The electromagnetic spectrum, harnessed for use as radio frequencies, is increasingly in high demand. Traditionally used by maritime services, space agencies, and broadcasters, numerous businesses, organizations, and government entities are now vying for spectrum as they discover that this natural resource enables innovative applications, such as 5G communication networks and geospatial analytics for agriculture.

But radio spectrum, which ranges from 3 kilohertz (kHz) to 300 gigahertz (GHz), is limited. As a result, countries, which manage the spectrum within their borders, are under pressure to respond not only to an enormous amount of interest in spectrum bands but also to a wide variety of potential uses.

New models are emerging that have frameworks and tools to help spectrum managers harmonize and manage tradeoffs and make informed decisions regarding emerging uses. The new models look nothing like the old one, which largely allocated spectrum on a first-come, first-served basis. Rather, they incorporate adaptive pricing and flexible licensing, for example, push some decision making to spectrum users, and leverage emerging technologies to create more autonomous environments that help countries and users alike maximize value creation and future potential.

Countries should adopt a new, flexible, and forward-looking model before their spectrum is locked up by legacy contracts that make it difficult, and perhaps even impossible, to accommodate new innovations or essential services in a timely fashion. Countries that fail to respond may forego the economic benefits of spectrum. Reshuffling the spectrum in the future may be too costly owing to sunk investments in equipment and the deployment of systems—or it may be too late to capitalize on industries’ digital transformations.

A Dizzying Landscape of Spectrum Seekers

An increasing number of organizations are shifting their spectrum needs as business becomes more connected and newer, disruptive operating models emerge. For example, Internet of Things (IoT) networks are increasingly powering Industry 4.0, unmanned aerial vehicles are gradually changing the operations of logistics, and private 5G networks are altering the dynamics of the telecom industry .

In numerous sectors, spectrum enables critical applications and activities, including mobile phones, TV broadcasting, maritime communications, remote sensing, Earth exploration, radio sciences, weather forecasting, global positioning systems, space exploration, intelligent transportation systems, and high-altitude platform stations.

In the space industry alone, satellite demand for spectrum has grown dramatically over the past decade; applications include universal and remote connectivity and smart geospatial analytics for agriculture. Other applications vying for spectrum include Earth exploration-satellite services, nongeostationary satellite systems, novel medium- and low-Earth orbit satellites, satellite systems in global maritime distress and safety systems, and Earth stations in motion.

Demand for spectrum is growing and shifting in size and shape at a swift pace. Tension is mounting over competing demands, with additional pressure to cater to new forms of development, such as megaconstellations that have thousands of satellites, while effectively protecting critical services, such as radio astronomy and Earth exploration-satellite services.

Many countries are aware that they need to adopt a new spectrum management model. But some countries have already done so, implementing models that leverage cutting-edge technology. Finland, for example, is using artificial intelligence (AI) to manage spectrum allocation. Inevitably, however, success will come if countries have a clear understanding of current and future demand, implement a strong framework to manage new uses and tradeoffs, and empower a spectrum management organization to support and secure national interests.

Why Countries Need to Protect and Leverage Spectrum

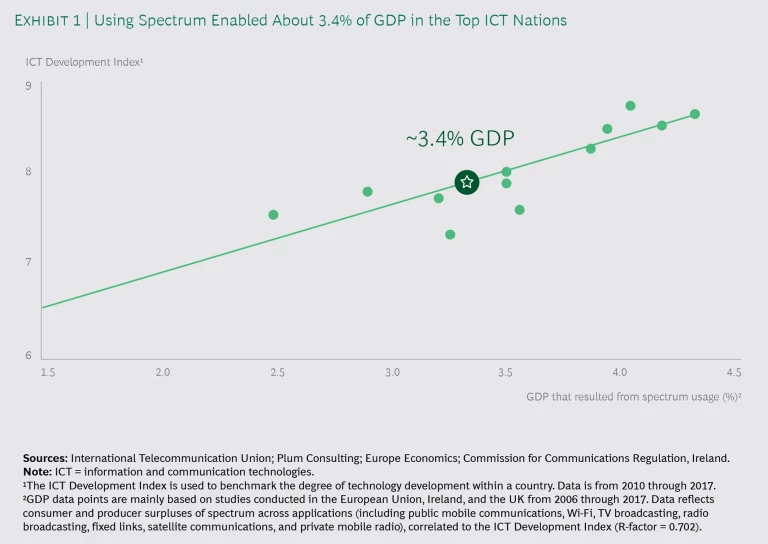

Given spectrum’s numerous use cases, it’s understandable that it can contribute significantly to a nation’s GDP. Some studies have found that in countries with advanced information and communication technologies, the use of spectrum enabled an increase in GDP of about 3.4%. (See Exhibit 1.) This contribution is attributed to spectrum enabling advances in a number of areas, including employment, technology, and investment in a wide variety of spectrum initiatives. If the pace of innovation around spectrum remains steady, it will provide more opportunities for countries to grow GDP and develop new sources of revenue.

Spectrum’s revenue potential is just part of its importance, however. Spectrum is also the communications backbone for a country’s crucial social and public services, including those provided by first responders, the military, and air, sea, and land transporters. As a result, spectrum plays a role in relief operations during natural disasters, it helps countries monitor and adapt to climate change so as to mitigate its effects, and it offers a means of providing broadband services to underserved rural areas.

Innovations around spectrum are not only highlighting opportunities but also setting the stage for tensions that spectrum managers will have to resolve. In the US, a battle is brewing between the US Navy and prospective 5G mobile networks. In a May 2019 memo to the Federal Communications Commission (FCC), the Navy asked the agency not to issue spectrum licenses to wireless carriers because 5G would cause interference for weather satellites. The FCC did so anyway, but this example points to a key issue: countries have a supply and demand problem. Without a new model that helps them anticipate competing interests and manage tradeoffs, nations risk the safety and security of their citizens, a future of innovation, and the benefits of having new revenue sources. Trends show countries are taking note and beginning to expand their spectrum activity. (See the sidebar “IMT Spectrum Allocations Around the World.”)

Innovations around spectrum are highlighting opportunities and setting the stage for tensions.

IMT Spectrum Allocations Around the World

IMT Spectrum Allocations Around the World

International mobile telecommunications (IMT) radio service is at the heart of terrestrial 5G deployment, which promises, among other benefits, ultrahigh reliability, negligible latencies, and extremely fast data-transfer rates. As countries enter this new era of communication, spectrum allocation activity to IMT radio service is rising, especially in the millimeter wave space. (See the exhibit.)

Consider that at the start of 2019, the maximum amount of spectrum that was allocated to companies by any given country was approximately 1 GHz, mainly in the sub-6 GHz band. By the end of the year, there was an uptick to about 2 GHz across a handful of countries, a sign that using millimeter wave for 5G is gaining serious attention from spectrum managers around the globe. The US, Italy, Japan, and South Korea lead the way in terms of total spectrum allocations for IMT, but the list of countries will continue to change as nations allocate more than 3 GHz of spectrum.

Given this activity, spectrum managers must play a significant role in initiating discussions with relevant stakeholders, setting up transparent plans that give certainty to an investment-heavy market, acting boldly in repurposing legacy spectrum, and making informed decisions about allocating bands in a timely manner. Spectrum managers’ focus should be on unlocking the maximum social, economic, and commercial value in an agnostic fashion so as to avoid influencing market dynamics.

Identifying and Managing Tradeoffs

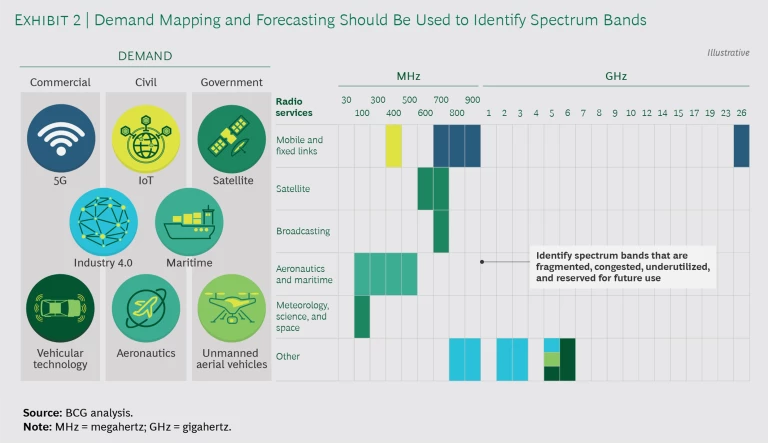

Competing demands from various users and sectors for similar spectrum bands highlight the imperative for spectrum managers to understand the overlapping and conflicting needs of its users. By managing tradeoffs carefully, spectrum managers can maximize value, such as social, economic, and commercial value. (See Exhibit 2.)

Suboptimal allocations may increase the risk of interference, make it difficult for users to share the same bands, limit the benefits of economies of scale, and delay the adoption of new and emerging technologies, negatively affecting various economic sectors. Furthermore, some industries may find themselves at a disadvantage depending upon how spectrum is allocated. For example, the space and satellite sectors could be handicapped by allocations to terrestrial services. This outcome could very well prohibit investments in radio and wireless infrastructure.

Traditional ways of allocating spectrum have created multiple challenges that need to be addressed. One such challenge is how to repurpose bands—such as very-high frequency (VHF) and ultrahigh frequency (UHF)—for new types of uses (digital broadcasting, for example). Another hurdle is how to free up congested bands to eliminate interference.

To resolve such issues, spectrum managers will need a way to assess the value of each assignment not only to the user but also to the broader population. This is a wide-ranging effort that must consider commercial uses, such as those pursued by telecom networks and commercial satellite companies; foster innovative uses, possibly by assigning unlicensed spectrum; accommodate national civil uses, such as the needs of first responders; and safeguard national interests, such as by allocating spectrum when it is needed for security uses.

When assigning spectrum to address increasing pressure on certain bands, spectrum managers will face situations in which current users have not yet adapted to new technological and economic paradigms. Such underutilized bands may have been used for 2G and 3G, for example. Managers should take steps to repurpose such bands for 4G and 5G standards. Conversely, congested bands are typically the result of making many assignments and not allocating enough bandwidth to each user. VHF and low-band UHF often need to be reassigned so that they may be used for international mobile telecommunications.

Spectrum managers should repurpose underutilized bands for 4G and 5G.

Some legacy assignments have, over time, been split across noncontiguous bands because users requested additional spectrum and adjacent bands were unavailable. Some bands have been designated for use regionally or internationally, but they have not been released by the host country. Looking forward, some bands may need to be reserved for future allocations.

Developing the Next-Generation Spectrum Management Framework

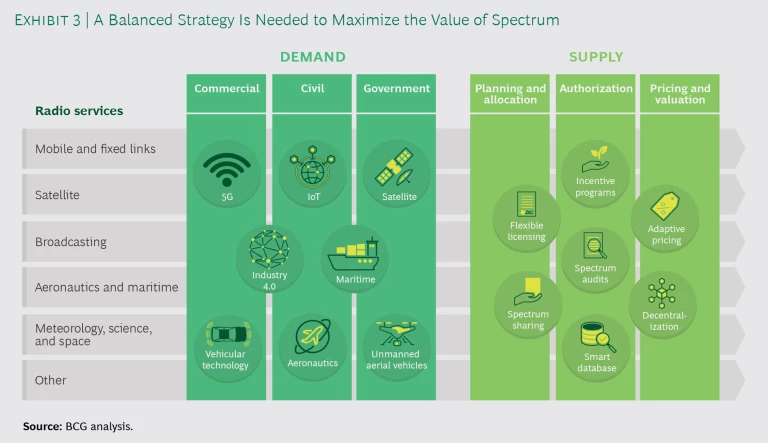

Given the changing demand and supply, countries need to implement a balanced spectrum strategy that requires a thorough understanding of the trends affecting spectrum, insight into the priorities of spectrum users and stakeholders, and knowledge of the supply. (See Exhibit 3.) Spectrum managers need an innovative framework and tools to accommodate the current and future complexities of demand and allocate the uneven supply.

More Sophisticated and Multidisciplinary Regulatory Tools. New policies and streamlined procedures must fit the current demand and cater to future uses. The best ones will decrease overhead and free up spectrum management resources so that they can be used for the economic, social, and legal aspects of spectrum management.

Public release programs, rebates, and incentives can help countries clear unused legacy assignments and decrease the amount of spectrum warehousing in support of a more competitive market. Regular audits can reveal actual use, compared with licensed use. For both private and public spectrum users, financial incentives can be provided to help free up underused bands. In the US, one proposal would give each public agency an allocation of a synthetic currency to acquire their spectrum usage rights. The UK has already set up a dedicated cross-ministerial body to identify opportunities for release.

There are also new models for pricing and trading that increase access to spectrum and enable healthy competition. With tools such as adaptive pricing, spectrum managers can reimagine fee structures to foster competition within and across sectors. Updating networks may bring down the price of spectrum, expanding the market to include users that previously could not afford it.

Demand Mapping and Forecasting. Spectrum planning and allocation must take a forward-looking approach, which requires conducting a broad impact assessment across various dimensions, including technology, the economy, public and social services, and national interests. Forecasting tools will help. The goal is to ensure the accessibility of spectrum for both new and existing users. As the amount of directly accessible spectrum starts to shrink, most mature spectrum regulators create specific programs to free up legacy bands that could be more valuable for new uses (such as 4G and 5G) than traditional uses (such as terrestrial TV broadcasting). In the UK, the Office of Communications is using prediction tools to anticipate where the demand will arise and how to address those needs.

The appropriate mapping of spectrum for radio services needs to be continually updated over the short, medium, and long terms. In addition, a thorough analysis of bands and usage models with particularly high demand should be conducted. These steps will allow spectrum managers to make informed decisions and thoughtful tradeoffs.

Responsive Authorization and Licensing. To handle the rapidly evolving needs of the ecosystem, the models used to assign spectrum bands must move away from the traditional fee-for-usage authorization. Commercial spectrum assignments, in particular those for international mobile telecommunications, have relied increasingly on market-oriented mechanisms, such as auctions, to ensure fair competition for high-demand spectrum. The European Union’s Wireless Access Policy for Electronic Communications Services is building a database of all bands that are available for flexible usage. In the US, Citizens Broadband Radio Service oversees the sharing of spectrum among government and commercial users, with real-time decisions being made to prevent interference and make decisions about who can use which bands.

Regulators have been relaxing usage restrictions on band licenses to spark innovations and new uses (on university campuses and in factories, for example) and to meet the needs of new entrants (such as industries and manufacturers). There is a trend toward a lightly regulated market that would allow assignments to be handled by other regulators or industry associations. The authorization of a secondary spectrum market would allow users to trade their spectrum licenses among each other. For example, it is common across member states of the European Union to allow spectrum trading in the harmonized bands that are available for flexible use.

Enabling Better Spectrum Management and Oversight

An empowered spectrum manager—one who is properly equipped to navigate the challenges of spectrum demand and supply—is central to maximizing value creation and balancing risks. A key set of enablers are needed to successfully transition to a more strategic role, in contrast to a historically administrative role. These enablers include engagement and open communication, market-oriented rules and regulations, broader skill sets, and emerging technologies.

Engagement and Open Communication. Historically, spectrum management often took a blanket command-and-control approach, largely limiting user input and involvement. Today, spectrum management is much different, with new models for spectrum use (such as sharing and trading) and new allocation mechanisms (such as auctions). In such an environment, decision making requires collaboration, transparency, and user buy-in.

Spectrum management has moved away from a command-and-control approach.

Spectrum managers can involve external stakeholders in many ways. For example, managers can use transparent communication channels (such as newsletters and public hearings) and implement more cooperative structures (such as stakeholder panels and steering committees). Such actions help ensure that spectrum demand is well understood by its users. Involving external stakeholders can also be instructive; their input can reveal the need for new regulations and issues with current ones, as well as ways to improve internal government cooperation on key spectrum matters. Furthermore, user collaboration is necessary for managing tradeoffs and addressing topics such as spectrum evacuation and repurposing. User input is also critical for managing interests and interferences across borders.

In Australia, the Communications and Media Authority publishes a newsletter for its stakeholders that discusses mainstream topics that affect spectrum decisions. Some countries have assembled stakeholder panels and steering committees to maintain cross-sector awareness and gather input on certain allocations that may have an impact beyond their specific purpose. In the UK, the steering committee is the Spectrum Strategy Committee; in the US, it is the Interdepartmental Radio Advisory Committee.

Market-Oriented Rules and Regulations. The International Telecommunication Union recommends that countries start with a legally binding document “that gives recognition to the radio spectrum as a national resource and the need to govern it in the interest of all citizens.” Among other things, this document may lay out the objectives of the regulator, define its authority for monitoring spectrum usage, specify the fees to be paid by licensees, spell out allocation and use parameters, set rules for inspection, and clarify penalties and parameters for forfeiture. Individual sectors may also have specific rules and regulations around spectrum and communications provisioning.

By updating rules and procedures for the new environment, countries can give their spectrum manager the authority to apply and enforce radio frequency regulations and secure national agreement on its mandate. In decentralized, market-oriented approaches, the spectrum manager should have the authority to maintain optimal spectrum usage by assessing competing uses and to act as arbiter and enforcer in disputes.

Broader Skill Sets. An expanded portfolio of skill sets and tools is needed to manage more than the traditional technical nature of radio frequency allocation. There may be a need for public policy analysts and financial analysts to support a broader look into value creation from an economic and social perspective and to develop regulations and pricing and valuation structures. And to keep an eye on national interests, spectrum management must involve cross-border agreements and international coordination, for which international law or policy specialists may be required.

Of course, radio frequency engineers and technicians are central to building and maintaining robust user analytics, compliance tools, and licensing platforms, as well as maintaining the overall health of the spectrum management system. But new technologies will augment and extend the efforts of engineers and technicians by automating routine tasks and leveraging emerging technologies. New technologies will also minimize the human risk factor, help preempt threats, and accommodate a fluid market.

Emerging Technologies. New technologies make it possible to rethink the approaches taken by spectrum managers and the tools they use. Imagine IoT sensors, mobile devices, connected vehicles, and other electronic devices forming an ad hoc network that can leverage blockchain-based databases with current spectrum usage. Then imagine it with an AI layer that can predict demand variations, optimize sharing conditions, and vary prices in real time.

Blockchain is particularly well-suited to managing spectrum because it provides a transparent and automated way to log usage. The head of the Federal Communications Commission in the US wants the agency use blockchain to allocate spectrum more autonomously, reduce administrative overhead, and help to establish a system of trust for users on the basis of shifting demand. IoT devices, which tend to operate on sub-3 GHz bands, may serve a useful role in detecting and reporting spectrum activity and interference back to the blockchain. By leveraging IoT’s collaborative feedback loop, spectrum usage data can be transmitted to a source that can act on the information and adjust allocation in real time.

Blockchain provides a transparent and automated way to log spectrum usage.

Across the globe, many countries are already leveraging emerging technologies to facilitate the adoption of new models for spectrum allocation and usage. France allocated €800,000 to help fund the winning project from a “hackathon” conducted by the National Frequency Agency. The intent of the contest was to identify ways to use blockchain to allocate and manage spectrum. The funding is part of the government’s effort to develop innovative public services with technology.

In the US, the Defense Advanced Research Projects Agency is focusing on finding the best solution for an autonomous, adaptive, and cooperative spectrum management platform. Its Spectrum Collaboration Challenge is a three-year competition that focuses on various wireless obstacles and scenarios to produce AI-powered solutions for both military and commercial uses. The Spectrum Collaboration Challenge leverages a radio frequency emulator called the Colosseum that runs thousands of scenarios in real time, producing more than 65,000 channel interactions across all types of wireless devices, including IoT sensors, cell phones, and military radios. The goal is to develop a way to have technology, not humans, power spectrum sharing across systems that collaborate autonomously.

AI is at the heart of such efforts. The National Institute of Science and Technology (NIST) in the US has been testing deep-learning algorithms for spectrum sharing that allocate band usage on the fly among military and commercial users. Specifically, the 3.5 GHz band, which is assigned to the US Navy for offshore radar operations, can be accessed by commercial users when the Navy doesn’t need it. NIST has developed a way for commercial users to easily access these bands and then vacate them when the Navy needs them.

Finland is actively bringing AI into spectrum management with automated, adaptive systems that handle parts of spectrum allocation management, including planning, sharing, authorization, monitoring, and pricing.

To realize the potential of emerging technologies, regulators need to lay the groundwork by acquiring the skill sets and tools required. Regulators also need to anticipate future use cases by adopting structures, processes, and tools that allow the imagination to be the limit as spectrum usage evolves in the coming years.

Adopting a Crisis Management Framework to Ensure Smooth Operations

Spectrum is a critical national asset that has an important role in safety communications. Therefore, major spectrum disruptions can have significant repercussions for a country and its citizens; such crises can leave a country vulnerable and its citizens isolated.

Threats to a country’s spectrum may come from a variety of sources, including rogue wireless drones, intentional malicious attacks, and natural occurrences, such as atmospheric or solar events. What’s more, fast-paced technological advancements may have unintentional consequences of creating disruptions or causing interference.

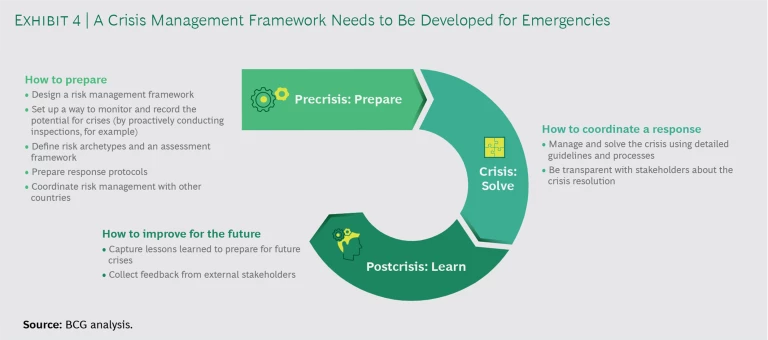

A clear approach to spectrum crises anticipates such risks and stipulates actions to take in the case of a disruption. Countries need to develop a spectrum crisis management guidebook, escalation processes, and governance to ensure agreement on authority levels and decision-making responsibilities. (See Exhibit 4.) This setup will help countries identify and prevent threats and act efficiently when there is an emergency.

Spectrum crisis plans should focus on in-the-moment responses, which require that teams be built on the fly and staffed according to the nature of the event; responsibilities and activities should be predefined under an established crisis management framework. Spectrum managers need to develop a crisis infrastructure for effective resolution and communication; most important, they should rehearse and test these plans to ensure the spectrum team is ready to deal with a crisis.

Interest in radio frequency bands will continue to grow, putting pressure on users and regulators. Countries have a window of opportunity to put a holistic spectrum strategy in place to reap the benefits of the dynamic and expanding spectrum market and to protect national interests. Countries that set a long-term agenda and commit to an empowered spectrum ecosystem will be well equipped to handle key tradeoffs among current and future users and make informed management decisions to maximize the value created by spectrum now and in the coming decades.