For most businesses, the days of steady, predictable revenue and earnings growth are long gone. Volatility and uncertainty are the name of the game now, a fact that the COVID-19 crisis has made painfully clear. The pandemic only adds to the long list of disruptive factors—digitization, intensifying competition, global trade wars, and zero-interest capital markets—that have transformed the global business environment. To succeed, companies must react more quickly to rapidly changing conditions. Flexibility and agility are in; bureaucratic hierarchies and long-term planning cycles are out.

Under these circumstances, CFOs have taken the steps needed to assert their role as their company’s “value steward.” They have focused on costs and liquidity, driving smart capital decisions and tightening performance management. Now, many are looking forward and asking, How should we run financial budgeting in these turbulent times?

To win in this new age of uncertainty, CFOs must do away with long budgeting cycles and rigid, overly detailed budgets. Even if a fundamental rethink of budgeting is not possible right now, several practical improvements can bring relief to the finance organization—and, by extension, to the entire business.

The Budgeting Challenge

Every budgeting exercise has three primary objectives: to set targets in order to motivate and reward performance; to coordinate resources by predicting midterm financial results and preparing accordingly; and to exert control by setting limits on costs and centrally influencing cost allocation.

Heightened uncertainty and volatility make it exceedingly difficult to achieve any of these goals. First, sudden market headwinds or unexpected windfalls cause absolute budget targets to be less and less useful. Comparing actual results against budgets no longer reliably indicates manager performance. Second, it has become more and more difficult to predict results in great detail and over long time horizons. In many cases, single-point estimates will almost certainly be wrong. Third, in uncertain times, managers must be able to respond quickly to changing circumstances. This frequently requires going over or under budget limits for entirely justified reasons. Control via rigid budget limits has become far less effective.

These issues only add to all the well-known, long-standing budgeting challenges: considerable effort and a high degree of complexity, intentionally pessimistic or unreachable targets, spend-it-or-lose-it behavior, quickly outdated assumptions, and the like. (See Exhibit 1.) In short, setting detailed, rigid budgets a year or more in advance is increasingly a futile exercise.

Adapting Next Year’s Budget

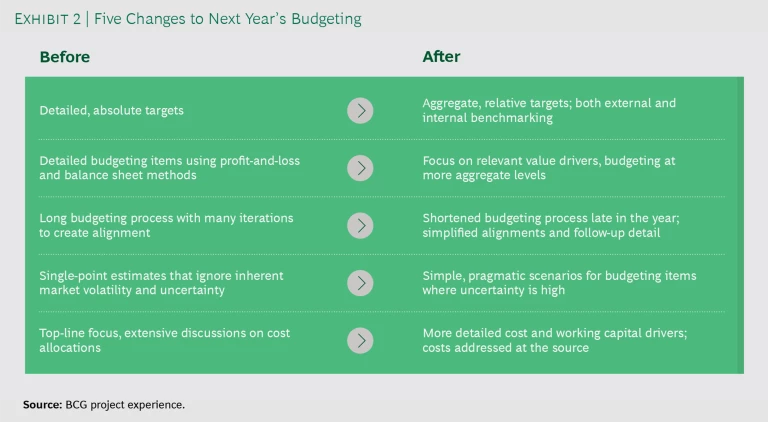

Some CFOs have already begun adapting next year’s budgeting process to the new reality in order to reduce unnecessary effort and frustration, not just in finance but also on the business side. Every CFO would benefit by taking five steps to increase flexibility and ease the pain of budgeting in the short term. (See Exhibit 2.)

Focus on relative targets. There are few absolutes in an uncertain world. Rather than setting overly detailed, absolute budget targets, companies should focus on more aggregate and relative targets that allow for the required flexibility. Margin or “cost per ton” targets and total-cost envelopes are preferable to detailed breakdowns of cost. Ultimately, predicting total sales at the regional level, for example, will likely prove to be more accurate—and thus more useful—than trying to pin down exact sales figures for each country or, worse, for each product line within a country.

Where possible, companies should consider employing external benchmarks such as market share, return on capital employed relative to the competition, or relative total shareholder return, but internal benchmarks such as each site’s operating margin relative to others can also be useful.

Changing targets and the resulting incentives is likely to be a highly political exercise. As one industrial goods company discovered, however, this can be avoided by encouraging the board to select a few targets from the current set and then leave the fundamental reworking for later.

Minimize budgeting scope. Many companies still take a mechanistic profit-and-loss and balance sheet approach to budgeting. Instead, it’s more helpful to develop value driver trees, which focus the budgeting exercise on the metrics that really matter. It also helps separate the drivers that can be reliably predicted from those that remain uncertain.

In addition, companies should rethink and probably shorten their budgeting horizon. Does production really need a two-year budget, when results for even the next quarter are uncertain? Does the company really need a long-term horizon for any except major capital investment decisions? Even in cases such as product development decisions, which require predictions beyond the next year, companies should limit themselves to the relevant time horizon and the data that matters for the particular decision at hand.

Flexibility and agility are in; bureaucratic hierarchies and long-term planning cycles are out.

Finally, budget at more aggregate levels. There is little to be gained from trying to predict long-term developments at the product or legal-entity level. Planning at the division or regional level will allow for sufficient flexibility. If planning for particular legal entities is needed—to conduct fair-value tests in accounting, for example—it should be carried out mechanically, at the end of the budgeting process. It should not have any impact on management decisions.

Shorten the budgeting process. BCG’s CFO Excellence database shows that top-quartile finance functions complete the budgeting process in just four weeks, less than half the time taken by the average company. Also, carrying out the process as late in the year as November, rather than starting in July, will give companies a clearer view of what the coming year might look like.

To successfully shorten the budgeting process, it must be conducted in the proper sequence. Good budgeting follows a classic W pattern. It starts with top-down setting of the strategic direction and financial ambitions, followed by a middle-up validation of financial cornerstones. Once the cornerstones are agreed on, the organization can fill in the required detail from the bottom up, before final approval. It’s essential to refrain from adding the details for as long as possible in order to avoid producing multiple, overly detailed versions along the way.

Introduce scenarios where relevant. Companies operating in volatile markets will likely find that single-point estimates of sales or the cost of certain materials will most likely prove to be wrong. Instead, these companies should think in terms of scenarios that reflect the underlying volatility.

Such scenarios need not be as elaborate as the full-scale, months-long process made famous by Shell Oil in the late 1960s. Instead, companies should be pragmatic, developing the three classic high, medium, and low scenarios and then producing simplified budgets for each. We strongly recommend using value driver trees, which make the exercise much easier because different assumptions can be swapped in and out. The business should lay out key initiatives in the middle, “expected” scenario and from that derive key variations, depending on whether things turn out better or worse. The right software can facilitate the process.

The usefulness of scenarios for budgeting purposes may seem obvious, but in our experience, few finance functions take this approach. In the end, scenario-based budgeting is not intended either to predict precise outcomes or to stretch your thinking beyond what’s likely, but rather to help the business think through plausible variances and prepare accordingly.

Top-quartile finance functions complete the budgeting process in just four weeks, less than half the time taken by the average company.

Emphasize cost and cash metrics. Given the current economic challenges, most companies are focusing more on cost and cash metrics. An international pharmaceutical company, for example, has increased the budgeting detail on cost and working capital drivers. Other companies, like one of our machinery clients, is changing budget responsibilities, moving from discussing cost allocations to ensuring that costs are addressed at the source.

Budgeting and Business Models

The specifics of an effective budgeting process are determined by a company’s industry and business model. Uncertainty around the short- and longer-term impact of COVID-19, for example, varies considerably from sector to sector. According to our most recent CFO Pulse survey , utilities and insurance and telecom companies remain optimistic about the effect of the pandemic on their revenues and earnings, while transportation firms are very concerned.

Companies also vary significantly in how their business models affect their budgeting processes. Retail businesses, for example, are likely to become even more tactical as their business cycles speed up, potentially making a formal budgeting process entirely unnecessary. Automotive companies, on the other hand, will continue to conduct a far more extensive budgeting process, given their complex, interwoven global supply chains and long product development cycles.

From a long-term perspective, it is also critical that companies begin to fundamentally rethink their steering models. Uncertainty will remain a fact of life. To allow the business to adapt quickly to changing circumstances, companies will need more frequent forecasting. This, in turn, will require better tools and processes, such as algorithmic forecasting . As ex-ante control via the budget becomes less reliable and effective, finance functions need to double down on ex-post control, which will depend on more timely and transparent reporting.

These short-term changes to the budgeting process are just the beginning. It’s time for CFOs to think through the significant shifts in resources and capabilities that will be required to support the business in the new age of uncertainty.