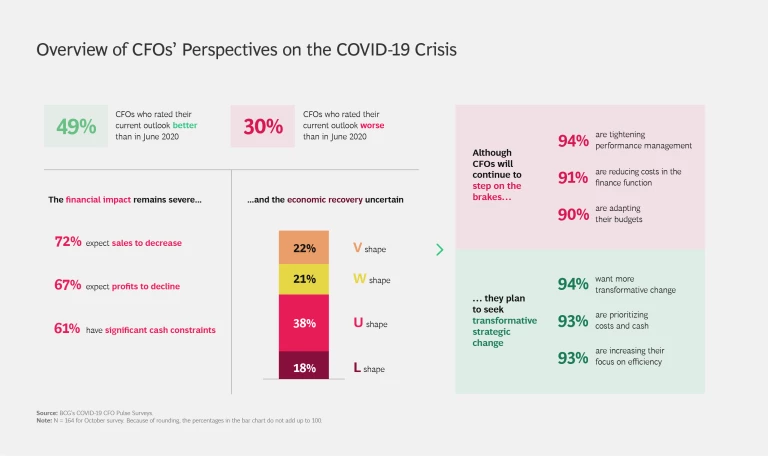

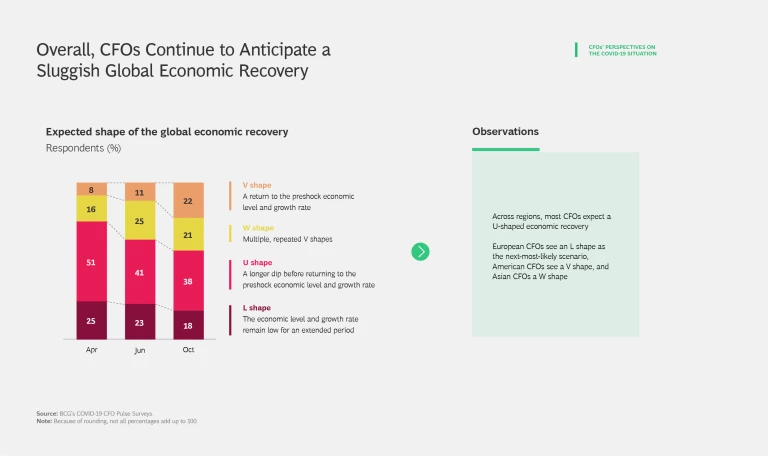

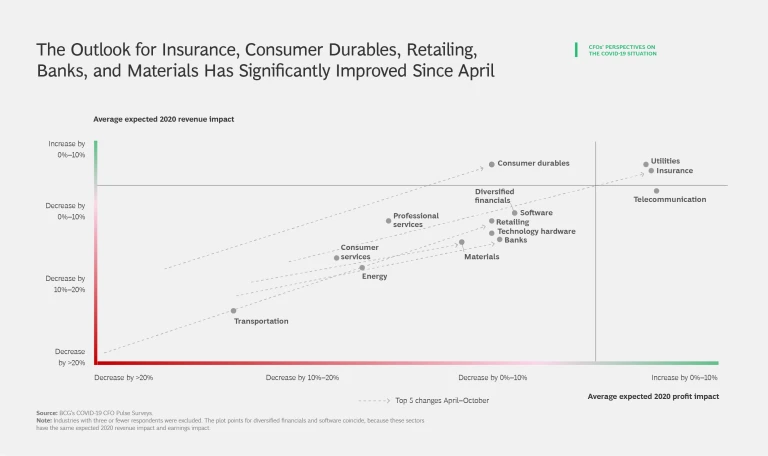

For the third time since the coronavirus pandemic began, BCG surveyed CFOs across the globe to understand their perspectives on the crisis. As in our previous surveys, in April and June , we find a slowly improving outlook across all regions. The tenor of CFOs’ responses differs by sector and geography, however, and indicates some clear winners and losers in the global lockdown. In particular, CFOs from the transportation, consumer services, and energy sectors remain the most concerned about the pandemic’s impact on sales and profits, while the outlook of their counterparts in insurance, consumer durables, and retailing has improved significantly since April.

About the Survey

- CFOs’ perspectives on the COVID-19 crisis and its impact on their companies’ performance

- CFOs’ planned short-term and midterm courses of action

The survey participants were primarily from companies in Europe and the US, with some participants from companies in Asia as well. These companies, including many large global organizations, represent a broad array of industries.

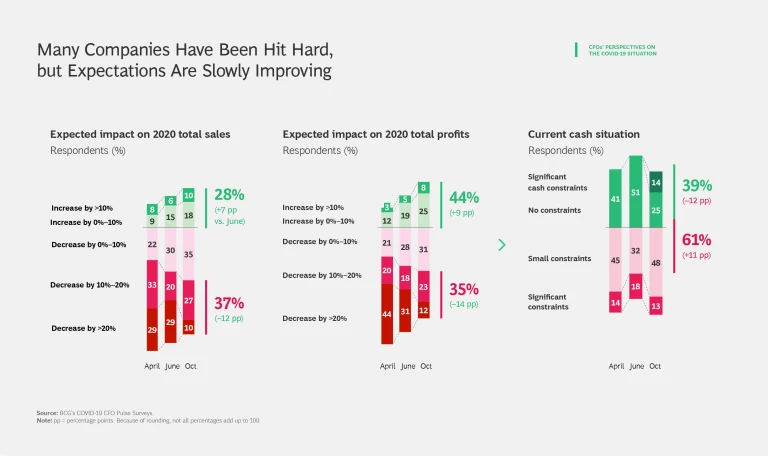

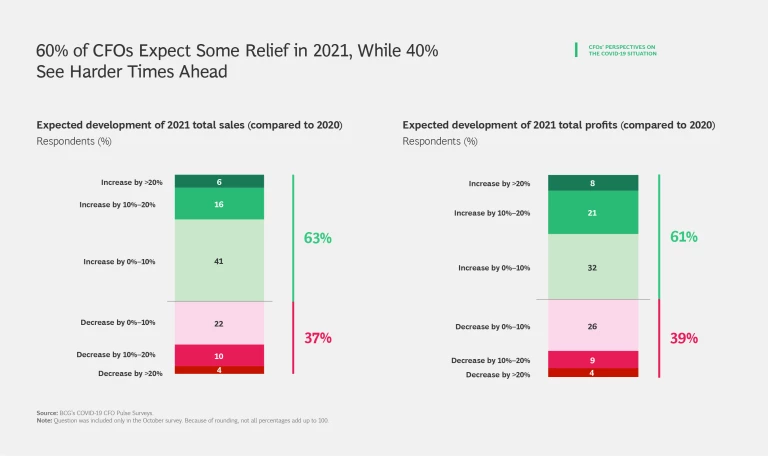

The pandemic will undoubtedly exact a heavy toll on most businesses. One-third of CFOs today expect their business’s sales and profits to decline in 2020 by at least 10% from their 2019 numbers, and 61% report some form of cash constraint—including 75% of CFOs at smaller companies. In addition, although 60% of CFOs express cautious optimism about 2021—anticipating an increase in sales and profits in the coming year—the remaining 40% believe their results will further deteriorate.

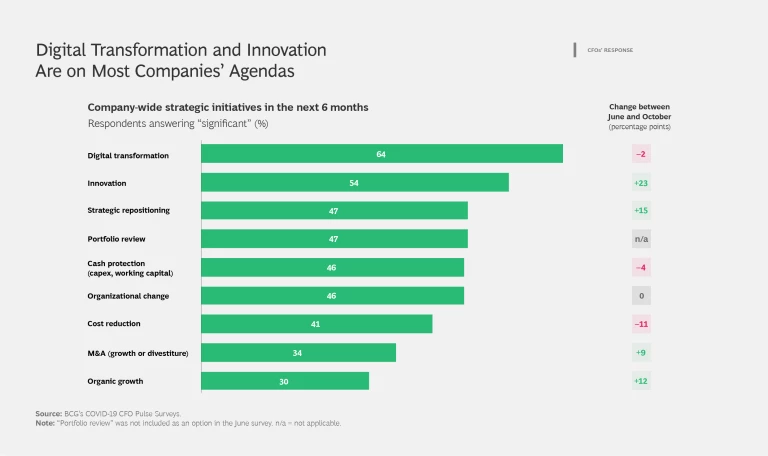

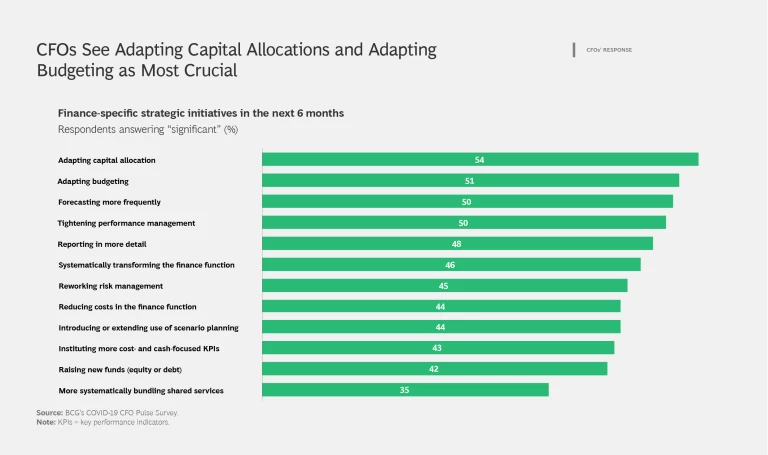

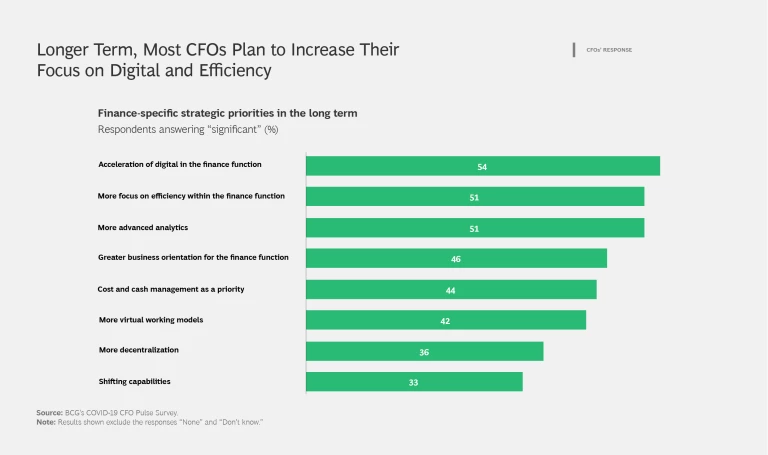

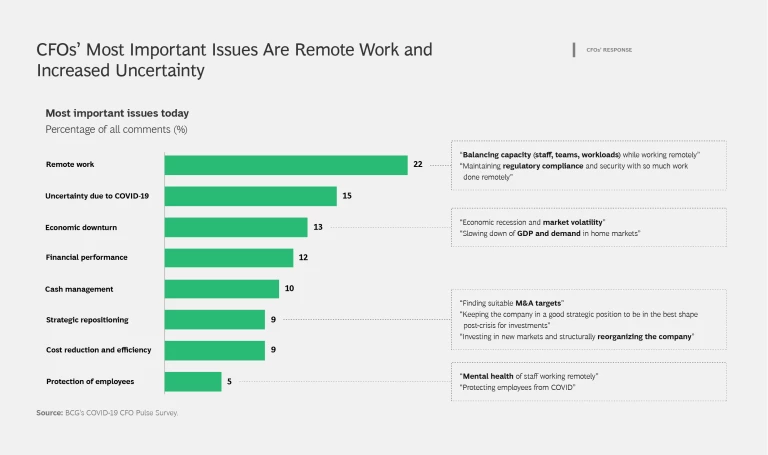

As the crisis continues, our respondents are still tightening their budgets and have shifted more of their focus to digital transformation, innovation, and strategic repositioning. They also say that the most pressing problems they face today relate to remote working, uncertainty surrounding the virus, and the economic downturn.

You can explore some of our detailed survey findings in the slideshow below.