The business interruption caused by COVID-19 gives travel companies a compelling reason to develop new models for understanding, engaging, and recapturing customers. These models, which involve designing and pricing more personalized offers , bundles, or packages of products, services, and features, will be bionic—with humans and machines working together in new ways to maximize the impact of each on the overall process and the results it achieves. As they work to shape their new business offerings and interactions with customers, travel companies will also need to reset their revenue management operations for a permanently changed marketplace.

New Models of Human-Machine Collaboration

While the longer-term trends reshaping the travel industry may have been interrupted by COVID-19, they will return along with the eventual recovery. One of the most far-reaching is digital customer engagement and personalization . Consumers have been trained by the likes of Amazon, Netflix, Alibaba, and Starbucks to expect seamless, consistent, and convenient purchasing experiences across multiple touch points. They expect products and services tailored to their individual needs , superior and engaging content, and rising loyalty rewards.

Travel and tourism companies are becoming bionic organizations that combine the strengths of humans and machines to develop superior customer experiences.

As travel products become more sophisticated, the ways in which they are priced will need to be reconsidered. Pricing is no longer about just the competitive cost of a ticket, level of service, or type of hotel room. It must be adaptable to the individual customer’s circumstances so that the pricing and revenue management (P&RM) function supports the overall digitization and personalization of travel products.

This means companies need new capabilities—specifically, bionic capabilities that combine the strengths of humans and machines. In travel and tourism, as in other industries, companies are becoming bionic organizations, developing superior customer experiences and relationships at every stage of the customer journey as well as more productive operations and dramatically increased rates of innovation. (See “BCG’s P&RM Summit.”) We have already found in our work with clients that effectively combining human analytical skills and machine data capabilities leads to better results than either can achieve alone. For example, before the COVID-19 crisis hit, bionic P&RM capabilities delivered an annualized increase in revenue per available seat kilometer of 2% to 3% for a large airline, with even bigger increases in periods with volatile demand.

BCG’s P&RM Summit

BCG’s P&RM Summit

The BCG Global Competence Center for Pricing & Revenue Management hosted its first P&RM Summit in 2019 in partnership with GOR (Gesellschaft für Operations Research), a leader in operations research from Munich University. The goal was to promote the exchange between academia and the business community about the state-of-the-art and future of P&RM in the travel industry. Nearly 150 people attended, including researchers, CCOs, CSOs, and P&RM managers from leading travel companies globally, representing 48 companies and 12 universities. The summit showcased the most recent business developments and scientific advancements in the field while discussing the future and trends of P&RM. The next P&RM summit will be co-hosted with BCG GAMMA, the firm’s team of data science and data engineering experts, and will focus on bionic P&RM.

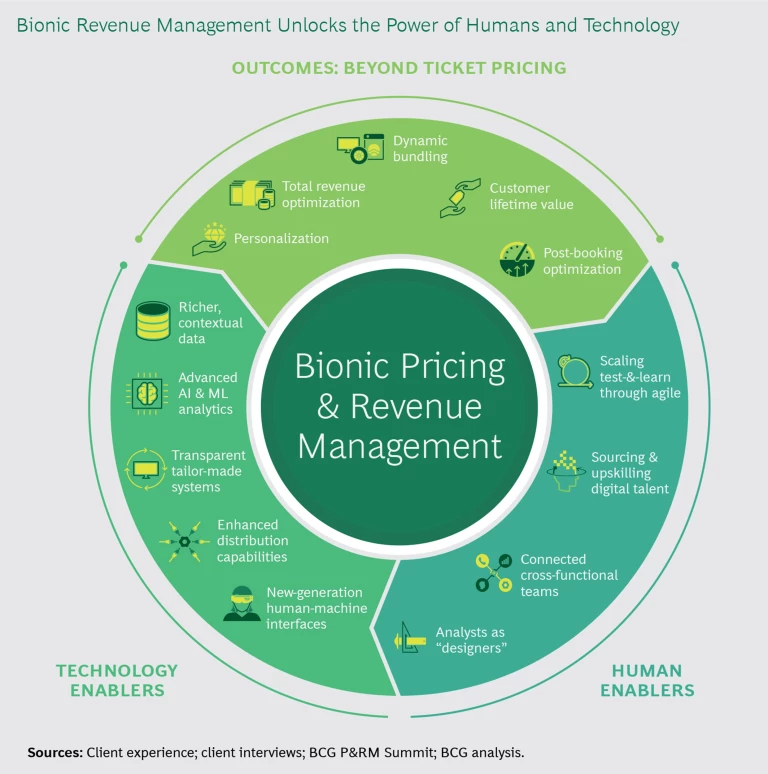

The primary barrier to progress today is no longer technology itself. Rather, it is finding the design that allows a company to unleash the potential of technology to improve activities in three categories: pursuing outcomes that go beyond ticket pricing, enabling technology to add value to human efforts, and enabling humans to extract value from technology. (See the exhibit.) To build the required capabilities and achieve best-in-class outcomes, travel companies need the power of both technological and human enablers. If there is a silver lining to the COVID-19 crisis, it is that organizations that move quickly have time to put the necessary capabilities in place in advance of the eventual recovery. Since the recovery in travel is likely to be gradual, it will be an advantageous time for operators to pilot and refine new P&RM practices, especially as past data and forecasts will not be relevant and there will be a higher risk tolerance for testing new practices in a rapidly changing new environment.

Beyond Ticket Pricing

Most P&RM leaders have already recognized the need to move beyond using price to optimize the value captured from sales. They are looking to maximize the value delivered to individual customers based on an enhanced understanding of their needs. These companies are testing individualized product design, ancillaries, and bundles as well as post-booking activities. Their goal is to recognize revenue potential throughout the booked voyage and ultimately to shift from a paradigm of pricing individual purchases to maximizing customer lifetime value (CLV). While few have made significant progress toward this goal, leaders are focusing on five outcomes.

Personalization. Our research has found that brands that create personalized experiences by integrating advanced digital technologies and proprietary data are seeing revenue increases of 6% to 10%. Personalization is about delivering additional value to customers , not simply setting a unique price for each customer for the same product. For example, many companies are already using their CRM systems to deliver targeted offers. Less common, but certainly more powerful, is integrating the CRM and revenue management systems so that the customer profile and purchasing behavior are reflected in the price-setting methodologies.

Travel companies with expiring inventory can benefit from creating real-time personalized offers that match customer needs and unused inventory. Such offers maximize conversion, profitability, and customer satisfaction. One airline uses advanced analytics to recapture customers who visited its website but did not complete the purchase, tailoring its offers based on the customer’s profile, spending behavior, and characteristics of the searched flight. The initiative has materially increased the website conversion rate, which has translated to several million dollars in incremental revenue.

Travel companies can benefit from using advanced analytics to create real-time personalized offers that match customer needs and unused inventory.

Total Revenue Optimization. Many travel companies still do not take full advantage of total revenue optimization. Yet our experience shows that even mature companies can capture more value by improving their pricing methodology to account for the combination of tickets, ancillaries, and bundling . For instance, machine learning (ML) techniques can augment scientific analyses of differences in consumers’ unmet needs and willingness to pay (WTP). P&RM leaders deploy consumer research, business intelligence tools, and analytics to unlock value from both bundling decisions and from prioritizing consumers with high expected ancillary spending. Mainstream cruise lines and casino resorts have pioneered ways to measure how likely customers are to spend, and they incentivize the purchase of cabins and rooms accordingly.

Dynamic pricing of ancillary products is another important lever. Many operators have started pricing these products based on WTP models, as they have done with their principal offerings. One airline designed and implemented a model that analyzes the conversion rates on the most relevant ancillary products and services in order to identify the most promising opportunities. Using an agile test-and-learn approach, the company launched several pilots simultaneously, which shortly generated an ancillary revenue boost of up to 20% relative to the control group. The new initiatives were then rolled out to other routes.

Dynamic Bundling. As individual fares and rates become more transparent and travelers’ expectations for memorable experiences increase, dynamic bundling is a way for companies to deliver increasingly higher customer satisfaction while enhancing profitability. Online travel agencies such as Orbitz and Expedia already allow customers to select packages of flights, hotels, rental cars, and other services at prices that adjust to actual market take-up and customers’ WTP. A few travel operators also are piloting this type of bundling. To create attractive packages, companies need to use quantitative consumer research and ML to develop an in-depth understanding of consumer demand segments and WTP.

Customer Lifetime Value. In a competitive market where the cost of acquiring new customers is high, building long-lasting customer relationships can be much more valuable than acquiring the occasional new customer or maximizing the revenue of the next booking. CLV methodologies can help travel companies address the unmet needs of high-value customers, incentivize frequency of purchase, and ensure that the pricing of residual seats (or rooms) reflects both the immediate revenue opportunity and each customer’s longer-term contribution to company profitability. Insurance and consumer credit industries can provide guidance here, given their experience in considering long-term returns in pricing decisions. CLV will be more important than ever, as winning back customers will be challenging in the transition out of the COVID-19 crisis.

Post-Booking Revenue Optimization. More companies are shifting their attention to comprehensive post-booking revenue optimization, which remains a broadly untapped lever to increase revenue and enhance customer service. Most companies do no more than offer customers online check-in reminders, missing opportunities to both maximize revenues and deepen customer engagement.

Optimizing revenue throughout the booking process involves sophisticated rebooking management and targeting of ancillary offers based on understanding a customer’s willingness to accept a different product or offer that will benefit the company. For example, an Atlanta, Georgia–based startup, Volantio, uses artificial intelligence (AI) and ML technologies to identify flexible passengers on strongly performing flights, make them offers to move to weaker flights, and seamlessly rebook them once they accept. Airlines can re-optimize capacity and yield continuously during a flight’s selling period. Another innovative model is the bid-based upgrade programs introduced a few years ago at airlines and, more recently, at cruise lines Royal Caribbean and Norwegian, as well as by suppliers in other travel verticals.

Technology and Human Enablers

Companies need both technology capabilities and human skills to enable these outcomes. The former include data, AI and ML, systems, and enhanced distribution capabilities. The latter encompass talent, cross-functional teaming, and agility. Bridging the two are new-generation human-machine interfaces.

Data. Travel companies have more kinds and volumes of data available than ever before. In addition to traditional data sets and shopping-behavior data, data that provides context to booking decisions can play a critical role in setting prices. Contextual data enables better understanding of customer decision making and emerging trends, and can include competitive information (scheduling, capacity, and pricing, for example), weather forecasts, social media feeds, special dates and events, and channel trends, all of which can be integrated with proprietary data based on search criteria to improve P&RM actions.

AI and ML. To generate insights that can be acted on, enormous amounts of data must be harnessed and processed. A midsize airline typically handles several million price updates on any given day, not to mention competitive benchmarking, fare filing, integrity monitoring, and marketing outreach. While people excel at managing volatility and spotting variations, machines are able to handle quantity far more efficiently, which can lead to gains in performance.

This is where AI and ML can make a big impact, and more travel operators are relying on these advanced technologies to perform recurring value-added tasks. Companies are developing automated and intelligent decision-support tools, such as dashboards, market trackers, and simulators, to “robotize” P&RM activities. Leaders use a combination of human and machine strengths to optimize the key components of their P&RM programs, including:

- Developing a full suite of alerts

- Defining the actions to be taken in each circumstance

- Measuring the effectiveness of the actions taken

- Implementing a reinforcement algorithm that learns from previous actions and improves optimization based on effectiveness

ML algorithms and advanced analytics programs allow for much greater sophistication than traditional methodologies in matching demand to capacity. One airline developed a demand forecasting tool to optimize hundreds of thousands of prices daily. Using both traditional forecasting methods and ML techniques, the tool systematically generates multiple forecasts in parallel for each future departure. An additional ML layer dynamically blends all the forecasts to come up with a systemwide assessment of demand. The system proved 35% more accurate than the company’s old forecasting model and up to 50% more accurate than its legacy revenue management system.

Another airline uses contextual data, data from historical promotion calendars, and an ML algorithm to identify the best-performing combinations of promotions. In pilot programs, it logged a 22% increase in revenue from promotional offers.

ML techniques can also improve pricing intelligence. For example, ML can quickly identify pricing opportunities and respond to competitive mismatches. It can also help automate fare filing, reduce lead times, speed time-to-market, and minimize human-generated errors. Airnguru, a startup based in Santiago, Chile, uses advanced analytics to help airlines monitor fare movements and optimize fare structures in near-real time.

Systems. To develop such technical capabilities, most travel companies need to upgrade their systems. Integrated smart application program interfaces, IT platforms, expanded data collection and storage capabilities, web analytics, and modern revenue optimization and CRM systems are now table-stakes capabilities. P&RM leaders are already replacing legacy technology with open architecture and IT ecosystems that provide seamless integration with third-party platforms. Cross-digital platforms and distribution systems provide a stronger focus on improving the customer experience. More companies are relying on custom- or in-house-developed systems to complement or replace older, one-size-fits-all revenue management systems.

Distribution. Travel companies still tend to base their prices on a limited number of fare, room, or vehicle classes and price points, largely because of the constraints imposed by legacy distribution systems. More flexible continuous-pricing models, in which prices are set within a range of values, are already the norm for nonlegacy players such as low-cost airlines and companies that do not rely on a global distribution system, including cruise and tour operators and car rental firms. A few legacy companies are also moving in this direction.

A recent study by the PODS Consortium at MIT found that despite the legacy technology challenges, continuous pricing can lead to revenue gains of up to 3.7%—more than enough to justify the investments in and changes required to current processes.

The International Air Transport Association’s NDC (New Distribution Capability) is one important step toward a more flexible digital engagement model for airlines. NDC allows for more information to be exchanged (such as data on ancillary products and services) and for prices and product offerings to be customized at each customer’s request and in real time, increasing companies’ ability to pursue multichannel offers. NDC technology provides visibility on fares, bundles, and ancillary product offerings to business travelers and presents a shopping experience that takes advantage of direct-to-customer online and mobile channels, among other benefits.

We expect to see a fundamental shift in the nature of work—from processes operated by humans to those designed and audited by humans.

Human-Machine Interfaces. As machines and AI take over more operations, people’s roles will inevitably change. Indeed, over the medium to longer term, we expect to see a fundamental shift in the nature of work—from processes operated by humans to those designed and audited by humans. Companies will be hiring people to develop augmented and automated processes and improve them over time.

Capturing value from this shift will require a massive redesigning of legacy business processes to enable humans and machines to work together. This is where many traditional businesses struggle, while digital natives can design for this sort of collaboration from the get-go.

Still, some travel companies are showing success. Before the COVID-19 crisis hit, one airline had already created an end-to-end bionic system to identify and prioritize flights that were booking too quickly or too slowly, according to its models. The system delegated actions to both human analysts and an ML algorithm. Analysts were able to shift their efforts to more high-leverage and strategic work. ML techniques contributed a more detailed and accurate view of the level and quality of demand forecasted, leading to improved prioritization logic and higher-quality interventions. In the quarters following implementation, the airline exceeded expectations.

Talent. Since many employees today do not have the required skills for a bionic future, the challenges of transition will be dramatic. Companies will need to employ multiple levers to survive the intensifying competition for talent. The most important of these will be retraining current talent. Travel companies need to broaden and deepen their skills, moving toward teams with cross competencies including steering- focused analysts, data scientists, product and category managers, front-end developers, and market strategists.

Perhaps most important, companies will need people who are characterized not so much by their business or technical skills but by their ability to focus on the frictions and pain points in customers’ experience and work collaboratively to find solutions to resolve them. This means that analysts will also act as designers.

Cross-Functional Teaming. There is no room for the silos that characterize most organizations today, as P&RM will need to interact daily with product development, marketing, sales, and operations, among others. Capturing pricing opportunities along the customer journey means leveraging skills and experience across multiple functions. The role of P&RM analysts with rounded profiles, capable of working together to design processes and pricing levers in a more complex environment, will increase. So will the importance of cross-functional teams with the mandate to break down areas of opportunity along the customer journey and take action.

Agility. As organizations become more aware of the limitations of using historical data to estimate future outcomes, implementing test-and-learn models will become a critical capability. Test-and-learn is a key element of an agile way of capturing pricing opportunities along the customer journey. Data-driven insights on pricing and product performance, testing systems and processes before scaling up, and providing execution certainty before scaling up will allow companies to move more quickly to refine their models.

While some of the changes discussed here have been underway since the early 2000s, this is not a “we have been here before” moment. The combination of available data, advanced technologies, and PR&M maturity is driving leading travel companies to explore new approaches and methodologies. New capabilities are coming to market fast. Companies that act quickly will establish an advantage in customer engagement today, and they will be able to more rapidly deploy advanced technologies such as AI and ML. Those that are able to adapt most readily to bionic revenue management will be in the best position to meet the challenges of volatile demand, new competitive scenarios, securing talent, and recapturing customer business as the travel and tourism sector moves on from the COVID 19 pandemic.