On the face of it, everything looks rosy for the US natural-gas industry, thanks to the transformation that shale has brought. Already the world’s largest natural-gas producer, the US is set to become the third-biggest exporter of liquefied natural gas (LNG) globally by 2020. What’s more, the shale boom is experiencing a fresh growth spurt, and upstream players are preparing for double-digit annual production growth in key basins during the next decade.

Most forecasters predict that demand for US natural gas from domestic sources and exports, along with supply, will rise rapidly. However, according to our research, declining costs for renewable energy and battery storage, as well as the decarbonization of heating in buildings, will likely cause the growth in natural-gas demand to slow down by as early as the late 2020s and then flatline by 2030. Moreover, the potential longer-term impact of US trade policy could further depress demand for LNG exports.

The effects of these trends will be felt by businesses all along the full natural-gas value chain: utilities, power generation companies, and equipment manufacturers. Indeed, some gas pipeline operators and local distribution companies could face fundamental challenges to their businesses. These companies need to plan ahead, reorient their investment plans, and safeguard their businesses now so that they can continue to thrive when the growth in demand for natural gas is constrained but supply is abundant. This could require some players to take radical preemptive actions. Preparing for an abundance of natural gas may be both a challenge and an opportunity for the US gas industry.

Preparing for an abundance of natural gas may be both a challenge and an opportunity for the US gas industry.

Shale Is Driving the Growth in US Gas Production

As a result of the explosion in shale gas and oil extraction that started in the middle of the first decade of the 2000s, shale now contributes nearly two-thirds of US dry-gas production, which excludes natural gas liquids (NGLs). It is the fastest-growing segment, up 20% per year since 2010. The shale boom has lowered energy prices, boosted the US economy, and transformed the country’s position in the global energy landscape , turning it from a net importer of gas to a net exporter in 2017.

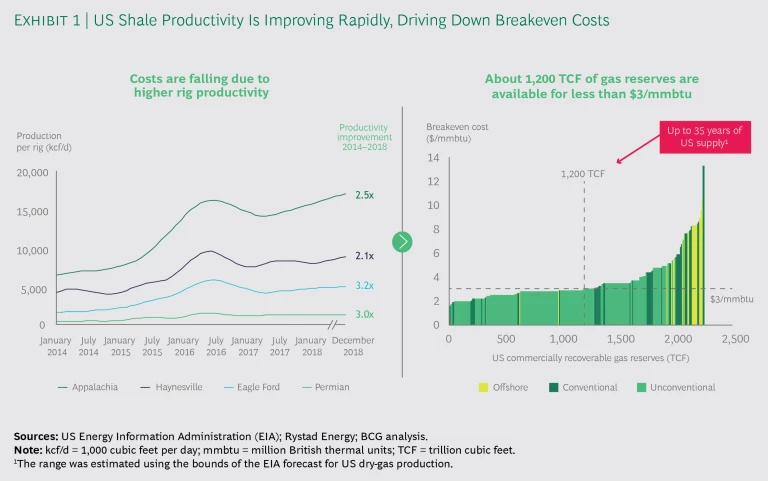

There are more benefits to come. According to the high estimate by the US Energy Information Administration (EIA), dry-gas production could increase by as much as 60% from 2017 through 2027, buoyed by growth from the US’s main shale formations: the Marcellus and Utica basins in the east and the Permian basin in Texas and New Mexico. Several factors are supporting this growth:

- Multiple technological breakthroughs have increased rig productivity by two to three times and reduced breakeven costs, going from $5 to $6 per million British thermal units (mmbtu) to less than $3 per mmbtu in many basins. By lowering the cost of shale gas extraction, the industry has greatly increased the volume of economically recoverable reserves. We estimate that about 1,200 trillion cubic feet (TCF) of gas—enough to supply the US for up to 35 years—is commercially recoverable at current wholesale gas prices using existing

technology.1 1 This estimate is based on the Rystad US shale model. More is likely to be available in the future as a result of further technological developments and cost reductions. (See Exhibit 1.) - Rising prices for crude and NGLs since 2016 have prompted exploration and production companies to increase overall hydrocarbon production. In the Permian basin, for example, gas production rose by more than 50% in one year largely because of crude oil production growth. In the Appalachian basin, a doubling of the NGL composite price has incentivized higher overall production, even though NGLs account for less than a quarter of total output.

- The easing of pipeline capacity constraints, especially in the Appalachian and Permian basins, is reducing structural price discounts for shale gas and enabling greater access to the market for gas. Despite some project delays, pipeline capacity in both basins is set to double by 2022.

Some headwinds could hold back growth in shale gas production. For example, labor constraints and higher supplier costs could hamper productivity improvements. Project delays, along with better-organized and broader opposition to pipeline infrastructure, could impede efforts to reduce capacity

A Combination of Factors Could Cause US Gas Demand to Peak

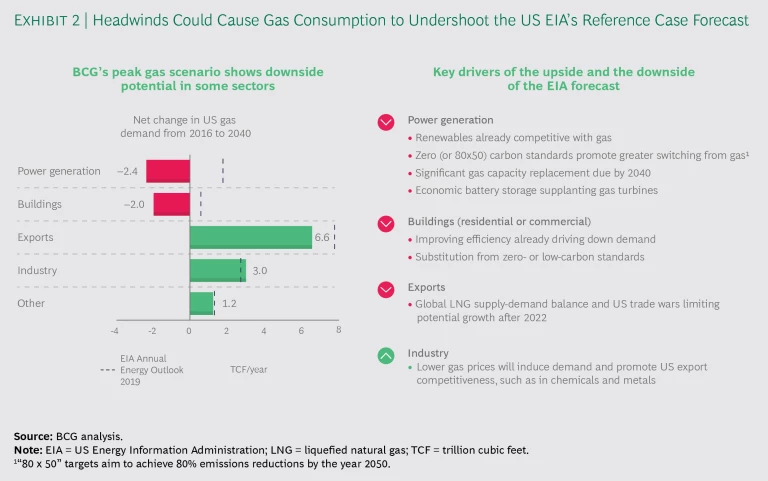

Most forecasters expect that demand for gas will increase, too. According to the EIA’s reference case estimate, the consumption of US gas will rise by 50% from 2016 to 2040, driven mainly by incremental LNG exports and industrial demand. Other forecasters predict slower rates of increase in demand.

However, we believe that the US will likely experience a peak in gas demand, with consumption growth slowing from the late 2020s and plateauing by 2030. The US gas market is likely to shift from being limited by the pace of growth in supply to being limited by the level of demand. According to our analysis, the demand for gas in power generation and both residential and commercial buildings could contract, rather than expand slightly as per the EIA’s projection, by 2040. Growth in the demand for LNG exports is also likely to be weaker than the rate predicted by the EIA. Only in the industry sector do we see gas demand surpassing the EIA’s forecast. (See Exhibit 2.) We detail the dynamics in each of these sectors

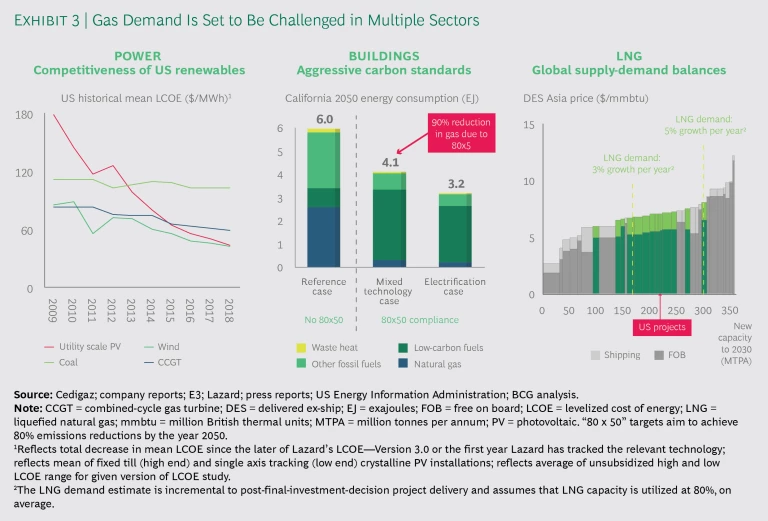

Power Generation. This sector is the biggest consumer of natural gas in the US: it is responsible for 34% of total demand across a combination of both high-utilization baseload and intermittent peaker plants. But the role of gas may diminish in both uses. In baseload generation, the rapidly declining costs of utility scale solar and wind will reduce the reliance on gas. In peaking, lower prices for battery storage, which can also increase the availability and dependability of renewable energy sources, will have the same effect.

The power generation sector is the biggest consumer of natural gas in the US.

Driven by experience curve effects, the average levelized cost of electricity (LCOE) for wind and solar has fallen dramatically in recent years. The price per megawatt hour (MWh) has dropped from more than $120 for solar and more than $70 for wind to less than $45 for each.

Indeed, Lazard’s 2018 assessment indicated that the average US unsubsidized LCOE was $43 for utility scale solar and $42 for wind. In contrast, the estimate also indicated that the LCOE of combined-cycle gas turbine (CCGT) generation has fallen only modestly, from near $70 per MWh to $56, primarily because of lower natural-gas costs. Consequently, additions in capacity for, and production growth from, wind and solar have exceeded those for gas for three of the past four years. Intermittent renewables do pose integration challenges, however, and cannot necessarily be treated as baseload in the same way as gas, which is increasingly raising the importance of load balancing.

Until recently, gas-fired peaker plants were expected to play the dominant role in balancing the electricity grid as intermittent renewable-energy production grows. But according to Lazard, the costs of utility scale battery storage are falling so fast that the technology is challenging that assumption. The same experience curve effects that have taken place in solar are now occurring in battery storage: the average LCOE for battery storage has fallen by half since 2013. As a result, unsubsidized storage costs are now projected to be competitive with new gas peakers within five to ten years, and batteries may even be able to displace existing gas peakers by the mid-2020s.

According to the EIA, gas consumption in the US power-generation sector will continue to grow, rising from 9.9 TCF in 2016 to 11.7 TCF in 2040. But we believe that more than one-third of the projected gas demand is at risk as renewables and battery storage replace baseload CCGT, peaker, and older, inefficient, gas steam turbines. While gas will continue to replace coal capacity in the near term, the biggest impact is likely to occur from 2030 to 2040, when about half of the US’s existing gas-fired baseload generating capacity reaches the end of its useful life. Given current and prospective economics (rather than regulation or policy incentives), renewables will supplant much of this retiring gas capacity.

Buildings. The use of energy-efficient products, better construction techniques, and improved insulation in commercial and residential buildings is already putting pressure on US gas demand. Per-capita residential consumption fell by one-third from 2006 through 2016 and will continue to decline because of the greater electrification of buildings and the use of such new technologies as heat pumps, which work by redirecting, rather than generating, heat.

State and local policy measures will accelerate this trend. In California, for example, residential gas usage could decline by 90% in about 30 years as a result of the state’s so-called 80x50 commitment, which targets an 80% reduction in greenhouse gas emissions by 2050. State regulators have already announced proposals to eliminate natural gas from new homes.

Indeed, our analysis has found that more than 30% of the US population lives in jurisdictions with similar 80x50 targets and enabling policies. Many of these areas are in northeast and west coast states, encompassing several large cities across the country, including Chicago, Houston, and Phoenix. These states and local governments are now implementing specific policy measures to meet their targets, with some even requiring the electrification of buildings.

We expect that demand for gas in US buildings could drop by 2 TCF per year by 2040 because of these shifts in consumption.

Exports. Project developers are planning to launch a second wave of export capacity by the mid-2020s. In order to secure financing and reach final investment decision, these projects will need customers to commit to purchase a portion of future output. Achieving sufficient commitments will be challenging for some, however. New US LNG projects are largely on the margin of the new supply coming to market, so US exports will be limited by global demand. (See Exhibit 3.) We anticipate that total US capacity would exceed global LNG demand growth by 50 to 75 million tonnes per annum by 2030 even if all high-potential LNG projects under consideration were

The residual effects of the current trade disputes between the US and other countries, especially China, could put further pressure on US LNG projects. Section 232 tariffs on steel and aluminum imports to the US are likely to add 10% to project construction costs. Meanwhile, the Chinese government recently levied a 10% tariff on US-produced LNG, which means that the fuel will be less competitive for buyers in China, the global leader in terms of growth in demand for

US LNG exports are already increasing dramatically, and that growth is set to continue. However, these forces may constrain LNG exports from reaching their full potential in the longer term. We believe that, as a result, the growth in US LNG exports could undershoot the EIA’s reference case estimate by up to 1 TCF a year by 2030.

Industry. Natural gas plays two crucial roles in this sector: it serves as a source of heat and is the feedstock for petrochemical applications. Industrial gas consumption has already been growing by 3% per year since 2015 as companies respond to lower prices. And a forecast of lower long-term prices has spurred petrochemical companies to increase capacity in the US. For example, Methanex, a leading methanol producer, has relocated two factories from Chile to Louisiana. US-based methanol export capacity is projected to grow sixfold from 2017 to 2021 as US and foreign-owned producers continue to invest.

In our view, competitive prices will boost the use of US gas in industrial processes by 3.0 TCF a year by 2040, faster than the rate of growth predicted by the EIA. Increased industrial consumption will also help to balance slower growth in other sectors. However, as with LNG exports, US trade policy could limit this growth as a result of either direct tariffs or a loss of confidence by investors.

In summary, looking across exports and domestic sectors, we see a shortfall in gas demand of 7 TCF relative to the EIA’s reference case in 2040. This would equate to a market that is 18% smaller than most forecasters expect.

What This Means for US Gas Players

To be sure, a looming potential supply-demand imbalance would continue to drive down gas prices. Given our outlook for gas demand and continued productivity improvements in supply, we believe that the benchmark Henry Hub spot price could fall below $2.50 per mmbtu for a sustained period starting in the early 2020s. This low-price environment will impact gas players in different ways. While gas will be cheap and readily available, the cost of renewable energy will be even cheaper on an LCOE basis. This will challenge the way that power generation companies with large portfolios of gas-fired turbines use their gas assets. Other participants may replace lost revenues by tapping potential incremental-demand opportunities, such as in industrial applications—provided they take steps to nurture those opportunities now.

A drop in the Henry Hub spot price will impact gas players in different ways.

We examined the impact of the industry’s evolving dynamics for the following three types of companies, which can prepare for disruption by adopting the specific measures we outline below.

Upstream Producers. Upstream natural-gas producers should continue to cut costs and improve recovery rates to ready themselves for a prolonged low-price environment. By applying new digital technologies that increase efficiency and boost recovery rates, they can continue to lower the breakeven cost of gas extraction. BCG and others have estimated that applying those technologies can cut shale capital expense costs by at least 20%. At the same time, by focusing on portfolio assets with a higher liquid content, such as NGLs, producers can boost profitability because of the price differential with dry gas.

Producers should also take actions that mitigate falling prices by locking in demand. First, they can begin moving toward long-term supply contracts with large industrial consumers or export-oriented LNG liquefaction plants. Second, they can develop greater marketing and trading capabilities, particularly for regions with a high potential for price volatility, so that they are less likely to encounter low spot prices. This is similar to moves that gas producers took in the 1980s, when deregulation broke the long-term pipeline contracting model.

Midstream Gas Companies. These companies cover a broad spectrum, and the impacts on any given business will depend largely upon its specific assets. Players with little or no pipeline exposure should aim for shorter and more flexible supply arrangements so they can benefit from price declines. But pipeline operators ought instead to push for secure, long-term sales contracts, given the outlook for weakening demand. They will need to add capacity to reduce existing bottlenecks in some regions, but they should be wary of overbuilding. Transmission operators with portfolio flexibility will also have the option to adapt to the regional trends that drive gas market discontinuities by timing exits from specific assets ahead of key policy or market developments.

Utilities. Utility companies, which distribute natural gas to end users, will face some of the toughest challenges. A decline in natural-gas demand could prompt a vicious circle: As gas consumption declines, the unit costs for the delivery of gas increase because fixed asset costs must be recovered through a smaller volume. This, in turn, leads to lower volumes for gas distribution companies, even higher per-unit expenses as distributors seek to recover their fixed costs from a shrinking pool of users, and yet more consumers switching away from gas.

Utility companies will face some of the toughest challenges.

Gas utilities also face a particular challenge because their business models give them less room to maneuver than other players. Their assets have high fixed costs, are capital intensive, and cannot be moved. At the same time, utilities have an obligation to serve customers and maintain high standards for safe operations. Nevertheless, they can take the following steps:

- Tap incremental demand sources. One no-regrets move that distribution companies can take is to tap sources of incremental demand and mitigate the effects of the powerful trends described above. The International Maritime Organization’s decision to begin reducing the sulfur content of marine bunker fuel in 2020 may provide a boost for LNG suppliers. Similarly, the role of compressed natural gas as a substitute for diesel in heavy trucks could grow if oil prices rise. In addition, such nascent technologies as gas-fired heat pumps and microgrids powered by distributed gas generators are ramping up. However, the potential of any of these opportunities to make up for lost revenues varies significantly from one region to another and generally depends on local initiatives. We suspect that the moves, although positive, will be insufficient to compensate for lost demand in most cases.

- Build the green credentials of gas. The gas industry will need to persuade customers and policymakers of the environmental benefits of natural gas. If they don’t succeed, they’ll risk ending up with stranded distribution assets as a result of the shift to electricity. Distributors can start by eliminating emissions in their pipeline networks, given that methane is a highly potent greenhouse gas. New technologies—such as biomethane, carbon capture and storage, and power-to-gas technologies, which convert surplus renewable energy into gas—could also bolster gas’s environmental credentials. But gas companies must begin making the case for, and investing in, these advances now if they are to gain traction.

- Use power as a hedge. Utilities with overlapping gas and power businesses have the option of expanding their power distribution businesses as a hedge against declining gas consumption, especially in areas with rigorous emission targets. In specific instances, they can encourage customers to switch from gas to electricity and preemptively shut down parts of the gas network where demand is low. But doing so will not be without challenges: companies will have to maintain safety and reliability standards even as they cut spending on gas pipelines, while also working with regulators to manage network contraction and avoid stranded assets. Pure-play gas utilities in regions with rapid transitions to renewables will face the greatest challenges because they have less room to maneuver.

- Prepare for disruption. Gas companies can successfully evolve, even in the face of significant disruption. But they will need to understand the specific challenges that lie ahead and prepare for change by adopting new approaches and a radically different mindset. In an analysis of the effects of disruption across sectors, we found that

only about one in three companies is able to navigate major shifts

in their industry. These thriving companies typically share five elements, including betting big on the future (typically with investments equal to at least 10% of their market capitalization), preparing organizations and investors for change, and taking preemptive steps to fund the journey. Given the unique challenges of the gas utility industry, making timely and bold bets—backed by significant funding—will be a key driver of success. This is not without significant risk, however.

- Customers. With prices set to fall, industrial and commercial customers will want to maximize the flexibility of their supply contracts by insisting on shorter durations and on reopener clauses. But low gas prices will have wider strategic implications. For some industrial customers, weak prices will support the business case for adding new manufacturing capacity. Others should consider investing in gas-intensive export-oriented products, such as petrochemicals or metals, which will become competitive as low prices become the norm.

The evolving market dynamic in US gas cannot be ignored. While it will impact all players in the value chain, not every company will have to revise its playbook. Upstream gas producers will continue to focus on driving down costs by applying technology solutions. For end customers, the promise of a very cheap and abundant energy source in a stable region of the world will open up new business and investment opportunities. Gas transmission and distribution companies will face the greatest challenges, however. They will need to understand threats and opportunities at both local and national levels, and prepare to make significant bets on the future, if they are to thrive in the face of disruption.