With the human toll that COVID-19 has already exacted in Europe and the risks that it still poses, insurers across the continent are thinking about actions they can take to safeguard their businesses. The pandemic is a threat to both the profitability and the capital position of all insurers. Primary insurers and reinsurers are in the same boat. They have to make some difficult decisions.

The tradeoffs are exemplified by a European life insurer with which we are working. The insurer needs to shore up its regulatory capital and has been debating whether to derisk its balance sheet or raise new capital. Those aren’t the only options available, however, and we have pointed out some additional possibilities. The questions that the insurer is wrestling with—as it considers each new idea—revolve around opportunity costs and consequences.

The dilemma this insurer faces is not unique. In a contracting environment that requires fast market action, there is no such thing as holding onto everything—a company must give up something in order to achieve a more important economic goal.

Here are the key questions that European insurers are asking at this moment of uncertainty—and some answers.

Has the downturn for European insurers already begun?

It depends on the area of insurance you’re talking about and the region. If you’re a glass-half-full person, you can take some consolation in insurers’ relative performance. The insurance sector doesn’t face an existential threat, as aviation and tourism do. Most insurers have avoided the economic devastation that those industries have suffered.

And so far, the vastly higher claims that you might expect in a pandemic have not materialized. In fact, some insurers—such as those offering automobile coverage—have seen claims go down. (Fewer cars than usual are on the roads.) Other insurers—such as those focusing on life and health policies—haven’t seen a big impact yet.

Still, the writing is on the wall: there is trouble ahead.

What scenarios for the balance of this year are likely for European insurers?

Weak economic conditions will mean a decline in new business. Credit defaults will mount. Coface, the global credit insurer, predicts a 25% rise in bankruptcies. More bankruptcies mean trouble for insurers’ balance sheets; they also mean a decline in commercial business.

In addition, we have started to see the first wave of claims related to business continuity policies. For the most part, European regulators and European courts are siding with customers, not insurers, on the question of whether pandemic-related losses are covered under business continuity policies. This puts pressure on insurers to ease the burden on customers. In France, insurers have pledged $450 million to a solidarity fund for small businesses that have been hurt by the pandemic. In Italy, insurers must offer grace periods for premium payments. In the UK, the country’s financial watchdog is calling for insurers to be flexible in their treatment of customers.

Another thing to keep in mind is the lag factor. Because most insurance customers pay their premiums at the beginning of the year, European insurers may not feel the full effect of the pandemic until 2021.

Finally, the volatility in European financial markets will also make things harder for insurers—about a third of which entered this year with their financial strength already impaired. (See Exhibit 1.)

Can you quantify the challenge that European insurers are likely to face?

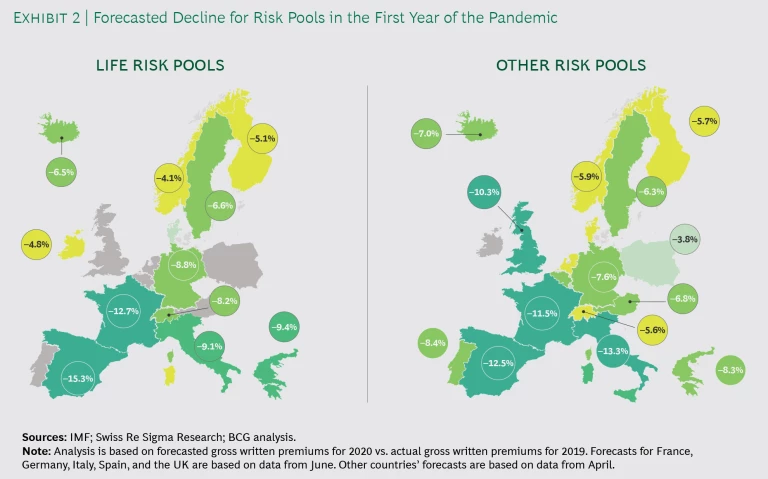

Yes—and it’s dramatic. There is some variation by market, but risk pools on the continent will probably drop overall by from 4% to 15% during the first year of the pandemic. (See Exhibit 2.)

You note that new business will inevitably decline, but there’s always some new business. What’s the right posture for insurers to take now with respect to new clients and new services?

It’s important to bear in mind the variation by geographical location and business type. Exhibit 2 gives a sense of the geographical differences, but there are other differences too. In commercial insurance, for instance, a potential policyholder’s risk can vary not only by sector, but also by subsector—and at the level of individual companies.

Restaurants serve as a good example. The ones that are set up primarily for takeout service or to operate in the open air have not been hit as hard by reduced customer traffic and have a good chance of surviving. But restaurants built for sit-down service are another story. Many of them could go bankrupt.

Insurers’ sales, underwriting, and actuarial teams need to weigh differences such as these. The differences should be part of how incoming business gets evaluated and how policy prices are set.

Is there a core set of moves that insurers should be making now to their P&Ls and balance sheets?

There is no short list per se. In fact, insurers can take a multitude of actions to put themselves in a better financial position.

On the P&L side, available levers include organizational simplification, customer retention management, improved claims processes, targeted upselling, and process optimization. Altogether, more than 100 levers exist on the P&L side of BCG’s optimization catalogue. Often an insurer can make the P&L improvements it needs by pulling just half a dozen or a dozen of these.

Balance sheets represent an equally big financial opportunity. We’ve seen insurers, during difficult times, reduce mismatches between assets and liabilities, optimize their investment portfolios, and improve their actuarial and capital models. BCG catalogs more than 100 levers on the balance sheet side too. As with the P&L options, deploying just a few well-chosen levers can go a long way.

Is this an either-or situation—you focus either on your P&L or on your balance sheet?

Not in our view. The P&L and the balance sheet are more intricately intertwined at insurance companies than in any other sector except, perhaps, banking.

A good example of this is an insurer that we worked with before the pandemic struck. The insurer needed to add $1.2 billion in reserve capital over a two-year period in response to changes in regulatory requirements. It met this obligation through a combination of P&L and balance sheet maneuvers. (See Exhibit 3.)

On the P&L side, the insurer moved aggressively to improve its operational efficiency and to optimize its product portfolio. These efforts yielded a third of the capital it needed. Another third came from the insurer’s restructuring of bad liabilities—a balance sheet move. The company dealt with the remaining $400 million shortfall by making yet another balance sheet move: raising low-cost capital overseas.

What best practices should insurers follow in this down cycle?

Four disciplined actions will be especially important in the year ahead.

- Intelligent Target Setting. When bad times are at hand, it may be tempting to institute uniform cost cuts across all departments. This would make sense if every department were equally efficient—but that situation almost never exists in reality. For example, an insurer might have a bloated sales department but a severely underresourced underwriting operation. It wouldn’t make sense to demand an equal or proportional reduction in costs from both departments. Most executives have a feel for the inefficiencies in their companies just on the basis of what they hear and what they see in their company’s results. By looking at industry benchmarks, they can confirm these hunches and use them as the basis for more informed cost-cutting decisions.

- Ruthless Prioritization. Insurers entering a downturn must formulate hypotheses quickly and focus on results. This will help them identify the right P&L and balance sheet levers, and give them a chance to become one of the one in seven companies that emerge from a downturn with improved sales and profit margins . The COVID-19 downturn could easily include aftershocks or unexpected developments of some sort. So it will be important, during the execution phase, for insurers to use agile planning cycles and maintain flexibility.

- C-Suite Commitment. Top-level involvement is crucial. One big challenge in any down cycle involves countering people’s tendency to retreat into their silos and become more protective of their domains. It’s up to leaders to prevent this from happening. Often that means making difficult decisions and spelling out the necessary tradeoffs.

- Faster Decision Making. Companies are sometimes guilty of waiting for perfect information. They can become bogged down in debates about alternative courses of action, each of which has pros and cons. This happens in every industry—including consumer products, entertainment, and technology—and sometimes the options aren’t all that different. “When we get to that point, I always say, ‘Let’s just pick a direction and go,’” an engineer at a consumer technology company once told us. We couldn’t agree more. Begin now and make adjustments later.