While startup activity in blockchain has slowed , large companies are still piloting and pursuing uses for this cryptofortified distributed-ledger technology. But just how committed are they to blockchain ? To figure that out, we chose to look at two indicators: patent applications and hiring data.

The results of our investigation show that the finance industry is especially active, investing in both technology and people. Technology companies, especially IBM, are relatively strong in both patenting and hiring activity, too.

It’s a mixed bag for other industries, however. Consumer and retail, health care, and cybersecurity, for example, display fairly high patenting activity but not much hiring.

These findings emerged from an analysis by Boston Consulting Group and Quid, a data analytics and visualization firm. The analysis drew on a broad variety of data sets to shed light on the state of blockchain.

Blockchain’s Hot Spots

Patenting activity in blockchain is rising quickly from a small base. The number of global blockchain-related filings has grown from just 26 in 2013 to 860 in 2017, the most recent year with complete data.

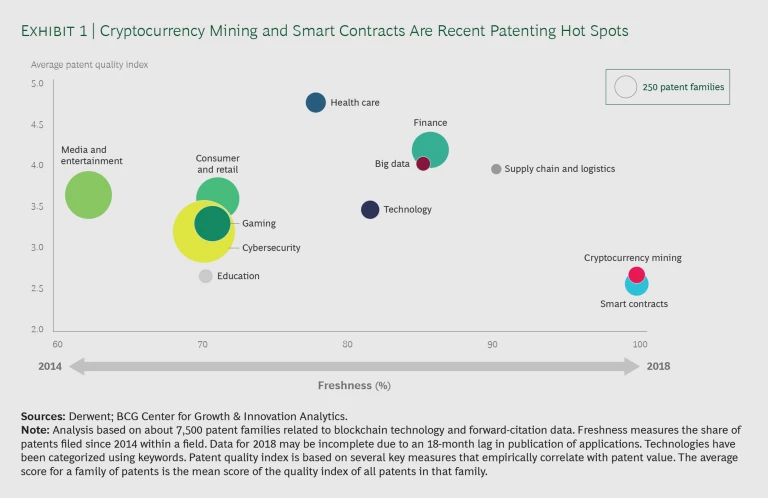

An Industry Lens. Exhibit 1 shows the quantity, quality, and freshness, or relative age, of blockchain patents within different industries. We measured quality by combining several key indicators, including an age-adjusted citation analysis; patents are more valuable when they are cited by other patents.

The finance industry hit the trifecta—strong in the number of patent applications, overall quality, and age. Technology, health care, and supply chain and logistics also performed well on all three dimensions.

Judging by raw numbers alone, cybersecurity has been the most popular application area: 1,702 blockchain patents and applications related to cybersecurity were issued or published in 2018, approaching twice the number for consumer and retail, the next most popular field. In April, for example, PayPal was awarded a cybersecurity patent to protect users from crypto-enabled ransomware. The overall quality of blockchain patents in cybersecurity, however, is not very high. Most recently, companies have started filing patents to protect cryptocurrency mining and smart contracts.

Cybersecurity has been the most popular application area, with 1,702 blockchain patents and applications issued or published in 2018.

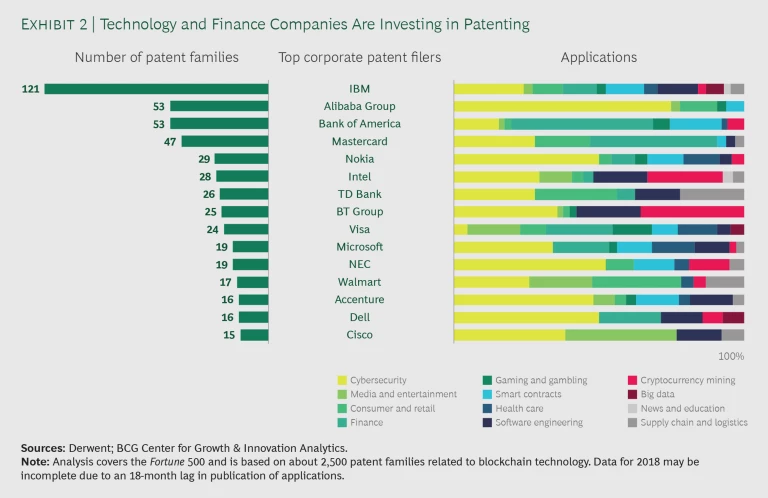

A Company Lens. We also analyzed the patent activities of individual companies. Among the Fortune 500, the leading filers were largely technology companies (IBM, Nokia, and Intel), financial firms (Bank of America and TD Bank), and retailers (Alibaba Group and Walmart). (See Exhibit 2.)

Many of these companies are pursuing blockchain businesses. For example, IBM has launched IBM Blockchain World Wire, a global payments platform; the company has also joined forces with Maersk to create TradeLens, a blockchain-based global logistics system.

Competitors sometimes take different approaches to pursue blockchain innovation. Within the retail and ecommerce industry, Alibaba is filing blockchain patent applications on such back-office functions as data processing and storage, business service processing, and security, while Walmart is focusing on front-end systems that facilitate shopping, payments, and delivery. In financial services, Bank of America is playing more at the application level, seeking protection for innovations related to the storage and protection of cryptocurrencies, while TD Bank’s patent portfolio covers core blockchain and distributed-ledger technologies.

Hiring Spree

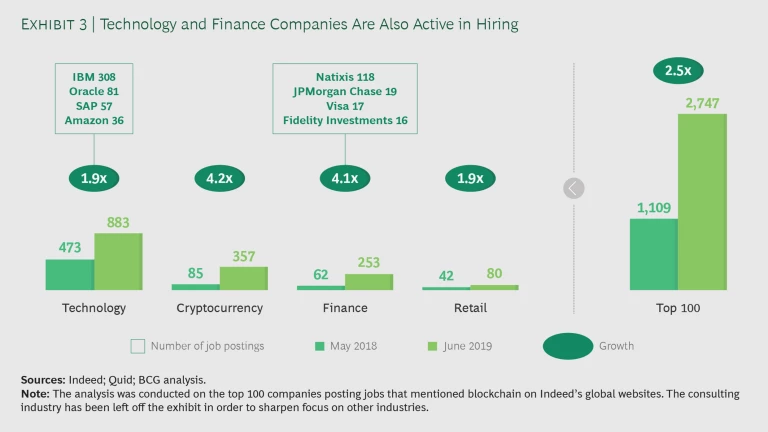

Similar to patenting activity, hiring data can indicate a company’s confidence in the growth and potential of blockchain. The number of job openings mentioning blockchain posted by the top 100 companies on Indeed reached 2,700 in June 2019—more than double the number posted by those same companies in May 2018.

Consulting, technology, cryptocurrency, finance, and retail had the most job postings mentioning blockchain.

The consulting industry leads the list, followed by technology, cryptocurrency, finance, and retail. Cryptocurrency and finance are the fastest-growing industries. (See Exhibit 3.)

Within finance, midsize French corporate bank Natixis was the source of nearly one-half of the job postings mentioning blockchain analyzed in June 2019. JPMorgan Chase, Visa, and Fidelity Investments were also frequent posters of such job ads. Within tech, IBM was the top online seeker of jobs in both June 2019 (308 posts) and May 2018 (166 posts)—in addition to being the number-one patent filer among the Fortune 500.

As a corporate tool, blockchain is still in the early days: a mid-2019 analysis of the transcripts of earnings calls of the Fortune 100, for example, showed that companies are not talking about it. But patent data, in particular, suggests that its use in such fields as health care, big data, supply chain and logistics, and smart contracts could shortly be on the rise. In 2014, for example, only one inventor sought protection in the US for blockchain technologies related to smart contracts. Just four years later, in 2018, nearly 100 US patent applications covering blockchain and smart contracts had been filed.

If blockchain goes mainstream, one of its main uses will be as a secure playing field for third parties who lack trust to come together and do business. It would not be surprising to see such fields as supply chain and logistics and smart contracts step out of the shadow of technology and finance.

Given such an environment, the best approach for most companies is to continue to pilot but be prepared to scale. The history of digital technologies is that they go one of two ways after hitting an inflection point: they either peter out or explode. Don’t get caught on the wrong side of the inflection.