This Focus was produced in conjunction with the Singapore Summit.

Innovation has always played an important role in both developed and developing economies. Breakthroughs in advanced economies, in domains ranging from computing and communications to new materials, have had far-reaching effects, setting in motion cycles of production that have created manufacturing jobs and new occupations in ancillary industries across the developing world. In some cases, they have helped poor nations achieve middle-income economies.

Nevertheless, the lion’s share of profits created in most industries has remained in rich nations, where the most important innovations originated—even when most production and consumption occur offshore. As a new wave of technological change sweeps over the globe, many policymakers and entrepreneurs in the developing world are asking whether this old pattern of wealth creation will persist.

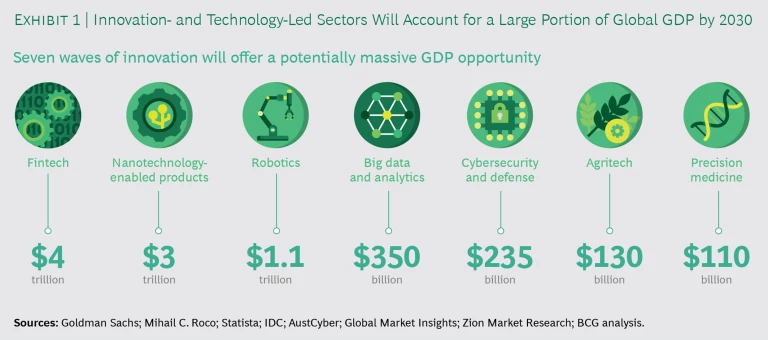

By 2030, industry sectors that rely on advanced digital technology could account for nearly $9 trillion in output worldwide.

The ability of nations to innovate is becoming ever more critical. Digital technology and disruptive business models are transforming industry after industry, shifting economic growth to new sectors. By 2030, fintech, nanotechnology-enabled products, robotics, big data and analytics, cybersecurity and defense, agritech, and precision medicine could collectively account for nearly $9 trillion in output worldwide. (See Exhibit 1.) The world’s advanced economies are again likely to dominate this next wave of technology-based industries. In addition to these likely winners, China and India—which are already leveraging their deep pools of technical talent and massive domestic markets to become players in digital industries—are in a strong position to serve as engines of innovation, investment, and wealth creation.

Where does this leave the rest of the developing world? We are especially interested in a cohort of 13 economies that we call the Middle Billion—nations other than China and India (which, owing to their enormous scale, are special cases) that have nominal per-capita GDPs of less than $10,000 and that will have close to or more than 100 million people by 2030. We will focus on three Middle Billion economies—Indonesia, the Philippines, and Vietnam—that account for nearly three-quarters of the population of Southeast Asia. Other Middle Billion economies are Bangladesh, Brazil, Democratic Republic of the Congo, Egypt, Ethiopia, Iran, Mexico, Nigeria, Pakistan, and Turkey. (See Exhibit 2.)

These nations are familiar with and, in some cases, expert at the game of trying to capture share in manufacturing sectors. But as innovation, technology disruption, and digitization create more economic activity, Middle Billion countries will need to learn how to capture their fair share of new opportunities in areas such as fintech, cybersecurity, and agritech. And in view of their limited legacy in the innovation space, we may once again see companies from the large developed countries capture most of the value. In digital media, we already see the The New Digital World: Hegemony or Harmony? of companies in the US and China.

This challenge may be more pressing than it at first seems. Industry 4.0 technologies, economic nationalism, and shifting costs are encouraging companies in some advanced economies to reshore manufacturing work that has long helped propel employment and GDP growth in developing nations.

The Limits of Traditional Development Paths

A number of countries have made the transition from a developing, factor-based economy through an investment-based stage and on to an innovation-driven economy, following the three-stage sequence that Harvard Business School’s Michael Porter describes in his classic The Competitive Advantage of Nations. South Korea made this transition by nurturing diversified conglomerates that absorbed foreign technology and reverse-engineered products to develop large export industries. Singapore focused on attracting manufacturing investment from multinational corporations (MNCs) and then persuading them to build local R&D centers and regional headquarters. Malaysia and Thailand became leading export manufacturing bases for MNCs and are in the process of building innovation systems. China has adopted a hybrid approach, serving as an export-manufacturing platform for MNCs while fostering national champions in heavy and high-tech industries. Along the way, these nations invested heavily in education and R&D to build their innovation capacity.

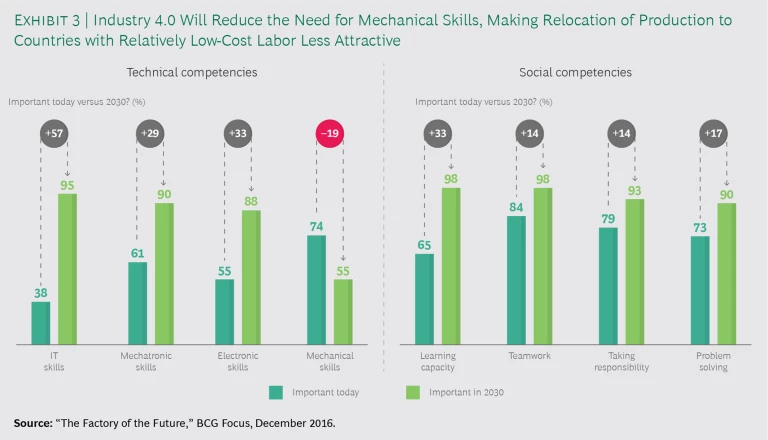

Many lessons from these notable transitions remain relevant for Middle Billion countries, but they may not be universally applicable. The manufacturing-led paths of South Korea, Singapore, and China, for example, required many years of massive investment and targeted, technology-intensive manufacturing to serve as steppingstones, and they were predicated on the assumption of continuing strong growth in global trade of manufactured goods. In today’s new global economy, which digital technology and economic nationalism are rapidly defining, growth in global trade and FDI has slowed dramatically. Industry 4.0 advanced manufacturing systems, such as autonomous robots and 3D printing, are making knowledge and proximity to markets bigger factors than labor costs in determining where companies locate their production. A Boston Consulting Group global survey also found that production managers expect factors such as IT, learning capacity, problem solving, and mechatronic skills to become more important in factories of the future, while they expect the value of mechanical skills to decline. (See Exhibit 3.) At the same time, productivity growth, which has not kept pace with rising costs in key emerging markets, is altering the economics of global manufacturing.

These trends have prompted some reshoring of capacity to developed countries and away from emerging markets, by making it more practical and economical to build customized products closer to customers. In discussing its recent report Trouble in the Making? The Future of Manufacturing-Led Development, the World Bank writes, “Companies once influenced by the prospect of inexpensive labor costs are beginning to favor locations that can better take advantage of new technologies.” While manufacturing will remain an important part of developing economies, it “may no longer be an accessible pathway for low-income countries to develop,” the World Bank says.

Why the Middle Billion Lag in Traditional Innovation

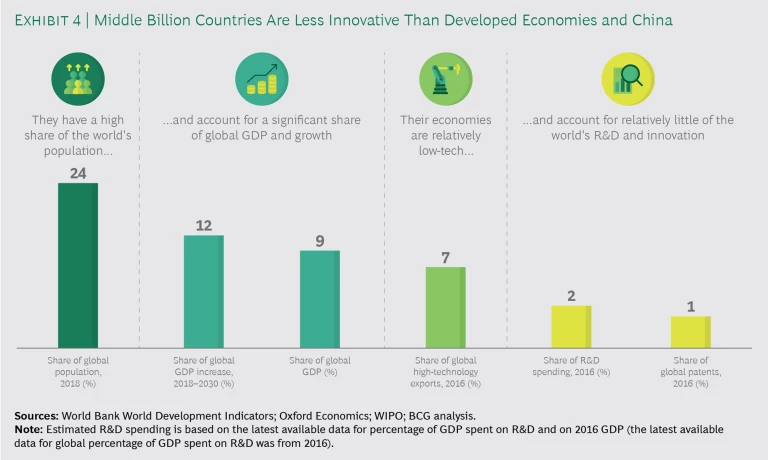

Given that the ability to foster, adopt, and adapt innovation is likely to play an increasing role in the development of Middle Billion countries, it makes sense to look briefly at their legacy performance. And here, if one uses conventional metrics such as R&D spending and patent production, the track record is not encouraging. Middle Billion nations account for 24% of the world’s population and 9% of its GDP, yet they generate only about 2% of global R&D spending and 1% of patent grants. (See Exhibit 4.)

In terms of conventional innovation capacity, few developing nations come close to China. In 2017, Chinese organizations obtained 249 patents per million people in the nation’s population. India obtained around 5.5 patents per million. Both figures are much higher than the corresponding numbers for Southeast Asia’s Middle Billion nations: Vietnam received only 1.6 patents per million, and Indonesia and the Philippines each just 1.3 patents per million.

China’s innovation system—driven by the combined power of its companies, universities, research institutes, and high-tech industrial parks—has become a pillar of its economic model. China is granted, on average, about 26 patents for every $1 billion of GDP. The only Middle Billion nations that have averaged at least 1 patent granted per $1 billion of GDP are Iran (8.6 patents) and Turkey (3.7). According to the 2019 Global Innovation Index report, published by Cornell, INSEAD, and the World Intellectual Property Organization, few Middle Billion countries have innovation systems that rate above the global average.

Why do Middle Billion innovation systems rate as underdeveloped when assessed by traditional indicators? Given their stage of development, these countries are in a better position to compete on cost in manufacturing and resource-based industries. Innovation is expensive, requiring significant investment and offering little or no short-term return. As a result, it is not the best investment—for government or for the private sector—in these economies. Moreover, universities in Middle Billion economies face constraints in scale and access to world-class research facilities, and they have limited opportunity to co-invest with businesses. For their part, the business models of many companies in Middle Billion economies emphasize directing innovative energies toward areas that promise an immediate edge against bigger foreign rivals—projects and process upgrades such as lean operations, quick response, and incremental improvements in design and features.

In addition to dealing with these resource constraints, Middle Billion economies—including those in Southeast Asia—tend to face specific challenges that relate more directly to government. For example, their business environments typically stifle innovators through overly burdensome regulations, slow-moving bureaucracies, and inadequate legal protections. In many cases, incentives favor investment in large industrial businesses rather than smaller technological enterprises. And governments often adopt protectionist trade policies to nurture manufacturing activities, even though research indicates that such policies often discourage innovation.

How Digital Changes the Game

The rapid emergence of the global digital economy presents significant opportunities for Middle Billion nations to reinvent themselves for the new game and become innovators in their own right. The ability to access knowledge everywhere through digital platforms makes innovation more global by simplifying efforts to apply advanced tools and techniques to new markets in order to create value. In the past, advanced knowledge resided in the leading science systems of advanced countries, and was effectively unavailable to Middle Billion nations. Now, however, knowledge is available virtually everywhere, including in nations that lack a world-class university. As a result, success depends less on formal scientific expertise—a traditional weakness in developing nations—and more on skills learned through general education, entrepreneurial drive, and an understanding of local markets.

Many Middle Billion countries also have large, rapidly growing user bases of digital technology that are already launching important startups. And they have latent pools of innovative talent that can serve as engines of wealth creation if brought into the formal sector and properly supported.

Southeast Asia is among the world’s most digitally connected and engaged regions. Internet usage in each of the ten member states of the Association of Southeast Asian Nations (ASEAN) is above the global average, according to research by BCG’s Center for Customer Insight (CCI). A recent CCI study found that 46% of Indonesians, 53% of Vietnamese, 64% of Thais, and 67% of Filipinos frequently use the internet. In fact, the average Thai, Malaysian, or Indonesian spends more time online—nine hours per day on a PC or tablet and four hours per day on a mobile phone—than does the average consumer in China, an emerging digital technology superpower.

What’s more, the ASEAN nations’ digital population is growing by around 14% a year, about the same pace as in India and more than three times as fast as in China. Vietnam’s internet population is projected to reach 82 million in 2020, and Indonesia’s will reach 215 million in 2020. A report by Google and Temasek projects that Southeast Asia’s internet economy will grow from $50 billion in 2017 to $240 billion in 2025. The promise of such dynamic growth makes the region fertile ground for startups that tailor their offerings to local needs and tastes. Southeast Asian internet companies raised $24 billion in funding from 2015 through the first half of 2018, and fundraising has been accelerating rapidly.

Indonesia, whose market for e-commerce, online travel, ride-hailing, and online ads is projected to approach $100 billion in 2025, according to the Google and Temasek report, has already produced four tech startups valued at more than $1 billion each: Gojek, Tokopedia, Bukalapak, and Traveloka. Gojek, for instance, is a ride-hailing, food delivery, and logistics platform that has more than a million registered drivers. Indonesia is also a booming market for financial technology platforms; from 2013 through 2017, Indonesian fintech companies raised $56 million in funding, according to the Tech in Asia website. Indonesia’s agricultural sector—in which professionals are establishing collectives and introducing modern farming technologies—and its health care sector offer digital innovators additional opportunities for success. Recent startups include iGrow, an online marketplace where the general public can invest in crops, and Halodoc, an online platform that connects patients, doctors, and other medical professionals.

Vietnam has produced two unicorns of its own: the gaming and mobile e-commerce platform VNG and, more recently, the fintech company VNPAY, which received $300 million in funding from SoftBank and the Singapore sovereign wealth fund GIC. Other prominent Vietnamese digital companies include Topica Edtech Group, one of Southeast Asia’s leading education platforms; the e-commerce platform Tiki; and the e-wallet app Momo. In the Philippines, conglomerates such as Ayala and Gokongwei are establishing investment funds for local tech startups.

Southeast Asia’s Middle Billion entrepreneurs can also benefit from linkages to innovation systems in more developed neighboring countries. Singapore, for example, has 30 innovation labs devoted to fintech and has launched 400 ventures in that space. An innovation hub called BLOCK71, part of Singapore’s sprawling one-north high-tech business and R&D park, offers mentoring, free plug-and-play space, and financial support to help local tech companies break into the US market. BLOCK71 also has an investment office and branches in San Francisco and Suzhou to help startups in the US and China that hope to expand in Asia. Bangkok’s True Digital Park aspires to become home to Thailand’s most complete and open ecosystem for digital innovation and startup support.

The average Thai, Malaysian, or Indonesian spends more time online—nine hour per day on a PC or tablet and four hours per day on a mobile phone—than does the average consumer in China.

Very little of this innovation is predicated on long-term R&D investments, relationships with academic institutions, or patent production, as has been the case for much of the innovation in developed markets. So while that type of long-term investment will remain critical for Middle Billion countries that are trying to catch up, evidence increasingly suggests that they should prioritize other metrics, such as venture-capital availability and new company creation within the technology space. Various sources have proposed new metrics to track progress in these areas.

Middle Billion nations seeking to advance innovation should prioritize metrics such as venture-capital availability and new company creation within the technology space.

Mobilizing the Asset of Hidden Innovators

Middle Billion economies have deep reservoirs of skilled talent and innovators hidden in the informal economy—entrepreneurs looking for the right opportunity, freelancers working in the gig economy, amateur inventors who dream of launching a business, self-taught computer programmers looking for a challenge, and household innovators who develop novel products or services in their spare time.

Often, innovation involves developing creative applications of technologies and modifying existing products to address an immediate need. It can also take the form of illicit activities, such as cracking gaming codes to accelerate to higher levels or hacking into computer networks around the world. Sociologist Jonathan Lusthaus, director of the Human Cybercriminal Project at the University of Oxford, attributes such activity to an “oversupply of technical talent” that local industries cannot absorb. Sophisticated hackers are so abundant in Vietnam, Lusthaus said in a recent article published by the business technology news site ZDNet, that the country may emerge as a new global hub for cybercrime, along with Russia and Ukraine. On the other hand, if Vietnam were to mobilize these resources appropriately, it could instead become a center for cybersecurity software and protection systems.

How can Middle Billion economies bring small entrepreneurs, freelance developers, and hidden innovators into the formal economy so they can gain access to innovation resources and pursue commercial opportunities? Vietnam’s independent coders and data miners, for example, are a valuable latent asset in developing industries beyond commercial cybersecurity solutions, big data analytics, and online gaming.

Policymakers and technology companies are beginning to recognize the benefits of broadening participation in national innovation systems to include people working independently of business, government, or academia. Indonesia, for example, has created an open data portal to serve as a source of government data and to offer help to developers—a practice that Jakarta, Bandung, and other metropolitan areas are following. Singapore is promoting crowdsourcing through its Open Innovation Platform, which fosters collaborative development of innovative solutions with startups, companies, and research institutes. India is opening public R&D facilities to private firms and individuals via an integrated online portal called the Indian Science, Technology, and Engineering Facilities Map.

Competitions offer another effective way to reach out to hidden innovators. As part of its effort to resolve horrendous traffic congestion in metropolitan Mexico City, for example, Laboratorio Para La Ciudad crowdsourced the immense daily task of mapping 1,500 bus, minibus, and van routes covering 51,000 kilometers in detail—recruiting hundreds of citizens to track routes through an Android app. It then made its Mapatón database available to all and teamed with Google to host a hackathon with cash prizes for teams that developed innovative digital mobility solutions. Google sponsors many such competitions through Kaggle, an online community with more than a million users in 194 countries that lets data scientists and machine learners share data sets and collaborate.

Hidden innovators who currently work outside business, government, or academia can make valuable contributions if encouraged to participate in national innovation systems.

Nurturing Middle Billion Innovation Systems for the 2020s

Middle Billion innovation systems that succeed in the 2020s will likely look different from those of advanced economies—and from those that propelled emerging markets in the twentieth century. Rather than embracing efforts to achieve economic growth by climbing the ladder in a broad portfolio of capital-intensive, science-driven manufacturing industries, plans will focus on carefully selected targets and will take a more market-driven approach. They will emphasize absorbing and applying the latest technologies and developing innovative applications that reflect a deep understanding of domestic demand and trends, as well as strategic judgment about where to create value in vast global digital ecosystems. And they will seek to mobilize and incorporate hidden innovators.

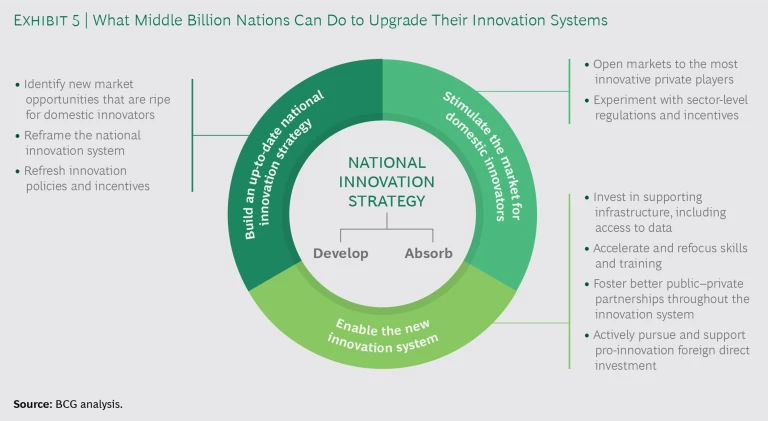

This represents a significant and discontinuous change from the way innovation systems worked in the past. In most Middle Billion countries, government will play a material role, since private sector activity alone is unlikely to achieve the necessary shift. Once governments have reframed their vision and policy with respect to their innovation systems, they will help stimulate demand in new opportunity areas and enable new components of the system. A Middle Billion government that wants to win in this new game must take steps to address three critical tasks: build an up-to-date national innovation strategy, stimulate the market for domestic innovators, and enable the new national innovation system. (See Exhibit 5.)

Build an Up-to-Date National Innovation Strategy

Building an up-to-date innovation strategy for a Middle Billion nation involves identifying appropriate new market opportunities, reframing the national innovation system, and refreshing innovation policies and incentives.

Identify new market opportunities that are ripe for domestic innovators. The first step in updating a national innovation strategy should be to review areas of domestic demand that local companies might serve in innovative ways. A recent example is the emergence of platform organizations in China—Alipay and Tencent—which grew digital payment systems to address the needs of many Chinese consumers, including those who were digitally connected but unbanked. Relevant areas of demand might arise through indigenous consumer habits or through gaps in the provision of social services, as in the case of Ping An Insurance Group, which developed the platform Ping An Good Doctor to provide digital health-care services to Chinese consumers who needed efficient access to general health-care advice. This process need not focus on purely white space; many good opportunities have been addressed by domestic providers in other countries and are ripe for the emergence of a local adaptation.

Reframe the national innovation system. Having established opportunity areas, governments should identify existing and potential innovation assets that seem most promising as means to address these opportunities within the new competitive paradigm. In particular, governments should take stock of their nation’s community of active, hidden innovators—including those whose activities may be illicit—to determine what they are doing and why.

Refresh innovation policies and incentives. Many Middle Billion countries have overlapping policies and initiatives in place to support innovation, often as a result of bureaucratic silos. We also encounter many policies in Middle Billion countries that are highly aspirational but unrealistic—for example, incentives to encourage the biotech industry, even though the national health-care system barely functions. Countries should instead adopt new policies to promote innovation in currently promising sectors and, in particular, to help hidden innovators. Although some governments may offer verbal support for innovators, their policies may encourage them to remain in the informal sector—by punishing their success with burdensome taxation, for example. During this policy review, governments should also consider adopting new metrics, such as measures of commercialization to complement conventional metrics such as patents.

Stimulate the Market for Domestic Innovators

Governments of Middle Billion countries can stimulate domestic innovation by opening markets to innovative private players and formulating appropriate sector-level regulations and incentives.

Open markets to the most innovative private players. In many Middle Billion countries, the government participates in the economy, giving it a disincentive to allow highly innovative local players to disrupt legacy business models. Yet among the most powerful tools that governments have at their disposal is the ability to create and stimulate demand for private players. Although certain strategic industries will remain state owned, this is an opportune time to open other sectors, where business models will eventually be disrupted, to give domestic companies freer rein to innovate. A prime example is digital media, an area where many Middle Billion governments retain stakes that go beyond strategic interests and where legacy business models face unprecedented disruption. This represents a significant opportunity for local innovators, as a large share of content will always remain anchored in local language and culture.

Experiment with sector-level regulations and incentives. Typically, regulations and incentives for innovation should differ significantly from one industry to another. Although it may be premature to focus on a shortlist of sectors, governments should use regulatory sandboxes and pilot schemes to experiment with promising sectors, and then reward national innovation by extending and deepening those schemes.

Middle Billion governments can stimulate domestic innovation by opening markets to innovative private players and formulating suitable sector-level regulations and incentives.

Enable the New National Innovation System

The process of enabling a new national innovation system includes investing in infrastructure, accelerating and refocusing skills and training, improving public–private partnerships, and supporting suitable foreign direct investment.

Invest in supporting infrastructure, including access to data. Much of the basic infrastructure for an innovation system, such as high-speed broadband networks, is rightly on the agenda of Middle Billion countries. But widespread access to databases will be increasingly important, too. Open data systems are essential for enabling innovators to experiment in real settings. Yet in many Middle Billion countries, a citizen can more easily gain access to highly detailed designs of the latest solar panels from other countries than see and interrogate data on the peaks and troughs of the local power grid. Governments can do a lot, at relatively little cost, to stimulate innovation simply by making nonsensitive information available to the public.

Accelerate and refocus skills and training. For some time, Middle Billion countries have committed themselves to improving science, technology, and engineering training, and many have academic and skills training programs in place. They should consider building on these systems by adding programs in a few key areas. The first is training in skills such as coding, data science, and computer-aided design to enable people to participate and create value in the innovation economy. Much training is available online at no cost; governments can publicize the importance of such training and work to integrate these skills into national curricula. The second area where additional programs are needed is training to help policymakers and officials understand and appreciate innovation. Many Middle Billion officials have expertise in traditional infrastructure, such as roads and irrigation systems, but they may lack a good framework for judging whether the independent creator of a combat game or a data-mining tool is a threat to society or a valuable asset.

Foster better public–private partnerships throughout the innovation system. Many hidden innovators and potential entrepreneurs would benefit from working in a more structured environment. Companies can do much more to engage with these individuals through their supply chains and training programs. For example, they can create innovation units that either employ hidden innovators or host them in a positive, well-supported environment. Governments can help by using state-owned enterprises in strategic industries to lead the charge. This might also help make some otherwise cautious state enterprises more agile and more open to innovation.

Actively pursue and support pro-innovation foreign direct investment. Despite the general desirability of promoting domestic innovators, foreign innovation leadership will make sense in many sectors. Few countries are sufficiently large and developed to maintain a domestic innovation edge in all sectors. Accordingly, countries should expect that some of the world’s most innovative companies will be permanent participants in their economies. (See “Five Things for CEOs to Consider When Expanding into Middle Billion Countries.”) Governments need to develop the ability to judge the quality and cost of innovations that are flowing into an economy through the activity of foreign players, in order to negotiate and manage such commitments at the point of entry. In areas with significant domestic markets that local players are unlikely to be able to address in the short term—such as specific health-care provision—governments should proactively seek and attract the world’s best players.

FIVE THINGS FOR CEOS TO CONSIDER WHEN EXPANDING INTO MIDDLE BILLION COUNTRIES

FIVE THINGS FOR CEOS TO CONSIDER WHEN EXPANDING INTO MIDDLE BILLION COUNTRIES

Global companies have a critical role to play in helping Middle Billion countries take on the innovation challenge, and they can strategically position themselves to participate in the ensuing opportunities. The following five points are important to keep in mind:

- Reframe the narrative with Middle Billion governments. The goal is to move from “We provide technology transfer in exchange for access to markets and a workforce” to “How can we use our assets and expertise to help enable local innovative activity?”

- Seek opportunities to deploy new business models. Unique demand conditions call for innovative models. Middle Billion economies can serve as excellent test beds for digitally driven or AI-based models that might be more difficult to deploy in developed markets, where existing structures are less flexible.

- Reach out to hidden innovators. While many hidden innovators will prefer to remain in small or entrepreneurial ventures, some of them will create more value by interacting with global firms. This represents a significant opportunity for firms—and the number of digital platforms through which hidden innovators can be reached and engaged is increasing.

- Consider repricing intellectual property. Often, firms in Middle Billion economies are unable to support the price of patented innovations from developed countries. But increasingly, firms are finding ways to commercialize innovations specifically for developing economies—without eroding prices in home markets.

- Recruit and develop talent early. Few things that global firms can do are more valuable to Middle Billion countries than developing their workforce, and firms will often find that they need to invest longer than usual to develop such talent. But the returns will be outstanding for both sides. Well-regarded training programs remain among the most powerful recruiting tools in countries whose educational systems may be straining to keep up with market needs.

The post–World War II era of globalization, characterized by steady growth in global trade and cross-border investment, helped catapult much of the developing world out of poverty and into the middle class. A number of impoverished nations that seized the opportunities with farsighted, well-executed strategies now rank among the world’s wealthiest. In the new global era, however, development paths that worked in the twentieth century are likely to be less successful. At the same time, technological change, the rapid spread of digital skills, and the proliferation of connectivity are opening tremendous new opportunities for the citizenry of developing nations. With national innovation systems and business environments designed for the 2020s, Middle Billion countries can become the next cluster of nations to emerge as engines of innovation, investment, and wealth creation.