The fifth generation of wireless technologies, 5G, promises to catalyze the development of mobile digital solutions that will help reinvent how business works and transform the way people interact with one another. Over the coming decade, 5G networks are likely to disrupt almost every industry in the world.

Most countries and policymakers have been talking about “a global race to 5G,” with a narrative focused on which nation is leading on narrow metrics such as the number of 5G subscribers and cell towers at any given point in time. Those numbers may be interesting, but they paint a partial and often misleading picture. 5G’s true significance lies in the fact that it will generate economic growth, create new jobs, and reshape innovation. (See the sidebar “Why Raw Numbers Don’t Tell the True Story.”)

Why Raw Numbers Don’t Tell the True Story

Japan, for instance, initially led in the 3G economy. Its integrated mobile internet service shaped a strong business case for network investment and new applications. Its 3G penetration rate was initially significantly higher than that of the US and Europe, according to a report from Recon Analytics. Japan’s population was only about 40% that of the US, so the US still had a higher absolute number of 3G subscribers than Japan did. However, the US penetration rate was not high enough to sustain the business case for investment. The same dynamic will play out in the 5G era, so simply comparing the number of subscribers countries won’t be useful in tracking progress or making investment decisions.

Headlines comparing the total number of 5G cell towers in a country are even less relevant. 5G coverage is a function of more than the raw number of cell sites—and the methodology used to count such wireless infrastructure—and includes geography, population density, the number of population centers, the type of spectrum used, and the type of technology. Any meaningful comparison of countries’ 5G progress must include the penetration rate over time.

US policymakers should turn their attention to these five key success factors that will enable the 5G economy to thrive over the next decade.

That’s why we believe US policymakers should fundamentally change how they think about 5G. Instead of focusing on a global race narrative, they should turn their attention to these five key success factors that will allow the building of the 5G economy in the US and enable it to thrive over the next decade.

- Spectrum Availability. To unlock the full potential of 5G networks, wireless providers need a sufficient mix of low-, mid-, and high-band spectrum, which should be made available through a market-based, transparent set of forward-looking auctions.

- Networks. Capital investments by cellular-service operators have been, and will continue to be, critical for building the 5G network infrastructure. A reduced regulatory burden at all levels of government will speed infrastructure build-out, which is necessary to increase subscriber penetration, the key measure of network reach.

- Innovation Ecosystem. US government policies should encourage ample private-sector R&D spending and provide strong IP protection to nurture a virtuous cycle of innovation and development.

- Business Climate. A combination of access to funding, openness to risk, and business-friendly policies will create an environment that is conducive to technological innovation.

- Talent. To ensure that the US workforce has the skills necessary for future technological changes, tech-related certification and degree training will be critical.

US progress on the key success factors suggest areas of both strength and room for improvement. While the innovation ecosystem and business climate are excellent, and operators are investing aggressively to build out 5G networks, the addition of more available spectrum—midband in particular—will be important, as will be continuing the streamlining of policies governing the building of the cellular infrastructure and labor-force readiness.

The Three Phases of 5G Growth

The 5G economy is likely to grow in three distinct phases. (See Exhibit 1.) Robust 5G networks that provide better data speeds, increased device density, and improved latency will constitute Phase 1. These networks will serve as the backbone of future economic growth.

In Phase 2, rising 5G penetration rates will enable transformational innovation through 5G-based use cases and improvements in existing applications. As the decade progresses and the 5G economy enters Phase 3, fully realized 5G-based use cases will deliver benefits to every citizen and business through higher productivity, improved cost competitiveness, and better health and safety. These phases will overlap; some applications will improve even as the networks are being built.

The evolution of the 5G economy will be similar to that of the 4G economy. The first 4G network in the US was launched in 2010, and by late 2014, penetration rates had reached 50%. At the same time, companies had developed new devices and apps designed to take advantage of the greater network speeds. By the end of the decade, 81% of US adults owned a smartphone. The app economy had grown to contribute 4.7 million jobs and nearly $570 million to US GDP by 2018, according to trade group the App Association. And because of 4G, the wireless industry’s contribution to the US economy more than tripled in the same

Phase 1: Robust 5G Network Buildout. 5G networks will provide the technological foundation for economic growth in this decade because they will allow:

- Faster Data Speeds. Download speeds will be 40 times faster than they are today.

- More Connected Devices. The maximum number of devices that can function in a specific area, known as connection density, will increase tenfold.

- Instant Response. Latency, that almost imperceptible pause before data transfer begins, will decrease, resulting in response times that are roughly 10 times faster than at present.

US wireless providers are already building networks and providing 5G services across the country. As the networks expand and the subscriber base grows, the consumer and business experience improve.

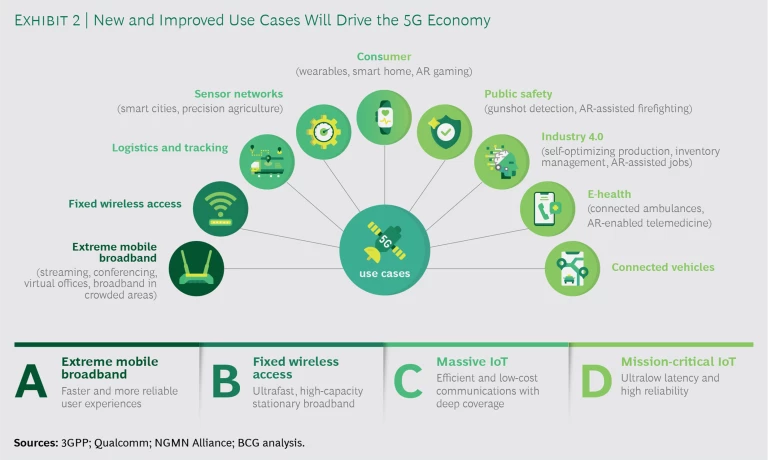

Phase 2: 5G-Enabled Use-Case Development. Increasing 5G penetration rates will spur improvements to existing wireless applications and the development of new applications that will be the building blocks of the 5G economy. (See Exhibit 2.)

Future 5G use cases can be broken down broadly into four types:

- Extreme mobile broadband (eMBB) will allow for mobile videoconferencing without lags, high definition mobile streaming in crowded areas, and more stable connectivity.

- Fixed wireless access (FWA) will leverage networks to bring broadband service to homes and businesses. This will expand both high-speed internet connectivity and consumer options.

- Massive Internet of Things will rely on an extremely high density of connected devices. Its creation will be aided by the lower power consumption of 5G networks, which will extend sensors’ battery lives and minimize the need for replacements, especially in hard-to-reach places.

- Mission-critical IoT will benefit from 5G networks’ ultralow latency, enhanced security (allowing for the transmission of sensitive data), and new network flexibility.

The evolution of 5G networks, and the investment costs of building them in a country as large as the US, will cause the types of use cases created in the near term to vary from those developed in the mid- to long term. In the short run, eMBB and FWA will become more widely available. Verizon already offers FWA 5G plans to customers in six cities. In February 2020, the National Football League teamed up with Verizon to outfit Hard Rock Stadium in Miami with 5G network coverage during Super Bowl LIV to demonstrate eMBB’s capabilities in a crowded setting. These are early examples, but as the US moves from building robust 5G networks to expanding use cases, both eMBB and FWA will likely increase.

Massive IoT and mission-critical IoT will develop more slowly. They will pop up across industries and consumer subsets in a small way, but the full benefits of these use cases will likely be realized later in the decade. For example, making self-driving cars a reality will require ultralow latency and redundant 5G networks in every area that a car can go. In the medium term, semiautonomous driving technologies will aid truckers on major transit routes as well as urban commuters in cities that have high-band 5G networks. Massive IoT and mission-critical IoT will eventually transform transportation as similar changes take place in other sectors.

Phase 3: Broad Benefits. As 5G networks get better in each phase, they will enable the creation of digital offerings that provide many kinds of benefits to people and organizations. 5G applications will transform almost every major industry in the US. They are likely to lead to greater labor productivity, boost companies’ global competitiveness, and improve public health and safety. In fact, 5G could well prove to be the key driver of national competitive advantage in the 2020s—just as US leadership in 4G technologies drove economic growth in the previous decade.

5G applications are likely to lead to greater labor productivity, boost companies’ global competitiveness, and improve public health and safety.

For example, companies will be able to use sensors connected to 5G networks to improve their ability to track raw materials and components throughout their supply chain. That will help employees, who will be able to collaborate remotely and conference on the go, to optimize transportation routes and reduce inventory requirements.

Similarly, 5G networks will help build the factory of the future. Employees wearing AR glasses will be able to analyze the status of machines, get expert advice in real time, and update operational parameters while staying safe. Sensors with extremely low latency will ensure that robots and employees can work alongside each other and instantly communicate to optimize their actions. The cost reductions brought on by these processes may be great enough to bring more manufacturing—and the associated jobs—to the US.

In another area, 5G-enabled telemedicine, combined with augmented reality (AR) applications, will increase access to health care providers on the go. During emergencies, smart city sensors will allow the deployment of faster, more informed emergency response teams.

Even those futuristic projections offer only a sneak peek at 5G’s potential. When the first US 4G network launched in 2010, no one predicted that 4G would lead to the creation of ride-sharing services, which were available to 75% of the US population by 2015; music streaming services, which accounted for 80% of the US music market by the middle of 2019, according to the RIAA; and the huge expansion in the number of mobile apps. These wireless services changed everyday life for people in less than a decade.

Global Leadership in Wireless Network Technology

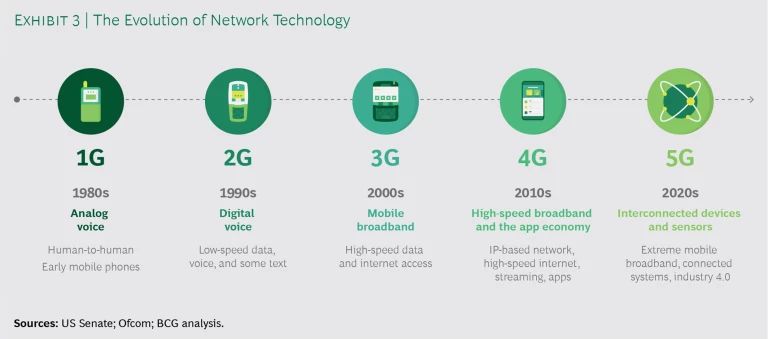

A new region or country has led the way in rolling out each generation of wireless technologies and with that head start has been first to reap the larger economic benefits. (See Exhibit 3.) After analog cellphones started making inroads in the West, European market leaders together created the global system for mobile communication (GSM) standard, which allowed them to form a broadly unified user base and dominate the 2G market.

By the end of the 2G era, spectrum-related regulations increased licensing costs and delayed commercial investment in 3G networks in Europe, so the region ceded its dominant position to Japan. This came as the economic impact of network technology was increasing because of the advent of mobile internet access. Japan became the leader of the 3G economy, as the country boasted an integrated mobile internet service that shaped a strong business case for investment in the mobile network and its applications.

Japan was well-positioned to lead the 4G economy, too. It was among the first countries to launch 4G networks and was able to use the high-speed broadband of 4G to launch the apps economy. However, the lack of an open ecosystem for digital content and application development around the dominant operating system slowed Japan’s ability to develop a full-fledged 4G economy outside its home market. That opened the door for the US.

How the US Came to Lead the 4G Economy

During both the 2G and 3G eras, the US was slow to roll out networks, leading to sluggish growth in penetration and longer waits for those networks to reach a critical mass of subscribers. In the second half of the 3G decade, however, some key shifts took place. Advanced smartphones began hitting the market and US regulators made important policy decisions, which led to increased investment by US telecommunications companies. (For example, in 2009, the Federal Communications Commission adopted a shot clock to expedite tower siting, establishing time frames for state and local governments to review proposed wireless deployments and modifications.)

The US also benefitted from the rapid auctioning off of spectrum by the FCC and incentives that prompted spectrum holders to make spectrum available to other users. From there, competition among wireless network operators ensured significant investments in building networks. However, being the first to launch a network isn’t enough; Sweden and Norway were actually the first to launch 4G networks. It’s important to ensure that network penetration attains a critical mass quickly, so there’s a market for applications and a platform for investment and innovation. By 2015, over 50% of adults in both the US and Japan had 4G subscriptions—a higher percentage than in most European countries, according to the World Cellular Information Service.

In addition to the networks, several drivers led to US leadership of the 4G economy. The US combined its innovation environment, talent, and a favorable business climate with widespread 4G networks to get ahead. Using the talent pool and resources from its personal computing industry, the US created an ecosystem for app-centric innovation and entrepreneurship. That allowed 4G technologies to permeate the US economy over the course of the decade.

Each wireless network generation has brought new devices and applications, enhancing its impact on the economy. Thus, the 5G stakes are higher than ever today.

The US took an early lead in innovation, and by 2012 patents for mobile services accounted for more than 20% of the total of those issued in the US annually. Innovation translated into economic growth; Silicon Valley’s ample early-stage funding interacted with a relaxed business environment, and job creation ensued. A virtuous cycle began as US tech hubs with expertise in software and digital services fueled additional growth in jobs, concentrating talent by drawing entrepreneurs, technical experts, and creative designers, from around the world.

Each wireless network generation has brought with it new devices and applications, enhancing its impact on the economy. Thus, the 5G stakes are higher than ever today.

Five Success Factors for the 5G Economy

Every country in the world will eventually benefit from 5G networks, which is why we suggest that policymakers pivot away from the idea of a global race and focus on the 5G economy holistically. This will require a forward-looking, substantive set of metrics to measure broad progress and capture how other industries will leverage 5G networks. Our research, based on what made the US lead the development of the 4G economy, shows that a country must manage five factors simultaneously to create a best-in-class 5G economy.

Networks. Widespread network deployment is critical to laying the foundations of the 5G economy, and rapidly achieving high penetration levels. A network obviously needs infrastructure, but real value is unlocked when consumers and businesses take advantage of faster and more reliable connectivity. In the US, cellular service providers built out nationwide 4G networks quickly and an increasing 4G penetration rate followed.

In terms of infrastructure, the US government in the 4G era created a regulatory framework that incentivized investment and helped promote a competitive wireless market. That will be particularly important for 5G networks because they will require a denser wireless infrastructure footprint, though the antennae will be smaller.

To enable 5G’s higher data capacity, there must be a concurrent increase in the backhaul, the link between the antenna and the core network. That will require the rollout of fiber-optic cables (fiber, for

As networks are built, it is important to measure consumer penetration rates. The 5G economy will not move from Phase One to Phase Two until a large proportion of consumers have started using the networks. Historically, global market leaders have enjoyed penetration rates of 10% to 20% by year two, which for 5G would be the end of 2021. (As this report was being published, the full impact of the COVID-19 pandemic was still impossible to predict. Consequently, uncertainty surrounds the effect it will have on 5G development and consumer take-up.)

Spectrum is the foundation of the entire mobile communication system. Governments must provide cellular service providers sufficient spectrum in a timely fashion.

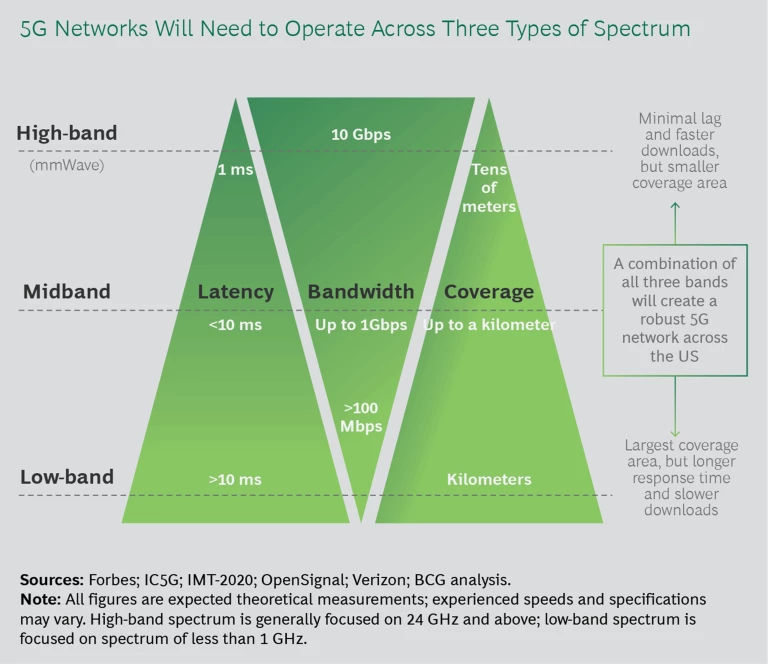

Spectrum Availability. Spectrum, a scarce resource, is the foundation of the entire mobile communication system. Governments must provide cellular service providers sufficient spectrum in a timely fashion. In the case of 4G, the FCC rapidly auctioned off spectrum even as US policymakers incentivized spectrum-holders, including federal government agencies, to make it available to other users if they did not need it. The availability of spectrum is no less important in the 5G era than it was in the 4G era, and the government must continue make it available in all the relevant spectrum bands, especially midband. (See the sidebar “The Types of 5G Spectrum.”)

The Types of 5G Spectrum

Low-band spectrum enables the use of wireless signals that can penetrate walls to reach deep inside buildings and cover large geographic areas, which allows for rapid and efficient deployment across the US. These signals, usually focused on frequencies lower than 1 GHz, provide an improvement over 4G, but peak bandwidth, and, therefore, speeds, will have a lower plateau, and latency will likely remain greater than 10 milliseconds.

Midband spectrum offers higher capacity and faster speeds than low-band spectrum and allows signals to travel farther than high-band signals. But it cannot penetrate buildings as efficiently and effectively as low-band signals and will not unlock the full potential of 5G speeds and response times like high-band.

High-band spectrum, also known as mmWave, is key to maximizing speed, minimizing latency, and increasing device density in 5G networks. However, high-band signals, generally defined as greater than 24 GHz, only travel short distances and have limited penetration. In order to work, they require the deployment of a larger number of low-power base stations (cells) to cover small areas. That makes it too expensive to act as the baseline network in less populated areas.

It’s important to understand the different kinds of spectrum because they determine which use cases 5G will enable, and when the benefits, such as commercial uses and revenues, will result. In addition to speed, connection density, and latency improvements, the established protocol for 5G networks enables lower power consumption by connected devices, enhanced security for data transmission, and the ability to slice networks into virtual networks tailored to the requirements of specific applications.

Innovation Ecosystem. R&D spending and IP protection will help the development of innovative new 5G services and foster cross-industry collaboration. A strong innovation ecosystem is already in place in the US. Since the early days of 4G, the US has awarded patents two-and-half times faster than the Europe, according to Chetan Sharma Consulting. The US tax code also includes a credit for R&D costs incurred in the US, which multiple studies have shown has increased spending on research in the US.

Business Climate. Concentrated funding, an openness to taking risks, and business-friendly policies will create an environment conducive to wireless innovation. In the case of 4G, the US government supported startups, including many app-based startups that supercharged the wireless economy, by passing legislation to increase access to funding and easing small business regulations. The world class ecosystem for early stage funding in the US has promoted the creation of innovative cellular businesses in the past and will continue to do so.

Talent. A workforce with the skills to manage technological changes will provide countries with the expertise to build state-of-the-art cellular networks and develop new applications. The mix of digital talent in the US, as well as the conducive environment for entrepreneurship, enabled both innovation and the affordable rollout of 4G infrastructure. The US attracted many immigrants with technical skills even as its digital and software talent clusters enabled the creation of tight-knit ecosystems. Maintaining a highly skilled workforce will be even more important if the US is to lead in the knowledge-based 5G economy. It will need talent across the entire value chain: from labor to install the 5G network infrastructure to technical expertise to build out applications, such as AR.

Measuring US Readiness for Success in the 5G Economy

That brings us to the key question: Will the US retain its leadership of the global cellular industry? BCG’s research shows that while the US continues to enjoy an edge in many areas, and is making progress on others, there’s room for improvement in several key areas.

Networks

Capital Investments. The level of capital investment per capita by US telecom providers is on par with, and often above, those in other developed countries. Since 2018 they have invested around $140 per person a year, including investments in 5G and other wireless networks, according to BCG calculations. This figure is similar to investments made by their counterparts in Germany and Japan but is seven times higher than those made by Chinese telecoms and twice as much made by South Korean providers. Many US telcos are also investing in expanding fiber to increase backhaul. From 2020 through 2025, US operators expect to invest over $250 billion in capital expenditures to build 5G networks, more than any other country in the

Policies to Support Investments. At the federal level, the FCC has modernized rules for building wireless infrastructure in order to speed up the rollout of 5G. However, the interpretation and implementation of those rules by municipalities has often been inconsistent. Implementing the rules in a transparent, efficient fashion is key, particularly because state and local governments have understandably changed the way they work during the COVID-19 pandemic.

Penetration. US cellular providers haven’t yet published 5G-specific data, but independent estimates suggest that the number of 5G subscribers was limited in 2019. The figures are changing rapidly, though, and will likely shoot up once the number of 5G-enabled smartphones rises and with the continued deployment of 5G networks across the country.

Spectrum Availability

The US government has made significant amounts of

low- and high-band spectrum available to service providers

, but, despite ongoing efforts by the FCC, still lags in the provision of the crucial midband spectrum. Many countries have 200-300 MHz more sub-6 GHz spectrum available, on average, for 5G than does the US. That needs to change, and soon. The FCC has announced that two auctions of midband spectrum totaling 350 MHz will begin in 2020, but other countries continue to aggressively move to assign midband spectrum, as well as low- and high-band spectrum, to wireless service providers.

Innovation Ecosystem

R&D Investment. US technology and telecommunications companies spend significantly more on R&D, as a percentage of sales, than do their global rivals. US technology and telecommunications companies spend 7.2% of revenue on R&D, compared with 1.7% in Japan, 2.6% in China, 3.6% in Germany, and 5.6% in South Korea. According to BCG’s analysis of data from Capital IQ, US telecom and

technology companies

spent a total of more than $130 billion on R&D in 2018. This analysis showed that US wireless companies are far ahead in absolute terms, too, investing five times as much in R&D as their Chinese

US technology and telecommunications companies spend significantly more on R&D, as a percentage of sales, than do their global rivals.

Business Climate

Ability to Attract New Ventures. America’s ability to nurture entrepreneurs and support new ventures remains unparalleled. In fact, the US ranks among the top three nations on key drivers of new business creation—including risk tolerance and startup skills—and is No. 1 overall for entrepreneurship, according to the Global Entrepreneurship Development Institute. The US also boasts 12 of the world’s top 30 cities for startups, including the top two overall, Silicon Valley and New York. Importantly, the US serves as a startup hub for technologies critical to the 5G economy. In Startup Genome’s Global Startup Ecosystem Report 2019, which ranked global startup ecosystems, the US had two of the top five regions in artificial intelligence and cybersecurity, and three of the top five in gaming, among others.

5G Business Awareness. It’s important for companies outside the wireless industry to get excited about the prospect of applying 5G to their businesses, and there are promising initial signs of that interest and investment. However, it is still early in the 5G era to see major decisions by US companies from outside the wireless industry. Some US companies are pushing for cross-industry collaboration and investment on 5G. One example: semiconductor giant Qualcomm recently launched a $200 million 5G-specific investment fund. However, it is still early in the 5G era to see major decisions by US companies from outside the wireless industry.

Talent

Workforce Readiness. The US workforce is showing some signs of lagging in the most relevant skill sets The FCC estimates that the US will require 20,000 new skilled workers to install 5G infrastructure, and more than 70% of companies that install telecommunications infrastructure are concerned about skills shortages, according to a recent survey by Sitetracker. High-tech companies in the US also face a challenge: in a 2019 Harvey Nash-KPMG survey of chief information officers, 67% of respondents said that the paucity of talent was hurting business. The talent problem will only become more acute as companies in every industry start digitalizing products, services, and processes.

The US telecommunications industry’s immediate to medium-term need for skilled workers to install 5G infrastructure is a major concern.

Although the US has some of the best universities in the world, the educational system isn’t producing enough technical talent. The industry’s immediate to medium-term need for skilled workers to install 5G telecommunications infrastructure is a major concern although targeted policies, such as the Telecommunications Industry Registered Apprenticeship Program, are providing on-the-job training to address the gap. At the other end of the value chain, China produces twice as many STEM graduates as the US does, after adjusting for population, which leaves the US with less talent to dream up new applications for 5G networks.

Where US Policymakers Can Help

Our research shows what policymakers can do across the five key success factors to help US companies stay ahead in the global cellular industry.

Spectrum Availability. A transparent, market-based auction schedule for 5G spectrum, with an emphasis on cleared, licensed midband airwaves, will allow spectrum to be made available to service providers as soon as possible.

Network. Building 5G networks is expensive, requiring early and ongoing investments in both mobile antennae and fiber backhaul. A reduced regulatory burden and a streamlined permit process will speed the infrastructure build-out. To reduce the time needed to obtain installation permits, there needs to be greater federal and local cooperation. In addition, targeted subsidies for the expansion of networks to rural areas, such as those available through existing FCC funds, can help bring equitable access across the US.

Innovation Ecosystem. The R&D efforts of telecommunications companies and device manufacturers will be critical to ensure that the US retains its industry leadership.

Business Climate. The freedom of private sector companies to innovate as the 5G economy develops will be critical. After all, risk-taking by entrepreneurs and investments by venture capital and private equity firms promote technological innovation. Additionally, given the nature of the disruptive applications that 5G will enable—drone deliveries, connected cars, and e-health, for instance—regulatory changes may be needed in sectors other than telecommunications to make those applications feasible.

Talent. Finally, training and retraining the US workforce in tech-related certifications and degrees will be critical for the future. In the past, the attraction of the best global talent to the US promoted innovation, increasing the skills of the whole community. Training today’s workforce for tomorrow’s needs, from basic programming skills to advanced machine learning, will allow all Americans to thrive.

And that’s crucial. The real measure of 5G’s success will be the growth in US economic output it generates and the jobs it helps create—not just the number of apps on our 5G smartphones.

This piece was produced in collaboration with CTIA.