The next battleground in media is figuring out how to acquire, retain, and establish direct relationships with subscribers. As media companies enter this contest, they will discover that subscribers are more alike than different in their reading and purchasing habits.

Younger generations, for example, still subscribe to print publications, and older generations like to share digital subscriptions almost as much as their children do.

But—and this is a big but—the generations respond to pitches and promotions in very different ways. Older generations are looking for convenience; younger generations want a deal.

The days of a one-offer-fits-all approach are long gone.

To reach new subscribers, media companies need to convert consumers who currently access their content through search, social, and aggregation channels. They should direct customized offers to specific audience segments and deliver highly curated content to individual subscribers. The days of a one-offer-fits-all approach are long gone.

The Surprising Findings About Subscriptions

To gauge the potential for the news media to move away from digital advertising—and the tightening grip of Google, Facebook, and ad-newcomer Amazon—and toward a direct-to-consumer relationship, we conducted a survey of 400 US consumers who broadly represent the nation’s profile.

Subscriptions matter. About 50% of respondents have a paid digital or print subscription to a newspaper, magazine, or newsletter. Although the share of subscribers rises by age, younger generations are active subscribers.

This finding suggests that the millennial generation resists stereotyping. Raised in the era of Facebook, YouTube, and Snapchat, millennials have a reputation for wanting content to be free, yet they are willing to pay for content they find valuable. Although the “Trump bump”—a surge in subscriptions after the 2016 presidential election—may explain the initial jump in younger generations’ willingness to pay, the effect is enduring.

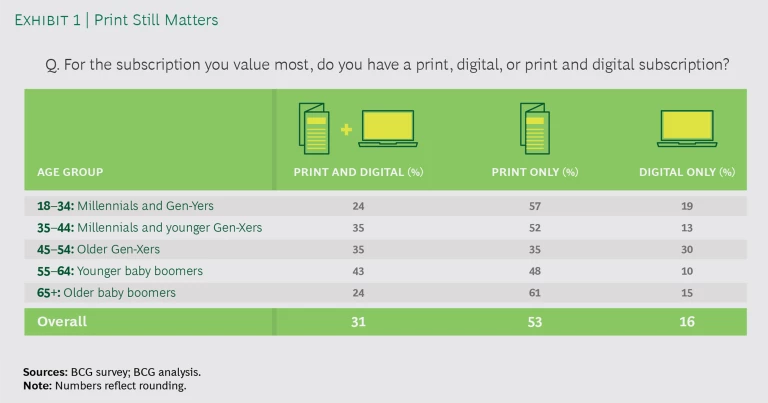

Print lives. For the youngest and oldest subscribers, print is a more popular option than digital or combined digital and print options. In fact, the 18- to 34-year-old group is nearly as likely to have a print subscription to their favorite publication as is the 65-or-older group, while those aged 44 to 55—who remember the pre-internet era—are the least likely print subscribers. (See Exhibit 1.)

All content is not created equal. Consumers interested in politics and news are much more likely to subscribe to a publication than are those who prefer entertainment. About two-thirds of consumers who follow politics and news have a subscription in those fields, compared with only about 40% of those with an interest in entertainment. This finding is consistent across age groups. But consumers aged 18 to 34 are much more attracted to entertainment, with 39% citing it as their favorite topic, compared with 14% and 16% who point to news and politics, respectively.

Sharing subscriptions is popular—and not just among the young. Nearly half of consumers aged 44 or under share their subscriptions, as do 45% of younger baby boomers (those aged 55 to 64), perhaps with their adult children. Surprisingly, older Gen-Xers are less likely than the elderly (aged 65 or older) to share. (See Exhibit 2.)

Younger generations try to pierce paywalls. Members of younger age groups have a starkly different attitude than their older peers about trying to read paid content for free. While 78% of those aged 18 to 34 have attempted to circumvent restrictions on the number of free articles offered online by a publication, just 33% of those aged 55 to 64 and 25% of those 65 or older have done so.

But the young won’t actively subscribe. Younger consumers, especially those under age 45, don’t just try to avoid paying. They are also unlikely to seek out a subscription. But media companies should not lose hope. These consumers are willing to subscribe in response to great offers, especially those built around a low price, a free trial, or unique content. Older consumers are more likely to pursue a subscription on their own, especially when the deals are convenient and cost-effective compared with newsstand purchases.

Brand loyalty matters across generations. Brand loyalty, highest among the older age categories, is nonetheless strong even among the young. Nearly one in six of those aged 18 to 34 said that their decision to subscribe was influenced by the fact that their family always had a subscription, and more than one-quarter indicated brand loyalty was a factor in their choice, second only to price.

Cutting Through the Clutter to Build Digital Subscriptions

While the survey results are encouraging and offer media businesses a path forward, companies have hard work ahead. Despite consumers’ willingness to subscribe, many are accustomed to reading content on news aggregation sites, such as Google News or Apple News, or through their Facebook or Twitter feeds. The launch of the paid Apple News+ will not make the process any easier for media companies looking to establish direct connections with their customers. Here are some ways to reach these consumers.

Move beyond search, social, and aggregation. Media companies need to experiment with ways to convert consumers who engage with them through search, social media, and aggregation into paying customers. One idea is to design social campaigns to create dialogue with specific consumer segments according to their values and experiences. Another: link the social interface more closely to the customer’s online interactions with the publication.

Surface and curate content for specific audiences. Given that younger generations are attracted to offers, media companies should create appealing content experiences. They do not necessarily need to create new content but can surface existing content that is relevant for particular audiences and easily accessible via precision marketing. Media companies will need to develop data analytics capabilities in order to understand potential customers and create personalized packages of content.

Create digital-only and personalized offers. Different audiences respond to different deals. To date, media companies have been slow to revise their one-size-fits-all offers. Gen-Xers, for example, are more likely to respond to ad-free access and exclusive invitations to events, while baby boomers appreciate coupons and gift cards.

Double down on soft-news titles. Media companies that offer entertainment, services, and other forms of soft news face a double whammy. Because they erected paywalls later than many other news-oriented media companies, they are still on the steep slope of the learning curve, and their core audience is younger and more likely to try to evade paywalls and avoid subscriptions. They have more work to do than other media companies, but—given that younger generations are more interested in entertainment than news—they have greater opportunities as well.

Measure, analyze, and adapt. Media companies should actively collect data on user engagement along the marketing funnel to refine audience segments and adapt the customer experience.

Media companies that offer entertainment, services, and other forms of soft news face a double whammy.

The battle for subscriptions is increasingly relevant across industries, as pay-as-you-go business models and the desire for recurring revenue take hold. If media businesses play their cards right, they could show other companies how to thrive in the digital era.