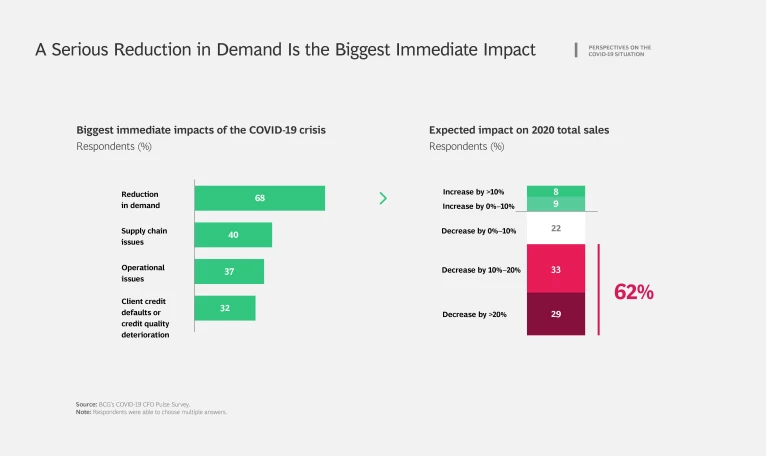

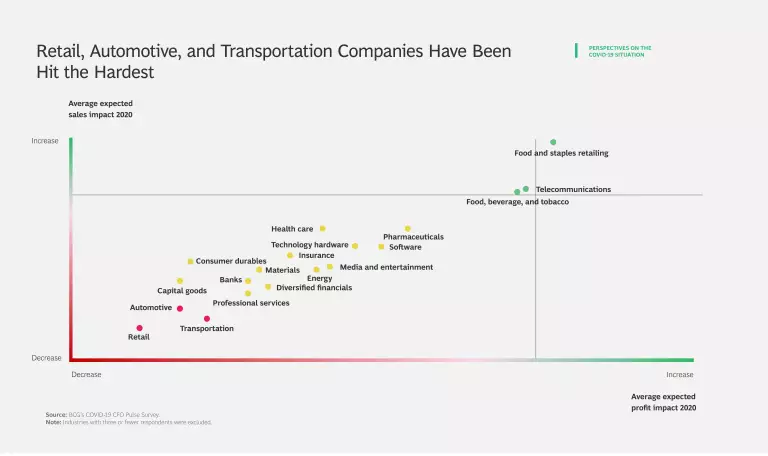

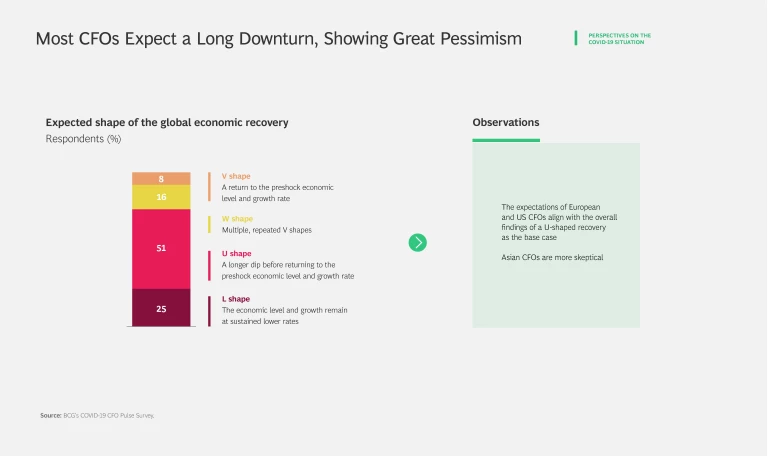

Global CFOs are surprisingly pessimistic about their companies’ outlooks even as some countries take steps to ease their COVID-19 lockdowns, according to a new BCG survey. In addition, respondents are less optimistic than many commentators about the likelihood of a quick economic rebound. The survey findings confirm what we have heard directly from many CFOs during our ongoing project work: they are experiencing the most challenging situation of their careers. (See the sidebar “About the Survey.”)

About the Survey

About the Survey

From April 8 through April 30, 2020, BCG surveyed 161 CFOs across industries and regions. The survey focused on two key topics:

- CFOs’ expectations for how the COVID-19 crisis will develop and the impact on their companies’ performance

- CFOs’ planned courses of action—in the short term and the midterm—as the finance function reacts to the crisis

The survey participants were primarily from companies in Europe and the US, with participants from Asia as well. The companies, including many large global organizations, represent a broad array of industries.

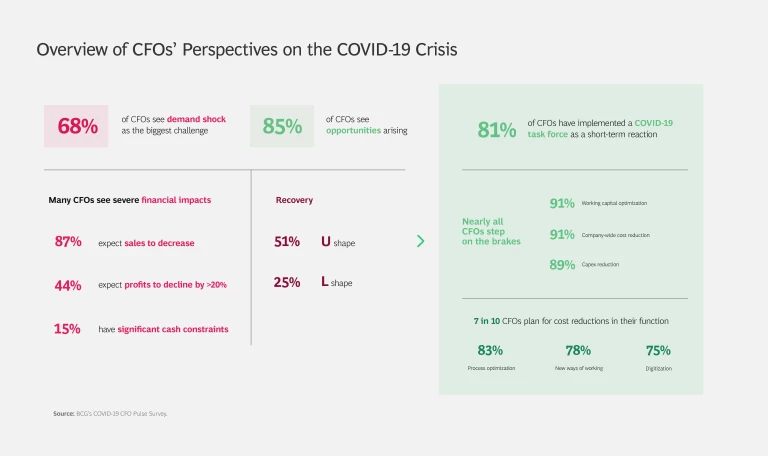

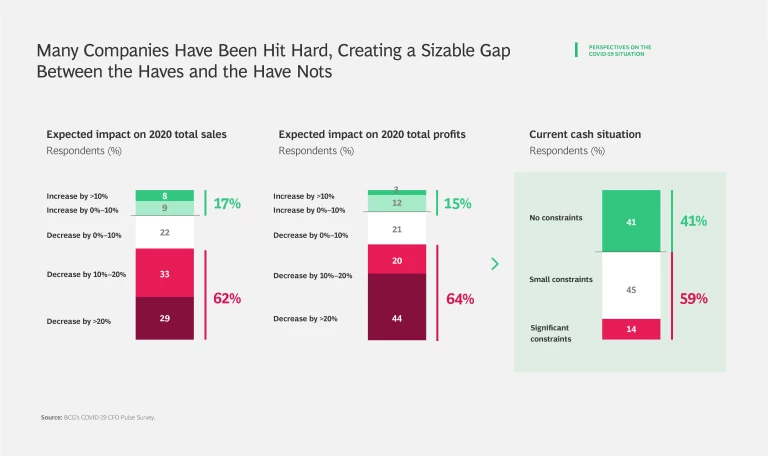

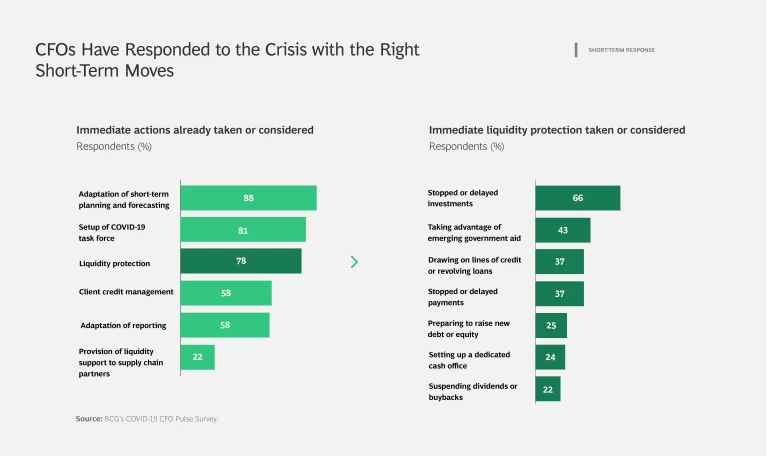

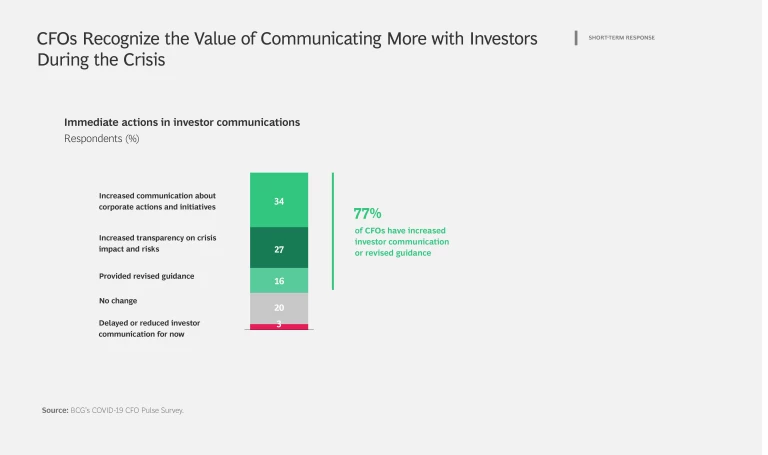

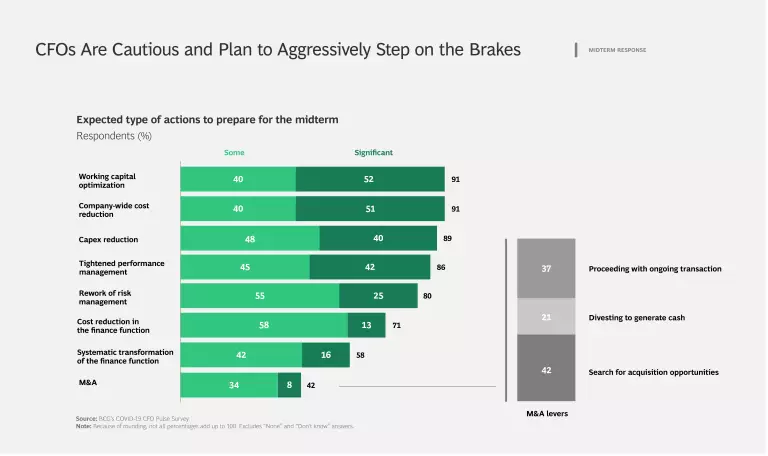

The survey shows that CFOs have almost universally taken the correct short-term actions to stabilize their businesses in response to a severe demand shock, including adapting short-term planning, setting up a COVID-19 task force, and protecting liquidity. It also reveals a strong consensus regarding a response for the midterm. Almost all CFOs plan to further step on the brakes by reducing working capital and capex, instituting company-wide cost reductions, and tightening performance management.

You can explore the detailed survey findings in the slideshow below.

While CFOs are making the right moves to keep their businesses viable, they must complement these efforts by helping their companies to emerge from the crisis in stronger competitive positions. Aside from securing financial resilience, successful CFOs will also ensure that their companies set aside resources to pursue new investment and opportunities.

We recommend that CFOs take a scenario-based approach to balance financial discipline with strategic flexibility as the crisis evolves (and the dust eventually settles), in order to prepare for the future. Depending on the quantified impact of each scenario, the best combination of actions should include:

- Protecting liquidity in a prudent way through rigorous management of net working capital and capex while balancing operational flexibility and long-term supplier and customer relationships

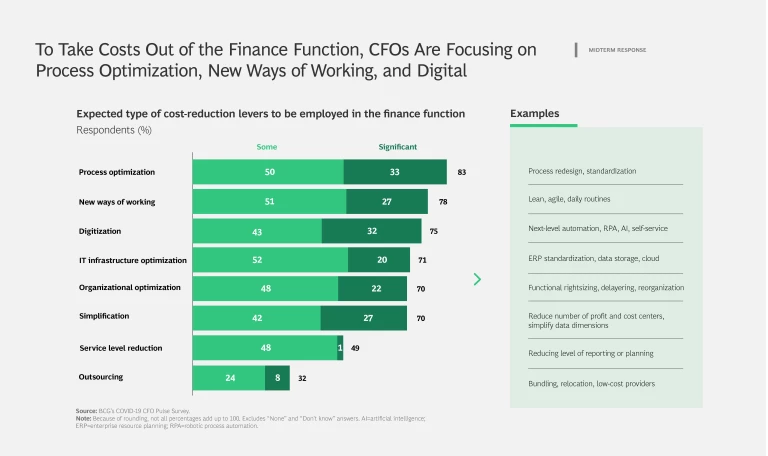

- Instituting a cost reduction program in which CFOs lead by example and address cost-cutting potential in the finance function first

- Making changes to systems, such as implementing tighter performance management or adjusting this year’s budgeting process to reflect increased uncertainty and a renewed focus on cost and cash flow

- Systematically searching for opportunities, such as taking advantage of competitors’ weaknesses, and pursuing them either operationally or via M&A

Pursuing competitive advantage in this crisis will not be easy. The temptation—if not the imperative—to step on the brakes is very strong for many companies. But even as the crisis inflicts unprecedented economic harm, companies should still maintain the resources to identify, prioritize, and pursue strategic opportunities. CFOs are uniquely positioned to help their companies be both resilient and bold, thereby preserving their ability to pursue advantage in adversity.