Foreword by Lise Kingo, CEO and Executive Director UN Global Compact

Foreword by Lise Kingo, CEO and Executive Director UN Global Compact

We are at a historic moment in time. Today’s decisions and actions will define the lives and circumstances of generations to come. The choices are ours to make.

We could continue with business as usual on a path that is fast-forwarding us toward points of no return with respect to global warming, the loss of biodiversity, and a growing struggle for access to our global commons: arable land, fresh water, clean air, and healthy oceans. It takes little imagination to foresee how things could spin seriously out of control, undermining peace, justice, economic stability, and global cooperation. The challenges facing our world are multidimensional and interconnected, requiring integrated, collective, and concerted action.

Or we could choose to turn risks into opportunities by following the roadmap that our governments—in consultation with business, civil society, and citizens—universally agreed upon in 2015: the Sustainable Development Goals (SDGs) and the Paris Climate Agreement. One thing is certain. Without the vital contribution of business, we will not be able to achieve these ambitions.

As the world’s largest corporate sustainability initiative, the UN Global Compact supports thousands of responsible companies on this journey, providing tools, learning opportunities, accountability, and encouragement. Already, 80% of our participating companies are actively engaged in pursuing the SDGs, with the Ten Principles of the UN Global Compact as the foundation of their efforts. Increasingly, the SDGs are driving the strategic business agenda, specifically the ways that companies can drive innovation and turn the risks of the world into opportunities.

However, to achieve the momentum and make the great shift that is required if we are to have the world we all want, we will need to find ways to better measure and manage progress on every one of the SDGs. Only by doing so can we ensure that our shared ambition is enough to deliver the impact required.

In 2017, Boston Consulting Group made an important contribution to this effort. With its report on Total Societal Impact, BCG presented businesses with a strong case for another lens—in addition to shareholder value creation—for strategy setting. The report demonstrated that, across four different industries, the companies that integrate sustainability with their core business and perform well across nonfinancial indicators related to environment, social, and governance concerns also outperform financially.

This year, a follow-up study to the report is helping provide even more evidence in support of the case for sustainable business. This report puts the spotlight on what we can learn from leaders in societal impact. Businesses in the Nordic countries were among the founding signatories to the UN Global Compact, and to this day, many of those companies are forging ahead, emerging as models of sustainable business leadership. I am pleased to see the corporate sustainability efforts of Nordic companies featured throughout this report and to commend them for their ongoing commitment to our collective learning journey.

We need to scale up faster, and we need to reach positive tipping points that will turn corporate sustainability from a nice idea into a practical mainstream reality for businesses everywhere.

The 17 SDGs and their 169 associated targets provide a scorecard for the world’s progress, requiring big and small companies—as well as the investment community, which can help steer the $ 2.5 trillion needed annually—to lead the charge toward achieving the SDGs and a more sustainable future.

I am certain that as you read this report, you will be inspired by the many positive examples of societal impact showcased here. Join our global movement of sustainable companies and stakeholders to create the world we all want.

A Spotlight on the Nordics

Climate change. Income inequality. Human rights abuses. Society today faces massive challenges that, left unaddressed, will have dire consequences. No doubt there is significant global effort aimed at tackling these challenges, most notably through the drive by UN member countries to meet the Sustainable Development Goals (SDGs). To achieve real progress, however, the private sector must also take significant action.

The good news: society’s most pressing issues present massive business opportunities. A study Boston Consulting Group conducted in 2017 found that companies that do well in delivering total societal impact (TSI) —the aggregate of their impact on society—boast higher margins and valuations. (See Total Societal Impact: A New Lens for Strategy, BCG report, October 2017.) Continuing our study of company performance and TSI, we have zeroed in on some of the leaders to understand what distinguishes those star performers. That work has revealed that when it comes to creating positive societal impact, companies that are located in one part of the world—the Nordic countries—consistently outperform companies in other regions.

To understand why Nordic companies excel—and what others can learn from them—we conducted an in-depth study of TSI in Denmark, Finland, Norway, and Sweden that included data analysis and extensive interviews with Nordic companies, investors, and other key stakeholders. We found that, first and foremost, Nordic strength in TSI is a function of visionary and capable company and board leadership. Leaders at many Nordic companies have a deep commitment to creating positive societal impact—a progressive view that sets the foundation for their strategy. That focus is strongly influenced by three groups of powerful external stakeholders: owners and investors focused on environmental, social, and governance (ESG) issues; government policymakers who expect companies to be corporate-social-responsibility leaders; and members of the general public who value companies focused on societal impact.

Nordic strength in TSI is a function of visionary and capable leadership.

Our study also assessed the ways that Nordic companies deliver such impressive results. BCG’s previous work identified How Companies—and CEOs—Can Increase TSI and TSR . This study revealed that Nordic companies excel at a critical subset of those factors, embracing best practices in three ways:

- Exhibiting strong leadership and collaboration to maximize societal impact

- Embedding TSI in the core business

- Ensuring that their ESG reporting is clear and sophisticated

All companies, regardless of where they operate, can learn from and adapt the Nordic best practices to their own environment. By doing so, they can not only enhance their business performance but also help move the needle toward overcoming some of the world’s most pressing challenges.

Total Societal Impact and Nordic Leadership

TSI is the overall impact a company has on society. Companies that bring a TSI lens to their strategy are able to strengthen not only the impact they create but also their financial performance. Our initial work on TSI involved a close examination of four industries—consumer packaged goods, biopharmaceuticals, oil and gas, and retail and business banking. We used ESG performance as a proxy for TSI. (See the sidebar “The Business Case for TSI.”) On the basis of that insight, we opted to explore and, perhaps, determine whether or not there is meaningful regional variation in TSI performance and, if so, which parts of the world are leading and why.

The Business Case for TSI

The Business Case for TSI

How does one begin to measure the full impact—economic, social, and environmental (ESG)—that a company has on society? As yet, there is no well-established methodology for doing this, but we can gain insight into total societal impact by assessing how well companies are performing in certain important ESG areas.

BCG tackled this by first identifying the ESG topics that are most important in each of the four industries we studied. We then assessed the relationship between ESG performance in those topics and two key financial variables: valuation multiples and margins (EBITDA margins and gross margins). For banking we used net income margin, a more relevant metric for that industry.

Our quantitative analysis revealed a solid link between performance on specific ESG topics and both valuation multiples and margins. In each of the four industries we analyzed, top performers in specific ESG topics enjoyed valuation multiples that were 3% to 19% higher, all else being equal, than those of the median performers in those topics. And top performers in certain ESG topics had margins that were up to 12.4 percentage points higher, all else being equal, than those of the median performers in those topics.

Although our analysis proves correlation and not causality, there is reason to believe that good performance in ESG drives improved business performance. It helps companies establish and maintain the license to operate in new markets, reduces costs and risk in supply chains, and strengthens the company’s brand and its ability to attract and retain talent. Ultimately, the two factors—strong ESG performance and strong financial performance—may create a virtuous cycle whereby strength in one powers performance in the other.

TSI Performance, by Region

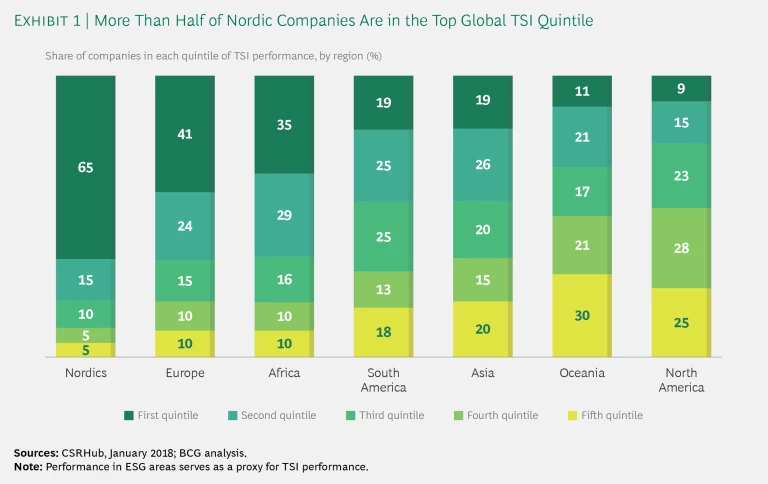

To explore regional variations of TSI, we used data from CSRHub, an aggregator of ESG data, to analyze the performance of more than 8,000 public and private companies worldwide—including more than 400 Nordic companies—to define global quintiles for overall ESG performance. We then analyzed the results by region, country, and industry to understand how ESG performance differed across those categories.

Breaking the full universe of companies into quintiles on the basis of ESG performance, we then examined the proportion of companies per region that fell into each quintile. (See Exhibit 1.) The Nordics immediately stood out: 65% of Nordic companies scored in the global top quintile. The next-best region trails far behind: 41% of companies in Europe (excluding the Nordics) are in the global top quintile. At the other end of the scale is North America with just 9% of companies in the top quintile.

Nordic companies’ market-leading performance on ESG does not come at the expense of financial returns. The TSR and valuations of the Nordic companies in our study were in line with those of the overall market—a finding that contributes to the growing body of evidence that a focus on ESG does not hamper shareholder returns.

This pattern holds for all three ESG areas—environmental, social, and governance. Nordic companies have the highest percentage of companies in the top quintile of performance in each area.

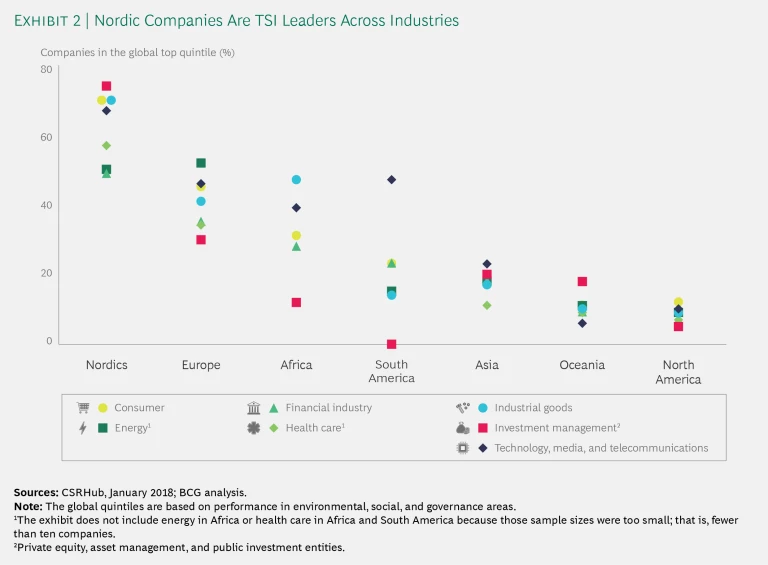

There is, of course, some regional variation at the industry level. But here too, the Nordics stand out. (See Exhibit 2.) In every industry but one the Nordics have a higher portion of companies in the global top quintile than any other region. The only exception is energy, for which the Nordics have the second-highest share of companies in the top quintile.

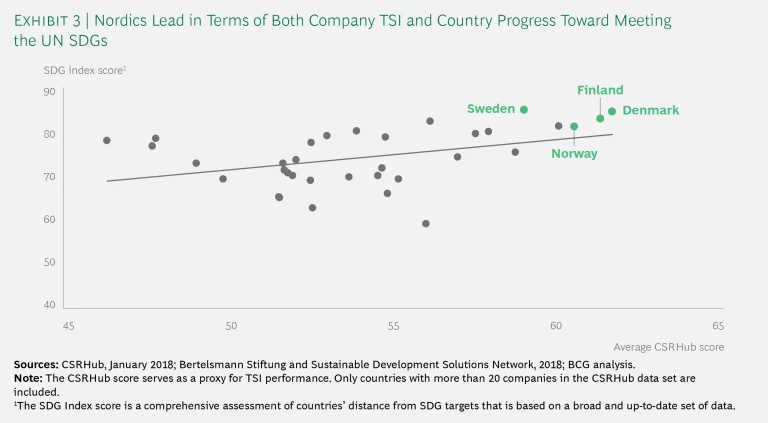

It is not surprising that the strong Nordic corporate performance on TSI is reflected in Nordic countries’ progress in achieving the UN SDGs. (See Exhibit 3.) Furthermore, the Nordics are leaders in creating well-being for their own populations. Nordic companies are top performers in Striking a Balance Between Well-Being and Growth , a diagnostic that tracks the relative well-being of countries around the world. (See Striking a Balance Between Well-Being and Growth: The 2018 Sustainable Economic Development Assessment, BCG report, July 2018.) In fact, Finland, Denmark, Norway, and Sweden have been in the top ten since the ranking was launched in 2012, Norway claiming the top spot every year.

Drivers of Nordic Performance

Given the regional variation we found, we wanted to identify and understand the key drivers behind the strong Nordic performance. Certainly, CEOs and boards of many Nordic companies have been early movers in the effort to integrate societal impact into the corporate mission—regardless of external support or pushback. At the same time, our research made it clear that the environment in which Nordic companies operate is also a critical driver of their TSI success. In particular, three powerful stakeholder groups influence and shape Nordic companies in ways that promote focus on societal impact.

Investors. In the Nordics, asset owners, asset allocators, and asset managers play important roles in driving corporate TSI performance.

Nordic asset owners—including the state and wealthy families, as well as asset allocators such as pension funds—have higher TSI expectations of their assets than owners in other regions, and some have relatively long time horizons for their investments. In Norway, for example, the state owns significant stakes in companies such as Equinor, DNB, and Telenor. All told, Norway’s government owns 35% of the shares in the country’s 25 largest companies. And the governments of Sweden, Finland, and Denmark hold stakes in, for example, Telia Company, Neste, and Ørsted, respectively, and have pushed companies in which they are invested to focus on critical societal issues. In 2007, Sweden became the first country to demand sustainability reports from state-owned companies, and Norway has stated explicitly that it expects companies with state-ownership to be front-runners in their sectors when it comes to corporate social responsibility (CSR). Denmark also requires all state-owned companies to report on CSR.

In addition, wealthy families are also significant, influential investors who drive TSI. The Wallenbergs in Sweden have transferred much of their wealth to the nonprofit Wallenberg Foundations, which donate more than $200 million annually to research. Combined, the Wallenberg Foundations are also the largest owners of Investor AB, which in turn holds big stakes in SEB and EQT Partners, two prominent asset managers, as well as several world-class companies including Atlas Copco, Electrolux, and Ericsson. The family has a history of focusing on long-term returns through its “buy and build” strategy, as well as on having a positive impact on society overall.

Asset managers measure and engage with companies on their TSI performance.

At the same time, industrial foundations in Denmark control several large companies including Novo Nordisk, Mærsk, and Carlsberg. Those foundations, along with Nordic pension funds, such as the Swedish AP funds, have brought an ESG focus to their investments for decades, and they support and encourage long-term, societally focused thinking at the companies in which they have invested.

Furthermore, Nordic asset managers are sophisticated and educated on ESG screening and engagement. Nordic investors, for example, are overrepresented as signatories on Principles for Responsible Investment, a UN-sanctioned charter that reflects a commitment to improving ESG performance in the investment portfolio.

Ultimately, asset owners, allocators, and managers focus on TSI within their portfolio companies as a means of reducing risk and ensuring long-term profitability. As a result, asset managers measure and actively engage with companies on their TSI performance, incentivizing companies to prioritize it. (See the sidebar “Investors’ Best Practices.”)

Investors’ Best Practices

Investors’ Best Practices

Many Nordic asset owners and managers are focusing their attention on how effectively the companies in their portfolio are delivering total societal impact (TSI). They stand out for their ability to integrate that focus into their investment strategy. On the basis of our study of Nordic investors, we have identified three best practices that distinguish the front-runners.

- Embedding an ESG Focus in All Investment Activities. Forward-looking Nordic investors go well beyond eliminating investments in certain industries and in companies that perform poorly in environmental, social, and governance (ESG) areas. Rather, they proactively assess the ESG performance of existing and potential investments with the goal of identifying not only companies that have strong TSI performance but also those that have the potential to improve. In addition to offering special funds that focus on companies with outstanding ESG performance, these leaders make ESG performance a factor in decision making throughout their portfolios, with ESG experts typically working alongside traditional investment professionals. Moreover, they consider their commitment to ESG to be a competitive advantage, and they use ESG review both as a tool for boosting long-term investment returns and as a selling point for attracting new types of investors.

- Engaging Directly with Companies on Key ESG Issues. Nordic investment leaders have well-established processes for engaging on ESG issues with the companies in which they invest. For example, they regularly hold company meetings for the specific purpose of evaluating and discussing ESG performance. And in many cases, they have established dedicated stewardship teams that are well trained to drive ESG reviews and discussions. They set clear expectations for ESG performance, requesting the same type of ESG reporting data from all their portfolio companies in order to ease the reporting burden for companies in their portfolio.

- Taking a Global Leadership Role. Many leading Nordic investors are public advocates for focusing on ESG performance. This includes pushing for greater precision in ESG measurement overall. Some investors have developed sophisticated dashboards for monitoring the ESG performance of their investments. And they are leaders in the drive to move beyond tracking company activities related to ESG—what are often described as inputs—to measuring impact on society. It is not at all unusual for them to use their votes at company annual meetings to promote TSI issues. And they build coalitions with other investors with the goal of promoting TSI, maximizing their voice and impact.

To understand what these best practices look like in action, consider the investment firm EQT. Founded in Sweden in 1994 with financial support from Investor AB, a firm controlled by the Wallenberg family, EQT invests in both public and private companies. The firm conducts detailed ESG reviews of all investments while engaging with portfolio companies directly to advocate for a focus on sustainable business practices and societal impact. This requires diligent effort by the firm in part because, while ESG information for public companies is regularly tracked and made public, robust ESG data does not exist for some private companies.

Consequently, EQT does extensive, in-depth due diligence to assess a company’s environmental, labor and human rights, and ethical track record before buying a stake in that company. The process is guided by the EQT Responsible Investment Policy, which covers topics such as the emission of harmful substances, anticorruption efforts, and the overall health and safety of the workforce. In addition, EQT has developed the EQT Sustainability Blueprint to encourage its portfolio companies to develop a comprehensive, innovative, and strategic perspective on sustainability matters. For example, companies are expected to identify their key ESG opportunities and risks and to report their progress on a number of ESG-related KPIs. EQT captures all of this in a dashboard that monitors the ESG performance of the companies in its portfolio.

The company has also initiated high-level assessments, together with an external advisor, to examine how portfolio companies are contributing to the advancement of the UN’s Sustainable Development Goals. The assessments indicate particular areas of potential impact and are provided to portfolio companies to stimulate deeper discussion on how their impact can be scaled up, maintained, or mitigated, depending on their nature. Furthermore, the firm plans to combine its detailed ESG measures with financial performance metrics to assess how an ESG focus bolsters long-term returns. If they are able to make that case persuasively to potential limited partners, it will be a powerful signal in the market. According to Christian Sinding, EQT’s CEO and managing partner, “The key lies in having a thematic approach and focus on sustainability throughout the entire investment cycle—from deal sourcing to exit—and making it an integral part of the business model.”

Another example is Norges Bank Investment Management (NBIM), the Norwegian Sovereign Wealth Fund. NBIM has publicly identified three “themes” on which it wants to lead: climate change, water management, and children’s rights. The fund has also outlined its expectations for the ways that companies should address human rights, tax and transparency, corruption, and ocean sustainability and asks its portfolio companies to factor material risks in all these areas into their business strategy, risk management, and reporting. NBIM is a vocal, public advocate for progress in these areas, including through its publications and its involvement in the development of international standards related to these topics.

Government Policymakers. Nordic countries have been early and ambitious movers when it comes to addressing important ESG challenges.

Some of these policies stem from actions taken by the European Union. For example, the EU has set binding greenhouse gas (GHG) emissions targets for its member states, including Denmark, Finland, and Sweden. The targets include a minimum reduction of 40% from 1990 levels and a 27% plus share for renewable energy by 2030. National governments throughout the EU are demanding that companies play their part in meeting these goals. (Although Norway is not a member of the EU, it is part of the European Economic Area, in which most EU rules and cooperative agreements apply.)

At the same time, some Nordic countries are pushing beyond the EU targets. Sweden, for example, aims by 2020 to reduce GHG emissions by 40% from 1990 levels and to have a fossil-fuel-free vehicle fleet by 2030. Starting in the 1990s, Norway introduced a series of strong incentives aimed at lowering GHG emissions. Those policies have had real impact: half of the cars sold in the country today are electric or plug-in hybrids.

Nordic countries have promulgated regulations in support of gender diversity, including a requirement in Norway since 2008 that boards of directors must have a least 40% representation of each gender. (See the sidebar “The Nordic Edge in Diversity.”)

The Nordic Edge in Diversity

The Nordic Edge in Diversity

Corporate leaders around the world understand the importance of diversity when it comes to attracting and retaining talent. Research has shown that companies with diversity in their leadership teams outperform in terms of profit margins, return on equity, and revenues generated from innovations. (See “ How Diverse Leadership Teams Boost Innovation,” BCG article, January 2018.) Gender diversity is a key element in such performance. The return on equity of the companies with the highest percentage of women board members was 53% higher than those with the lowest female board representation, according to Catalyst, a nonprofit focused on advancing women in leadership.

In terms of gender diversity, Nordic companies stand out. In The Global Gender Gap Report 2018, the World Economic Forum reported that Iceland, Norway, Sweden, and Finland hold the top four spots when it comes to gender parity, and Denmark was listed number 13. In addition, a recent BCG global survey of 16,500 people found that although only about one-quarter of respondents said that they had personally benefited from their company’s diversity program, in the Nordics that percentage was much higher—nearly 50%.

These statistics reflect societal norms that are fundamentally different from those in many other parts of the world. These norms are influenced in part by Nordic government policies aimed at supporting gender equality. Norway and Sweden, for example, have progressive policies related to paternity leave—policies that have been shown to be strongly correlated with an increase in the percentage of women in leadership positions. (See How Policies Can Drive Gender Diversity in Denmark, BCG Focus, April 2018.) It’s hardly surprising, then, that female participation in the labor force is higher in Nordic countries—including Denmark, Finland, Norway, and Sweden—than in other parts of the world and is nearly on par with male participation in the labor force.

Despite those impressive statistics, the Nordics still have some challenges related to gender diversity. While the pipeline of educated female workers in Finland and Denmark is strong—both rank at the top of the educational attainment index used by the World Economic Forum to track gender parity in education—women in both countries hold less than one-third of private-sector leadership positions. That is well below the 40% level seen in countries such as the US and Brazil. The Nordics have made impressive progress toward gender equality, but the journey is far from over.

Although many countries’ regulators require little formal disclosure, EU and Nordic countries are leaders in ESG reporting. The EU requires large companies within its member states to report on environmental, social, and personnel matters; diversity; human rights; and corruption. In addition to ensuring compliance with these requirements, some Nordic countries have imposed regulations that stipulate even more disclosure, even from small companies.

The Nordic Public and Culture. The people of the Nordics—and their cultures—have a profound impact on the way companies within their borders operate.

Consumers, for example, are highly attuned to social responsibility. According to the head of corporate social responsibility at a Nordic consumer company, “Consumers are critical of companies doing bad and rewarding of companies doing good.” Case in point: spending on fair-trade products in Norway grew roughly 30% from 2015 to 2016, the third-highest increase of all the countries tracked by Fairtrade International. And the people we interviewed in Nordic companies emphasized over and over how important ESG performance was to prospective employees—especially younger ones. “Millennials want a greater purpose in their job—something to be proud of,” the head of sustainability at a Nordic financial institution told us.

The culture of the Nordics aligns well with a focus on broader societal issues. For one thing, these countries have a tradition of broad stakeholder engagement—a tradition that academic research has linked to Nordic leadership in sustainability overall.

Lessons from the Nordics

What, then, distinguishes the Nordics? What makes companies from this part of the world so effective at delivering TSI? We have identified three primary areas in which Nordic companies excel—and that contribute significantly to their TSI.

Strong Leadership and Collaboration

TSI-leading Nordic companies have strong leadership, maintain a commitment to global ESG norms and goals, and understand the power of partnerships.

And they know that there is no substitute for bold leadership. The leadership teams—including the CEOs and boards—of many Nordic companies are committed to TSI, have established teams dedicated to the TSI agenda, and take active roles in promoting its value to investors. Because so many of these companies are global players, they are positioned to sign and actively drive frameworks and norms that advance critical ESG issues, including the UN Global Compact, the SDGs, and the Principles for Responsible Investment. They are powerful voices for progress at global events hosted by organizations such as the UN and the World Economic Forum.

At the same time, Nordic TSI leaders understand the importance of collaboration. They build select and deep partnerships with civil society groups, government agencies, organizations in the research community, and other companies that can drive progress in critical ESG areas. Some have created for-profit partnerships aimed at advancing a societal goal, understanding that those partnerships may generate relatively low margins. They push for industry coalitions that can advance TSI goals and set industry standards. And they are eager to share their successes and best practices globally.

Case in point: Leaders of 13 large Nordic companies and a global industry organization have formed the Nordic CEOs for a Sustainable Future, an initiative focused on promoting new business models that are oriented around creating value for society. The CEOs have committed to integrating the UN’s SDGs into their corporate strategies and are creating a forum for sharing success stories and exploring potential collaborations to magnify societal impact. The initiative also creates a platform for the Nordic prime ministers to engage directly with CEOs on how to move from pursuing sustainability as a compliance exercise to being purpose-driven companies. A key objective is to explore ways to deliver more impact through collaboration. The member organizations to date are Equinor, Hydro, Íslandsbanki, Marel, Nokia, Posten Bring, SAS, Storebrand, Swedbank, Telenor Group, Telia Company, Vestas, Yara, and the mobile industry organization, the GSMA.

One of those member companies, Yara, demonstrates how strong leadership can drive progress by combining sustainability with technological innovation. The Norwegian crop nutrition company, in line with its mission to “responsibly feed the world and protect the planet,” has committed to advancing the SDGs—particularly those related to climate, poverty and hunger, and the Paris Agreement. Svein Tore Holsether, Yara’s president and CEO, is a vocal and visible leader worldwide on such topics. In addition to helping to form Nordic CEOs for a Sustainable Future, he sits on the the Redefining Value program of the World Business Council for Sustainable Development (WBCSD) executive committee and is a commissioner on the Business & Sustainable Development Commission.

The company’s commitment to ESG issues is reflected in its drive to harness new technology to transform farming. Yara has made a particular effort aimed at assisting farmers in the optimization of fertilizer use. Not only does this effort help farmers improve their crop yields and profitability, it also reduces the impact their farming practices have on the environment. Through acquisitions and internal research, Yara has developed new precision-farming sensors and apps that, for example, can, on the basis of local soil conditions, tell a farmer how much fertilizer to use.

Leadership can drive progress by combining sustainability with innovation.

At the same time, the company has built strong partnerships aimed at improving agricultural sustainability: a partnership with Veolia, a global resource recovery company, to recycle nutrients and one with Engie, a global energy and services company, to work on the development of green ammonia, a carbon-free alternative to the traditional ammonia used in agriculture. In addition, Yara has pioneered innovations in its logistics operation, partnering with Kongsberg to build Yara Birkeland, the world’s first fully electric and autonomous container ship with zero emissions. “The SDGs offer a framework for great business opportunities,” says Holsether. “We don’t have a strategy for sustainability ; instead we have a sustainable business strategy.”

Embedding TSI in the Core Business

Leading Nordic companies integrate TSI into the core in three ways.

First, they gain a clear understanding of TSI opportunities and risks. This can include conducting a thorough ESG materiality assessment of the business that anticipates future TSI trends and building a TSI focus into the culture and the company’s ways of working.

Second, they look for ways to boost TSI through the company’s existing and adjacent businesses. This includes looking for ways to improve the positive societal impact of existing products or services, as well as leveraging existing technology and capabilities to venture into related or entirely new businesses. It’s not unusual for forward-looking Nordic companies to initially accept lower margins as an investment in future, profitable returns.

Third, they pay particular attention to social and environmental issues in their supply chain. They establish clear and transparent standards for all partners in the supply chain, standardizing due diligence related to ESG issues for all suppliers, conducting regular supplier assessments, and providing support and guidance to help below-standard suppliers improve.

Neste, a Finnish energy company, is a powerful example of what happens when companies put TSI at the heart of their core business. Founded in 1948 as an oil-refining company, Neste has made a major transformation, shifting its focus to biofuels over the past dozen years despite early pushback from investors resulting from the initial lower profitability of that business. Today Neste’s renewable fuels account for almost 70% of the company’s comparable operating profit.

Neste helps its customers reduce climate emissions by developing cleaner solutions for transportation, aviation, and marine uses, as well as renewable solutions for the chemical and plastics industries. Produced entirely from waste and residues such as animal and fish fats and used cooking oil, Neste MY Renewable Diesel helped reduce GHG emissions by 8.3 million tons in 2017 alone—a result that is equivalent to taking 3 million cars off the road—and has enabled customers to reduce GHG emissions by more than 33 million tons over the past ten years. And Neste MY Renewable Jet Fuel helps aviation operators reduce their GHG emissions. The company has also developed renewable products beyond transportation, including renewable solvents used in the production of paints, glues, detergents, and cosmetics. To ensure that these resources are sustainably produced, the company maintains a leading traceability system for all its renewable feedstocks.

Neste’s transformation has yielded significant internal benefits as well. The company says its focus on improving societal impact has helped it develop skills and capabilities that have positive effects on all its operations. And today, Neste ranks third on the list of the world’s 100 most sustainable companies.

At some Nordic companies, public ESG reporting is on a par with financial reporting.

Consider Novo Nordisk, a focused health care company headquartered in Denmark, which has similarly embedded a TSI focus in its core business. The company’s bylaws spell out a commitment to what the company calls its Triple Bottom Line business principle: being financially, socially, and environmentally responsible. Novo Nordisk’s mission is “driving change to defeat diabetes and other serious chronic diseases.” This entails providing solutions beyond making medicines. For example, Novo Nordisk, along with the Danish government, is a founding partner in the Defeat-NCD Partnership, an initiative hosted by the UN that is intended to, among other things, ensure a more consistent supply of low-price insulin and optimize the distribution of medicines. In addition, Novo Nordisk has a long-standing policy that guarantees the availability of low-price human insulin in the world’s least developed countries, low-income countries, and some middle-income countries for select relief organizations. In 2018, more than 29 million people were using Novo Nordisk diabetes care products, and more than 5 million of them were being treated with human insulin at $0.12 per day.

The company’s TSI focus is driven and supported in large part by its ownership structure: more than three-quarters of the voting shares are controlled by the Novo Nordisk Foundation, whose purpose is to provide a stable basis for the companies of the Novo Group and to support scientific and humanitarian purposes.

Ensuring Sophisticated ESG Reporting

Nordic companies that are TSI leaders understand that what they measure and make public matters. As a result, they lead in data collection, measurement, and reporting, as well as in promoting ESG reporting broadly.

As part of these efforts, Nordic companies invest in data collection and measurement as well as in reporting on their performance. When it comes to data collection and management, Nordic TSI leaders focus on a select group of material parameters, generate robust and timely data, and try to measure actual impact. They also provide business units with standardized tools and processes that allow for easy reporting of TSI metrics. For reporting, they define clear and measurable TSI KPIs and build a dashboard for tracking TSI impact and overall organization performance. At some Nordic companies, public ESG reporting is on a par with financial reporting, conducted with reasonable assurance by an external auditor.

Furthermore, leading Nordic companies engage, challenge, and support TSI rating agencies and investors that are focused on ESG performance. To this end they ensure that their ESG data is reliable and available, and they work proactively with rating agencies, challenging uncertainty and discrepancy in data. These leaders also build a team to manage ESG measurement and performance. And they regularly quantify the impact the company’s focus on TSI has on improving financial performance or reducing risk, reporting the details in annual and quarterly reports.

Finland-based renewable-materials company Stora Enso exemplifies these best practices. Not only is the company at the forefront of tracking and reporting its ESG performance, it is also pushing to address the complex challenges surrounding ESG measurement and reporting overall. “We understand what we need to do to keep the company ahead of the game,” says Noel Morrin, the company’s executive vice president of sustainability. “But there are substantial challenges with the ESG reporting and rating practices related to data reliability and methodological inconsistency.”

For example, the company, which bases its reporting on the principles of the Global Reporting Initiative, has been working with an external auditor to have its direct and indirect carbon dioxide emissions information assured as investment grade data. At the same time, Stora Enso is also working with ESG rating agencies and others to drive improvements in ESG data quality, alignment on methodologies, and the adoption of new technologies to improve measurement and reporting. Among its initiatives, the company is cofunding work to update the Rate the Raters report, which assesses the transparency and quality of sustainability ratings, and it has a seat on the board of the Redefining Value program of WBCSD, which aims to improve the credibility and consistency of sustainability reporting.

Stora Enso’s leadership has achieved global recognition. Its 2017 sustainability report was in the top ten of WBCSD’s global cross-industry ranking of ESG reporting.

Taking TSI to the Next Level

Our study of the Nordics has revealed valuable insights on what can drive success in TSI. And while there are clearly factors unique to the Nordics that support their leadership in this area, there are also best practices and lessons that companies around the world can emulate.

For Nordic companies, the question is, How can we continue to improve our TSI performance and bring our leadership to the next level?

Within their organizations, the leaders should push to build a culture that is defined by TSI. This should include ensuring cooperation and alignment on TSI ambitions and actions across all departments and functions. Leadership should create procedures that can drive the adoption of TSI best practices throughout the company, and they should pay particular attention to TSI initiatives that are designed to focus on issues that are important to and resonate with employees and consumers.

They should also take steps to expand their global profile and leadership, making sure that, for example, consumers as well as partners in their value chain are attuned to TSI. In addition, they should push to raise formal industry standards and work with governments to promote legislation that incentivizes companies to focus on TSI. Furthermore, they should partner with peers and researchers, including through investments in startups, to drive innovation—particularly as it relates to new digital tools that will maximize TSI.

Companies that up their game both internally and externally will become catalysts for change, filling a critical role in society’s efforts to make progress toward tackling significant challenges.