Propelled by the longest economic expansion in the country’s history, the US automotive industry has enjoyed an extended run of strong results. But the industry faces substantial challenges. Converging trends on the financial, customer, and competitive fronts are likely to make business more difficult and less profitable in the next two to five years.

For dealers, the challenges are acute. They face ongoing declines in the sales margins of new and used vehicles, price-savvy customers who are increasingly shopping online, and growing competitive threats from players that are attacking critical elements of the value chain.

Financial, customer, and competitive challenges are likely to make business more difficult and less profitable.

In addition, evidence points to an impending economic downturn in the United States. In a recent article , BCG projected a downturn that could see sales of new vehicles fall by 9% to 15% by 2021. A decline of this magnitude would materially reduce profits for both manufacturers and dealers—and ultimately threaten the survival of many of the latter.

Given these challenges, it is vital that US auto dealers take action—now—to prepare.

A Storm Is Brewing

Auto retail has experienced many changes in the industry’s operating environment and business model, changes that will only accelerate in the coming years.

To begin with, today’s customers arrive at dealerships much better informed about vehicle features and prices, with online price comparison tools and websites such as TrueCar and CarGurus increasingly driving price transparency. They also arrive with a stronger sense of the model they’ll buy. According to BCG’s Center for Customer Insight, 62% of customers who bought a car within the past two years had determined what make and model they were going to buy before arriving at the dealership; within that group, 81% had determined (within $1,000) what price they were willing to pay. Buyers also increasingly begin the purchase process online and want the fast, seamless, omnichannel experience offered by top online retailers such as Amazon.

This increased price transparency and consumer sophistication, combined with the rising popularity of alternative transportation models such as ridesharing, is putting pressure on vehicle sales margins. And that pressure is being exacerbated by the large number of vehicles—more than 4 million, the highest number in over a decade—coming off lease in 2019. The last time the number of vehicles coming off lease was near this level, residual losses were approximately $2 billion.

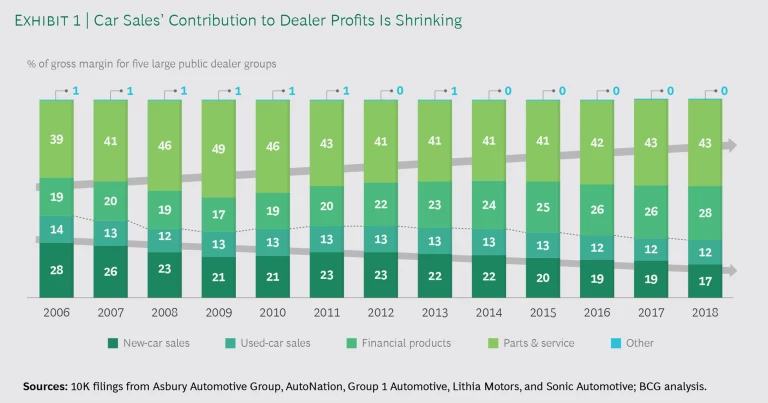

These factors are forcing dealers to rely more heavily on financial products and parts and service to maintain their profit margins. The numbers are telling: collectively, five large publicly traded dealer groups (Asbury Automotive Group, AutoNation, Group 1 Automotive, Lithia Motors, and Sonic Automotive) saw the portion of their margin coming from vehicle sales fall 13 percentage points, and the portions from finance and parts and service rise 9 percentage points and 4 percentage points, respectively, between 2006 and 2018. (See Exhibit 1.)

Dealers are also facing threats from players such as Carvana and Fair that are looking to disrupt the value chain and steer customers away from brick-and-mortar dealerships. Even the OEMs themselves are hedging their bets and testing the waters with pilots and investments in disruptive players. Examples include Ford’s acquisition of the car subscription company Canvas, which Ford subsequently sold to Fair while retaining an ownership stake, and Daimler’s investments in car sharing players such as Turo and car2go.

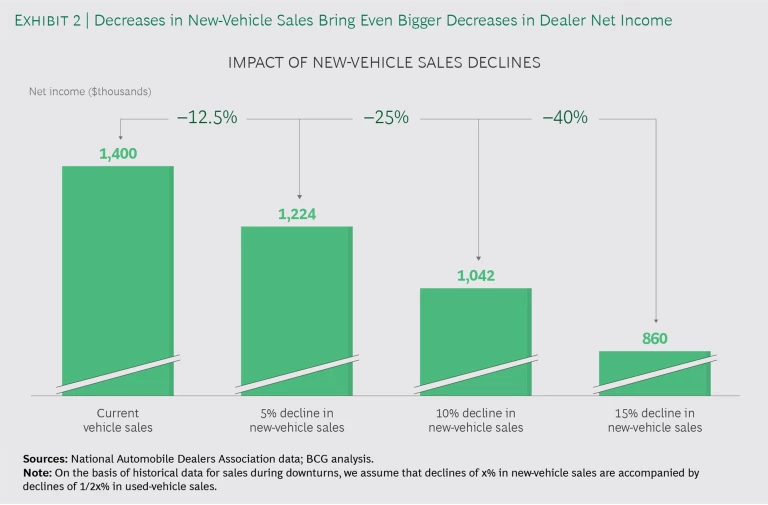

The average dealership could see its net income fall by 25% to 40%.

All of these changes are converging just as the industry faces a potential slowdown in US economic growth, one that could bring (as noted earlier) a drop in new-vehicle sales of 9% to 15% by 2021. A sales decrease of this magnitude would weigh heavily on the entire auto industry but take a particularly heavy toll on dealers—the average dealership could see its net income fall by 25% to 40%, a decrease large enough to force many dealerships to close. (See Exhibit 2.) Taken together, these trends create a perfect storm for automotive retail.

Preparation Should Begin Today

Although dealership closures in the impending downturn likely won’t be as numerous as they were in the 2008 Great Recession, some closures are inevitable. (See the sidebar, “How Dealers Weathered the Great Recession.”)

How Dealers Weathered the Great Recession

How Dealers Weathered the Great Recession

The Great Recession of 2008 battered the US automotive industry and culminated in the government bailouts and bankruptcy filings of GM and Chrysler. Demand for vehicles plummeted; automakers responded by curtailing production and closing dealerships. Production in 2009 was 44% lower than in 2006, the steepest decline the industry had seen in 70 years. The number of domestic light-vehicle dealerships fell 20% from the end of 2006 through 2011. GM closed 35% of its dealerships, Chrysler 40%, and Ford nearly 20%.

Dealers that weathered the Great Recession relatively well took action on three fronts. They renewed their focus on high-margin departments, such as used-car sales and parts and service. They aggressively cut costs, in part by making significant reductions in headcount. (Employment at dealerships fell 16% between 2005 and 2010.) And they strategically pursued M&A, taking advantage of low multiples on attractive acquisition or partnership targets. (The ratio of enterprise value to earnings before interest and taxes, or EV/EBIT, for a number of large public dealership groups stood nearly 15% lower at the end of 2008 than in the middle of 2007.)

To maximize their odds of survival, individual dealers must do three things: create a plan for weathering the downturn, build downturn-ready practices, and play to win. (See Exhibit 3.)

Create a Downturn Plan

To create an effective plan, dealers should focus on the following:

- Applying Lessons from the Last Downturn to Today’s Context. Dealers with multiple locations should do retrospective analysis on the sales and profitability performance of their dealerships in the last downturn to identify where the greatest opportunities and risks reside. These insights can help them develop a proactive plan and investment strategy for the downturn.

- Identifying Attractive M&A Targets in Advance. Dealers should proactively identify acquisition candidates that would enhance their capabilities, geographic footprint, or brand or segment mix. This will allow them to move quickly when prices decline.

- Teaming Up with Manufacturers and Financing Partners. Dealer groups should work with OEMs to create a shared view of incentive programs that could help moderate the downturn’s financial impact. They should work with financing partners to plan for shifting customer credit profiles—in particular, the likelihood of rising defaults.

Dealer groups should work with OEMs to create incentive programs that help moderate the downturn’s impact.

Build Downturn-Ready Business Practices

The efficiency of management and sales teams and business practices will become increasingly important in a downturn, when resources are constrained. To foster efficiency, dealers should focus on the following:

-

Optimizing Costs and Spending. Evaluate cost levels by benchmarking against best-in-network dealers and industry peer groups (for example, the NCM 20 Groups). Sales, general, and administrative costs, especially, are often ripe for savings through aggregation or automation of back-office functions, sharing of service and maintenance labor across dealerships, and the realization of potential synergies from acquisitions.

Marketing budgets are often targeted for spending reductions in a downturn; however, we caution against indiscriminate cuts. Dealers should instead consider changing their media mix, with an eye toward increasing the effectiveness of their current spending. Investments in digital capabilities can be particularly rewarding, but getting the most out of an investment in digital is challenging. Marketing teams must build an ongoing test-and-learn capability; they must form hypotheses on opportunities, create pilots to test those hypotheses, and facilitate the scaling and rollout of successful pilots. But the rewards for getting digital right can more than compensate for the effort: we have seen increases of 15% to 30% in cost efficiency and 20% to 50% in the effectiveness of dollars spent.

- Optimizing Inventory. Dealer groups should redouble efforts with OEMs to bring in the fastest-turning new vehicles and free up capital for advantaged inventory. Best-in-class retailers are using increasingly detailed market intelligence built on big data and advanced analytics to better match inventory to demand. Dealers should learn from these examples and double down on inventory optimization plans across their network. On the used-vehicle front, dealers must ruthlessly offload slow-turning units through the wholesale channel to ensure that sufficient working capital is on hand for new-vehicle floorplan financing.

-

Pushing High-Margin Products and Services. During the Great Recession, dealers made a material change in how they drove profits, leaning increasingly on high-margin products and services such as finance, insurance, vehicle servicing, and parts and accessories. Succeeding in the next downturn will require even greater focus on these revenue streams.

To this end, dealers should consider developing strategies to encourage customers to turn to dealers, rather than nondealer providers, for vehicle maintenance services. Dealers could use white-label aftermarket parts to lower prices, and create price transparency on services to fight the perception that nonwarranty dealer service is expensive. Dealers can emphasize customer segments in which they already have a toehold—a BCG study showed that in some luxury segments, more than 80% of owners thought dealer and nondealer services were comparably priced.

- Collecting, Segmenting, and Using Data to Increase Sales and Profits. Being more systematic about the collection and use of data to customize pricing, incentives, and recommendations for vehicle models and options can boost sales and protect margins. Dealers can use data to determine which customer segments will be the least price-sensitive and to understand what motivates customers to buy a new car, buy a used one, or defer the purchase decision during a downturn. Using this information, dealers can design segment-specific offers that maximize price realization and volume. To complement this segmentation, dealers should develop digital tools (including software and apps) that give salespeople the ability to make real-time, high-quality decisions on the products and incentives they need to offer to close deals at maximum profit.

- Modernizing the Sales Process. Creating an omnichannel buying experience that allows customers to shop at home and makes their queries accessible to the dealer’s sales teams will enhance the shopping experience and reduce dealers’ staffing levels. Enabling such a seamless experience requires an investment in digital capabilities. But our experience suggests that the payoff can be stronger brand loyalty and a substantial reduction—in some cases as much as 25%—in salesperson time per transaction.

- Building Leaner, More Flexible Sales and Management Teams. To fully leverage their investments in optimized processes, dealers must reorganize their sales and management teams (for example, by consolidating administrative roles) so that they are sufficiently lean. In parallel, dealers can test incentive structures that reward salespeople for providing excellent customer experiences rather than meeting sales targets—a change that many large dealer groups have found leads to improved sales and lower costs. Some dealer groups also find it worthwhile to create “SWAT teams” that help spread best practices across their networks.

Play to Win

Although it may be tempting to hunker down and focus on defense, downturns can present critical opportunities to play offense. Prudent cost cutting and the sale or closing of underperforming dealerships in advance of a downturn can provide the necessary cash reserve. Some of the best uses of cash will likely be M&A (as mentioned earlier), support for effective M&A execution, and the design of alternative store formats.

M&A execution should emphasize the realization of synergies. BCG’s cross-industry retail experience suggests that an effective postmerger integration program can, for example, lower sales, general, and administrative costs by an average of 15%.

Some of the best uses of cash will likely be M&A and the design of alternative storefronts.

Large dealer groups that serve dense urban areas should consider alternative store formats. In particular, they should explore smaller storefronts that serve primarily as structures for educating customers and facilitating the completion of sales. These stores could be complemented with a few large, centralized inventory lots in less expensive locations.

Finally, although we have focused mainly on opportunities within dealerships, we believe that, in a downturn, dealers and OEMs alike should seek opportunities to reset the dealer-OEM relationship. Deeper collaboration across inventory and data management, vehicle incentives, and the customer experience could become a source of competitive advantage for an automaker in the face of overall industry disruption.

Significant near-term challenges are at hand for the US automotive retail industry, and not all dealers will survive. But by taking action now, dealers can maximize their chances of success and position themselves for growth over the longer term.