Leaders of transportation and logistics (T&L) companies need to transition from defense to offense in their approach to climate action. Typically, T&L executives have viewed sustainability efforts as a compliance burden or a potential source of cost savings. In addition to considering these issues, they need to recognize that climate action offers them a broader opportunity to create tangible value by tapping into new markets and meeting new types of demand for low-carbon services. By taking the right approach, companies can increase their resilience to a known and imminent threat.

The imperative for T&L companies to embrace environmental sustainability is clear. Transportation activities (aviation, rail, shipping, heavy and light trucking) are responsible for approximately 17% of global greenhouse gas (GHG) emissions. Without the industry’s participation, countries will not be able to meet their goals for limiting the global temperature increase over the remainder of this century. (See “The Case for Climate Action.”) Rather than distracting from this effort, the COVID-19 crisis should be seen as creating an opportunity and obligation to accelerate action . Indeed, climate change exploits many of the same vulnerabilities exposed by the pandemic—but even more severely and over a longer time frame.

The Case for Climate Action

Scenarios indicate that GDP per capita will decrease by 30% by 2100 if global warming continues on the current trajectory. In contrast, if countries follow through on the Paris Agreement by reducing the projected temperature increase to 2°C, GDP per capita will drop by 13% by 2100—a much more manageable burden.

To avoid the catastrophic consequences of climate change, governments and businesses must act decisively to limit global warming to 1.5°C to 2°C by 2100. This requires net human-caused CO2 emissions to fall 45% by 2030 (versus 2010 levels) and ultimately reach net zero by 2050. Achieving a reduction of this magnitude will entail unprecedented changes in consumption and ways of doing business over the coming decades.

Transitioning to playing offense in sustainability will not be easy for T&L companies. Fortunately, they can draw on best practices developed in other industries. Adoption of new fuel technologies will be essential to completing the journey to zero carbon emissions, as will partnering with governments to fund the efforts and reduce the risk. Companies that get it right will create financial value as well as help save the planet. In other words, we believe that “doing well by doing good” is indeed possible.

The Costs and Benefits of Climate Action in T&L

T&L companies have a significant role to play in changing the current trajectory of GHG emissions. Heavy-duty transportation (aviation, heavy road transport, and shipping) is among the harder-to-abate sectors. It accounts for roughly 95% of all freight emissions, exceeding 4 gigatons of carbon dioxide (Gt CO2) in 2019. If nothing is done, emissions are likely to hit 7 Gt CO2 by 2050.

To be sure, decarbonizing the T&L sector requires a significant financial investment. Abatement costs are especially high for heavy road freight, air freight, and shipping—they typically range from $180 to $230 per ton of CO2, above and beyond the cost of fuel efficiency measures. But if T&L players act too late, the price tag will continue to grow over time. Given projected emissions, full decarbonization of heavy-duty transportation by 2030 would cost in excess of $1 trillion, assuming the technology exists to make it happen. The outlay will increase by $400 billion by 2050. Considering the long asset cycles in T&L, it is vital that players start taking action now. Indeed, the industry is experiencing mounting pressure from customers, employees, regulators, and investors to act on emissions.

The imperative for climate action amplifies a perfect storm of challenges that already existed in the T&L sector, including stagnating revenue and declining profitability as well as ongoing disruption from digital technology and innovative business models. To ensure their long-term survival, T&L players should launch a transformation with climate action at the center.

Unfortunately, most companies are not taking action, and those that have started have not yet been ambitious enough. BCG research reveals that among 872 transport companies, 70% do not disclose, or only partially disclose, their emissions and only 23% have set emissions targets. Of those setting targets, less than half (9% of the total) have reduced CO2 emissions versus last year. But the few goals that companies have established are too low: transportation companies are targeting, on average, a 30% emissions reduction by 2030, whereas the 1.5°C scenario requires a 50% drop across the industry by that year and a 100% decrease by 2050.

T&L companies that are pursuing tangible plans to reduce emissions have generated superior total shareholder return (TSR), according to our analysis. From 2017 to 2020, the average annual TSR of T&L companies that demonstrated a high commitment to environmental, social, and corporate governance (ESG) standards was 10 percentage points higher than that of industry peers. (See Exhibit 1.) Although it is difficult to prove causality between ESG commitments and TSR, the correlation is striking.

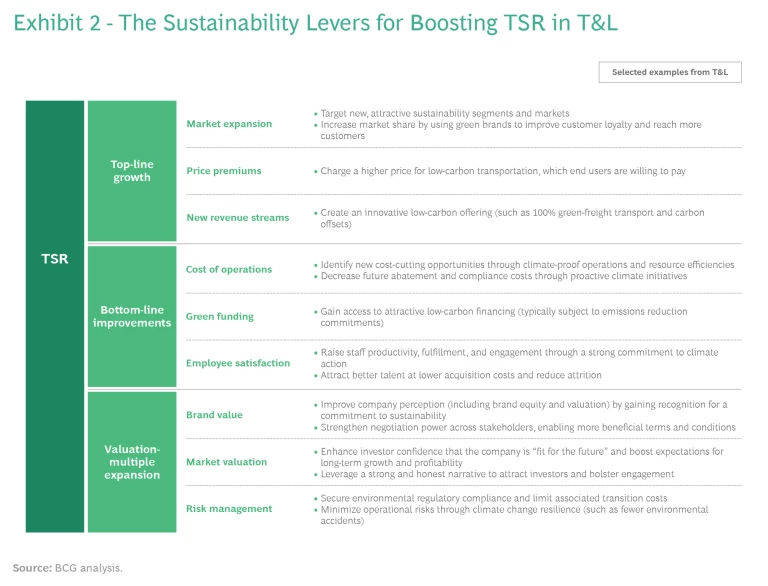

From our experience, we have found that climate initiatives enable T&L companies to create significant TSR by promoting three important sustainability levers:

- Top-Line Growth. A sustainable T&L company gains access to new markets and customer segments. Many T&L customers now ask for emissions data as part of their request for tenders. Customers’ willingness to pay more for sustainable transportation and services has enabled companies with a proven reputation for providing climate-friendly transportation to charge premium prices. BCG research shows that 70% of end-consumers are willing to pay a 5% premium for green products, which eventually results in an increase in green offerings throughout the industry. In addition, sustainable companies’ employees are more motivated and engaged in their work, enhancing their effectiveness.

- Bottom-Line Improvements. By investing in more sustainable operations, companies can achieve significant cost reductions relating to resources (for example, fuel and utilities) and operations (such as through fleet optimization). Firms with a sustainable brand also incur lower costs to acquire and retain high-caliber employees—many job applicants say that they consider a company’s sustainability when evaluating job offers. And, when on the job, employees’ higher satisfaction and engagement boost their productivity. Moreover, these companies gain preferential access to attractive financing and funding that are linked to sustainability metrics, reducing the cost of debt. Many banks have incorporated sustainability standards into the loan approval process. (See “Maersk’s Sustainability-Linked Loans.”)

- Valuation-Multiple Expansion. By investing in a sustainable brand and improving operational resilience, companies reduce strategic and operational risks. Moreover, by communicating to investors about their climate initiatives, they strengthen expectations for growth and profitability and boost confidence in their management practices.

Maersk’s Sustainability-Linked Loans

Exhibit 2 provides concrete examples from leading T&L players.

Some of the most prominent T&L incumbents, such as Maersk, FedEx, and DB Schenker, are leading the way. They have already reduced CO2 emissions by up to 40% compared with 2008 levels and have ambitious plans to be climate neutral by 2050.

The Journey Toward Zero Carbon Emissions

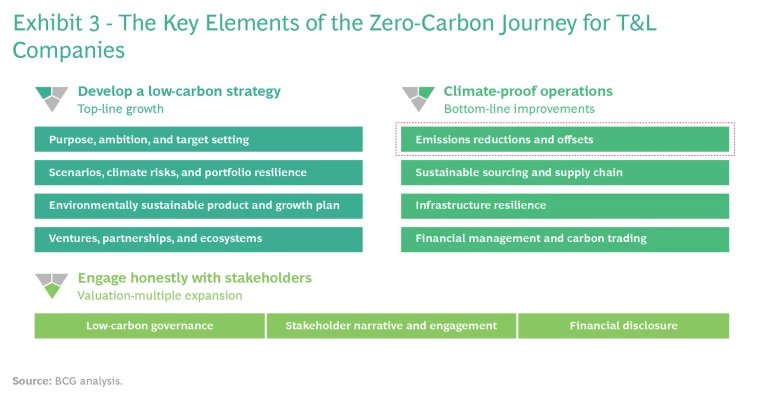

To transform and decarbonize their business while creating TSR, T&L companies should take three overarching actions:

- Develop a low-carbon business strategy. By understanding their current trajectory on the zero-carbon journey as well as the climate scenarios and related risks, companies can identify opportunities for a low-carbon business that could contribute to revenue growth. T&L firms can also set bold fact-based emissions reduction targets for 2050 and form strategic partnerships. Many T&L companies will need to engage in partnerships and participate in ecosystems in order to plan, execute, and derisk the zero-carbon journey.

- Climate-proof operations. The ultimate goals should be for companies to reduce the CO2 intensity of their operations, engage in sustainable sourcing with suppliers to address their carbon footprint holistically, and manage the physical risks (such as damage to equipment and facilities from flooding) posed by climate change.

- Engage honestly with stakeholders. It is crucial that companies be open and communicate about their climate journey with external stakeholders, and this should include making climate-related financial disclosures. Superficial communication about sustainability will not generate benefits—today, most investors reward only tangible environmental results. In addition, companies should actively work with regulators, the public, and other players in the value chain to foster the support needed for decarbonization and justify the risk-return reward.

Each action comprises several concrete initiatives. (See Exhibit 3.)

A Subsector Example: Emissions Reductions and Offsets in Shipping

For a concrete example of how the levers are applied, we take a closer look at climate-proofing operations in shipping—specifically initiatives related to emissions reductions and offsets. Ship operators have a significant opportunity to create value through these initiatives, as the shipping sector is a major source of emissions and faces high abatement costs. Moreover, the relevant concepts are applicable to other hard-to-abate T&L sectors, especially air freight and heavy road transportation.

These initiatives involve the use of four key levers for transportation activities, each relevant to shipping:

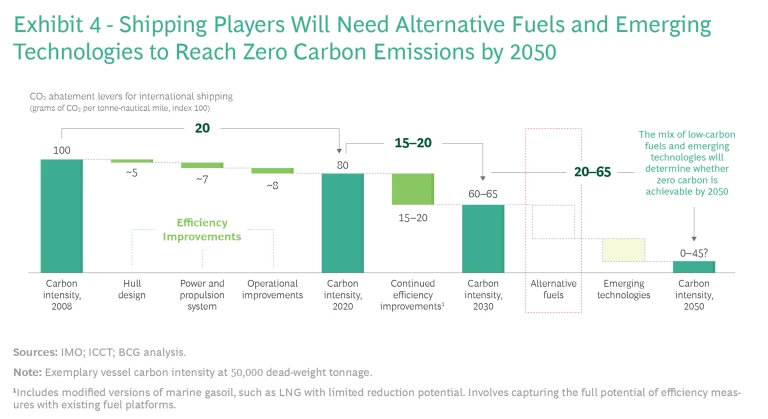

- Efficiency Improvements. Companies can use existing technologies and improvements to operations and infrastructure in order to reduce fuel consumption and enhance the efficiency of operations. Vessel efficiency, in particular, can be increased through changing the hull design (for example, the shape or coating), boosting the power and propulsion system (such as trim optimization or turbochargers), and implementing operational improvements (for instance, voyage optimization or capacity utilization). Vessel operators have already pursued most of these levers since the financial crisis in an effort to cut costs through lower fuel consumption. Although not the primary objective of past efforts, decreased fuel consumption also reduces emissions.

- Emerging Technologies. New technologies support efficiency increases, reduce fuel impact, and enable the use of alternative fuels. In the commercial long-distance shipping sector, innovative tools to cut emissions include new propulsion systems (for example, adoptions and adaptations of older technologies such as sails and kites), robotics (for use in cleaning hulls and enabling smoother voyaging, for instance), exhaust treatment offerings (such as scrubbers for sulfur oxide and nitrogen oxide emissions), and digital solutions (including digital twins). These technologies can reduce fuel consumption as well as emissions.

- Alternative Fuels. New fuel technologies include liquefied natural gas (LNG), biofuels (such as biodiesel), power-to-X fuels (that is, renewable electricity transformed into fuels, such as e-methanol, e-ammonia, and synthetic diesel), and electrification (for example, batteries that are either 100% batteries or a hybrid of battery and fuel cell). This lever focuses solely on reducing emissions. Most technologies are immature to date, and there is a broad variety of alternative fuel candidates for full decarbonization, each with relative merits.

- Carbon Offsets. Companies can compensate for, but not reduce, CO2 emissions through offsetting mechanisms. Offsets can be voluntary, where companies commit to decreasing their net carbon footprints using offsets (such as paying to plant trees), or mandatory, where companies are required by their respective governments to purchase carbon credits equal to their emissions.

Industrywide collaboration is essential for implementing these levers. For example, a group of major industry players, led by Maersk, has established a research institute in Denmark to pursue the goal of zero-carbon shipping. A global, cross-disciplinary team of specialists will collaborate to accelerate the development of alternative fuels and emerging technologies.

Since 2008, a few large shipping incumbents have reduced their carbon intensity by approximately 20%. (See Exhibit 4.) To decrease it by an additional 80% by 2050, companies will need to implement other measures. Continued efficiency improvements within the existing fuel platform (using marine gasoil [MGO]) are projected to cut carbon intensity by only an additional 15% to 20%. To reach zero carbon emissions, companies need to adopt alternative fuels and emerging technologies. Below, we take a closer look at the options.

Next-Generation Fuel Platforms in Shipping

For long-distance shipping, several options are available that combine alternative fuels and emerging technologies. These include a wide variety of fuel types, each of which is different with respect to technical and commercial maturity and viability. We believe it is too early to meaningfully project the best possible solution. Candidates include the following:

- Liquefied Natural Gas. Some shipping players are exploring LNG as a future fuel option, mainly because it can be used without modifying existing engines (that is, it can be “dropped in”) and is widely available. But it has downsides. To use LNG globally, companies need to build new infrastructure, such as gas pipelines at ports, and that means making long-term investments. Most important, LNG decreases emissions by only approximately 25% relative to MGO. Advanced forms of LNG that would enable further reductions, such as bio-LNG or hydrogen-based LNG, will not become cost-competitive compared with other alternative fuels.

As a result, LNG is regarded as an interim means of reducing emissions until other alternative fuels are commercially ready; only a fraction of vessels use LNG today. Considering these limitations, as well as the 30-year-plus asset cycles in shipping, LNG seems unlikely to provide the fuel platform needed to decarbonize shipping before 2050.

- Biofuels. This alternative fuel produces low carbon emissions. As an example, biodiesel reduces CO2 emissions by approximately 80% compared with MGO. Moreover, drop-in is possible. But biofuels also have significant limitations. The production of bioenergy consumes land resources and comes at the expense of food production. In addition, the availability of feedstock is limited and could be further threatened by climate events, such as droughts. And demand could be heavy owing to cross-industry competition for fuel (such as from aviation). As a result, biofuels should be regarded as a mid-term complementary fuel, rather than a standalone, scalable decarbonization solution for shipping.

- E-Methanol. Unlike LNG and biodiesel, e-methanol and other power-to-X fuels produce zero CO2 emissions. Although the existing conversion technology is not ready for widespread commercialization, some drop-in opportunities exist. Moreover, e-methanol has low toxicity. A key disadvantage of this fuel is that it requires carbon capture technology (which is currently immature) and a new propulsion engine, resulting in high investment costs. Nevertheless, it is among the candidate technologies because it is similar to MGO with respect to its density and versatility and in how it is transported and stored.

- Hydrogen-Based Fuels and E-Ammonia. Environmentally friendly hydrogen provides the basis for fuels, including e-ammonia, that produce zero CO2 emissions and are, in principle, fully scalable. But these fuels pose several challenges. Chief among them is the need for substantial infrastructure to transport liquid hydrogen and protect against the high toxicity of ammonia. Additionally, there are constraints related to bunkering infrastructure and limited opportunities for drop-in, which creates the need for a new propulsion engine. Despite the downsides, we believe these hydrogen-based fuels are viable candidates for large-scale decarbonization of shipping.

Unlocking the potential of alternative fuels requires significant action, collaboration, and commitment from all value chain participants: engine suppliers, ship builders, green-energy vendors, ship owners and operators, and freight customers. Each participant should define a strategy for achieving decarbonization. Additionally, the public sector will likely need to provide funding in order to support investments.

How to Get Started

T&L companies should embark on a climate action transformation journey today. From our experience supporting hundreds of decarbonization efforts around the world and across industries, we believe that T&L companies should act on six crucial imperatives:

- Assess the status quo of the business and understand how climate change and carbon policies can affect it and day-to-day operations.

- Define a low-carbon ambition and strategy and back them up with a concrete and realistic plan that will also boost TSR.

- Initiate no-regrets moves immediately to create momentum inside the company and demonstrate results to external stakeholders.

- Enable the journey through cross-sector partnerships to reduce risk. Increase the size and feasibility of efforts by applying a variety of resources and experiences.

- Decarbonize operations by focusing on direct emissions (known as “scope 1” emissions) and their impact on the overall value chain.

- Engage the full ecosystem of stakeholders by adapting governance and communication practices to achieve the low-carbon ambition and strategy.

A company’s initial focus depends on its current progress in the sustainability journey. A rapid “health check” is often a good first step to assess where the company stands today, which provides the basis for defining the path and initiatives to move forward. This will uncover whether a company can target specific areas or needs to embark on a full climate transformation.

To ensure economic sustainability, T&L players should move quickly to incorporate environmental sustainability into their business model and long-term strategies. The investments and abatement costs will only get more expensive over time, and operational resilience will diminish. Fortunately, T&L companies can draw upon concrete approaches and best practices developed in other sectors. The methods are available—it is just a question of which T&L players will be the first to capture the advantages.