If you could be thrust forward to an investment conference in 2030, you’d get a glimpse of a very different machinery industry. It would be much more valuable than the one that exists today. It isn’t even a given that the company with the highest market capitalization would be a familiar name. It could be one that currently operates on the fringes of industrial machinery.

Three accelerating and interconnected trends will fundamentally transform the $2.5 trillion industrial-machinery sector over the next decade.

The differences would be evident in the changes at construction sites. In 2030, construction equipment will come with guaranteed levels of uptime, and site managers will be able to remotely monitor the equipment with the help of digital notifications about maintenance and repair needs. The managers will have access to automatic project updates that they can use to quickly change the day’s work plans. Other digital tools will track each machine’s fuel consumption and CO2 emissions. These will be must-haves in the more tightly regulated world that’s coming.

Three accelerating and interconnected trends—the evolution from products to solutions, the rapid adoption of digital technology, and the sustainability imperative—will fundamentally transform the $2.5 trillion industrial-machinery sector over the next decade. These trends will shape the path to value creation for those most willing to rethink their current business models and will pose an existential threat to any companies that remain complacent.

The New Rules of Competition

The biggest machinery makers used to have a seemingly insurmountable advantage owing to the scale of their manufacturing bases, the quality of their engineers, and the reach of their physical channels. The gap has narrowed considerably; OEMs once considered to be in the second tier now offer high-quality products of their own. New distribution partnerships, both physical and digital, have increased these smaller OEMs’ competitiveness.

Moreover, the threat isn’t just from machinery OEMs that have upped their game. Digital-solution providers, aftermarket servicers, and rental businesses are among the new players that now compete for incumbents’ customers. Some of them have more flexible operating models and a more customer-centric mindset than the incumbents.

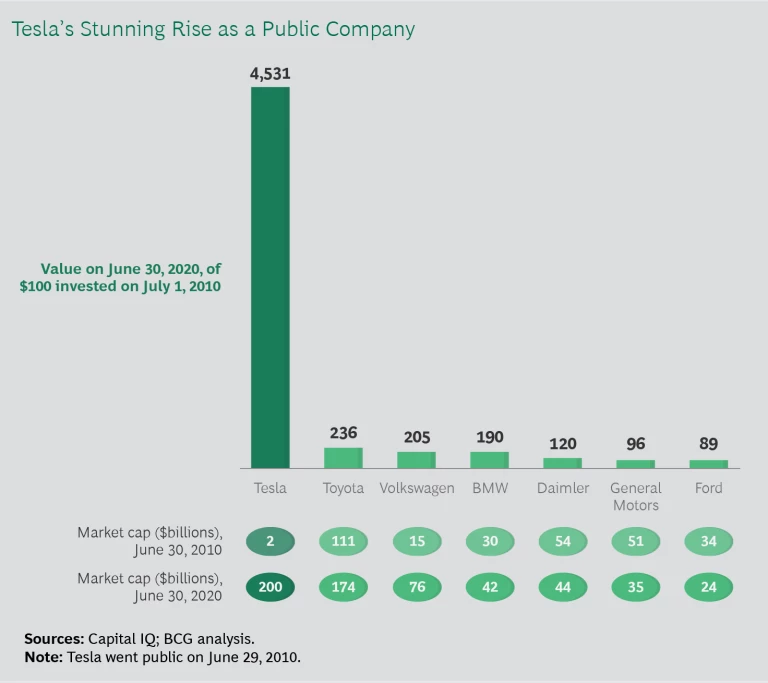

In many ways, incumbent machinery companies are in a position analogous to the one that automakers found themselves in a decade ago, when Tesla was struggling to gain traction in the automobile industry. At the time, automobile manufacturers had plenty of capacity, and consumers seemingly had no shortage of choice. There was widespread skepticism about the need for a new automobile company, especially one selling an expensive product and relying on a type of infrastructure (charging stations) that didn’t exist in the US. But Tesla’s fundamental value proposition—cars that are largely digital and much more environmentally friendly—was so compelling that the company has overcome all the barriers it faced. Automakers’ early complacency will haunt them for decades. (See “Tesla’s Rise and Incumbent Complacency.”)

Tesla’s Rise and Incumbent Complacency

Tesla has accomplished this by staking out a leadership position on the same trends that are altering the competitive dynamics in industrial machines. Environmental responsibility? Accelerating “the world’s transition to sustainable energy” is at the center of Tesla’s mission statement. Digital? Tesla, which makes extensive use of interactive displays, autonomous features, and software updates, provides an experience that is in some ways more like smartphone ownership than car ownership. Solutions over products? Tesla is squarely positioned in the mobility-as-a-service space as its cars become increasingly autonomous.

In short, Tesla is many people’s idea of what the car of the future should be. This has helped the company pick up market share and grow at a faster rate than the broader automobile industry. Even though it sells only one car for every ten sold by the biggest auto-makers, it has the highest market capitalization of any automaker. This past June—a decade after its initial public offering—Tesla’s value jumped past Toyota’s. (See the exhibit.)

Tesla is starting to have an impact in adjacent areas as well. Lyft, seeing the appeal Tesla has to Lyft’s own target demographic, has announced plans to move to an all-electric fleet by 2030. And Tesla, not content to limit itself to consumer vehicles, is in the early stages of adding battery-powered commercial trucks to its portfolio.

We’re not saying that a company exists that is about to do to industrial-machinery companies what Tesla did to automakers. The machinery industry has significant barriers to entry, including incumbents’ intimate knowledge of the machines and systems that customers use for complex operations, and incumbents’ huge installed bases. This gives them data and insights into customer needs. But these will be advantages only if OEMs adjust their business models to address the three trends. (See Exhibit 1.)

The Combined Impact of Services, Digitization, and Sustainability

One noteworthy thing about the three trends is how they are converging. Here’s a closer look at each individually and how its acceleration will affect OEMs’ strategies.

The Shift Away from Products and Toward Solutions. Industrial-machinery companies have been moving in this direction for decades, focusing mainly on aftermarket services: providing parts and technician support in response to customer demand. These services have high profit margins and are recurring, contributing to the growth and reducing the cyclicality of many machinery companies’ businesses. These services allow manufacturers to differentiate themselves through something other than product price and create stickier customer relationships.

In and of itself, however, the sale of a maintenance part isn’t a “solution.” Nor is the hour that a skilled technician spends installing that part.

Solutions happen when industrial-machinery companies do something that directly affects customers’ bottom lines, often by inserting themselves into some aspect of a customer’s operations or processes. A good example is inventory management. By seamlessly integrating procurement systems and placing orders automatically, OEMs can make sure that customers have replacement maintenance parts as soon as they need them. Minimizing machine downtime is another solution that OEMs can provide, by remotely monitoring machines and finding the best time to perform repairs given the customer’s project schedule. This signifies an evolution of many OEMs’ value propositions: from providing great products and repair parts to enabling business productivity through optimized machine performance and the elimination of unplanned down-time. Customers have embraced the shift from inputs to outcomes, and the solutions trend appears certain to accelerate.

The solutions mindset is already evident in the aerospace industry. Decades ago, aircraft engine manufacturers shifted their value proposition from selling aftermarket parts and labor to a performance-based contracting scheme. Commercial airlines don’t always compensate manufacturers like General Electric or Rolls-Royce for parts and labor anymore. Sometimes the payment is for product availability, which is measured by hours flown.

The Digitization of Assets and Operations. There are many examples of how digital technology and more accessible data are revolutionizing industrial machines. In harsh environments where workers are difficult to recruit, digital technology can allow assets to be run remotely. In quarries, digital can help managers optimize their work sites, coordinating the activities of dozens of machines to improve throughput and reduce idle time. We’ve already mentioned the real-time monitoring of asset health, with its potential to identify potential failures early on when they’re cheaper to fix and before they result in unplanned downtime.

The integration of digital technologies isn’t an inborn capability of industrial- machinery OEMs, which have their roots in mechanical engineering, not digital technology. The challenge that OEMs confront is multipronged—relating both to different kinds of technology (hardware and software) and to an ecosystem of players with varied backgrounds and strengths. OEMs also face participation decisions: who to partner with and what to buy versus build.

Several high-profile digital startups, with no physical machine products of their own, have entered the market.

John Deere and Caterpillar are among the OEMs that have moved aggressively into the digital space—John Deere with a digital ecosystem that helps farmers increase their productivity, Caterpillar with a set of fleet management applications for tracking construction equipment. At the same time, several high-profile digital startups, with no physical machine products of their own, have entered the market. One, Samsara, offers digital solutions aimed at on- and off-highway truck fleet managers, with dispatching and monitoring functionality. Another, Built Robotics, has attracted attention by adding autonomous capabilities to construction equipment.

For now, these young companies operate on the periphery of the industrial-machinery industry; they haven’t siphoned off a lot of business. Arguably, their offerings (including telematics devices, data aggregation, and software development services) are complementary rather than competitive. But that could change as digital solutions grow in value and customers adopt them. The risk for incumbent OEMs—in this new world of hybrid digital and physical ecosystems—is that a third party with expertise in digital could own the interface that end customers value most. That third party would then be in a position to shape the way customers choose their next machine, or next maintenance part, especially if the third party’s interface directs the transaction.

The Sustainability Imperative. The third important trend in industrial machinery involves sustainability. The pressure to reduce pollution and the effects of climate change is coming from multiple sources: the public, government regulators, and investors.

An example from the public realm is the September 2019 global climate strike. Millions of people around the world marched and protested to push for action on climate change.

In the government realm, the commitment has varied from country to country, but it’s hard to imagine that things won’t turn—sooner or later—permanently in the direction of tighter environmental standards. In some places, they already have. Many localities, concerned about particulates, air quality, and noise, have introduced regulations to discourage diesel-based equipment on construction sites. This is affecting decisions about the equipment used on new building developments in Paris, on road repairs in Stockholm, and at landfills in Los Angeles.

And then there’s the very direct pressure that investors are putting on industrial-machinery companies. BlackRock, the world’s largest asset manager, has started to take voting action against companies that don’t have sufficient carbon reduction plans in place—and other big investors have followed suit. Companies that pay the most attention to emissions and other aspects of total societal impact now trade at a premium to those that pay less attention, according to BCG analyses.

An important thing to keep an eye on is the availability of technologies (including many machines and components) that contribute to greener business practices . In many sectors, these technologies are already economically competitive, with no subsidy or government action. This is true, for instance, of solar panels versus coal for power generation. In the case of other technologies, like battery storage in higher-power-output applications, the moment of economic viability is coming. The push for greener machine technologies will accelerate if carbon prices go up, carbon border taxes are imposed, or governments subsidize the technologies’ development—all of which are possibilities.

Executives are rolling the dice if they assume that sustainability will be an issue for their successors but need not be a priority for them.

Executives are rolling the dice if they assume that sustainability will be an issue for their successors but need not be a priority for them.

The good news is that sustainability isn’t all about playing defense. For OEMs with an ability to innovate, the regulations relating to sustainability create opportunities that didn’t previously exist.

Battery maintenance is a good example. In cities where an OEM’s assets run on electrical energy, the OEM could deploy trucks that would provide replacement batteries and portable-charging services. There is a digital element to the replacement solution too since many assets nowadays are outfitted with telematics equipment. The OEM could know—without having to be told by construction site managers—which assets needed servicing and could optimize the routes and scheduling of its trucks.

A Decade of Strategic and Operating-Model Changes

To thrive during this decade, industrial-machinery manufacturers will have to rethink significant parts of their strategies. Here are the five biggest questions they should ask:

- How do we develop the customer centricity needed to ensure that our solutions have value? An intimate understanding of the near-term problems your customers are facing, and of how they generate profits, should be the basis of your planning. Take emissions reductions—a big current concern for those who operate heavy machines. Some European countries have signaled that they will require job sites to provide regular emissions reports. OEMs could develop tools to track emissions, which would be helpful for construction customers in these and other heavily regulated countries.

- How do we shift our approach to product development and life cycle solutions? The definition of value in industrial machinery has changed, and an integrated approach is needed. That means that in addition to thinking about their physical machines, OEMs should consider the services needed over those machines’ lifetimes and the digital tools required. Most next-generation machines should have both physical and digital product launches. For instance, a company designing a new elevator can’t be concerned just with motors, pulleys, and atmospheric-pressure controls. The new elevator also has to be designed to work with the operating systems of the building it’s going into and must have the capability to enable other digital services, like automatic floor calls based on ID badge scans at the turnstile.

- How should we participate in the sustainable-machinery segments and digital ecosystems that are taking shape? This is about staying relevant in the world that everyone is operating in today. OEMs should develop scenarios related to the changes their customers will face in the intermediate and long terms, especially shifts related to sustainability and digital technology. These scenarios will drive OEMs’ participation decisions—what they need to own and where they need to partner.

- What must evolve in our channel and go-to-market strategies? Industrial-machinery companies face a balancing act here. Distributors are necessary for OEMs to reach their geographically diverse markets. But indirect sales also put distance between OEMs and their end customers, creating inefficiencies in the OEM-to-customer feedback loop. The industry needs to move toward more collaborative relationships—both OEM to customer and OEM to distributor. While there is no one-size-fits-all answer to this question, we expect to see significant rethinking and some experimentation in OEMs’ go-to-market approaches.

- What changes do we need in our culture and ways of working? Industrial-machinery companies require greater agility to keep up with the pace of digital innovation and maintain flexibility. Some of this will involve increasing the concentration of in-house digital expertise. At the same time, there needs to be more cross- functional collaboration. With today’s lines and boxes, the people responsible for sustainability, services, and digital are often in different departments, or—worse—are distributed among different product groups. These silos aren’t conducive to rapid-cycle innovation and need to be dismantled.

Let’s jump forward to 2030 one last time. Up on the screen, at that investment conference, is a product from the industrial-machinery company that everybody is talking about. It’s a combine, fully electric and autonomous.

The combine looks completely different from today’s combines because it has no cab or engine bay. It comes with its own app that allows users to control the machine, monitor its health in real time, and do an automated visual inspection using the camera on their phones. Moreover, the entire machine is made of recycled content, most of which will be reclaimed at the end of the asset’s life and either rebuilt or recycled into another combine. Most customers don’t own their combines outright; they pay for uptime availability and the pounds of crops harvested. For the small number of customers who do buy combines, the manufacturer offers a service to provide battery swaps and overnight-charging services.

The breakthrough, on multiple levels, that this next-generation product represents will happen sooner than machinery executives expect. So will the economic disruption. This is no time for complacency: the existence of manufacturers is at stake.

Bill Gates famously said that people tend to “overestimate the change that will occur in the next two years and underestimate the change that will occur in the next 10.” That’s a reality that industrial-machinery companies should keep in mind during a decade that has started in tumult, with more to come.