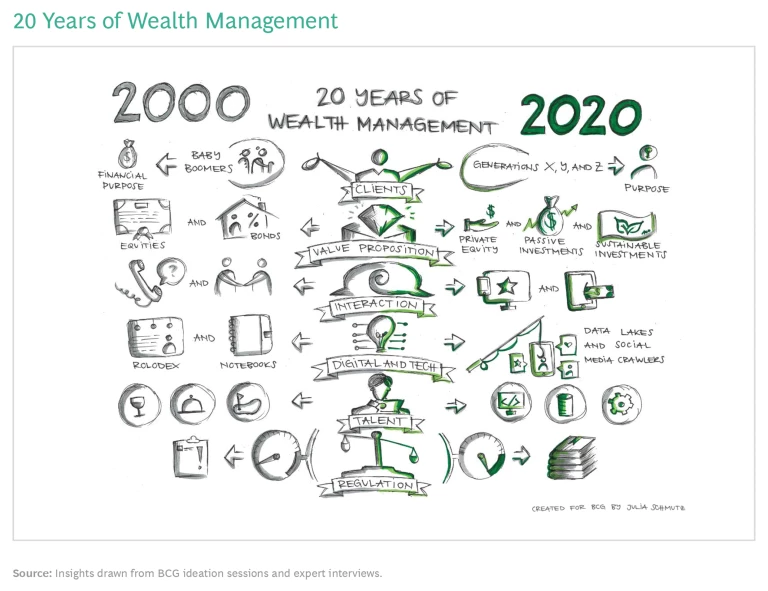

The wealth management industry is over 200 years old. Yet for most of that history, providers have operated according to the same general playbook. It took the massive digital and regulatory disruption of the past 20 years to begin shaking up industry business models, and evidence suggests that most providers have moved slowly, with many still adhering to traditional ways of private banking. (See the exhibit.)

Among the major obstacles to change are fear of losing key relationship managers (RMs) and clients, a belief that the high-touch model is crucial to success, and the ten-year bull market, which shielded players from having to make tough decisions sooner. Despite a significantly larger asset and client base, however, the industry’s profit pool remains about the same as it was more than a decade ago, having reached just $135 billion in 2019 compared with $130 billion in 2007.

The COVID-19 pandemic—for all its devastating impacts—is a wakeup call. Wealth management providers should heed that call and recommit themselves to the improvement efforts they have long needed to make.

This is BCG’s 20th year of producing our Global Wealth Report. Our 20-year vantage point—along with the data that we have amassed over that period—allows us to distill important patterns in the nature of wealth growth and provide an outlook on the years ahead.

One striking feature of wealth growth over the past two decades has been its extraordinary resilience. Despite multiple crises, wealth growth has proved to be stubbornly robust, springing back from even the most severe tests. Today there is more wealth in more hands, and the wealth gap separating mature markets and growth markets at the beginning of the century has narrowed dramatically. Over the past 20 years, personal financial wealth globally has nearly tripled, rising from $80 trillion in 1999 to $226 trillion at the end of 2019.

Nevertheless, effectively serving the world’s wealthy is going to get far more complicated in the years ahead. As the demographics of wealth shift, so will the needs and expectations of wealth clients. In addition, the disruptive forces that emerged at the beginning of the century are accelerating. As digitization lowers barriers to entry to wealth management as a business, competition will intensify and offerings that once provided differentiation will face commoditization.

Fittingly for our 20th anniversary, this year’s report takes a 20-20 view, looking back over the past two decades and ahead to 2040. Our review of global market sizing, which encompasses 97 markets, provides a detailed retrospective. In addition, we evaluate the potential long-term impact of the COVID-19 crisis and consider whether the resiliency of wealth growth will endure.

This year’s report also includes a vision of the future of wealth management, based on ideation sessions and interviews held with clients, experts, next-generation individuals, and industry professionals. (Several artistic renderings from those sessions are featured in this report.) We examine how the industry’s value proposition and offerings will change over the next two decades, how interaction models will evolve, and which successful business models will emerge. We close with a checklist outlining what leaders must do in the months and years ahead to prepare for that future. Our CEO agenda lists specific actions that will enable organizations to address the demands of the present environment and manage their profitability while transforming their businesses to thrive in the future.

As always with our annual global wealth reports, our goal is to present a clear and complete portrait of the business and to offer thought-provoking perspectives on issues that affect all types of players in their pursuit of innovation, growth, and profitability.