The COVID-19 Australian Consumer Sentiment Snapshot series highlights insights drawn from a BCG consumer survey that we execute with our coding and sampling partner, Dynata. Our research is designed to uncover how consumer perceptions, attitudes, and spending behaviours are impacted by the evolving COVID-19 crisis. This snapshot presents insights from Round 4 of the survey, completed in the Australian market from 30 October to 5 November, 2020. We have also drawn comparisons with research completed in Round 1 (20 April to 24 April, 2020), Round 2 (21 May to 25 May, 2020), and Round 3 (2 July to 5 July, 2020).

Round 4 of our COVID-19 Australian Consumer Sentiment Snapshot was launched at a time of persistent high infection rates in the USA, and as Europe and the UK faced a concerning second wave. In contrast in Australia, much of Victoria had just emerged from months of lockdown and on Monday 16 November declared its seventeenth consecutive day without either new cases or coronavirus deaths. Overall, Australia’s COVID-19 situation is starting to stabilise. Indeed, it feels like we are on a path to COVID-19 normal.

Read the other Australian Consumer Sentiment Snapshots

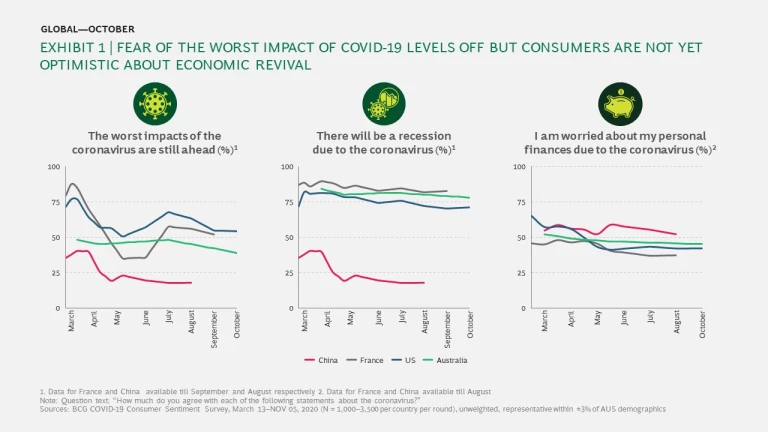

As a result, Round 4 survey responses show a 9 ppt fall in the number of consumers who believe the worst of coronavirus is still ahead, compared to 48% of consumers in July’s Round 3. According to BCG’s global consumer sentiment survey conducted 11-13 September and 9-12 October, this shift in sentiment is mirrored in the USA and France despite growing infection rates in both countries. Although concern about the virus itself is falling, fears about economic recession persist, and more than 70% of consumers from Australia, the USA and France see little likelihood of early economic revival. See Exhibit 1.

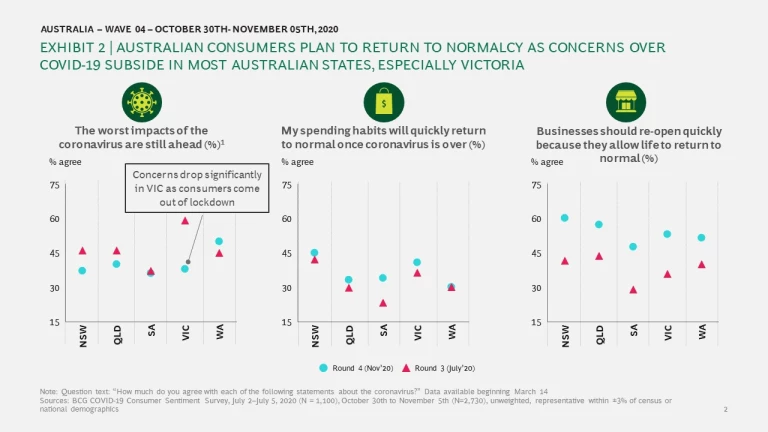

Despite persistent concerns about economic recovery, Australian consumer sentiment in the wake of COVID-19 continues to improve in most states, partly in response to Victoria’s apparent success in containing the virus.

More Victorian consumers are optimistic that the worst is over: the number of consumers who expect that the worst is yet to come has dropped from 56% in Round 3 to 39% in this round. With this resurgence of positivity, more consumers no longer plan to put their spending on hold. In fact, 16% more consumers believe that businesses should re-open quickly, and normal shopping behaviour to resume. See Exhibit 2.

Some winning categories sustain growth, some emerge as new winners

With an improvement in consumer sentiment, 39% of Australian consumers claim that they have already returned to normal spending behaviour.

This claim is highest in states and territories least impacted by COVID-19 disruptions, with 53% of consumers in the ACT saying they have returned to normal spending behaviour compared to 31% in Victoria.

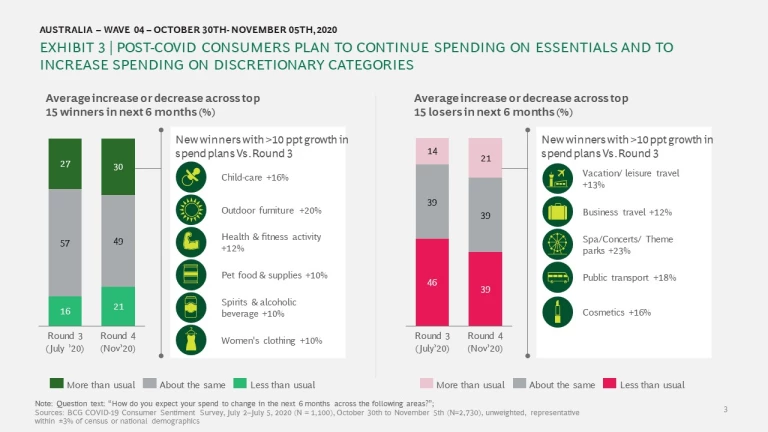

Round 4 of our survey showed that category-by-category spending has increased overall, that Australian consumers show no sign of reducing spending on essentials, and that they intend to increase spending on discretionary categories. Among essentials, child-care, women’s clothing and outdoor furniture joined the list of high-spend categories, in addition to continued increases in spending on food and beverages, utilities and education. More consumers plan to step up their spend in discretionary categories such as leisure travel, recreational activities, and cosmetics – all categories which were under pressure until Round 3 of our survey. See Exhibit 3.

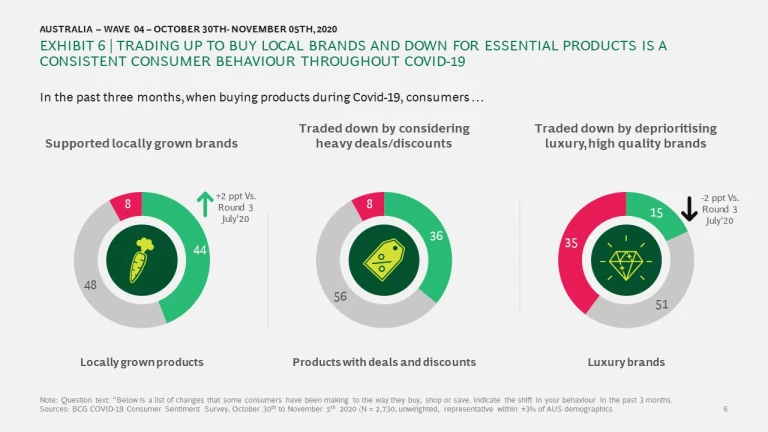

Luxury brands and products still face challenges, with only 16% of consumers expecting to spend more in these categories in the next six months, up 8% since the July round of the survey (Round 3).

In summary, it is clear that consumers are showing signs of a return to normal spending behaviour, a space to watch for retailers in the lead up to the holiday season.

Consumers’ determination to spend more brings hope for the travel industry

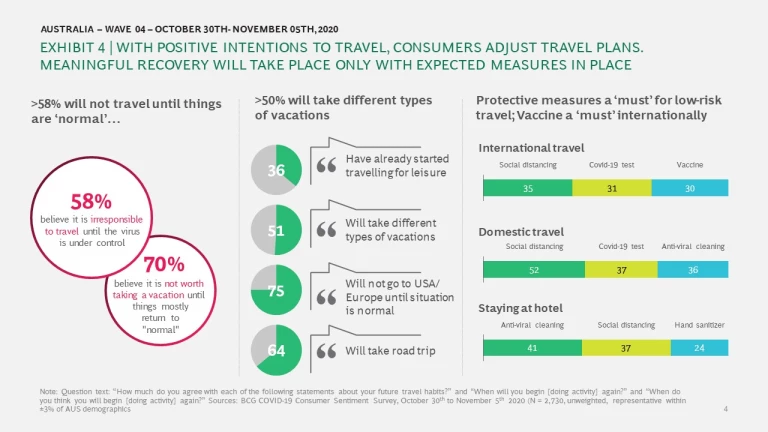

As consumers begin to revive their spending behaviours, a positive shift is evident in travel. In Round 3, only 26% of consumers expected to return to international travel within 12 months. In Round 4, 46% of consumers said they expect that international travel will resume by the end of 2021, and 70% of consumers said that they can’t wait to start travelling again.

However, the path to travel recovery is not straightforward. Despite a clear desire to travel, more than 58% of consumers believe it is irresponsible to travel until the COVID situation has stabilised. As a way-out, consumers are looking forward to an end-of-year break, and plan road trips: 42% of consumers have planned their end-of-year vacation, and about 60% of them will take an intrastate or interstate road trip.

Long-haul international travel is even more challenged, with 75% of consumers saying that they do not intend to travel to the USA or Europe until the global COVID-19 situation normalises, while 34% are positive about taking a trip to New Zealand, and 41% to neighbouring Asian countries sooner. To resume international travel to Europe or the USA, consumers see vaccines as a critical factor. For domestic travel and hotel stays, consumers do not see a vaccine as critical, but do expect providers to take protective measures such as social distancing and anti-viral cleaning. See Exhibit 4.

We predict that the lingering impact of coronavirus could be ‘on the way we travel’, rather than on ‘whether we travel’. The travel and tourism industry will move closer to a COVID-19 normal by pursuing a coordinated approach to help consumers feel safe in their travel.

Although uncertainty persists, it’s time to reboot and look ahead

While COVID-19 has caused significant shifts in consumer behaviour, the question remains how many of these shifts will be sustained. In Rounds 3 and 4, close to 60% of consumers told us that ‘things have changed permanently and will never be the same again’.

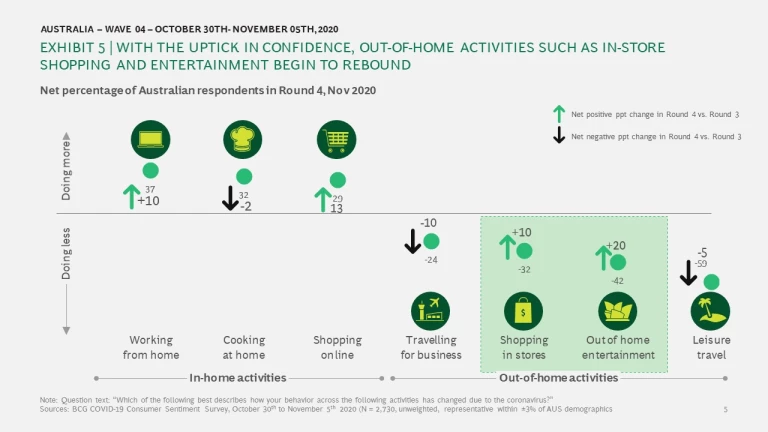

Changes of behaviour over the past three months are informative, with a net increase of 10 ppt in the number of consumers working from home from an already high base, and a continued increase in online shopping activity (13 ppt increase over Round 3 in July).

At the same time, consumers have started to return to in-store shopping (10 ppt net increase compared to Round 3) and out-of-home entertainment (20 ppt net increase compared to Round 3). This indicates that at least some of the pause on in-store shopping was a temporary response to circumstances. See Exhibit 5.

Other changes in shopping behaviour are likely to persist post COVID-19: 44% of consumers show a preference for locally grown products and locally owned brands (up 2 ppt from Round 3). This preference is prompted by a desire to support Australia’s local economy. Consumers also remain budget conscious, with 36% continuing to actively hunt for deals and discounts. See Exhibit 6.

The pandemic has pushed consumer behaviours in different directions, and some changes are likely to be permanent. How many and which of these behavioural changes stick will be constantly evaluated by companies as they seek to adjust to prevailing market dynamics to survive and to sustain growth.

COVID-19 is an accelerator for digital, but don’t ignore offline

Imagine if we had had to live through isolation without digital tools. The digital landscape has allowed us to manage our lives in many new ways:

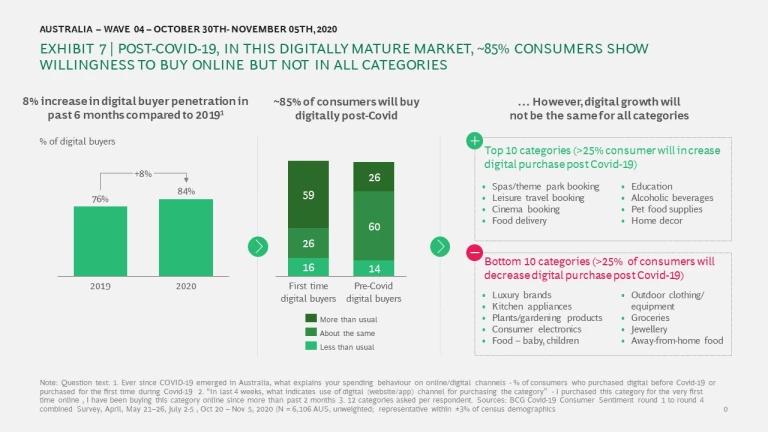

- consumers who had never purchased online, started (8%)

- consumers who had previously shopped online regularly, increased their online shopping (26%)

- non-food categories continued to grow online

Round 4 of our consumer sentiment survey indicates that consumers expect to continue to shop online post COVID-19. However, only a few categories will continue to grow their digital share as consumers express a strong desire to return to in-store purchases for categories such as food, electronics, appliances and luxury products. See Exhibit 7.

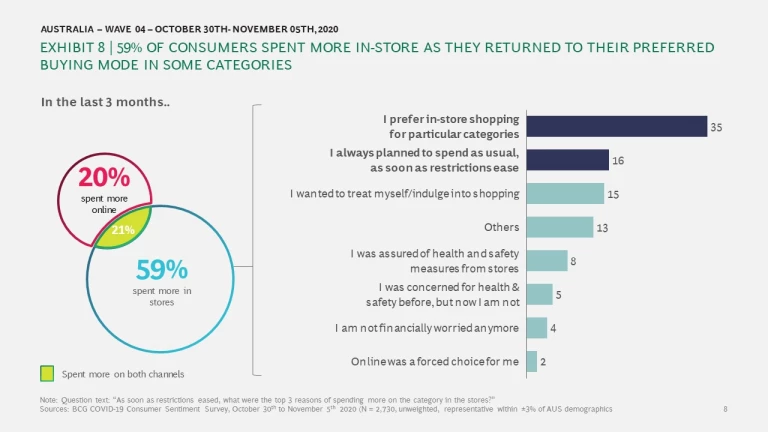

Digital will drive growth during and after the pandemic, but for many consumers the importance of offline retail remains as strong as pre-COVID-19, and an increasing percentage of people are returning to in-store shopping. In Round 4, 14% of consumers did more in-store shopping than pre-COVID. It also appears that in-store shopping is no longer just for one-off indulgences, and consumers are returning to pre-COVID-19 shopping habits, with 35% stating that they always prefer to buy some categories from physical stores. See Exhibit 8.

Between 80% and 90% of consumers preferred to shop in-store for medicines, fresh food, packaged food, household cleaning products, personal care products, children’s clothing and luxury products.

Online purchases are driven by convenience to buy ‘anytime, from anywhere’, best prices, home delivery and trust in the category online from experience, whereas shipment charges and the inability to touch and feel products such as consumables, are significant disadvantages of buying online for many consumers.

In summary, emphasis on digital remains critical but at the same time seamless integration of online and offline channels is required to maintain the pace of growth post COVID-19.

Personalisation, an important catalyst of sustained trust

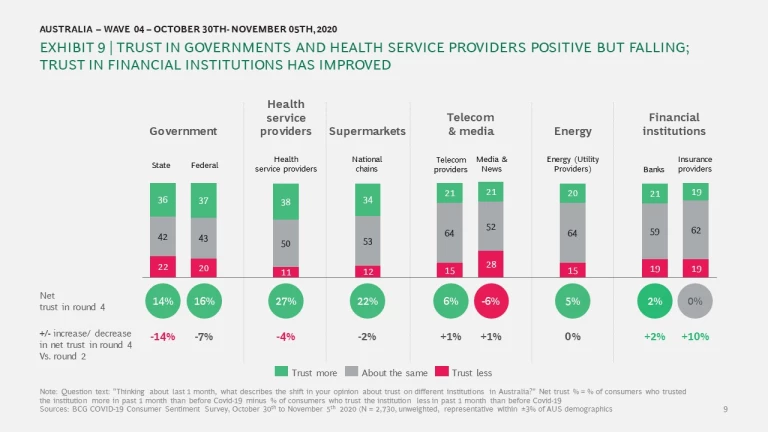

Consumers continue to show trust in health service providers, supermarkets and government for their remarkable response to COVID-19. However, compared to our Round 3 survey, trust in government and health service providers has dipped. At the same time, we continue to see some shift towards positive net trust for banks, insurance providers and telecoms companies. See Exhibit 9.

Organisations that have been able to secure customer trust were praised for their honesty and integrity, regular communication, responsiveness and fair treatment of customers.

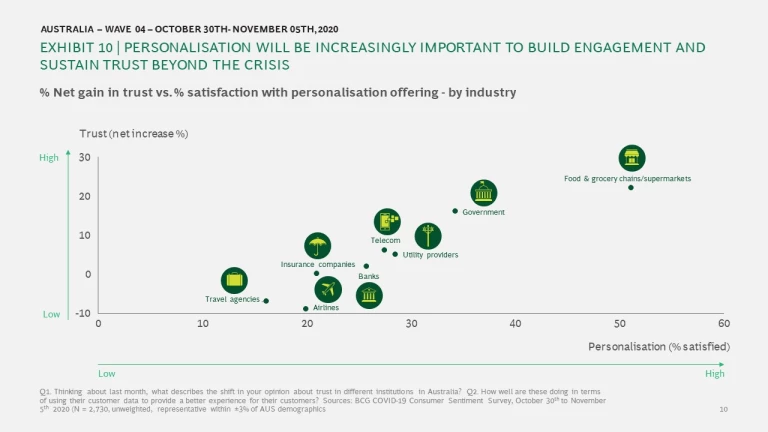

This all points to personalisation as a critical catalyser of success. To create an impact across all these dimensions, it is important to know your customer and customise your offerings and support accordingly. Our data shows that companies that manage to satisfy their customers with customer-driven personalisation efforts can secure higher net trust scores. As an example, supermarkets and governments were praised for their personalisation offerings and experienced among the largest net increases of trust across all organisations. See Exhibit 10.

To succeed, personalisation strategies require customers to share their data. Around 42% of consumers said they are happy to share their data. Consumers that prefer not to share cite two leading reasons: they are sceptical about their data being shared elsewhere (33%); they lack certainty around how their data will be used (19%); and 12% say that they have not seen any benefits of sharing their data with organisations.

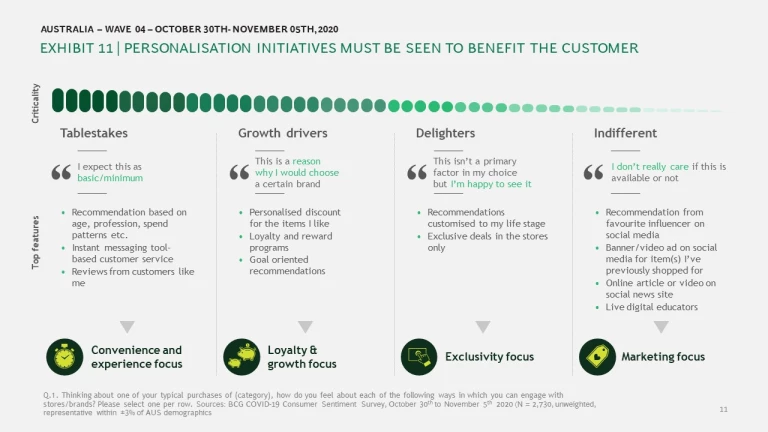

Consumers’ willingness to share their data depends on whether they receive any benefit in doing so. For example, consumers will be more willing to share their data if it makes their customer experience quicker and easier, if they derive financial benefit, or if their loyalty is rewarded. Consumers also need clear communication about how their data will be used, and assurance around how their data will be protected. See Exhibit 11.

Looking ahead

Companies innovate in tough times, and COVID-19 has been a catalyst for new avenues of growth, for accelerated use of digital and more effective use of customer data. The following strategies can help companies emerge stronger post COVID-19.

Respond to the dynamics of COVID-19 normal. The COVID-19 normal will have many dimensions: for example, close to 60% of consumers have been working from home in the past six months and many enjoy doing so. In response, companies are revisiting their flexible work policies to create the most effective hybrid working model for the future. The organisations that get this right will have a clear advantage in the war for talent. To read more, click here .

Personalisation, a key to sustained positive trust. Personalisation has moved beyond getting your customer’s name right and segmented offers. To build sustained trust, companies must use their customer data in a more sophisticated way to focus customer engagement on an individual’s personal circumstances and reflect their needs with the right engagement, in the right channel, at the right time. Customers are less likely to be forgiving of messages that are not relevant to them. To understand more about the personalisation imperative, read, here .

Shifts to digital are profound, but a seamless multi-channel experience is equally important. The COVID-19 outbreak has pushed many offline retailers into the online world, but with an uplift in consumer confidence they must now manage the solid proportion of consumers inclined to return to in-store shopping. Although we’ve established that digital growth will persist after the COVID crisis subsides, the growth trajectory will not be at the same pace for all industries. Many consumers have already resumed their in-store shopping habits. Companies must put response strategies in place to meet demand online and offline. This will require rapid inventory management, COVID-safe points-of-sale in store to ensure employee and customer well-being, and a seamless online-to-offline purchase experience.

In summary

Consumer sentiment has shifted rapidly in line with the coronavirus progression, and consumer behaviour and attitude shifts have followed. As concern subsides in Australia, consumers are largely committed to returning to pre-COVID spending behaviour and at the same time, determined to carry forward some of the lifestyle changes they adopted during COVID-19. Embracing digital and using digital tools to maintain personal sustainability and choice around where and when to work are likely to be lasting trends. Consumers also value data sharing when it proves to be beneficial to their customer experience. Personalisation will be key to building trust post the crisis. Companies need to keep these themes in mind as they plan their strategies to win consumers in the post-COVID-19 normal.