As if the past several years weren’t bad enough, the global agriculture industry has been hit hard by the COVID-19 pandemic. During five years of bumper crops, low commodity prices, and trade wars, shares in agriculture companies have underperformed the market. As of late April, share prices were down another 20% to 30% since the beginning of 2020.

The COVID-19 pandemic has brought into high relief the strategic importance of agriculture.

But the pandemic has also brought into high relief the strategic importance of agriculture. No one knows what the coming post-COVID-19 recovery will look like for the global economy, but for the agriculture industry, it will likely be a relatively steep rebound followed by positive growth in the long term. Nations around the world—especially those that import much of their food—will seek to offer further support to their agriculture sectors in order to shorten supply chains and better secure and improve the resilience of their food supplies. Together with the push to meet sustainable-agriculture goals and implement new agricultural technologies, this will open up opportunities to increase revenues for every segment of the agriculture value chain.

Agriculture companies looking to help promote food security and position themselves to be winners in the post-COVID-19 world must conserve their financial strength so that they can make the necessary strategic acquisitions, boost their efforts to build or buy technologies that promote sustainability while supporting farmer P&Ls, and develop more tailored offerings that put the individual grower in the center. Here’s how.

The Seeds of Decline

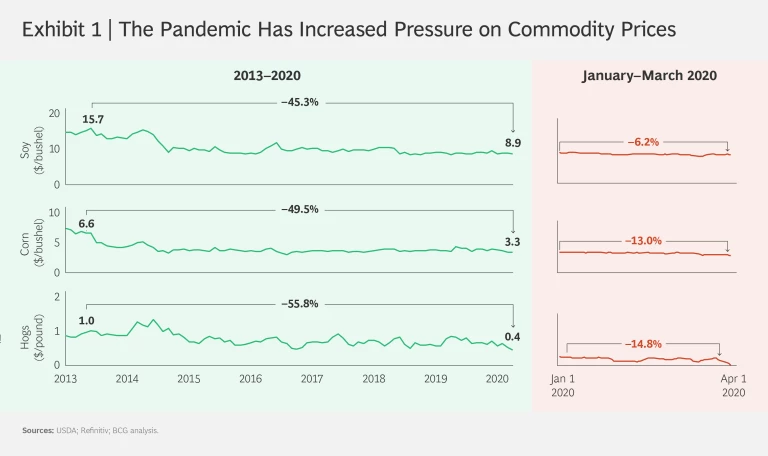

The latest chapter in the story of the global agriculture industry began in 2013, when key indicators of the sector’s health were at all-time highs. That’s when commodity prices had reached a peak. In the US, soybeans were selling for almost $16 a bushel, corn for nearly $7 a bushel, and hogs for about $1 a pound.

But several years of high yields, followed by the US-China trade war, led to a steady decline in prices, and by January 2020, they were down an average of 50% from their 2013 highs. As a result, the industry’s value creation suffered: compared with 2013 levels, value-added farm-gate output in 2019 fell by 14% in Europe, 20% in the US, and fully 37% in Brazil. And since the COVID-19 crisis began, commodity prices have fallen another 6% to 15%, accelerating the ongoing downturn. (See Exhibit 1.)

With commodity prices so low and revenues down, farmers put the brakes on significant investments, preferring to manage their spending tightly in anticipation of further price declines and uncertain market developments. They postponed machinery replacements, purchased seeds without the latest traits, and turned to generic crop protection products rather than newer, more innovative offerings. In the US, for example, total farm expenditures fell from a high of $287 billion in 2014 to a low of $241 billion just two years later and have since been essentially flat.

The resulting impact on the shares of industry players has been stark, too. Between 2014 and 2018, the sector underperformed the stock market as a whole, realizing total shareholder returns (TSR) of just 2%, compared with 7% for the S&P Global 1200. Over the past two years, their returns deteriorated further, largely in response to ongoing trade wars.

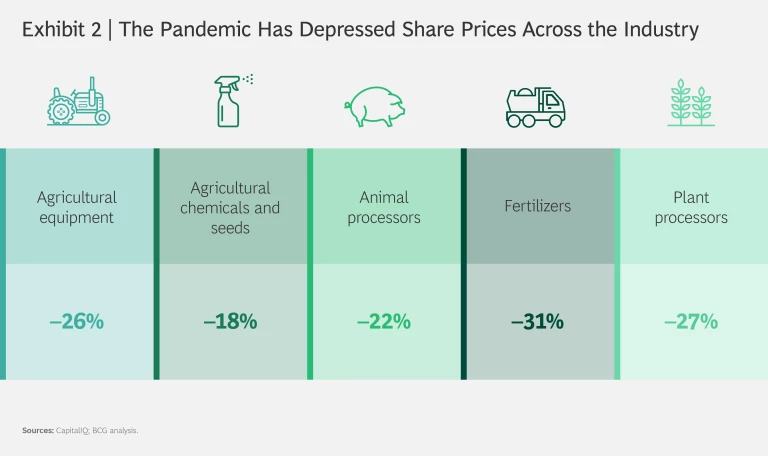

Then came the COVID-19 pandemic. During the past few months, share prices for agriculture companies have fallen across the board, with fertilizer producers and crop processors taking the biggest hits. (See Exhibit 2.)

Still, much of the poor TSR performance can be attributed to external factors; overall, revenues and profitability held up throughout the entire period, especially among the larger players. For the most part, agriculture companies are fundamentally solid businesses that are poised for strong growth once the COVID-19 crisis eases.

Bad Weather

Of course, it remains unclear how long that will take. Meanwhile, the pandemic is breeding pain and uncertainty across the global economy and in every industry. And agriculture, its supply chain—and indeed the entire global food system—are no exception.

The consumption of animal proteins as well as fruit and vegetables has declined significantly as a direct result of the shutdown of restaurants, hotels, and catering, and because people tend to use lower-value ingredients when cooking at home. The demand for biofuel has also taken a big hit, given the decline in transport-related activities.

Furthermore, our ability to plant and harvest this year’s crops and to deliver the food already circulating within the system are at risk, owing mainly to a lack of labor and the disruption of logistic chains created by border closures, restrictive controls on transport, and operational shutdowns.

Labor Shortages. In addition to the loss of employees throughout the agricultural supply chain who are locked down or otherwise unable to go to work, the industry faces a major shortage of the immigrant workers needed to harvest seasonal products like strawberries and asparagus. Many governments are already running campaigns to attract workers and fill the gap, but the overall impact remains uncertain.

The German government, for instance, is pursuing a two-pronged strategy. Despite strict immigration policies and a virtual halt to all immigration of non-German citizens into the country, the government is bringing in some 80,000 seasonal workers from Eastern Europe on specially chartered airplanes to work on farms and relieve the shortage. At the same time, it has launched a massive campaign to encourage university students and workers from service and production industries that have been shut down to engage in seasonal field work.

Similarly, France’s government is calling for a “shadow army” of unemployed workers to replace much of the usual seasonal migrant workforce and take part in farm work, while the UK is bringing in Eastern European immigrant workers despite border closings.

Logistics Chain Disruptions. In response to the COVID-19 pandemic, countries around the world are closing their borders, further constraining international food distribution. The result: considerable waste of fresh food such as fruits, vegetables, meat, and dairy, and significant cost inefficiencies. Not only do border controls limit the movement of food, potentially causing shortages where food is most needed, but the restrictions also fuel truckers’ reluctance to cross any border, for fear of being trapped in newly enforced lockdowns far from home.

The highly uncertain situation brought on by the pandemic has already triggered vicious cycles of fear and response.

This highly uncertain situation has already triggered vicious cycles of fear and response. Both Kazakhstan and Serbia, for example, stopped all exports of such staples as buckwheat, sugar, potatoes, onions, and sunflower oil. To prevent further border closures, governments must set clear rules for cross-border transport of food and agricultural supplies and openly communicate these guidelines.

Controls and restrictions on movement are also causing complications in the supply of essential agricultural inputs such as seeds, fertilizers, and crop protection products, putting at risk the entire planting season in the Northern Hemisphere. In China, for example, shortages of seeds and fertilizers as well as labor are forcing farmers to shift from high-value crops to less valuable crops such as rice, significantly impacting their revenues and profits.

Still, the impact of the COVID-19 pandemic has varied, depending on the agriculture segment. Companies in heavily consolidated segments such as seed, fertilizer, crop protection, and animal health, as well as commodities-trading companies, appear to be weathering the storm thanks to their sheer size, financial reserves, and structural profitability. But fragmented segments with multiple niche players, including animal feed, farm distribution and retail, farming implements, and primary-commodity processing, are struggling owing to their lack of size, financial reserves, and portfolio diversity.

Hence, companies in certain highly competitive segments with poor structural profitability are already facing financial stress, including sugar producers, local distributors and retailers, feed mills, some tier 2 implement players, and, notably, agricultural-technology startups that have not yet generated substantial cash flows. In fact, all small companies with high fixed costs and limited cash reserves are likely to see their profit crisis turn into a significant liquidity emergency within a few weeks.

The Growing Season

Despite the current fears of local disruptions in farming and the food chain brought on by COVID-19, the agriculture industry overall is structurally healthy, and farm expenditures are expected to rise in the short term.

As lockdown measures are loosened across the globe, hotel, restaurant, and catering businesses will likely recover quickly, reviving the consumption of animal protein and fruit and vegetables. Travel and transport will also bounce back, boosting demand for biofuel to pre-COVID-19 levels.

The US, the world’s largest and most mature agriculture market, is a bellwether for the global industry. Precise data on US farm expenditures and value creation for the second half of 2019 and the first quarter of 2020 are not yet available. But there is cause for optimism in key indicators.

Although prices of agricultural commodities have been hit by COVID-19, the impact is considerably lower than in other commodities, such as industrial metals and energy. Also, prices have already recovered slightly since March and stabilized within the past few weeks, encouraging farmers to plant more, and thus to spend more. For example, the USDA’s planting forecast for spring 2020 suggests that US farmers are planning to shift more acreage to major commodity crops such as corn and soybeans. Corn acreage is expected to increase by 8%, to 97 million acres, on par with the all-time high of 97.2 acres in 2012, while soybean acreage is set to grow by 10%, to 83.5 million acres.

Livestock farmers, too, continue to increase production. Inventories of hogs and pigs increased by 4% in the first quarter of 2020 compared with first-quarter 2019, reaching an all-time high of 78 million head. Overall, the expansion of output at stable price levels will likely improve farm income and therefore farm spending as well.

Moreover, the current pandemic, together with the lessons learned from recent trade wars, will likely lead to a variety of agriculture policies intended to shorten national food chains. The effort to ensure secure and resilient food supplies should generate significantly greater government support for local farmers, especially in net importers of food and agricultural produce, including the EU, the Middle East, members of the Commonwealth of Independent States, and China, Japan, and South Korea. (See the sidebar, “Food Security and the Localization of Agriculture.”) In contrast, today’s net exporters, like the US and Brazil, will likely suffer the negative impact of lower exports, slowing down or flattening the revival of agriculture there.

Food Security and the Localization of Agriculture

Food Security and the Localization of Agriculture

Determined localization can make a real impact on a country’s agriculture industry. Case in point: Russia. After the EU imposed sanctions on the country in response to the 2014 Ukraine conflict, Russia banned agricultural imports from all EU countries as well as the US, Canada, Australia, and Norway. The ban affected annual imports of about $1.8 billion worth of milk and other dairy products, $1.6 billion of fruit, $1.6 billion of pork, and $3.2 billion of other crops and livestock.

Thanks to the efforts of both Russian and international investors, Russia’s agricultural output grew by more than 25% to 5.6 trillion rubles in the first two years after the ban (about $83 billion at the average 2016 exchange rate). The initial phase focused on production that could be scaled up quickly, including field crops, poultry, and hogs. As the embargo and Russia’s import ban drag on, Russian farmers have begun turning to longer-term categories such as dairy cows and tree crops.

Russia’s experience shows that governments concerned about food security and determined to enact policies and incentives to promote local agricultural production can accomplish a great deal in a short time. Likely candidates for similar initiatives include the EU, China, Japan, and others. The needed investment will drive demand for all kinds of agricultural inputs and equipment, boosting the industry’s growth for the foreseeable future.

Indeed, NGOs, industry associations, and lobbying groups are already pushing for increased localization. The UN’s Food and Agriculture Organization is urging the agriculture ministries of all the G-20 nations to pursue localization efforts in order to prepare better for potential future crises. And the head of France’s largest farm union, FNSEA, has been calling on her fellow citizens to rethink the food they consume: “What has changed with this crisis is that to think that one can look for food in the four corners of the world is madness. We must support our French farming sector so that it can provide diversity, quantity, quality and safety for all.”

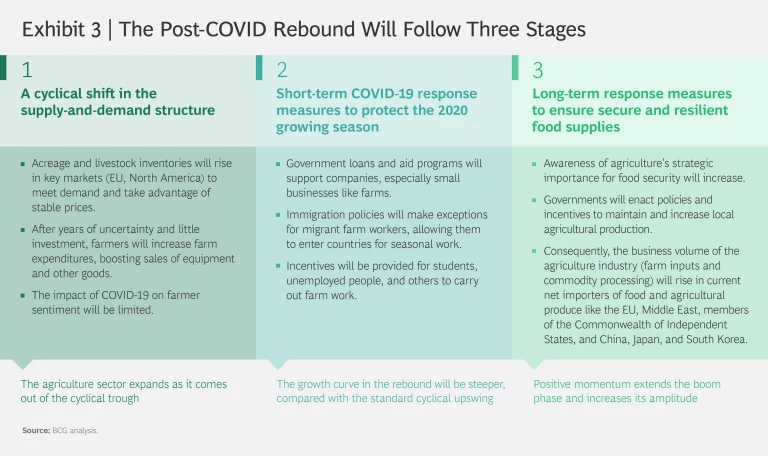

Taken together, these trends suggest that on a global level the agriculture industry will see a somewhat V-shaped recovery, varying by segment and region, once the adverse effects of the COVID-19 pandemic subside. (See Exhibit 3.)

The industry looks increasingly healthy in the long term as well. The global population is expected to reach close to 10 billion by 2050, and rising wealth will lead to dietary shifts from staples to more sophisticated fruits, vegetables, and animal proteins. Technological advances will spur further growth. In the past, manual labor has been a significant cost factor for growers of specialty and horticultural crops such as fruits and vegetables and for large farms that require machine operators to cultivate thousands of hectares. The current pandemic has demonstrated the strategic importance of access to seasonal workers in times of labor shortage, encouraging farmers to invest more in automated harvesters and other equipment to reduce dependence on manual labor.

Farmer incomes will also benefit from the long-term push for environmentally friendly agricultural practices and sustainably grown food. Consumers are becoming increasingly willing to pay for nutritious, safely grown food. And future government support programs will likely require adherence to sustainable-farming practices as a prerequisite for financial support in the form of green components of economic-stimulus packages.

For example, the US Federal Communications Commission recently announced plans to allocate $1 billion to precision agriculture. To that end, it formed the Precision Agriculture Connectivity Task Force to develop ways to improve connectivity in rural farming areas and enable digital-farming technologies as a key element in ensuring a more resilient food supply. “The ability to take today’s technology and best practices and rapidly deploy them to secure and improve the current food supply is of paramount importance,” task force leader George Woodward said in a press release. “Ensuring the farm-to-table ecosystem is supported with cutting-edge technology has never been more important.” This too will drive the value of agricultural produce and thus farmer incomes.

Harvest Time

The coming post-COVID-19 upswing will offer many opportunities for agriculture companies of all kinds to join the effort to promote food security and sustainability and benefit from the industry’s recovery. Strategic options include pursuing inorganic growth and filling product and service portfolio gaps through M&A, boosting sustainability through new agriculture technology and other products, and developing customized services for individual grower segments.

The post-COVID-19 upswing will offer many opportunities for agriculture companies of all kinds.

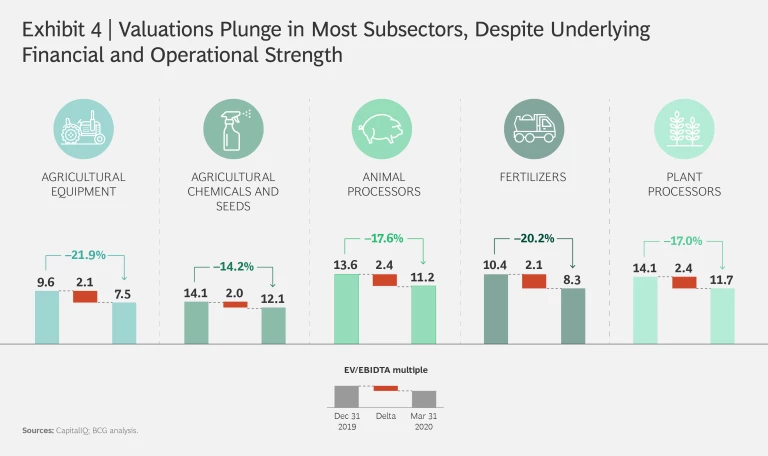

Inorganic Growth. The COVID-19 pandemic has caused valuation multiples of agriculture companies to drop as much as 20%, depending on the subsector. Yet the fundamental business performance of many players remains strong. (See Exhibit 4.) This offers both strategic buyers and financial investors the opportunity to purchase significantly undervalued but operationally robust businesses at a considerable discount compared with average valuations or to pick up smaller businesses in need of cash.

Companies needing to close gaps in their product portfolios and expand their geographic footprints should actively pursue bolt-on acquisitions. Agricultural-technology players may be especially ripe for acquisition by companies looking to complement their own offerings or accelerate the development of sustainable technologies, such as drones and agricultural robots.

All companies planning to enter the M&A market must make sure that they have sufficient cash on hand and adequate credit lines and should consider unconventional financing measures such as enlisting private equity firms as coinvestors or minority shareholders.

Sustainable and Digital Agriculture. The global trend toward sustainable agriculture and healthy foods will continue through the crisis and subsequent recovery. Concerns about the impact of high-intensity agriculture—its carbon footprint, the external costs such as fertilizer runoff into lakes and rivers, and its negative impact on biodiversity—are growing. Fully 80% of consumers in the EU view environmental issues surrounding agriculture and the production of healthy and sustainable food as key priorities.

In response, NGOs and government policymakers and regulators will keep pushing the industry to become more sustainable by shifting to more environmentally friendly practices and inputs. Already, governments are tightening regulations on everything from chemical crop protection products to animal feed derived from slaughtering waste and the use of antibiotics to promote livestock growth. Just recently, for example, the German government ratified a novel fertilization rule—in the midst of the COVID-19 pandemic.

All agriculture companies must make sustainability a strategic priority, in the innovative products and services they offer and in their own operations and business practices. Products that reduce costs for farmers or safeguard their current cost structure while increasing sustainability will quickly gain market share and replace conventional technologies.

For crop farmers, these products include organic fertilizers and biostimulants that increase the nutrient-uptake efficiency of crops and reduce fertilizer use, biological crop protection products, and digitally enabled tools for better agronomic decision making in combination with variable-rate application. Robotic equipment that replaces manual and seasonal labor will see growing demand from specialty-crop farmers. Indeed, the race is on to design and market agricultural robots for use on an industrial scale.

Livestock farmers, too, are looking for more sustainable solutions. Input suppliers should emphasize the development of disease-resistant breeds, effective gut-health solutions to further replace antibiotic growth promoters as well as digitally enabled preventive animal health solutions that allow real-time monitoring of animals for early detection of health issues, optimizing the lactation cycle, and tailoring nutritional additives.

Farmer-Centric Solutions. Digitization has already had a profound impact on the agriculture industry, and those effects will only increase going forward. Traditional players and new entrants alike are developing innovative solutions to longstanding problems and boosting sustainability at the same time. Weeding and harvesting robots, ultra-precision-spraying drones, high-efficiency vertical-farming facilities that use far less water and avoid any loss of nutrients—these and other technologies will transform farming as we know it.

Many such solutions, however, do not yet deliver clear value to individual farmers. In fact, many companies that provide growers with the latest high-tech products and services appear to be putting the technology horse before the cart of practical applicability. To create meaningful value for farmers, companies must design and market tailored offerings that solve real issues for specific grower segments.

Finally, companies in every industry segment must transform their current go-to-market approach, which still depends on physical meetings with the farmer, and put more emphasis on creating “digital proximity.” At the center of these data-enabled go-to-market strategies is the need to generate a greater understanding of individual growers and their needs and provide timely, customized recommendations and prescriptions

Making Hay

As bleak as things look for the global economy in the midst of the COVID-19 pandemic, the agriculture industry is poised for recovery. Commodity prices are stable, farmers appear to be boosting investment, and government plans that promote sustainable local agriculture and increase food security will encourage future growth.

Industry players looking to support these efforts and benefit from the upswing should work to develop innovative input products and digital tools to support farmers, consider making strategic acquisitions to widen their product portfolios, and better understand the needs of individual grower segments.

And they should make these moves soon, as the competition will only stiffen as the upturn grows in strength. Otherwise, the next few years may be a “tough row to hoe,” as the saying goes.