As countries lift lockdowns and companies ramp up operations, CEOs face an unprecedented challenge. Across the full scope of their company, they must manage two efforts on different time horizons: competing in the prevaccine pandemic environment over the next 12 to 24 months and repositioning their company to thrive in the postpandemic world. In other words, they must win the fight and transform to win the future . To succeed, CEOs should focus on five priorities now.

What It Takes to Win in the New Reality

Virtually overnight, the economic shock caused by the COVID-19 pandemic has given rise to a new reality that leaders must discern, adapt to, and shape. The new reality is characterized by shifting customer needs and behaviors, increased uncertainty and volatility, and a reversal of globalization trends. For most companies, this challenging environment will cause significant decreases in revenues and profits. In a recent

BCG survey of business leaders

, almost half said that they expect their company’s profits to decline by more than 20%, and 90% are planning company-wide cost-reduction programs.

However, CEOs should not accept declining performance as inevitable in the new reality. The BCG Henderson Institute

studied the performance of all major US public companies during the past four downturns

. Competitive positions were more volatile in the downturns, creating both opportunities and risks. Although most companies suffered losses, 14% of the companies managed to increase revenues as well as profits despite declines in their industries. What did these companies do differently? It can be boiled down to three overarching actions: they acted early, they took a long-term perspective, and they focused on growth as well as cost reduction.

For CEOs today, this historical insight suggests that achieving strong performance in the new reality will require more than a rapid crisis response over the course of a few weeks. Winning the fight will be a marathon that lasts until a vaccine or highly effective treatment is widely available—12 to 24 months from now, according to the World Health Organization. During this period, business continuity and competitive position will constantly be at risk and require active management. And, winning the future will demand making long-term, proactive moves even as the fight phase persists.

Unfortunately, many companies do not appear to recognize the imperative of making long-term moves as they fight the pandemic. In BCG’s survey of business leaders, less than 30% said that they plan to reimagine their supply chain structure during the crisis. Conversely, investors see the upside in being farsighted while managing the crisis. In a recent BCG survey of investors , 88% said that they want CEOs to focus on building capabilities to create advantage, drive future growth, and be better positioned for winning the future, and 65% are even open to dividend cuts to drive current resilience and future advantage.

Five CEO Priorities

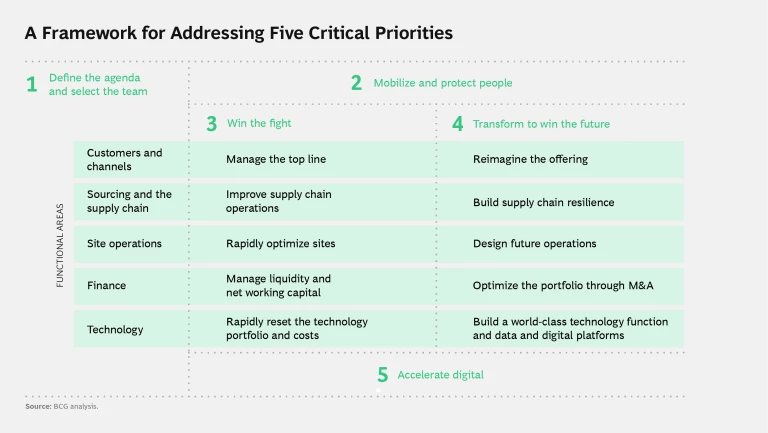

To respond proactively, CEOs must understand how the new reality affects their company and their markets, and CEOs must act decisively in the face of a wide variety of challenges. Earlier in the pandemic, we proposed a set of short- and medium-term priorities for responding to the crisis and leading organizations out of adversity . Now, to ensure business continuity during the fight and to build the foundation for a prosperous future, CEOs need to broaden their perspective and focus on five priorities.

To help CEOs address these priorities we created a framework. (See the exhibit.) It provides the key activities that companies must pursue in five functional areas. In especially hard-hit industries, such as commercial aviation and tourism, companies will need to pursue all activities to implement a transformation. In other industries, companies can use the framework to design a tailor-made action plan that reflects their needs.

Define the Agenda and Select the Team

In a reality characterized by uncertainty, it is more important than ever for leaders to provide clear guidance. Even in the absence of reliable forecasts, CEOs must set an agenda for the next 12 to 24 months and beyond, into the postpandemic future. There will be no-regret moves, such as rapidly eliminating unnecessary costs in operations or in administrative functions. But other significant decisions, such as changes in the product portfolio or the closure of production facilities, will have to be made despite uncertainty around future developments. For these decisions, the timing is crucial—leaders must stay abreast of the evolving situation and quickly adjust action plans using an agile working model. Developing and analyzing multiple scenarios will help to significantly increase reaction speed as events unfold.

CEOs must set an agenda for the next 12 to 24 months and beyond, even in the absence of reliable forecasts.

Many companies have set up a rapid response team to lead the initial crisis-management efforts. To meet the challenge of defining an agenda for the coming months and for the long term, CEOs should broaden the team’s mandate and expand its membership to include people from all functional areas. This team can orchestrate and integrate all activities and ensure that they cover the spectrum from immediate impact to long-term impact.

To succeed, the team needs to be set up with sufficient capacity and seniority to drive fast actions and effective change for the next 12 to 24 months. The team should identify and prioritize opportunity areas and assign them to specific owners to pursue. To demonstrate impact and build momentum, the team should devote some of its initial focus to quick wins. To support the team’s efforts, the company should establish rigorous governance, processes, and reporting. Leadership sign-off should be required for all initiatives to ensure buy-in.

Mobilize and Protect People

People are the heart of a company. To maintain business continuity and achieve longer-term objectives, CEOs must mobilize and protect their people.

The crisis has accelerated the adoption of new work practices, and we expect these approaches to remain across organizations in the new reality. This is a unique opportunity to redefine the future of work. For example, deviations from standard practices, such as remote work, that have typically been regarded as inefficient are now being deployed on a broad scale. By applying the lessons learned from implementations across businesses, companies can optimize these practices and enhance the efficiency, satisfaction, and engagement of the workforce over the long term. Satisfaction and engagement will also be crucial for retaining employees, especially as the market for talent heats up again during the recovery.

One of the unique aspects of this crisis is that most of the historical data, decision support models, and forecasting approaches for demand and supply planning became obsolete practically overnight. To improve decision support and scenario planning, companies can use Lighthouse—a digital analytics platform that can be rapidly deployed. Lighthouse combines new, near real-time data feeds of internal and external data with multiple analytics models, driven by artificial intelligence (AI), and advanced visualization tools. The result is a dashboard that provides near real-time transparency on demand and supply, allowing for more-informed decisions and scenario planning that reflects the new environment.

The crisis has also elevated the standards for health and hygiene in the workplace, and we expect these will endure. For the first time, companies will need virus-monitoring systems to keep their workplaces and employees safe, to build workers’ confidence, and to help manage business continuity and risk. For example, BCG is deploying its Safe@Work app that provides a digital virus-monitoring solution for contact tracing and employee safety management. The tool supports comprehensive efforts to track employee health, identify and break infection chains, encourage and monitor safe workplace behaviors, and communicate consistently.

We have defined a set of people priorities that will help to ensure a safe and motivated workforce during the challenging months to come.

Win the Fight

For most companies, the immediate priority is to secure the cost efficiency and continuity of their current operating model. However, in addition to having short-term liquidity and stability, companies must ensure that the entire operating model and cost structure can support the next 12 to 24 months. To make it happen, CEOs should lead efforts to actively manage liquidity and net working capital as well as to reduce costs across the company. And, because the objective is to secure margin, CEOs also need to focus on actively managing the top line.

Companies must ensure that the operating model and cost structure can support the next 12 to 24 months.

Manage liquidity and net working capital. Companies need to increase liquidity and reduce nonessential spending along the value chain. The goal should be to create financial leeway in order to navigate through emerging challenges. The effort should be led by a cash management office that is explicitly responsible for managing short-term liquidity, creating liquidity plans, launching cash preservation measures, and monitoring and forecasting cash and liquidity development.

Reduce costs across the company. Companies should consider both nonpersonnel and personnel costs. The adjustment of nonpersonnel costs is among the key levers to generate quick impact without immediately impacting the company’s workforce. For example, a company can cut costs in the supply chain by improving supplier management and logistics operations. Another opportunity is to rapidly adjust technology costs by refocusing the pipeline of technology and IT projects toward high-value and highly strategic projects, future-oriented platforms, and solutions for remote working and digital collaboration.

To respond to the severity of the current crisis, companies must also consider reductions in personnel costs. Many companies will need to introduce flexible work models and rightsize the workforce in frontline and support functions. Additionally, by rapidly optimizing sites, companies can often reduce operating costs by more than 10%. Companies should also quickly review their product portfolio and mix to analyze cost-saving opportunities. This includes reconsidering product launches and suspending sales activities for certain products in specific regions.

Manage the top line. Many companies were forced to focus on digital sales channels during the lockdown phase to secure revenues. In the win-the-fight phase, new channels, such as e-commerce, will continue to provide a valuable opportunity to maintain customer engagement and to generate additional sales. Because customer needs and behaviors have shifted so much, and because the competitive environment will be volatile, a rapid review of pricing opportunities across much of the product portfolio will also likely be necessary to preserve revenues.

Transform to Win the Future

CEOs should not allow the focus on near-term profits and competitiveness to obscure the need to transform the business in order to win the future. They need to pursue a variety of activities, largely simultaneously with the effort to win the fight. The concurrent efforts are required not only because leaders need to set up the business for long-term success but also because the duration of the fight is uncertain. We see three sets of activities that are keys to winning the future.

Reimagine the offering. Companies should adapt their business model in response to changes in customers’ demand preferences. For example, as uncertainty increases and cash becomes critical, more customers may prefer signing machine-as-a-service agreements rather than making high initial investments in machines. Such market changes can offer the opportunity for breakthrough innovations. Innovative companies have a significant advantage, even during a recession. According to a BCG study , the total shareholder return of the 50 most innovative companies outperformed the MSCI World Index by more than 20% four years after the 2008 financial crisis.

Build supply chain resilience and design future operations. The first weeks of the COVID-19 crisis revealed a weak spot for many companies: a global supply chain that operated efficiently in a steady-state environment but was highly vulnerable to external shocks. In fact, supply disruptions caused some companies to stop or slow down production even before the coronavirus outbreak reached their facilities.

Companies need to increase the resilience of their end-to-end supply chain, including internal operations.

To transform to win the future, companies need to increase the resilience of their end-to-end supply chain, including internal operations. This requires reviewing and optimizing the entire operating model, with a focus on the footprint of the supplier network as well as the company’s own production network. Digital tools, such as a supply chain control tower or a digital twin solution , can significantly improve transparency and stability as well as enhance productivity. Considering that increased volatility and uncertainty are expected to persist even as the immediate crisis subsides, end-to-end resilience and greater operating efficiency must be long-term imperatives.

Optimize the portfolio through M&A. Companies should review their business portfolio to identify the potential for divestitures and M&A. Low company valuations in the weak economy may expand the opportunities for M&A . Furthermore, BCG research indicates that, two years after an acquisition, the relative total shareholder return of deals done in a weak economy exceeded that of strong-economy deals by 10 percentage points . By proactively pursuing the right deals, companies can outgrow their competition quickly. To create sustainable value, companies need a clear vision for their M&A strategy that is based on a small number of long-term themes. Even as they look for new sources of growth, top-performing companies stick to their well-defined strategic vision, while adapting it as necessary to the increased volatility and uncertainty of the new reality.

Accelerate Digital

For most companies, digital and AI have been prominent topics when developing their strategic roadmap in recent years. The pandemic response has rapidly accelerated digital implementations to enable remote work, for example, or to improve the online customer experience. Companies have experienced several years’ worth of digital changes within the past few months. In a recent BCG survey of business leaders, 80% said that digital transformation has become even more urgent in light of the crisis. To keep pace, companies have needed to make significant catch-up investments.

The combination of externally induced change and catch-up investment creates momentum that companies should leverage to accelerate digital initiatives across all functions both to win the fight and to win the future. In pursuing these initiatives, they need to directly support many of the actions discussed above and rigorously focus on creating business value in order to ensure that digital projects have a short-term to midterm payback.

Digital technologies can enable significant cost reductions—in our experience, 10% to 30% in supply chain and manufacturing functions, 10% to 20% in procurement spending, and 20% to 40% in shared services. For instance, robotic process automation increases the efficiency of back office processes, advanced data analytics allows for optimization of business processes, and digital automation technologies significantly increase productivity on the shop floor. Another efficiency lever is the bionic supply chain , a new approach that aims to create seamless cooperation between humans and digital systems. To successfully implement these digital solutions and further accelerate digitization, many companies will need to strengthen their technology and IT functions.

Pursuing these five priorities will be essential to winning the fight during the next 12 to 24 months and positioning the company to win the future. The companies that emerge from the crisis stronger than ever will be those that deploy rapid, agile decision making and take decisive actions across the immediate-, medium-, and long-term time horizons. Put simply, tomorrow’s winners will be determined by the actions that CEOs take today.