This report was produced in collaboration with Salesforce.

Something is amiss with the state of B2B marketing. Most companies acknowledge that there is a huge opportunity to engage customers much more effectively as buying behavior shifts online. Many have tried to accomplish this with account-based marketing (ABM), which concentrates the efforts of the marketing, sales, and service teams on engaging high-priority accounts in a more personalized way—fully leveraging the breadth of digital channels to augment traditional offline sales efforts—to improve business results.

But, for many, ABM has proven difficult to implement, and initial efforts have frequently failed. That’s because ABM is usually marketing-led, without sufficient buy-in from the sales and service organizations. In fact, the term account-based marketing is a misnomer. Alignment and integration across marketing, sales, and service are essential to personalize account engagement and optimize end-to-end customer journeys.

The term account-based engagement (ABE) more effectively captures the requirements and coordination needed to deliver highly personalized and integrated pre- and post-sales customer experiences.

The term account-based engagement conveys the cross-functional integration necessary to orchestrate opportunities in the complex ecosystem of large accounts.

To identify what it takes to succeed with ABE, BCG interviewed 34 senior executives at 21 technology, manufacturing, and business services companies that recently implemented ABE programs. We found that ABE, done well, delivers impressive results, although most have struggled with initial efforts to implement it. Our study shows that companies that have persisted and successfully managed ABE implementation challenges have realized faster pipeline growth, higher close rates, larger average deal sizes, and greater customer retention. Indeed, every company should learn from the experiences of the ABE trailblazers.

What Is Account-Based Engagement?

Over the past decade, most B2B buyers have enthusiastically embraced the internet to research options, evaluate vendors, and, sometimes, buy goods and services. This digital shift has catalyzed technological advances that are helping B2B marketers engage with buyers more effectively through online channels such as email, conversational messaging, social media, display advertising, and websites. It has also resulted in an explosion of data that is helping companies understand customer engagement and surface indicators of buying intent that B2B marketers can use to personalize customer journeys. Marketing platforms have played an important role in automating lead generation, capture, nurture, and prioritization to provide marketing-qualified leads to sales in the B2B market to great success.

However, the data suggests that current B2B marketing practices must be improved to deliver better results. Look at the overwhelming evidence: More than 80% of the visitors to a website are unlikely to be potential customers.

There’s a huge opportunity for B2B sellers to engage with buyers more effectively. They need to address buyers’ specific needs better by personalizing their engagement with them and integrating digital experiences with offline sales communications. It becomes challenging because sellers must navigate the complex ecosystems of decision makers and influencers that characterize buying behavior in large organizations. Clearly, traditional demand generation, which primarily focuses on one-to-many marketing with generalized messaging and individual lead nurturing, needs to be improved for the complex ecosystems of larger accounts.

B2B sellers must address buyers’ specific needs better by personalizing their engagement and integrating digital experiences with offline communications.

Tackling this challenge has traditionally been the promise of ABM, which helps sellers focus on engaging each account in a more personalized way to improve the customer experience and deliver better business results. ABM’s promise is compelling, as is evident from the recent rise of interest in the topic; Google’s Search Volume Index for the term account-based marketing skyrocketed tenfold from 2015 to 2020. Yet ABM has been a challenge for many companies.

Many companies have struggled to define what ABM means in the context of their business models and how it should be applied by region, product category, and customer segment. As a senior Salesforce marketing executive described it, “There’s a lot of hype around this topic. We had to help our executives understand what it really is and define what it meant for Salesforce. Explaining it and selling it can be very tough otherwise.”

Using the term account-based engagement (ABE), rather than account-based marketing, shifts the focus to aligning marketing with sales and service and better communicates what is critical for success. This helps clarify and position what’s required for senior marketing, sales, and service executives and their organizations to be successful with this strategy and adapt the approach for their business models.

At its core, ABE focuses on aligning marketing, sales, and service on the strategy and tactics to win accounts, retain customers, and grow sales through targeted and personalized omnichannel engagement. That’s how we define ABE. B2B sellers can now also use rapidly improving technology and data to target a broader range of account sizes and segments than was previously economically feasible. In addition, most companies will need to support traditional lead generation, which focuses on capturing, nurturing, and closing all inbound leads.

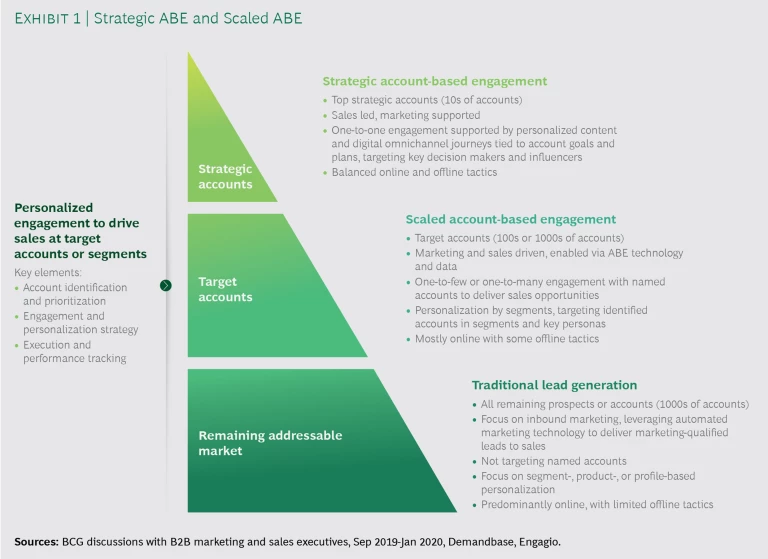

Over time, two distinct types of ABE have emerged: strategic and scaled. (See Exhibit 1 and “How Salesforce Successfully Implemented Scaled and Strategic ABE.”) Strategic ABE focuses on the needs of a B2B seller’s largest and most strategic accounts. Indeed, personalized engagement with strategic accounts isn’t new; most companies have created account teams with dedicated sales and service staff that address the needs of these accounts in a highly personalized way. What’s new, though, is the closer integration of marketing into the account team. That enables marketing to leverage more fully the power of digital channels and customized content to personalize account engagement in ways that amplify the efforts of the sales and service teams. This more personalized interaction must be informed by a deeper understanding of the customer’s pain points and business strategy, which, if done effectively, deepens the relationship.

How Salesforce Successfully Implemented Scaled and Strategic ABE

How Salesforce Successfully Implemented Scaled and Strategic ABE

Salesforce, the cloud-based customer relationship management solution company, has been an early ABE leader. Four years ago, it launched a scaled ABE program with a one-to-few approach and has successfully expanded it with a one-to-one strategic ABE program over the past year.

The company initially targeted 300 accounts. Brianna Dinsmore, senior director of account-based marketing, explained: “We started with a one-to-few approach to make the business case to get executive buy-in for the program. So, showing the approach could work at scale was important.”

Salesforce began by focusing on underserved accounts in manufacturing subindustries. Marketers aligned with the subindustry sectors to understand customer needs better so campaigns could be personalized for target accounts in each. The approach focused on events, an area of strength for Salesforce. The company targeted senior executives in high-priority accounts and created event experiences personalized to their needs.

In 2019, Salesforce expanded its ABE program to include one-to-one engagement with its largest accounts. For instance, the company targeted 35 high-potential retail and consumer sector accounts for hyper-personalized marketing that included account-specific next-best actions and customized content. Marketing works closely with sales and service to orchestrate activities across touchpoints, using digital engagement that is connected to offline sales engagement. Lindsay Cary, director of account-based marketing, described the effort: “To get going, we had to engage directly with the sales and service teams; it was almost like a group therapy session. The key was aligning with the account executives. We needed to break down some walls there.”

To support ABE, Salesforce uses corporate marketing centers of excellence, which provide scale and expertise for email and nurture marketing, data and analytics, technology, creative, and industry and product marketing, which have been instrumental in launching and expanding ABE. Salesforce has benefited from a unified culture, which emphasizes the integration of marketing, sales, and services. The teams have worked closely together from inception, using personalized actions in key channels, such as events, to drive the cadence and messaging to turn customers into evangelists.

Salesforce has navigated the complexities of running multiple ABE programs in a large matrixed organization. Its scaled ABE initiative increased unique visitors to Salesforce.com by 212% and close rates by 15%. In addition, it attained 100% ABE account coverage with high-value engagement (marketing activations or responses with statistically significant impacts on revenue). Salesforce’s strategic ABE program, though more recent, has increased pipeline generation by 45% year-over-year and average deal size by 53% year-over-year from the top 15 retail and consumer industry accounts.

While strategic ABE typically focuses on tens of accounts, scaled ABE extends the benefits of personalization to hundreds or even thousands. Both use innovations in B2B marketing, sales, and service technologies for more personalized account engagement, but scaled ABE does so to greatly expand ABE’s benefits cost-effectively. Strategic ABE is one-to-one and more sales-led; scaled ABE is one-to-many or one-to-few, and more marketing-led. The manner in which a company decides to deploy the two approaches across product categories, customer segments, and geographic regions to achieve its goals—such as the acquisition of new accounts, cross-selling to existing accounts, expansion to new buying centers, and retention of existing accounts—is critical for success.

How Account-Based Engagement Creates Value

ABE often drives value simply because it serves as a forcing function that ensures closer collaboration across typically compartmentalized departments. (See “Unifying Marketing, Sales, and Service to Succeed with ABE.”) All too frequently, there’s a divide between marketing and sales, in particular, characterized by friction and mistrust. In the words of a vice president of product marketing at a global technology company, “Managing across the marketing and sales divide is one of the most daunting problems in B2B today. The functions are often disconnected, with marketing typically responsible for top-of-funnel and sales for bottom-of-funnel.”

Unifying Marketing, Sales, and Service to Succeed with ABE

Unifying Marketing, Sales, and Service to Succeed with ABE

Orchestrating the marketing, sales, and service functions is challenging, but it’s critical if ABE is to succeed. As the former global marketing head for an information services provider pointed out: “Marketing cannot be beneficial unless it is aligned with sales and service. The three parts must be working together, speaking the same language to accounts.”

Marketing, sales, and service executives must first agree on the ABE program’s goals. They must decide, for instance, if the primary goal is account acquisition, expansion of existing accounts, or improving retention. They must also align on the account segments to target—for instance, top strategic accounts, large accounts, or midsize accounts—and, therefore, whether they should use strategic or scaled ABE or both. Finally, there must be agreement about which accounts to target, supported by plans that will achieve account-specific business objectives.

Institutionalizing the alignment process through joint planning efforts in which all three functions participate is a best practice. As the former director of enterprise marketing for a global software company commented: “Gaining alignment requires discipline around joint account planning that many companies don’t have. We used two-day bootcamps to align with customers and develop proof-of-concepts that would work best with executives as part of our account planning process.”

Once account goals and plans are established, communication and performance reviews are critical to ensure that the account teams are on track to achieve their goals and, if they aren’t, can respond in an agile fashion. “As joint account planning became foundational, we implemented weekly account pit stops with sales for quick feedback and discussion on what was, and wasn’t, working,” said the former senior marketing head of a business services company.

Novel approaches may be required. The vice president of global brand and digital marketing for a technology services company implementing a strategic ABE program described the approach: “We moved to having one marketing person acting as a mini-CMO, across six account teams, to help drive brand awareness, develop customized content, and drive analytics.” The approach enabled marketing to better understand the account sales strategy and to execute a marketing plan that directly connected to sales.

Marketing, sales, and service must also align on the key decision makers and influencers to target, and the right approach and channels to use in order to optimize engagement across the customer buying journey. This requires research on the customer buying process to understand better which buyer roles are involved at which stages in the process. A marketing director with a global software company commented: “We found that a typical sale required 15 to 17 touches to close, including digital, event, and sales interactions across the buying team.”

In addition, infrastructure, such as technology, data, and process, serves as the connective tissue across functions. Given the rising importance of managing technology, data, and analytics, companies have found that the use of centralized structures, such as demand centers or centers of excellence, helps ensure that scale economies, expertise, and cross-functional orchestration are fully utilized. A senior director of marketing technology at a global networking company expanded on this point: “We recently implemented a demand center to integrate marketing and sales. Now we’re looking at leveraging this structure as way to relaunch our account-based program with much tighter sales buy-in and stronger program management.” A senior director of corporate marketing with a global software firm added: “We worked closely with various centers of excellence to build infrastructure, help with data analytics and metrics, and drive process integration. It proved critical to scale our program.”

Addressing the organizational and change management elements is critical, particularly communications to drive organizational buy-in. “We started our communications plan as one-to-many but quickly decided we needed to move it to one-to-one,” commented Tracy Eiler, InsideView’s chief marketing officer. “It was a lot more work but was well worth it to get the buy-in we needed. We also learned a great deal more about accounts and where the opportunities resided.”

Traditionally, marketing has viewed its role in B2B as executing broad-based campaigns, whose success is measured by click-through and open rates, and, ultimately, leads generated for sales. Sales has owned account strategy and engagement, pipeline development, and revenue growth, while the service team has focused on after- sales support and issue response to maximize customer satisfaction and retention. Because these functions often operate in silos, their goals are frequently not aligned with what really matters: optimizing the customer experience to engender customer trust and advocacy in order to maximize long-term account revenues and margins. B2B sellers can attain those objectives only by working cross-functionally to provide seamless, end-to-end customer experiences that deepen existing relationships and help develop new ones. Unless functional silos are broken down, ABE programs will never succeed. (See Exhibit 2.)

For most companies, ABE will prove to be a new go-to-market strategy, representing a major change in how they deal with their most important accounts. ABE drives value by shifting the focus from the performance of campaigns and the volume of leads generated to the quality of engagement, growth in opportunities, increase in revenues, and the enablement of success with key accounts. A marketing director at a global software firm emphasized: “Marketing must dive deeper into research to develop personalized stories that speak to buyers for each account or segment of accounts. It must influence them at a more emotional level by hitting on their key pain points with consistent messaging across the buying team.”

For most companies, ABE represents a major change in how they deal with their most important accounts.

ABE can be used to acquire new customers but is also frequently used to expand relationships with existing customers. A general manager for a major technology company commented that the approach is “a very effective tool for highly sophisticated cross-selling within existing accounts, which requires significant collaboration on communication and messaging.” A vice president of product marketing at a major software firm expanded on the use of nurture marketing for ABE to build existing customer relationships: “Marketing automation can play an important role in engaging existing accounts and expanding relationships. At times, business opportunities get stuck and need to be nurtured. These opportunities can be aggregated by the marketing automation platform to provide a better view of what’s going on.”

Moreover, ABE can be deployed across the customer journey to drive more benefits, such as increased customer satisfaction, retention, advocacy, and, ultimately, growth in customer lifetime value. That level of integration isn’t easy to accomplish but is well worth the effort. In the words of a former head of marketing and AI for a major information services company: “We recognize that a paradigm shift is happening. Customer expectations are changing, which affects marketing, sales, and service. That required a massive shift in our thinking and took vast effort across all three functions to respond. It ultimately provided tremendous benefits.”

Most studies find that ABE programs deliver results. Among marketers who use such programs, 97% say they experienced a higher return on investment, according to the Altera Group. In its 2019 benchmarking study, the Information Technology Services Marketing Association (ITSMA) found that 92% of respondents using account-based programs saw a positive impact on account engagement, 83% witnessed a positive impact on pipeline growth, and 72% reported an uplift in revenue growth. And, according to an earlier ITSMA study, these programs delivered “the highest return on investment of any B2B marketing strategy or tactic, primarily through higher close rates and average deal size, and, ultimately, greater customer lifetime value.”

ABE’s value will only rise as companies scale their programs. Our study confirms this: we found a great deal of anecdotal evidence that the ABE leaders have realized major gains in account engagement, customer acquisition, pipeline growth, close rates and funnel velocity, deal sizes, cross-selling, retention, and revenue growth. (See Exhibit 3.)

Tackling the Challenges Along the ABE Maturity Curve

ABE is easy to start but difficult to sustain. Most companies can start ABE programs by focusing on a few strategic accounts or on a product segment or region where account teams are open to experimentation. At this level, ABE doesn’t require major investments in technology or data, beyond the basic CRM and marketing automation necessary to engage with the most strategic accounts. Engagement programs, custom content, and measurement can be handled at lower scale manually. However, most companies will need to transform their go-to-market models significantly if they are to expand their ABE programs across their enterprises, which will likely require additional investment in infrastructure and change management.

In moving up the ABE maturity curve, companies often make a few mistakes. First, many companies stumble because they don’t recognize that ABE is, at its core, a strategy; that it’s a fundamentally new way of going to market. Instead, they treat ABE as if it were just a set of new tools. Second, many companies scale their programs too quickly, biting off more than they can chew as they launch their program. Rather than starting with controlled pilots, they implement ABE for too many accounts and at an enterprise-wide level from the start. Third, many companies underestimate the organizational complexity associated with ABE. Managing this complexity requires a thoughtful plan and perseverance. Fourth, and most important, many companies approach ABE as marketing-led, without sufficient support and buy-in from key executives in their sales and service organizations.

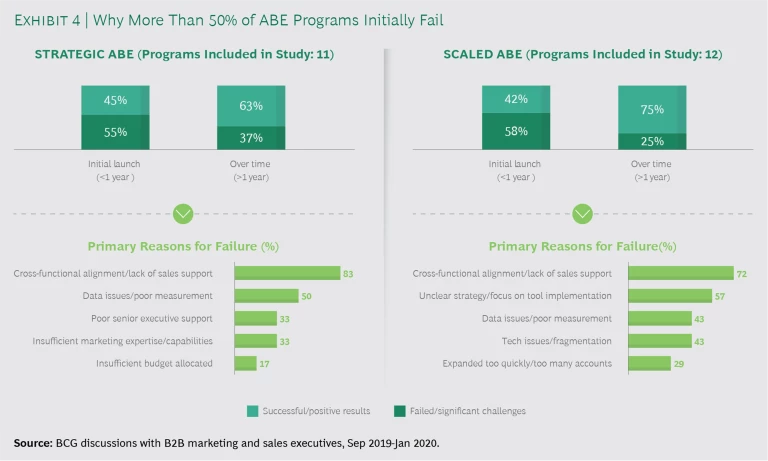

For all these reasons, many companies fail at their first attempt at ABE. More than 50% of the ABE programs we identified failed initially; that was true of both the strategic and scaled varieties. In both cases, companies told us that the overwhelming reason for failure was the lack of sales support and alignment with marketing. While data issues and poor measurement also plagued 50% of the strategic ABE programs that failed, the lack of clarity around strategy affected almost 60% of scaled ABE programs. (See Exhibit 4.) However, many of the companies learned from their experiences and, eventually, succeeded with their ABE programs. Ultimately, 67% of the strategic ABE programs and 75% of the scaled ABE programs covered in our discussions went on to succeed after companies regrouped to address these challenges.

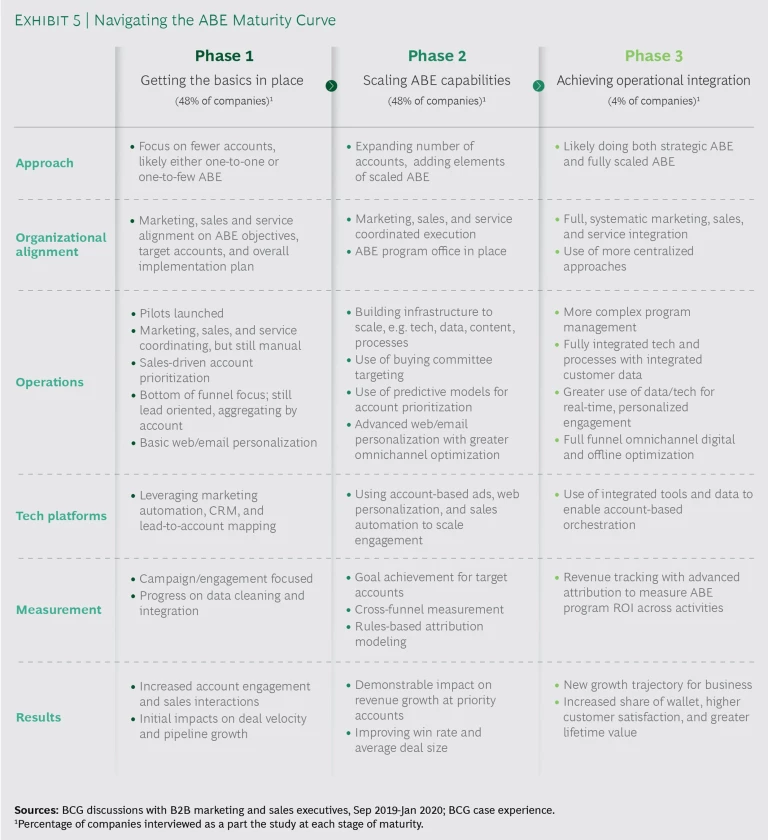

Companies will benefit from assessing the current maturity of their ABE programs in relation to their long-term aspirations. Doing so will help develop a path to scale the program in the most expedient way. It will also help identify the immediate next steps, which will be a function of the company’s position on the maturity curve, its longer-term goals, and its organizational and operational challenges. Our study suggests three phases of ABE maturity. (See Exhibit 5.)

Phase 1: Getting the Basics in Place. Most companies can get going with ABE quickly by focusing on getting the basics in place and starting with pilots that target a few accounts. During this phase, companies are in the early stages of aligning the marketing, sales, and service functions. They are usually focused on getting agreement on the right set of accounts to prioritize as well as the program’s overarching goals.

Operationally, the marketing, sales, and service functions are just starting to work together but are not yet integrated. The approach is often still lead-focused, using web and email personalization. Companies may also be starting to aggregate leads by account to get a more holistic view of the opportunities within each of them. Most companies haven’t yet built out their technology platform fully to support ABE but will have basic marketing automation and CRM in place and will have addressed data quality issues, so they have a clean view of their accounts. At this stage, often the measurement of ABE efforts is not fully automated and may still be focused on campaign performance rather than systematically measuring the return on investments in the program.

Nonetheless, these early efforts can bear fruit. Companies at this stage often see a sharp increase in engagement at select accounts, driving an uptick in sales interactions, deal velocity, and pipeline growth rates.

Phase 2: Scaling ABE Capabilities. Companies start to shift gears to build the core capabilities and infrastructure needed to scale ABE to a broader group of accounts during this phase. This typically includes expanding a strategic ABE program to more accounts and launching a scaled ABE program.

By now, marketing, sales, and service are coordinating operational activities more effectively. Companies have also started putting the infrastructure in place, consisting of the initial efforts to build and integrate the technology stack, implementing more sophisticated data management and integration approaches, creating scalable content processes, and linking activities and communications across functions. Doing so provides more sophisticated capabilities, such as the ability to generate insights from customer data, target key members of buying committees, use predictive analytics for account prioritization, orchestrate and measure customer journeys more effectively, and optimize digital omnichannel engagement across the funnel.

During this phase, companies are also developing measurement capabilities, so they are effectively measuring goal achievement by account, tracking the performance of groups with ABE initiatives compared with control groups, and attributing revenue to the activities that contributed the most, initially by using rules-based approaches. At this stage, companies typically see tangible growth in revenues from ABE programs, with rising win rates and larger deal sizes.

Phase 3: Achieving Operational Integration. Companies at this phase are typically executing ABE programs at full tilt, often strategic and scaled programs simultaneously, depending on the customer segments they are targeting. Marketing, sales, and service are fully integrated and working cohesively to personalize engagement with target accounts. By this time, companies have figured out the operational balance between centralization and decentralization. Most have moved in the direction of centralization, better utilizing the capabilities of demand centers or centers of excellence to support their ABE programs. Doing so helps organizations take advantage of scale efficiencies and build expertise in managing technology, data, and analytics as well as optimizing key processes such as content development and campaign management.

Companies are now making greater use of technology and data for real-time personalization. They are also better coordinating the customer buying journey across online and offline touchpoints, often orchestrating the process across many members of the buying team and the influencer network. They have also addressed the customer data challenge and created a tightly integrated marketing, sales, and service technology stack, which is critical to ensure alignment across those teams. Companies at this stage are tracking the returns on investments in ABE programs with attribution techniques for allocating revenues to the activities that generated them, using advanced statistical and AI-based approaches.

As companies achieve operational integration, the results of ABE start accelerating. Companies usually see increases in share of wallet, customer satisfaction, and customer lifetime value from the accounts they’ve targeted. We haven’t seen many companies make it this far, but some are making good progress and are close.

Many executives admit that it’s difficult to achieve full cross-functional operational integration. The ABE leaders, we find, have worked their way up the maturity ladder by ensuring that marketing, sales, and service have an equal voice at the table and respect for one another’s contributions. Without this, failure is inevitable. In fact, achieving the organizational and cultural shifts necessary to ensure success with ABE is often more important and difficult than building the technology and data infrastructure to support it. It demands understanding clearly how each function contributes to business goals such as revenue growth, customer retention, and lifetime value optimization, and major changes in the ways B2B companies work cross-functionally, often requiring sophisticated program management, full-scale change management, and exceptional leadership.

The ABE leaders have worked their way up the maturity ladder by ensuring that marketing, sales, and service have an equal voice at the table.

Lessons from the ABE Leaders

As part of our study, we identified companies that have successfully implemented and grown ABE programs. These emerging ABE leaders have made significant progress in connecting strategy and execution across the divides between marketing, sales, and service to deliver better customer experiences to their most important accounts, which has paid off with improved business results. While the ABE pioneers have taken different approaches, some common lessons can be learned from their paths to success.

Don’t wait; start small. Most companies can start ABE programs immediately for a small group of accounts or a particular product segment without making large investments in new infrastructure. They can set up pilots that, for instance, focus on closing high-priority deals, cross-selling in a small number of accounts, or penetrating a few underserved segments. At this scale, the program’s success will not hinge on investing in technology to automate engagement or data analytics. Measurement can be done manually, if need be, and the pilots’ results can be used to build the business case to win executive support for a larger rollout of the ABE program.

Most companies can launch ABE programs for a small group of accounts without large investments in new infrastructure.

DXC Technology, a B2B technology services company, learned the importance of starting small the hard way. Seven years ago, it launched a full-scale program from the outset, targeting around 400 accounts. The program didn’t take off as planned, so the company had to pull back. Nick Panayi, DXC’s former vice president of global brand, digital marketing, and demand generation (and IPsoft’s CMO since July 2019) explained frankly: “We set out several years ago to prove that an account- based approach could work. But we made the mistake of viewing it as a set of tools and capabilities, and targeted way too many accounts at the start. Sales did not see value and did not buy in, so we failed.”

DXC’s marketing programs team then regrouped and relaunched the program as pursuit marketing, targeting only the most strategic deals the company wanted to close. It worked closely with sales to identify those deals and embedded a mini-chief marketing officer in each deal team for the duration of the pursuit. The mini-CMO acted as the point of contact for building custom content for each deal, often using customized microsites. Over time, DXC saw web traffic from the strategic accounts rise by 33%. As sales increasingly bought into ABE, and as deal win rates increased, sales gave marketing a 99% approval rating on value created. Now, DXC is planning to scale its ABE program to cover 80 accounts, using its earlier investments and learnings to ensure success.

Align on goals; stage the rollout. The launch of every ABE program should start by ensuring a match between a company’s ideal customer profile and the total addressable market. In doing this, companies must develop a list of specific accounts—and the people at those accounts—that companies should target. Not targeting the right accounts means precious sales and marketing resources will be wasted in pursuit of the wrong targets.

Then, companies must develop data-driven insights about customer buying behaviors and pain points, which should inform the goals and strategies for each account. It’s also critical to gain alignment across marketing, sales, and service to determine how the company should roll out the program and what the goals should be for specific accounts.

InsideView, a software-as-a-service targeting intelligence platform company, started its ABE journey by conducting deep research to understand why it won or lost deals. Tracy Eiler, InsideView’s CMO, explained: “Initially we thought that only people on the buying team were involved in a purchase, but we found that, on average, 34 people in the target organization interacted with the marketing campaign. This was a lightbulb moment for us; it became clear that we needed to have a better understanding of all the people involved.”

In response, InsideView launched an ABE program to develop a more orchestrated approach for multichannel personalization, which significantly affected its marketing, sales, and operations teams. The program initially focused on personalized engagement with 250 accounts. The company found this to be too broad, so, in the next phase, it focused more on companies in subindustry sectors characterized by high renewal rates for its services. Expanding in these subsectors increased profitability. In the third and current phase, InsideView has focused on driving new customer acquisition by warming up prospects to help land sales meetings with them.

InsideView found that change management was critical. Its sales staff, in particular, needed persuading, so Eiler decided to meet with many of them personally. “Our account managers have personal relationships with their accounts,” Eiler noted. “We needed to show them that marketing wasn’t going to just come in and do something that wouldn’t match their cadence of communication. We had to create a safer environment for meeting with our sellers to encourage understanding and sharing. It was critical to build those relationships as we rolled out our program.” As a result of the ABE program, InsideView grew its business in the enterprise segment faster than in the small business segment last year, resulting in a doubling of the average deal size and improvements in account stickiness.

Build infrastructure and capabilities to scale. As companies look to roll out ABE programs across the organization, targeting a large number of accounts in more segments or industry verticals, building the infrastructure, particularly technology and data infrastructure, becomes important. That forms the backbone for the information flows and collaboration that connect the marketing, sales, and service functions, and enables the company to use data more effectively to deliver personalized customer engagement across the buying process.

In rolling out ABE across the organization, technology and data infrastructure becomes important.

When VMWare, a leading cloud-computing and virtualization software and services provider, began to deploy SaaS and cloud services, it realized that their marketing required a different approach. The company was targeting different roles and, in some cases, different companies than it ever had. For instance, VMWare had to shift from targeting infrastructure executives to cloud engineers and architects as well, and, in some cases, new buying centers. Michael King, VMWare’s senior director of cloud marketing, expanded on the challenge: “We couldn’t reach the new buyers one-to-one; that approach wasn’t scalable. So we started by targeting 1,600 accounts that were already engaging with our content. Then, we grouped people by titles, and personalized our engagement with them.”

VMWare had to build capabilities from scratch to support the new program. It built a new stack that was more attuned to the needs of the ABE program and created new technology and data teams that worked closely with the corporate digital team. These teams now serve as an innovation hub that rolls out key learnings to the rest of the company. Thanks to its ABE efforts, VMWare’s cloud business has seen deal velocity improve from 12 to 18 months to 6 to 9 months, on average, while the close rate for the ABE deals is three times that of other deals.

Transform to integrate across functions. For most companies, implementing an ABE program turns into a transformation of the marketing, sales, and service functions. It demands bridging organizational silos, adopting new ways of working together, building new capabilities, and managing large-scale change initiatives. Implementing ABE can prove to be extremely challenging, particularly across a large, matrixed organization.

For most companies, implementing ABE turns into a transformation of marketing, sales, and service.

Thomson Reuters, the Toronto-headquartered global business services company, had to approach ABE with a sense of urgency in the case of its legal division. A very high proportion of its subscription-based business required negotiating periodic renewals with large buyers. So the company decided to launch an ABE program, the initial focus of which was retention and upselling.

Almost immediately, Thomson Reuters figured out that the customer experience across marketing, sales, and client management played a major part in renewal decisions, and that addressing cross-functional fragmentation was critical. Jillian Gartner, Thomson Reuter’s director of account-based marketing for the legal division, described the company’s approach: “Including the client management organization was an absolutely critical element of our program for both one-to-one and one-to-few. The client management group had important account intelligence and relationships that were critical to our success. For us, connecting across organizational divides started at the top. Our marketing leadership team worked closely with the sales and client management leadership to gain buy-in for the program at the highest levels.” The program became successful over time, getting positive customer feedback and having a large impact on the business’s bottom line.

Thomson Reuters expanded its initial efforts to cover additional products and locations, using its early successes to build the business case to expand the program. It found that it could scale more effectively by utilizing centralized capabilities to manage data and technology and grouping similar accounts into segments to personalize on a one-to-few basis. Consequently, Thomson Reuters has been able to dramatically increase renewals and consistently grow revenues at above-market rates.

ABE holds enormous promise for B2B companies. Those that don’t invest in building ABE programs risk falling behind rivals, providing subpar experiences for their best customers, and missing opportunities they may not even be aware of. There’s no excuse for not getting going with a pilot right away, although scaling an ABE program to include a larger number of accounts spanning geographic areas, customer segments, and product categories will require careful planning, committed execution, and large-scale change management.

At its core, ABE is all about integrating marketing, sales, and service tightly, breaking through the cultural divisions in organizations, and engaging more deeply and effectively with the customers that will matter most for your business success moving forward. This new approach must be rooted in a deeper understanding of the higher expectations that customers have of being engaged by sellers in ways that reflect and anticipate their needs. Companies that rise to this challenge will be rewarded with higher retention, advocacy, and lifetime business value from their customer relationships. What could be more important than that?