and academics. Because there are now more treatments on the market, companies need to teach physicians about the mechanisms and merits of their drugs. It’s critical to target the small number of physicians who diagnose or treat a particular disease as well as the physicians who refer patients to them. Digital marketing can be quite helpful in personalizing the content, frequency, and channels used to interact with these doctors.

Get the supply chain up to speed. Many new technologies, such as gene therapy, have never been mass produced before and so probably require new supply chain setups. To be ready on launch day, companies need to start preparing their supply chains sooner than in the past. This is especially important given the severity of many rare diseases and the long waiting lists of patients in need of treatment.

Creating Maximum Value and Long-Term Success

To conduct a launch that creates maximum value for patients, physicians, payers, and the company itself, preparations must begin early. Companies that don’t get it right the first time around will pay for their mistakes.

In addition, the right capabilities need to be in place. Digital, data, and advanced analytics capabilities are increasingly critical. Cross-functional collaboration is also important to ensure that the strategic direction is effective. Companies need to make sure the different areas of focus are aligned and that functions are involved early and continuously.

Because rare-disease drugs are used worldwide, interactions with all stakeholders—regulatory agencies, payers, providers, patients, and patient organizations—are even more vital than with other drug launches. Companies should aim to make every single interaction a good one.

Companies should no longer regard a rare-disease drug launch as a one-time event. Only by treating it as a continuous flow of activities, with new indications and patient populations added over time, can companies succeed in making their drugs accessible to all the people who need them while boosting the bottom line.