Here’s good news for consumers, the auto industry, and potentially the planet—an unusual trifecta. BCG’s latest global automotive powertrain forecast shows sales of electrified vehicles (xEVs) growing even faster than expected. These cars will seize a third of the market by 2025 and 51% by 2030, surpassing sales of vehicles powered purely by internal combustion engines (ICEs). Our previous forecast, completed in 2017, showed xEV sales taking a quarter of the market by 2025 and approaching 50% by 2030. Battery-powered electric vehicles (BEVs) and plug-in hybrids (PHEVs) will seize almost a quarter of the market by 2030; we had previously projected their global market share at about a fifth.

Several factors are driving the accelerated rate of xEV—and particularly BEV and PHEV—uptake. One is government incentives, which play an important role in lowering the total cost of ownership (TCO) for consumers. Another is tighter regulation on tailpipe emissions in a number of markets, which force OEMs to produce more xEVs to meet emission targets. A third is falling battery prices and the extended driving ranges that these batteries allow, which contribute to rising consumer satisfaction with xEVs.

Battery-powered electric vehicles (BEVs) and plug-in hybrids (PHEVs) will seize almost a quarter of the market by 2030.

All told, consumers are happy, and the industry can retool with greater certainty for an electrified future. The top 29 OEMs already plan to invest more than $300 billion over the next 10 years to further xEV production, and many claim they can do so profitably. Some 400 new models should appear by 2025. Assuming that global weaning from fossil fuels continues, automobiles will contribute fewer greenhouse gases on a “well-to-wheel” basis over time. All of this should happen if—and this is a big if—governments continue to support electrification with financial and nonfinancial incentives and, in some regions, by tightening regulations during the next few years. By 2023, market forces will take over and drive xEV sales. Until then, maintaining momentum requires a public-private push.

This report, an update of our January 2018 report, The Electric Car Tipping Point , looks at what has changed in the forces driving EV adoption and what those changes mean for consumers, the industry, national and local governments, and the planet.

A Faster-Growing Global EV Market…

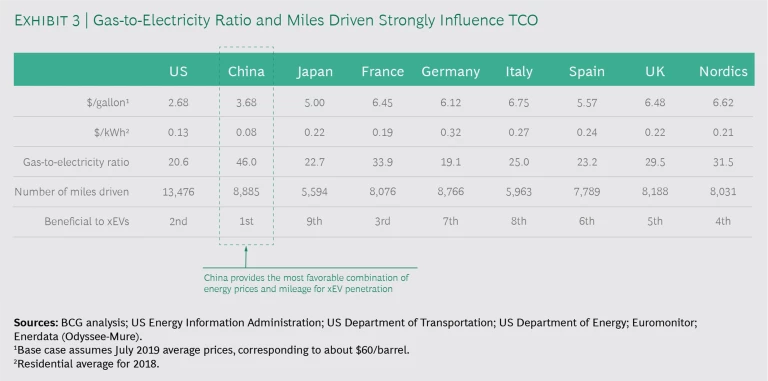

Two years ago, BCG predicted that the future of the automobile would be electric. We also specified that regulatory requirements would be the primary driver of xEV sales in the near term, as car makers worked to meet tightening fleetwide emission standards in most major markets. Over time, we said, falling battery prices and declining TCO would fuel rising consumer demand and EV sales. The mix of xEVs—mild hybrid electric vehicles or 48-volt hybrids (MHEVs), full hybrids (HEVs), PHEVs, and BEVs—would vary by market, primarily in response to fossil fuel prices, electricity prices, and driving distance each year. It would also depend on consumers’ willingness to invest up front in an electrified car to save later on fuel costs.

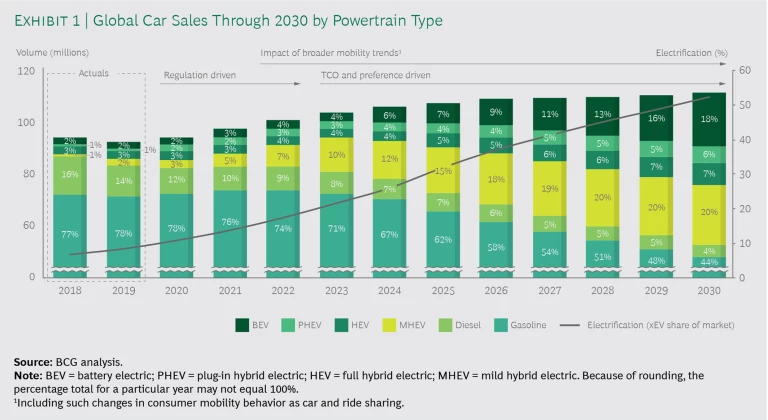

Since then, the confluence of regulatory and marketplace factors has caused sales of xEVs—particularly PHEVs and BEVs—to grow faster than anticipated, a trajectory that we expect will continue. Global production volume of PHEVs and BEVs in 2019 was about 2.8 million vehicles. That’s a small number to be sure, but it’s nearly 800,000 more than we had projected in 2017. Consumer interest is rising fast: US surveys show almost 40% more people considering a PHEV—and 20% more considering a BEV—in 2018 than in 2010. Fully 70% of EV owners intend to purchase electric again, and we now see a growing number of US families with two BEVs in their garages. In light of the accelerating xEV sales and the factors behind them, we have revised our market forecast. (See Exhibit 1.) We now expect sales of xEVs to overtake sales of traditional ICEs by 2030. PHEV and BEV sales will grow especially quickly in the second half of the coming decade, with BEV sales representing almost 20% of the global market.

The trajectories for xEV sales vary by powertrain type and by market. On a global basis, we now expect falling battery prices to lead to a tipping point for BEV five-year TCO in 2022 or 2023 (the exact year differs by region and by size of car). The favorable economics of xEVs for ridesharing (taxis and ride-hailing services) will contribute to additional growth—hybrids already account for a significant share of the taxi business—but the impact will be lower than we expected two years ago. For example, in the US, the percentage of new car sales attributed to ridesharing could reach 10% by 2030 (or 8% of total vehicle miles driven), close to half of what we had assumed. BEV sales from 2025 to 2030 should rise more than 30% a year.

Sales growth for PHEVs in most markets will be slower than that for other xEVs, held back by unfavorable economics. Nonetheless, many OEMs will maintain a two-track BEV-PHEV strategy, and some markets will continue to incentivize PHEVs while building out their electrified vehicle infrastructure. PHEVs appeal to consumers who regularly drive longer distances and to single-car owners. They may also find a growing market in the rising number of cities that plan to ban ICEs in city centers.

HEV sales will likely see steady high-single-digit growth rates throughout the decade. In the near term, HEV economics are favorable for ridesharing until BEV costs come down. Some OEMs will likely then move away from HEVs, but the powertrain will retain niche popularity—for example, in Japan and in many urban areas, where the average number of miles driven is low.

Many OEMs will lean on MHEV sales over the next several years, since the technology offers the cheapest way to improve the efficiency of ICEs and meet CO2 regulatory standards—up to a point. As a result, sales will grow as much as 40% a year. The fast ride will slow by about 2025, however, as the falling price of batteries enables BEVs to take share.

Diesel sales over the next decade will plummet under the strain of hostile regulations and, in some cities, outright bans. Lower capital investment and platform refresh rates by OEMs will cause declines in pure ICE volume to accelerate through 2030 and beyond. Their global share will drop from 69% in 2025 to 48% in 2030, with diesel’s share falling to as little as 4% of the global market.

Diesel sales over the next decade will plummet.

…With Regional Variations

The adoption curve for EVs varies by market, depending primarily on TCO, including the price of the vehicle, the number of miles (or kilometers) driven, and local gasoline and electricity costs. (For individual national and regional projections, see the appendix.) That said, with a combined 50% share of the worldwide auto market, China and Europe play a significant role in shaping global trends. The short-term direction in the US is unclear as policy differences between the current administration and the State of California play out.

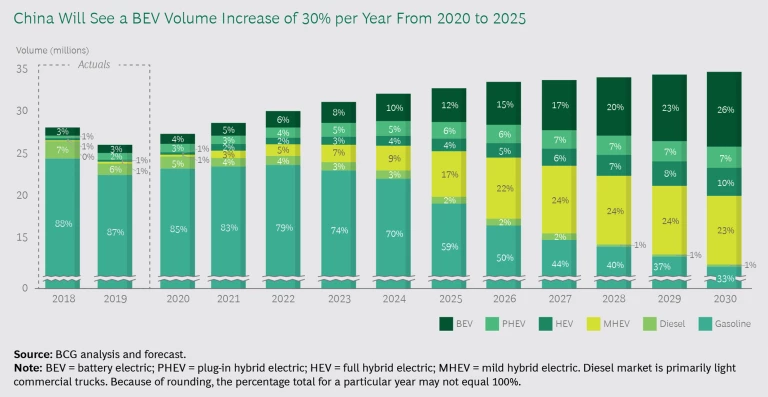

As we pointed out in our last report, the Chinese government’s financial and nonfinancial incentives have made China the leading market for EVs so far. The country’s combination of low electricity costs and high gas prices help give xEVs favorable TCO relative to ICE-powered cars and trucks. China shows the fastest growth among BEVs of any major market; BEVs’ share of the market there should reach 12% by 2025 and 26% by 2030, while ICEs’ share is projected to drop from 95% in 2018 to 34% by 2030. OEMs will also promote MHEVs to address CO2 regulations. The recent stabilization in xEV sales in China reflects the government’s planned phasing out of incentive programs—an effect that underscores the importance of sustaining incentives between now and 2022, when market forces will be strong enough to support xEV sales growth on their own.

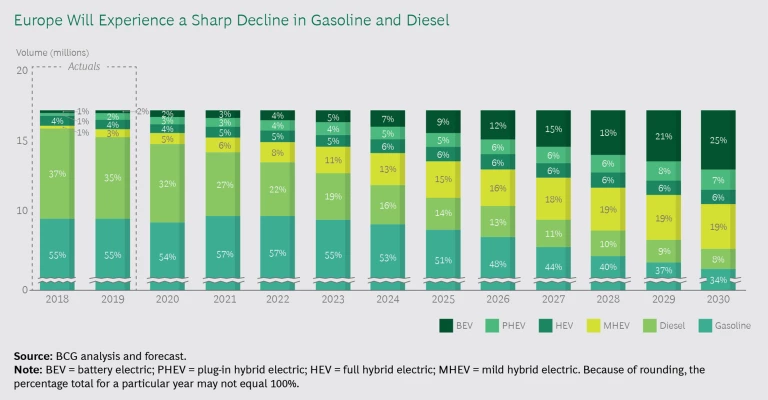

As early as 2020, in keeping with regulations adopted at the end of 2018 that put manufacturers at risk of substantial fines for not meeting emission-lowering targets, Europe will start to pull away from gasoline and diesel powertrains and toward a more balanced mix of electrification than other markets will have. In the near term, subsidies for BEVs and PHEVs keep these vehicles competitive with other powertrains. By 2030, the market share of pure gasoline- and diesel-powered vehicles will shrink to 42%, that of BEVs will grow to 25%, and hybrids will divide the remainder, with the largest share belonging to MHEVs (19%). BEV and PHEV growth will be especially strong in France, Germany, the UK, and the Nordic countries (which we expect will show combined 2030 shares of 39%, 35%, 33%, and 47%, respectively). This growth will come at the expense of traditional ICEs, whose share will shrink to 40% in France, 36% in Germany, 40% in the UK, and 34% in the Nordics.

In the near term, subsidies for BEVs and PHEVs will keep these vehicles competitive.

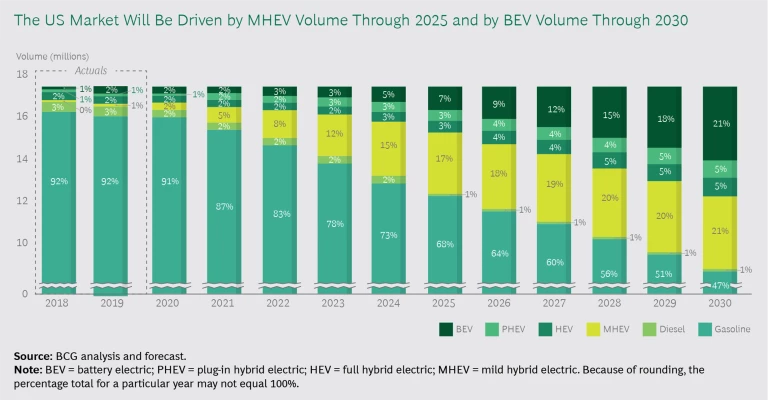

Regardless of how the current differences in regulatory approach play out, the US will be the slowest major market to electrify, owing to the relatively low cost of gas and the larger size of US cars and SUVs. Big differences will persist between states such as California that are adopting zero-emission standards and Texas, which relishes minimal regulation and the ability to drive long distances. Nationwide, as battery costs fall, BEVs will increase their share from 7% in 2025 to 21% in 2030. MHEVs will grow from their negligible share today to 21% of the market, as OEMs leverage technology to achieve CO2 targets in the least-expensive way. Overall, traditional ICEs will power 48% of cars and trucks in 2030.

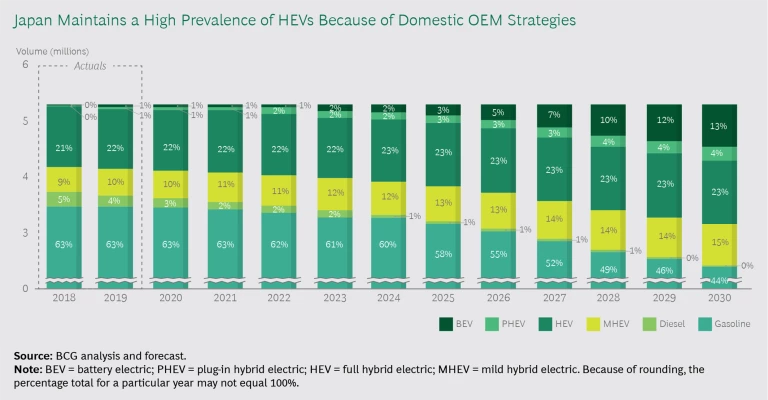

The Japanese market will develop according to its own dynamics. There, HEVs already have a 22% share and will be difficult to dislodge, as OEMs have made substantial investments in a dominant “middle ground” technology that meets emissions standards and consumer needs. Growth in BEVs (to 13% by 2030) and MHEVs will come primary at the expense of traditional ICEs. HEVs are likely to hold their own as a combination of low yearly mileage and a lot of urban driving makes hybrid drivetrains an adequate technology for the country.

The Drivers of Accelerated EV Acceptance

Multiple factors are driving rising EV sales, especially in the near term, but at a macro level the two most important are that EVs offer appealing TCO for consumers and that they represent the lowest-cost solution to meet regulatory standards for the industry. These factors are converging around electrified vehicles, and both will favor BEVs and PHEVs sooner than we had thought.

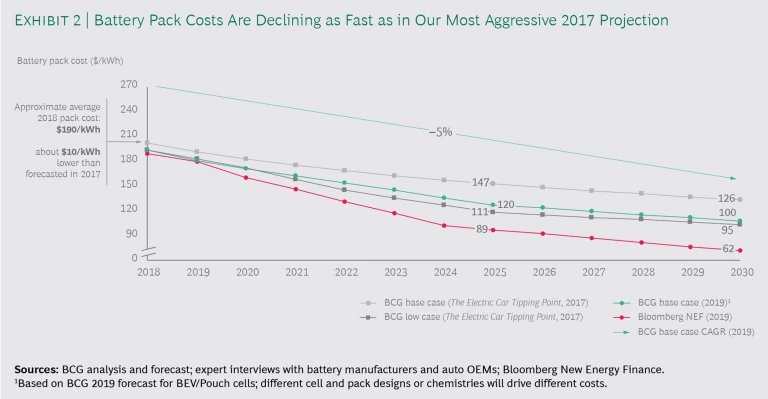

Falling TCO. By far, the biggest cause of falling TCO for BEVs is battery prices, which are decreasing more steeply and more quickly than expected. On the basis of extensive discussions with battery manufacturers and experts around the world—notably in China and South Korea—as well as with car manufacturers about their expectations as they work out their battery purchase plans, we now expect battery pack costs to fall below $100 per kilowatt hour (kWh) by 2030 (as opposed to about $126 per kWh in our previous projection). (See Exhibit 2.) Much of this drop will occur in the next few years, boosting TCO benefits for consumers and accelerating EV market uptake. The speed of the decrease is quite remarkable. Over the course of 15 years, between 2014 and 2030, battery pack prices will have slid more than 80%, from $540 to $100. Some market observers and OEMs, including VW and Tesla, are predicting an even faster decline.

Although consumers will still need incentives to support BEV sales during the next two to three years, once the car is purchased, electricity is cheaper—often much cheaper—than gasoline, by the kilometer or mile. Take the US, where both gas and electricity are cheap and distances far. Our previous research showed TCO for a medium-size, C-segment car in the US market reaching a five-year tipping point for BEVs in about 2027. (In addition to being influenced by purchase price and maintenance costs, TCO is a function of the number of miles driven, gas or electricity costs, and residual value. See Exhibit 3.) We now believe that the TCO tipping point for the same vehicle will come in 2022 at a five-year cost of $32,950. The five-year TCO for BEVs will then fall steadily from there to less than $29,150 in 2030, giving drivers a real financial incentive to go electric.

Almost as important in a market as large and diverse as the US, the TCOs for different types of vehicles follow a similar pattern. By 2030, a large battery-powered car’s TCO will have dropped from about $46,000 today to less than $37,750. For a midsize SUV, TCO will fall from $41,000 to $34,750. For a pickup truck (long the most popular US vehicle), TCO drops from $55,550 to almost $46,950. In all three cases, the tipping point arrives early in the coming decade. (Pickup trucks will see their own pattern of benefits, depending on application and load considerations.)

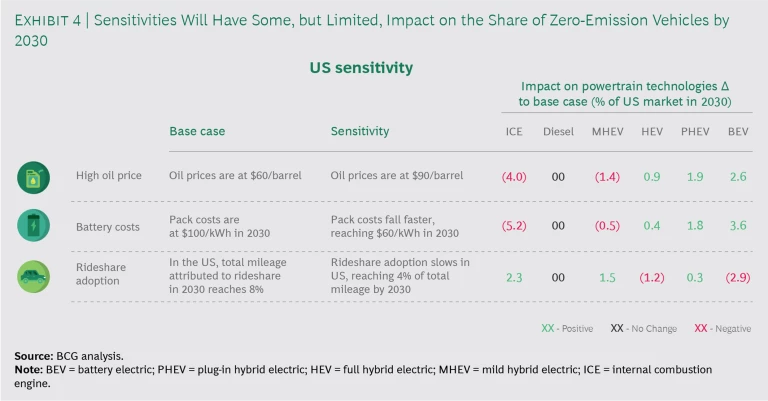

Moreover, our projections show relatively little sensitivity to variables such as the price of oil. Our base case assumes that oil will remain at the $60-a-barrel level. If it were to jump to $90 (and stay there), we project that traditional ICEs in the US would lose an additional 4 percentage points of share while BEVs would gain 2.6 points—not insignificant numbers in a big market, but not game-changing either. (See Exhibit 4.) Likewise, a further decrease in battery costs from $100 per kWh to $60 per kWh would increase the share of BEVs in 2030 by 3.6 percentage points.

Regulatory Considerations. OEMs must produce more xEVs to meet tightening regulations globally and to avoid costly fines. In the near term, in particular, regulations will drive companies toward technology improvements and lowest-cost solutions that will help them meet requirements such as reducing CO2 emissions.

Three types of regulation will accelerate electrification in the years before EVs reach a favorable TCO relative to ICEs. The most important, of course, is emission standards, such as the US’s Corporate Average Fuel Economy (CAFE) and China’s Corporate Average Fuel Consumption (CAFC). Despite recent moves by the current administration in the US, we believe that CO2 tank-to-wheel regulations will remain tight or become tighter in most key markets and that industry targets cannot be met without BEVs and PHEVs.

In Europe, OEMs need to decrease CO2 emissions by about 20% to meet 2021 targets. Recent increases in fleetwide emissions underscore the challenge. For example, Europe’s fleetwide emissions have risen, rather than fallen—from 118 grams per kilometer of CO2 in 2016 to 120 g/km in 2019—as the share of gasoline engines, replacing diesel, and of SUVs has increased. TCO-driven forecasts suggest that without government incentives the EU fleet mix will not be able to reach current CO2 targets, which could result in heavy penalties for the industry.

Two other types of regulation also play a role in driving xEV sales. One is credit programs. Some governments as a matter of policy require OEMs to invest in and sell clean-technology vehicles. An automaker’s sales must achieve credits equal to a set percentage of zero-emission vehicles in order for the company to avoid fines. California’s Zero Emission Vehicle (ZEV) program—which ten other US states have also adopted—and China’s New Energy Vehicle (NEV) program are two examples. It is noteworthy that California has nearly reached its 2025 target, with about 7% penetration of BEVs and PHEVs.

In addition, we are seeing an increasing number of jurisdictions limit the use of, if not outright ban, ICE-powered vehicles. Paris intends to ban gasoline and diesel vehicles in the city center by 2030. Rome has announced plans to ban diesel vehicles from the city center by 2024, and Milan by 2030. German cities have gained the legislative power to make these decisions independently of the federal government.

Consumers and OEMs. The more experience consumers gain with xEVs, the more they like them. As sales increase, surveys show rising consumer satisfaction and willingness to consider purchasing or repurchasing xEVs. A February 2019 survey by Harris in the US found that almost three-quarters of drivers believe electric vehicles are “the future of driving.” (The survey was conducted for Volvo.) In July 2019, Consumer Reports and the Union of Concerned Scientists found that almost 65% of prospective car buyers in the US were checking out EVs. Potential buyers spanned all income ranges, including 39% of people making $50,000 to $99,999 a year and 31% making less than $50,000.

OEMs are doing their part to boost EV sales and build the market. With the $300 billion that they have committed to EV engineering, production, and support, OEMs are expanding their factory capacity and building out their charging infrastructure. They plan to bring nearly 400 BEV and PHEV models to market by 2025, giving consumers many more options in vehicle powertrain and size.

Slower Growth in Shared Mobility. The one area in which demand will rise more slowly than previously anticipated is shared mobility. Two years ago, we based our ride-sharing forecasts on the assumption that adoption rates in 2030 would range from 40% to 80% in large cities (populations of more than 1 million) and from 20% to 40% in metropolitan areas immediately surrounding city centers. Because all of these shared cars will be electrified—and the majority of them will be fully electric, owing to the fast payback possible by that time—shared mobility will significantly boost the proportion of new-vehicle sales claimed by electrified vehicles.

It’s now evident that these forecasts were aggressive. We have modified our view mainly on the basis of a more refined cost-per-mile comparison of owned versus shared cars—in particular, the number of empty miles traveled by shared cars, the cost of parking for owned cars in various cities, and a deeper understanding of consumer mobility preferences. Today we believe that ride-sharing adoption rates in 2030 will be about half the previously anticipated rates. As a result, our still optimistic view of the percentage of shared vehicles that will be sold is about 11% in China, 10% in the US and Europe, and 4% in Japan. (These percentages assume the availability of autonomous vehicles that lower the cost per mile of shared mobility.) Increased xEV sales to consumers, thanks primarily to falling TCO, will more than counterbalance the impact of this reduction in shared xEV sales.

The Impact on Climate Change

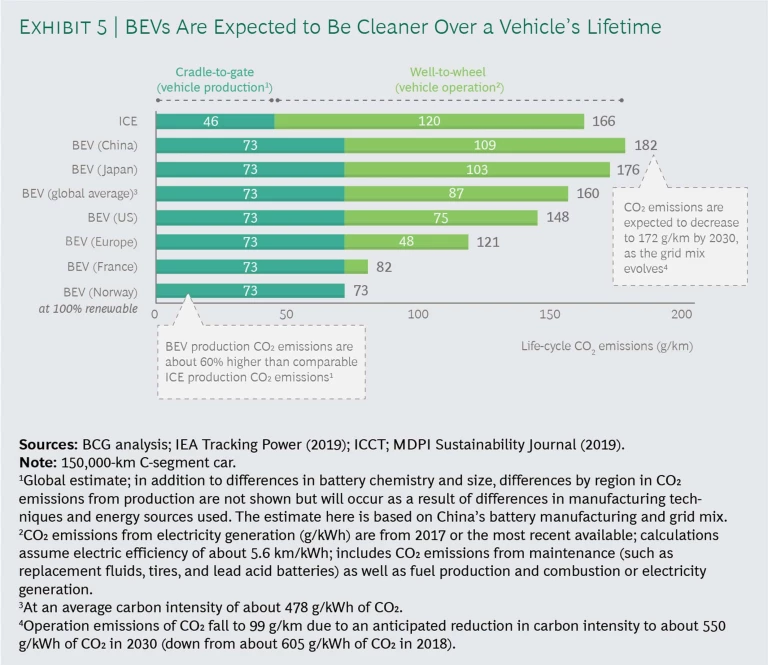

Many studies have found that, depending on the vehicle’s region of manufacture and its battery size, producing a BEV can generate up to 60% more CO2 emissions than producing a comparable ICE; but once in operation, BEVs provide better well-to-wheel emissions. The emissions impact of BEVs varies substantially from one country to another, however, with the main determinant being the country’s degree of reliance on fossil fuels in energy production. In operation, the average ICE will produce around 120 g/km of CO2 emissions over its life cycle. At one end of the spectrum, a BEV in Norway produces as little as 0 g/km (assuming 100% use of renewables) while at the other, a BEV in China produces as much as 109 g/km. In the middle, a BEV in the US produces 75 g/km.

The life-cycle emissions advantage of an EV thus depends on the vehicle’s location, with the regional energy mix being the main driver of CO2 emissions. (See Exhibit 5.)

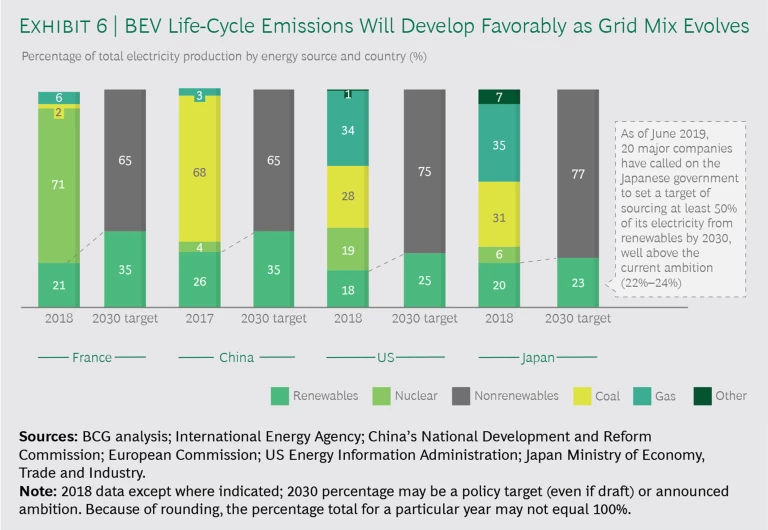

It also depends substantially on where the vehicle’s battery is manufactured and on how CO2 efficient that manufacturing process is. We therefore expect the full life-cycle emissions of BEVs to improve over time as the grid mix evolves. (See Exhibit 6.)

The positive global impact of EVs—particularly BEVs—on climate change mitigation is likely to increase over the next decade as the percentage of energy produced from renewable sources rises. But governments have a big say in whether electric vehicles will be a significant part of the solution to global warming. In most major markets today, incentives support BEV sales; and they will remain a necessary intervention for the next two to three years. A number of countries are also trying to move more aggressively to renewable energy sources. Germany has targeted 65% renewable power by 2030 and Spain is targeting 100% renewable power by 2050. But the events of recent years remind us that the world remains politically volatile, and today’s policies are not guaranteed to be in effect tomorrow. (See “BEVs Versus Hydrogen.”)

BEVs Versus Hydrogen

BEVs Versus Hydrogen

Hydrogen-powered fuel cells have long been touted as a high-potential alternative to ICEs. But our latest research concludes that governments and the auto industry are better off maintaining the momentum of BEVs as the greenest solution for passenger cars for the coming decade.

Hydrogen’s potential as a clean fuel source is unquestionable. But it also has some considerable liabilities: hydrogen is a tiny molecule that can be difficult to contain; it has a lower energy density than carbon-based fuels; and it is relatively expensive to transport and store. In addition, low-carbon hydrogen is costly to produce, given the lack of maturity and scale of the two technologies currently available.

In order for low-carbon hydrogen to overcome those disadvantages, players must identify applications for which demand will justify the necessary investments in large production facilities and infrastructure. And they must steer clear of applications for which low-carbon hydrogen is unlikely to become cost competitive.

Our research, which involved using a proprietary H2 cost model to evaluate hundreds of opportunities, indicates that the most promising applications for low-carbon hydrogen over the next decade lie in industrial processes such as ammonia, steel, and chemical manufacturing, and, potentially, heavy transportation. Thanks to their higher round-trip energy efficiency and their ability to leverage established infrastructure, battery-powered electric cars have developed a cost advantage in individual mobility that fuel cell vehicles are less likely to achieve in the near term. As a result, hydrogen is likely to remain a niche technology for use in passenger cars, with higher promise for commercial vehicles and for sea and air transportation.

Everyone Needs to Get Ready

The accelerated uptake of EVs has major implications for all players, including OEMs, suppliers, and governments (national, regional and local), not to mention for the planet itself. OEMs and suppliers will need to make significant investments in new technologies and capabilities and will need to reinvent their existing business models. Governments and regulators, particularly at the local level, will need to assess how vehicle electrification reshapes transportation for their citizens and businesses and how they can influence the technology’s evolution through suitable policies and regulations.

Investment Required. OEMs face a double whammy: they need to invest heavily in new fields even as their traditional revenues slow and their margins come under pressure. Slow-moving OEMs and suppliers may find themselves shut out of fast-growing profit pools if they do not make the requisite investments now in technology and capabilities that will enable them to participate. They may also find themselves subject to significant penalties in some markets. Some new markets will operate according to very different business models that require OEMs and suppliers to rethink where and how they participate.

The need for investment is not limited to OEMs or the industry. Electric utilities will face additional strain on their infrastructure as demand for battery charging rises. The cost of grid upgrades (and the question of who will pay) must be considered. There’s also a need—and again a question of who pays—for investment in charging infrastructure. Three charging modes are popular: home charging (surveys show that two-thirds of charging takes place at home today in the US and in most other countries), public charging, and highway fast charging (necessary to promote full adoption). Individuals set up home charging, using hardware and installation support that OEMs and third-party party providers supply. Typically, utilities (state-owned and private), OEMs, and third parties provide public and highway charging.

Multiple models of public charging have taken shape so far. In China, government subsidies have funded infrastructure construction by state-owned utilities. The utilities charge drivers per kWh or offer free, government-subsidized charging. Charging prices per kWh can’t exceed the equivalent of 15% of 1 liter of gasoline. Norway’s government subsidizes utilities to facilitate EV adoption through special state enterprises. Some EV charging subsidiaries are joint ventures of multiple utilities. Each utility or network decides on pricing (per kWh or per hour), with maximum prices regulated by the government. In the US, energy consumers, governments, and local subsidies cross-subsidize EV charging. Utilities use a predetermined ROE calculation to set the basic tariff for all energy consumers, and they include investment in charging infrastructure in their capex budgets. More than 70% of public charging is free to EV owners. In France, new legislation promotes the interoperability of plug formats and of payment methods so that any car can recharge at any public station.

Accelerating electrification will reshape automotive value chains.

Implications for OEMs. Accelerating electrification will reshape automotive value chains over the next several years. Automakers face a host of big questions that go to the heart of the future of their businesses. These include the following:

- Where do we build new capabilities in major components such as electric powertrains? Will battery cells be a differentiator that OEMs should invest in?

- What will the new value chains look like? How far into new value chains do we need to integrate? Do we make, buy, or partner with others to manufacture powertrain components? Given the proliferation of powertrain types, how do we approach the tasks of making the right technology bets, establishing the necessary partnerships across the value chain, and managing investments and capital deployment?

- What impact will different approaches and powertrain choices have on margins?

- How should we manage increased model and feature complexity?

- What is our pricing strategy for incentivizing customers to buy xEVs in the near term in order to meet regulatory standards? How do we achieve regulatory compliance at the lowest cost? How can we accelerate the reduction in EV TCO for customers?

- How do we differentiate our products in a BEV environment? How do we manage the sales mix to compete aggressively?

- How should our dealer networks, business models, and servicing capabilities evolve as the powertrain mix shifts?

- Do we invest in a charging network or recycling or both?

Implications for Suppliers. Suppliers face similar questions—and the answers may lead some to reinvent their businesses. Companies must take action in three areas:

- Position the business for areas of future growth. As new revenue pools develop in relation to such elements as batteries, motors, power electronics, high-voltage connectors and cable, battery management systems, thermal management systems, and charging components, suppliers need to identify the areas of highest value and the best OEMs to partner with in an electricity-based industry. They also need to determine where they should participate in the xEV component value chain: where are the right adjacencies, and where do they possess the right to win?

- Expand capabilities to secure competitive edge. Incumbent suppliers need to explore new business models and go-to-market approaches as value chains evolve and as the customer base changes. How should suppliers approach making the right technology bets, establishing partnerships across the value chain, and managing investments and capital deployment? What adjustments should they make to their product portfolio? Are acquisitions the fastest way to gain know-how? These questions are particularly acute for smaller companies that rely on diesel car sales in Europe. Such companies should think about consolidating to share costs and reinvest.

- Manage legacy business. In order to finance new ventures, suppliers must manage volume declines in their legacy business. How should they manage the profitability of manufacturing ICE components as they make the shift to xEV components? What will be the impact on margins of this shift in production?

Already, major companies are making transformative moves and major investments to reposition their businesses for the future. For example, Delphi spun off its powertrain business to allow it to manage the transition from ICEs to EVs. The remaining business (now called Aptiv) focuses on active safety, self-driving technology, infotainment, and electrical architecture. Valeo has acquired full ownership of the joint venture it had with Siemens for power electronics, and Bosch has developed a business to build battery packs for OEMs. We expect this type of activity to accelerate in coming years.

Issues for Governments. At the national level, the shift to electrification has ramifications for jobs, skills, tax revenues, infrastructure, and the environment. Clearly, it raises a number of issues of public policy. While some national governments are relatively advanced in dealing with these issues, many have yet to define a vision for automotive electrification or explain how they plan to support it.

The most immediate question for most countries is whether and how to continue financial and nonfinancial incentives for xEVs. In our assessment, these incentives remain critical for maintaining the rising sales momentum established in the past several years, until market forces can support xEVs on their own. China’s recent experience with the market impact of phasing out incentive programs too soon is one example of the power of incentives. Norway is another. It has offered incentives for decades and currently charges no VAT or purchase tax on BEVs, which in 2018 had a 31% share of the vehicle market, leading the world in BEV share. Other countries offer various financial incentives, including cash credits and tax forgiveness, as well as such nonfinancial incentives as free priority parking spaces, access to dedicated traffic lanes, and streamlined car registration procedures. In our view, the best way for government to advance the market is to make its policy on incentives clear and transparent—for both the industry and consumers—for the next several years.

Tightening emissions regulations is a second critical issue. Among major markets, the direction in Europe and China toward more stringent regulation seems set; but policy differences in the US between the federal government and California, the most populous state, muddy the waters. This creates uncertainty in an industry that, above all, needs clear targets to work toward. The dilemma for the industry is evident in the fact that multiple major manufacturers have sided with California, primarily in the interest of certainty, while others have signaled that they would agree with less strict standards, if the US were to embrace a single policy along those lines.

Many countries also have numerous legislative barriers to expanded xEV ownership, such as laws that restrict or regulate installation of charging stations (public and private) or that needlessly complicate EV ownership and usage. Thus, in France, charging stations are permissible only on the top floor of underground parking garages, and companies must collect a tax on the electricity that employees use to charge their EVs while at work. Elimination of such roadblocks would help countries maintain momentum toward an EV future.

Many countries also have numerous legislative barriers to expanded xEV ownership.

Governments outside Asia, which currently dominates battery manufacturing, may want to consider measures to promote development of their own battery industries. Battery cell manufacturing is a high-value-added activity that represents from 70% to 75% of the final cost of battery packs. It is also a complex process that requires technical expertise, substantial capital investment, and steady access to raw materials such as lithium, cobalt, and nickel that can be challenging to source. Relying exclusively on foreign manufacturers presents its own issues regarding supply certainty and cost as well as long-term technological leadership. European governments (primarily Germany and France) are supporting a few initiatives to develop new battery technologies and manufacturing programs. The US, which was an early mover in local battery projects, has not unveiled a new plan since 2009.

Policy decision making with respect to EVs will fall on municipal governments, too, because the shift to electrification—for both owned and shared cars—will have its biggest impact on cities. Many cities are already trying to deal with the ramifications of the rapid rise in ridesharing which will be a driver for electric cars. For example, the popularity of private cabs in New York City has contributed to a drop of 18% in the average speed of traffic in Manhattan at peak hours over the past four years. Cities actively looking to shape future electric mobility should consider taking the following actions:

- Ensure the availability of required infrastructure. Local governments have a big role to play in coordinating infrastructure investments—in EV charging spots in the streets, intermodal hubs, and dedicated lanes, for example. They can also ensure the measurability of commuter demand and traffic data.

- Identify barriers. There are plenty of hidden hurdles to electrification. For instance, France recently found that it needs to change its legislation to accelerate the installation of private charging stations in shared apartment units. And although a number of countries have made good progress in installing public charging infrastructure, many of the stations themselves lack interoperability or do not provide fast charging. Governments need to identify and remove red tape that hinders development of and investment in electric infrastructure and market mechanisms.

- Incentivize the marketplace. Municipal governments can help shape the direction of market development with financial and nonfinancial incentives that encourage new electrified mobility solutions. They can also foster local initiatives that bring together OEMs, car dealers, charging partners, parking operators, and consumers to accelerate and facilitate consumer adoption.

The auto industry has never before experienced a fundamental shift in powertrain. Now it appears that the transition to a predominantly electric drivetrain will occur even more quickly than industry watchers had expected. If the change is going to happen, governments must keep their foot on the electric accelerator until the tipping point in the market is reached. But by 2023 or so, the bigger question will be whether OEMs and their suppliers are ready for marketplace-driven EVs.