Spending on the public cloud and related services is growing at a compound annual rate of 25% across Asia-Pacific (APAC), faster than in the US and Western Europe. Cloud outlays now account for about 5% of the average IT budget, and that figure is likely to double by 2023.

Although businesses across APAC are eager to embrace the cloud, foundational gaps are slowing adoption and hindering growth. Weak alignment between business and IT, talent shortages, and ill-defined processes are among the barriers slowing cloud-based innovation and growth.

Although businesses across APAC are eager to embrace the cloud, foundational gaps are slowing adoption and hindering growth.

These are among the findings of an eight-nation study from Boston Consulting Group and Amazon Web Services that focused on Australia, India, Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. The study also included in-depth interviews with senior executives from the financial services, energy, industrial goods, and retail sectors.

The COVID-19 pandemic will make it more urgent for business leaders across APAC to increase their rate of cloud adoption. As companies shift workers to virtual environments and employ end-user computing, many are rushing to roll out essential collaboration tools. To reduce vulnerabilities, they will need to move from ad hoc applications to the more secure environment of the cloud. Likewise, restrictions around workplace access could make it difficult for companies to staff and manage their infrastructure and data centers effectively. These pressures, combined with the need to prepare for a post-COVID return to growth, require businesses to close the foundational gaps that have hindered cloud use to date.

APAC Businesses See the Cloud as a Driver of Top- and Bottom-Line Value

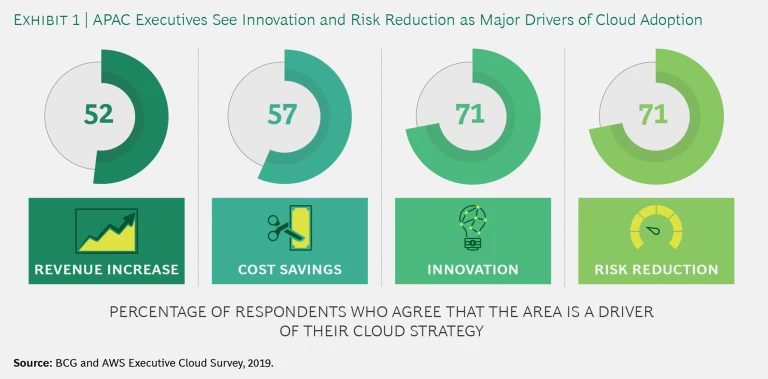

Business leaders believe that cloud adoption can unlock strategic value in ways that go well beyond cost savings. Notably, a majority of APAC executives say that they are pursuing cloud initiatives to accelerate innovation, growth, and customer engagement. (See Exhibit 1.)

From 2016 through 2018, APAC businesses have increased their cloud spending from 3% of their IT budgets to 5%. By 2023, cloud spending is expected to make up 10% of the average IT budget. The ability to access best-in-class digital capabilities is one catalyst for investment. For example, an Australian airline was able to save US$40 million in annual fuel costs by using cloud-based analytics to simulate tens of thousands of flight patterns and create more efficient routes. The company’s CIO said, “We were able to spin up approximately 4,000 CPUs, run the analysis, and then spin use back down to nothing.”

Although not the primary driver of cloud adoption, cost savings are still an important part of the business case for many executives. A technology leader at a Singaporean financial services firm told us, “While our main drivers are risk reduction and the ability to provide better service to our business stakeholders, we also realize cost efficiencies due to pay-per-use models where we can scale up during peak usage.” Similarly, an Indian financial services group moved its IT infrastructure to the cloud in an effort to achieve significant cost savings along with the ability to deliver personalization at scale and develop new services.

Companies Lag in Organizational Readiness

Despite growing interest in the cloud, only 20% of APAC companies have migrated a majority of their applications to the cloud, and less than 25% of business applications are cloud ready. The slow adoption is diluting returns and forcing businesses to maintain on-premise legacy infrastructure in order to run their operations.

Disconnects between business and IT are one barrier to scaling the cloud. A technology leader at a financial services company in Singapore remarked, “While business leaders understand the benefits of the cloud, getting buy-in and funding for specific initiatives is difficult.” Overall, 40% of companies said their cloud program lacked a clearly defined business stakeholder. “Top-level support from business units is the biggest challenge,” said an executive at a Philippine producer of industrial goods.

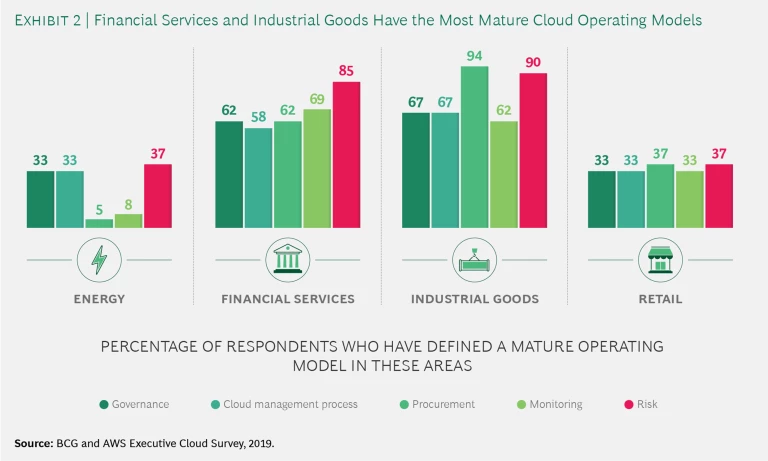

In addition, few organizations outside the financial services and industrial goods industries have adapted their monitoring, procurement, and risk practices for the cloud. (See Exhibit 2.) Without a cohesive cloud operating model, it becomes far more difficult for companies to integrate cloud capabilities into the core business and deliver sustainable outcomes. Half of all respondents said that process weaknesses were slowing adoption.

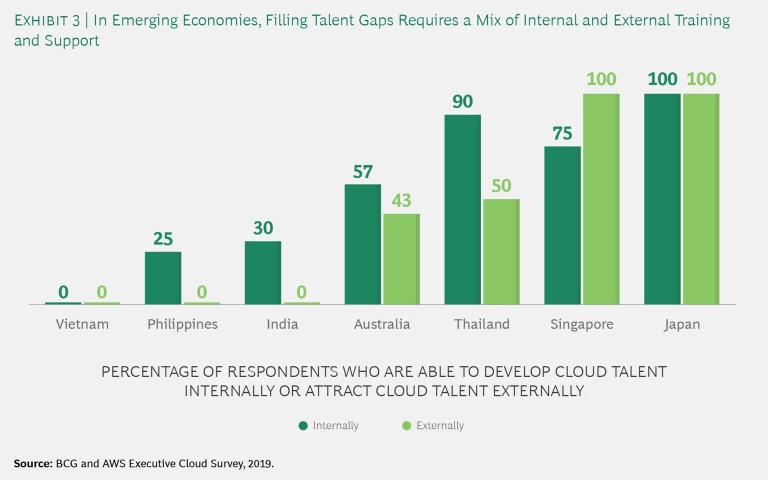

Skills gaps are another barrier. Effective use of the cloud requires expertise that is in high demand, such as engineers and coders, as well as specialists to design and implement business-focused use cases. The talent shortage is most pronounced in Vietnam, the Philippines, and India. (See Exhibit 3.) “Our top challenge is bringing in the right talent,” said a technology leader at an Indian bank. To close the gap, 55% of respondents said that they are focusing on reskilling staff. Although retraining exercises are important, they can slow the rate of cloud adoption if they’re not augmented by outside support.

Complexity is another challenge. Early-stage cloud adopters can struggle with the learning curve of managing both on-premise and public-cloud platforms.

To Optimize Cloud Value, Follow These Six Steps

Fortunately, APAC businesses can shorten their learning curve by following the example of more experienced players. To capture the full potential of the cloud, companies should embrace these six steps:

- Align business outcomes and create joint business and IT ownership

- Migrate workloads on the basis of their underlying value

- Establish a cloud operating model and consider forming a center of excellence

- Create a talent strategy that optimizes internal and external resources

- Rethink cybersecurity and take advantage of the solutions embedded in cloud services

- Future-proof your technology architecture

Organizations that marry their enthusiasm for cloud-based services with a commitment to put the right operational elements in place have the potential to transform their business and significantly outperform their peers.