The telecom industry remains one of the bottom performers across all 33 industries tracked in BCG’s latest value creators study, coming in 24th for the 2014–2018 period. Average annual TSR dropped by one-third, from 9.9% during the 2013–2017 period to 6.6%. The industry is struggling with familiar challenges ranging from regulation and rising capital spending to declining margins and ARPU. In North America and Europe, for example, ARPU has experienced five-year average annual declines of −5% and −3%, respectively.

Pathways to Success

Despite the industry’s relatively weak performance, 15 of the 63 operators in the sample managed to generate double-digit annual returns. Besides cutting costs to improve margins, all of these operators demonstrated aggression, breadth of scope, investment in digital capabilities, and quality of execution. (See Exhibit 1.)

- Number-two telecom value creator, Sweden’s Tele2, has succeeded by sticking closely to its strategy of fixed-mobile convergence and consolidation. Its merger with Com Hem, a fixed-line carrier, also of Sweden, was well received by investors. Tele2’s share price rose by 20% in the week after the company reported better-than-expected cost savings from the union. The stock also rose by 9% in late November after the EU approved the merger of the operations of Tele2 and T-Mobile in the Netherlands.

- PT Telekomunikasi Indonesia, the 4th-ranking telecom value creator, has been investing in its network to support fixed-broadband usage and drive revenue growth. Telkom Indonesia, as the operator is commonly known, also has a majority stake in the country’s leading mobile operator, Telkomsel, and has thus indirectly benefited from rising mobile penetration in remote regions. Both companies are investing in digital businesses and internal digitization to counter the threat of over-the-top services, which are cutting into the growth in voice and SMS traffic.

- Orange, the number seven telecom value creator, has relied on a series of smart moves and investments focused on improving the customer experience. It is generally recognized for boasting the best network experience and quality based on what matters most to customers in key geographies. Orange also has radically simplified and digitized its offers, improving service efficiency in the process.

Dialing into a Digital Future

Creating value in telecom is essential because the industry enables and supports an ever-expanding range of economic activities. Our research with the World Economic Forum in Europe shows that investments in telecom infrastructure generally pay for themselves, as measured by GDP growth, in 7 to 18 months . But the payback for operators themselves can take as long as ten years.

National policymakers need to address this disconnect so that nations can take advantage of broadband—what Brad Smith, Microsoft’s president, has called “ the electricity of the 21st century .” Without a strong telecom infrastructure, many of the capabilities that drive value creation in media, tech, and the broader economy, such as the cloud, will be hampered.

Creating value in telecom is essential because the industry enables and supports an ever-expanding range of economic activities.

In the meantime, operators cannot sit on the sidelines waiting for regulators to act on their behalf or for industry economics to magically improve. They must grab a piece of the future by reshaping their organizations and making a few fundamental changes.

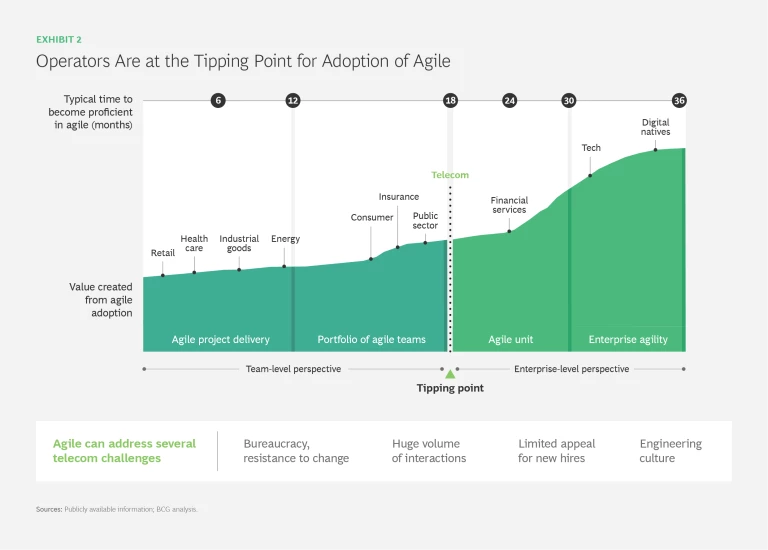

- Digital Transformation of the Core. Operators should be actively digitizing their entire value chain from end to end, as companies such as Telstra and KPN have started to do. All the pieces matter—network, support functions, and customer experience. As many companies have discovered, it is nearly impossible to offer simple and intuitive customer journeys on the front end if the back end is complex and inflexible. The transformation should cover both technology architecture and people architecture—the way employees work and cooperate. “Agile” has become code for a range of activities that involve test-and-learn methodologies, cross-functional teaming, and decentralized and empowered decision making, which are all essential workplace tools. With a concerted push, the telecom industry could move past the tipping point and achieve the benefits of agile at scale. (See Exhibit 2.)

- Simplification of Products and Processes. Consumers and business customers demand the same ease of use from their telecom operators that they receive from Amazon, Deliveroo, and Zalando. This shift toward intuitive, seamless customer journeys represents a sea change for the telecom industry, which historically has been known for its product-centric take-it-or-leave-it service. Product simplification and digitization go hand in hand. Without a simple, easy-to-understand product architecture, the benefits of digitization will be limited.

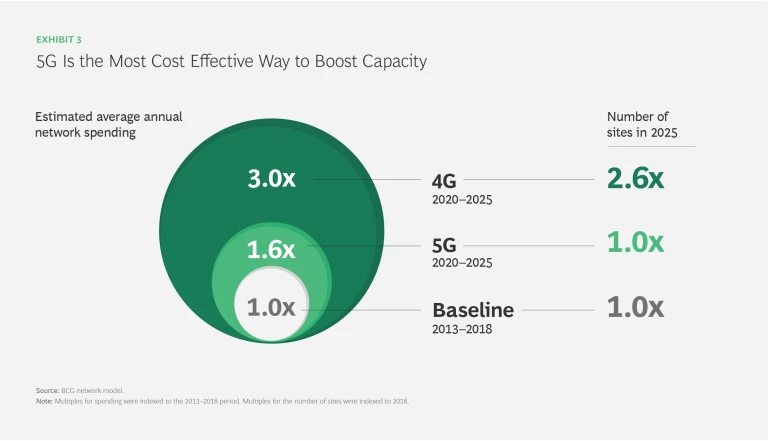

- Converged Connectivity, Value-Based Network Investments, and 5G Leadership. Operators need to rethink their fixed and mobile network investments. In the short term, they should be optimizing deployments through advanced analytics and AI (more on that below) in order to lower the cost base. Despite regulatory pressure to invest in fiber everywhere, they should make neighborhood-by-neighborhood decisions based on an analysis of competition and potential value creation. At the same time, mobile operators should be preparing to upgrade to 5G. Advanced 5G technologies are the best and least costly way to accommodate traffic increases. (See Exhibit 3.) But 5G investments will pay off only if operators also create new premium-pricing models that, for example, support mission-critical Internet of Things (IoT) services. This new approach will require them to develop business cases built around demonstrating value to their customers, which will allow operators to move away from one-size-fits-all pricing.

- In-Market Consolidation. In Europe and Asia, where many nations still have too many operators, the industry would benefit from regulatory relief to permit consolidation and achieve the economies of scale available in other markets. Only two of the top ten telecom value creators, for example, are based in Europe, where most markets have three or four operators. Even with the EU’s approval of the Tele2 and T-Mobile merger in the Netherlands, for example, that small market still has three mobile operators. In other countries, regulators have often tried to introduce an additional competitor by mandating the creation of a mobile virtual network operator.

- Adjacent Growth Opportunities. Telecom operators should not let their mixed record creating value through new businesses outside of their core stop them from pursuing such areas as the IoT, smart homes, smart cities, cybersecurity, and other B2B services, especially where these services are network-centric or mission critical. In an increasingly connected world, operators are in a strong position to take advantage of these opportunities. But they need to play it smart, moving up the stack only when they have a clear advantage over their competitors, which are often the global tech giants. Verizon, for example, sees such an advantage in telematics, where it has built a vertically integrated business helping companies stay connected with their fleets and field staff.

- AI-Enabled and Data-Driven Innovations. Similar to most other industries, telecom has many opportunities to leverage AI and data analytics to save costs, generate revenue, and even engage in breakthrough business models. In particular, on the cost side, operators can use AI to improve field force management and network rollout and optimization. On the revenue side, AI can enable stronger capabilities in churn management, pricing and acquisition, and marketing activities such as next-best actions.

The telecom industry is too critical to national prosperity to be a bottom performer. As recently as three years ago, it was in the

middle of the pack

. As a highly regulated industry with universal service obligations, telecom may never be a highflier. But the decisions of management over the next five years will likely shape the future of these companies—and of their home countries as well.