Industrial companies have an enormous carbon footprint. Their production and logistics operations account for more than half of all global carbon dioxide equivalent (CO2e) emissions from fuel combustion. Considering current trends, emissions from production and logistics would need to decrease by approximately 45% by 2030 to be on a path to meet the Paris Agreement’s 1.5°C target for limiting the global temperature increase. As longstanding environmental concerns intensify, industrial companies are feeling increasing economic pressure to tackle the problem.

Recognizing the need for action, leading companies are implementing initiatives to decarbonize their operations. Moreover, some companies have gone further and started to require their business partners in the supply chain to demonstrate a commitment to decarbonization as well. The result is a convergence of environmental and economic imperatives that all industrial companies must be prepared to address. The solution is a concept that we call “the green factory of the future,” in which the integrated application of decarbonization measures reduces net emissions to zero.

To better understand the opportunities and challenges that decarbonization presents, a BCG study examined expectations for and adoption of decarbonization measures in industrial operations. The study focused on the results of a global survey of nearly 1,200 operations executives from numerous producing industries. (See “About the Study.”) This survey was conducted before the COVID-19 pandemic spread globally. However, although the pandemic has altered some short-term priorities, the climate challenge and the urgency to respond to it remain unchanged . In the middle term, the actions described in this report will continue to be relevant and may even have gained significance. Indeed, as companies revamp their strategies to win the post-pandemic future , they have a unique opportunity to focus on climate action.

About the Study

About the Study

BCG conducted a survey of industrial companies’ executives and operations managers to assess their progress toward implementing decarbonization measures in operations. We defined industrial operations as producers’ core transformation processes, including production and such related functions as maintenance, product quality, and logistics (inbound, in-plant, interplant, and outbound).

We selected the survey participants at random from 1,188 global companies of at least 250 employees each. The companies represent a broad array of producing industries: automotive, consumer goods, engineered products, health care (pharmaceuticals and medical technology), materials and process industries, and technology (telecommunications and IT equipment). The participants were based in Austria, Brazil, Canada, China, France, Germany, India, Japan, Mexico, Poland, the UK, and the US.

The survey sought to evaluate the participants’ current degree of implementation of decarbonization measures in their operations and their motivation to implement further measures. It also sought to identify the most important levers affecting implementation, as well as the major challenges and enablers. In addition, the survey asked about the benefits that participants expect to gain from decarbonization.

Our study’s analyses focused exclusively on industrial-sector emissions resulting from fuel combustion. In order to pinpoint the relevant issues for industrial companies, we chose not to consider other important sources of emissions, such as the agriculture sector, or other specific types of emissions, such as waste and fugitive emissions.

The study found that industrial companies want to reduce their carbon footprint, with more than three-quarters of them viewing decarbonization as a high priority. So far, however, most companies have struggled to achieve their goals. Only 13% of survey respondents say that their company has fully implemented decarbonization measures in their production and logistics. The biggest obstacle to more aggressive action seems to be concern that the initiatives will raise conversion costs.

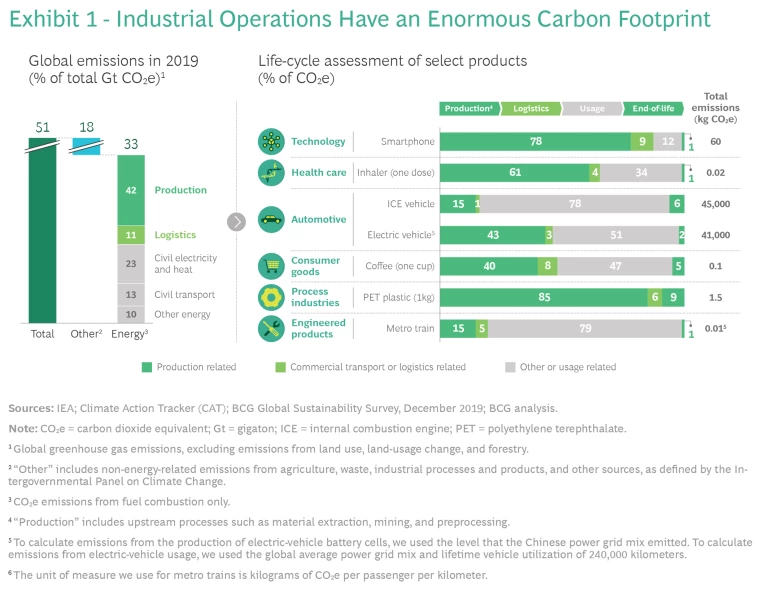

Industrial production and logistics operations account for more than half of global CO2e emissions from fuel combustion.

We believe that industrial companies should not regard environmental sustainability as a threat to economic sustainability. Indeed, as pressure intensifies to pursue decarbonization throughout the industrial supply chain, environmental and economic sustainability will become increasingly difficult to separate. Although the challenges are significant, the results of our study show that companies can implement win-win actions that benefit the environment and create financial value. The keys to success are to identify the most effective decarbonization measures and to evaluate the economic impact of adopting these measures in a way that considers factors beyond conversion costs—such as getting ahead of regulations, attracting investors, and winning new customers. By using a rigorous evaluation process, a company can ensure that environmental and economic sustainability go hand in hand in the green factory of the future.

Why Sustainability Matters in Operations

Our study focused on environmental sustainability in industrial operations, comprising production and logistics. We gave special emphasis to greenhouse gas (GHG) emissions, which are predominantly CO2 but also include such gases as methane and nitrous oxide. (See “The Basics of Sustainability in Operations.”)

The Basics of Sustainability in Operations

The Basics of Sustainability in Operations

Sustainability has three pillars, each of which is relevant to industrial operations:

- Social—for example, integrating an aging workforce into digitally enabled jobs, and creating an ergonomic working environment

- Environmental—for example, achieving carbon-neutral production)

- Economic—for example, contributing to the company’s profitability and long-term economic growth

These pillars—informally known as “people, planet, and profits”—are tightly interwoven. As emissions regulations become more numerous and more stringent, a company’s economic success will depend increasingly on its ability to become environmentally sustainable. For example, as of 2019, 46 countries had launched initiatives to establish a price for CO2 emissions, either through a tax on emissions or through certificates that offset emissions. Compliance with such regulations directly impacts companies’ economic performance. Social sustainability is implicated, too. For example, as public awareness of the need for environmental sustainability increases, employees can better relate to a company with a strong environmental agenda and will feel more satisfied working there.

Although the pillars are interconnected, our study focused on environmental sustainability as a pivotal element of a company’s long-term success. Of the many topics relevant to environmental sustainability in operations, four are especially prominent:

- GHG Emissions. For example, emissions from coking and from reduction of iron ore through coking in steel production

- Water Usage. For example, extensive use of water for hydraulic fracking

- Waste Production. For example, the production of 1.5 metric tons of bauxite residue per ton of alumina

- Biodiversity Impacts. For example, effects from the use of pesticides in agriculture

Although industrial companies must address each of these topics, we focused on GHG emissions in operations that result from fuel combustion. The Greenhouse Gas Protocol, an organization that provides global standards, categorizes GHG emissions into three scopes. Our study encompassed all three:

- Scope 1. Direct GHG emissions from sources owned or controlled by the company; for example, emissions from chemical production

- Scope 2. Indirect GHG emissions from electricity purchased by a company—for example, emissions from electricity produced in a coal-fueled power plant

- Scope 3. Other indirect GHG emissions not controlled by a company—for example, emissions arising from the transportation of material from suppliers or the use of a product during its lifetime

Achieving environmental sustainability through reduced GHG emissions is an essential element of The Factory of the Future and is integrated into all of its dimensions. These dimensions include structure (for example, improving the insulation of the factory building), processes (for example, optimizing the routing of logistics vehicles in the plant), and technology and digitization (for example, monitoring energy usage of machinery equipment and automating the shutoff of equipment).

As noted earlier, industrial operations are responsible for a significant share of global GHG emissions. CO2e, the standard unit for measuring GHG emissions, estimates how much of a contribution a given quantity and type of GHG may make toward global warming. Production accounts for more than 40% of global CO2e emissions from fuel combustion, and commercial logistics accounts for more than 10%. (See Exhibit 1.)

The share of CO2e emissions attributable to production- and logistics-related activities depends on the product, as the life-cycle assessment in Exhibit 1 illustrates. For example, for a car powered by an internal combustion engine (ICE), the share of emissions attributable to production is relatively low (15%), whereas 78% of emissions result from operating the car. In contrast, for a battery-powered electric vehicle (EV), nearly 43% of emissions are attributable to production, mainly owing to battery production, which is quite energy intensive. For this reason, although it may seem counterintuitive, the lifetime emissions for EVs are almost the same as those for ICE vehicles. We based our life-cycle assessment for EV batteries on production in China, where battery producers and power companies depend, to a significant degree, on electricity from a power grid that relies on emissions-heavy hard coal, lignite, and natural gas. To calculate emissions from EV utilization, we used the global average power-grid mix.

Leading companies are taking action to reduce their operations’ carbon footprint. For example, the Volkswagen Group has announced that its ID.3 EVs will be the first model manufactured at its Zwickau plant using carbon-neutral production. The automaker hopes to achieve carbon-neutral production for its entire fleet by 2050.

Daimler has announced an even more aggressive time frame for decarbonization. The automaker wants its entire fleet of passenger cars to be carbon neutral by 2039. It also intends to make its assembly plants carbon neutral by 2022, by transitioning from coal-based electricity to energy generated exclusively from renewable resources. Looking beyond its own operations, Daimler is requiring its suppliers to adopt its standards for decarbonization. Other large automakers have imposed similar requirements. As a result, having a climate-friendly production process in place has become table stakes for winning their business.

Various stakeholders are demanding that companies transition to environmentally sustainable operations . For example, BlackRock, a leading investment management company, has announced that sustainability will become its “new standard for investing” and an integral part of its strategy for increasing long-term returns.

Industrial companies’ management teams seem to recognize the need for action. Among study participants, more than 75% say that carbon neutrality is either the most important initiative at their company or one of the top three initiatives. When asked their main reason for seeking to decarbonize operations, 28% of respondents cite the need to meet regulatory requirements, and 25% point to reducing conversion costs. Only 15% say that customer demand is their primary reason.

Envisioning the Green Factory of the Future

Given the clear need for action to reduce GHG emissions in operations, what targets are reasonable? Companies usually discuss goals for reducing GHG emissions in terms of meeting the 1.5°C target derived from the 2015 Paris Agreement, in which more than 190 countries committed to taking steps to limit the global average temperature increase to 1.5°C above pre-industrial levels. To achieve the 1.5°C target, countries would need to reduce their overall net emissions to zero by around 2050, with incremental reductions along the way. Unfortunately, many countries—including the top five emitters (China, the US, the European Union, India, and Russia)—are falling short of meeting their goals. The concrete actions we discuss below can bolster efforts to achieve the target.

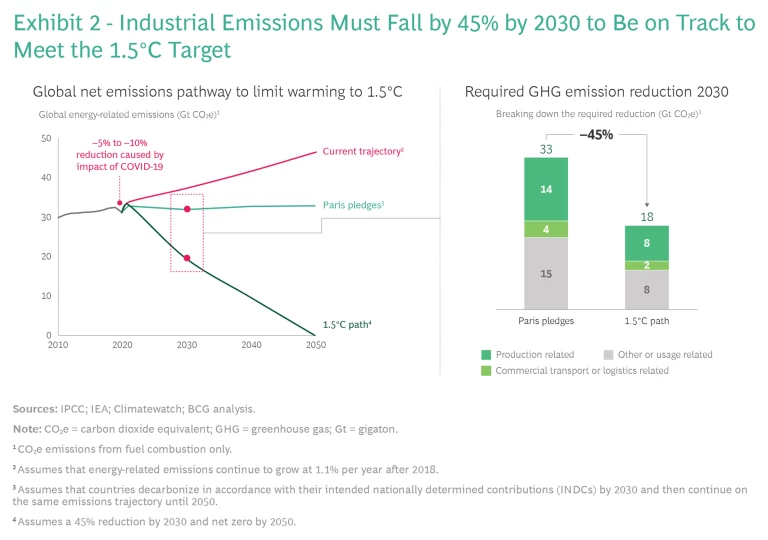

As of 2019, global GHG emissions from fuel combustion totaled approximately 33 gigatons of CO2e (Gt CO2e). To be on a path to achieve the 1.5°C target, net emissions would need to fall to 18 Gt CO2e by 2030. However, extrapolating the current trend for global emissions to 2030 yields emissions of 33 Gt CO2e—a shortfall of 15 Gt CO2e against the incremental goal for meeting the 1.5°C target. To close this gap by 2030, GHG emissions from production and logistics would have to decrease by 45% relative to the current trend. (See Exhibit 2.) From that point, incremental reductions would have to continue for two more decades until net emissions dropped to zero.

How can a company help close the gap? To reduce its operations-related GHG emissions, a company can avoid, reuse or store, or offset or compensate for emissions. Each category of actions includes one or more abatement levers. For each lever, we present examples of the most important applications in industrial operations, as confirmed by study participants. (See Exhibit 3.)

Avoid. A company can avoid emissions by increasing its energy efficiency or by changing how it conducts or powers its operations:

- Increase efficiency. A company can use several approaches to increase its efficiency. First, to improve the energy efficiency of its operations, it can apply operational excellence levers that improve operational performance and emission levels simultaneously. The primary levers include reducing scrap rates and machine idling time and optimizing layouts to reduce the complexity of logistics processes. These actions enable a company to directly cut emissions by reducing waste, process emissions, and energy consumption. A company can also take steps to generate, use, and recover heat more efficiently. Examples include using high-efficiency burners that also recover waste heat, introducing heat exchangers that connect co-located users, or installing heat pumps that raise the temperature of waste heat to a usable level. Second, to minimize the distances that parts travel in its supply chain, a company can use intermodal transportation to optimize its logistics network and materials handling. Third, to reduce consumption, it can deploy energy monitoring, management, and steering systems (for example, deploying a stop-and-go mechanism for machinery that triggers a shutoff when the equipment is not in active use, or installing air pressure systems to facilitate leak detection). One way to increase logistical efficiency is to replace human control with an automated system that guides or controls vehicles. For instance, Rio Tinto, one of the world’s largest metals and mining companies, has launched a project called AutoHaul to automate trains that transport iron ore to its port facilities in Western Australia. The system autonomously conducts nearly two-thirds of all train kilometers, permitting more-efficient operations that have reduced fuel use by 13%.

- Change processes or technology. A company can change its core production processes or technology in order to substitute a low-emissions process for a high-emissions process. For example, SSAB, which seeks to achieve carbon-neutral steel production by 2026, is cutting CO2 emissions by replacing the coal-coking process traditionally used for ore-based steelmaking with a process powered by fossil-free electricity and hydrogen. Other examples include using rail transportation instead of trucks and replacing conventional manufacturing with 3D printing to minimize waste, packaging, and transport emissions. For instance, by the end of 2019, Boeing had used 70,000 3D-printed parts in its commercial and defense aircraft.

- Switch fuel or power source. A company can use other energy sources in place of fossil fuels and fossil- fuel-based power generation. Options include using electricity generated from renewable sources (for example, solar and wind) rather than coal, using internal combined heat and power (known as CHP) fueled by biomass in place of natural gas, and using electricity rather than diesel to power forklifts. For example, Mercedes-Benz’s Bangkok plant, which is on track to achieve carbon-neutral production starting in 2022, uses large solar-powered systems on its roof to generate electricity. The company stores the excess power in a stationary second-life battery storage system that uses recycled electric vehicle batteries.

One way to increase logistical efficiency is to replace human control with an automated system that guides or controls vehicles.

Reuse or Store. A company can apply two main levers to reuse or store carbon emissions:

- Recycle and remanufacture. A company can convert waste into reusable material (recycling), or it can reuse existing parts to produce new equivalent products (remanufacturing). For recycling, one prominent use case is the introduction of a closed-loop system involving local recycling of materials (often plastics) to create new products. Using recycled materials requires significantly less energy than using virgin materials does. For instance, recycling aluminum requires up to 95% less energy than producing the primary metal from bauxite, and thus avoids the corresponding emissions. A good example from the construction industry involves the efforts of HeidelbergCement, which has cofounded a recycling company called Rewinn that produces construction aggregates by recycling concrete from demolition sites. The company has the capacity to produce up to 250,000 metric tons of aggregates annually through recycling. As an example of remanufacturing, a heavy-duty engine manufacturer offers its clients a choice for machine maintenance and refurbishment: they can opt for newly manufactured spare parts or for fully functional used parts at a lower price.

- Capture carbon, and use or store it. A company can capture carbon emitted as a byproduct of production processes and use or store the carbon to prevent its release. For example, Thyssenkrupp Steel plans to reuse carbon through a new method it is developing called Carbon2Chem. This method converts gases produced during steel production into base chemicals that can be used to make fertilizers, plastics, or fuels. Meanwhile, Carbon Recycling International, an Icelandic company, has developed a technology that helps transform CO2 emissions into methanol via direct hydrogenation of captured CO2. The company plans to deploy this technology at scale in the chemicals industry as the first step toward commercializing it.

Offset or Compensate. A company can compensate for its CO2 emissions through offsetting measures. Such measures can be unrelated to the company’s own production or logistics. For example, Willmott Dixon, a UK-based construction company, has partnered with Natural Capital Partners to select and execute carbon-reducing projects that provide social benefits to local communities. These benefits advance the goals of the foundation that Willmott Dixon has established to promote social causes. The projects include preserving 47,000 hectares of a carbon-dense tropical peat swamp in Borneo that was in danger of being converted into palm oil plantations. Most companies, however, view offsetting as a complement to other abatement levers, rather than as a standalone solution with significant independent impact. For example, Bosch is using offsetting as an interim solution to accelerate its progress toward carbon neutrality. As the company increases the share of renewable energy in its production through 2030, it will compensate for unavoidable CO2 emissions through carbon offsets.

Companies Lag Behind Their Ambitions

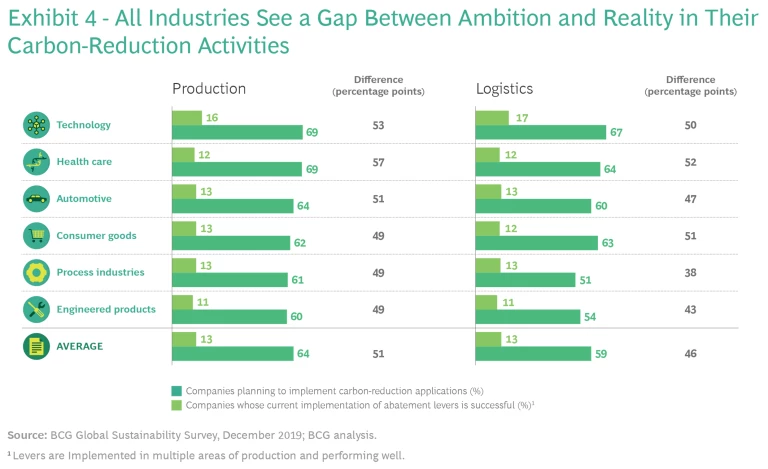

More than 60% of study participants say that their company plans to implement decarbonization measures. And more than 90% of participants say that their company will dedicate a portion of its manufacturing investment budget to decarbonization measures in the next three years. Among those participants, roughly half say that the company will spend more than 10% of its available manufacturing investment budget on decarbonization in the next three years.

To realize their ambitions, companies must improve how they implement their plans. Although we see promising examples and high ambitions, many previous efforts to implement decarbonization measures have not been very successful. Only 13% of participants report that their company has fully implemented decarbonization measures in their production and logistics.

Exhibit 4 shows the gap between future ambitions and current implementation status from an industry perspective, separately for production and for logistics. The technology industry has the highest ambition to reduce carbon emissions. Already, many companies that produce IT and technology equipment and hardware have the necessary capabilities to develop and implement decarbonization measures. In addition, many technology companies are highly motivated to address sustainability issues. For example, Microsoft has announced plans to become “carbon negative” (removing more carbon from the atmosphere than it emits) by 2030. Beyond that, it plans to erase by 2050 a volume of carbon equal to all of its emissions since its founding in 1975.

Although many companies have good intentions and plan to implement decarbonization measures, in most instances they have not set science-based targets for measuring their success. Worldwide, only about 330 companies have established science-based targets for decarbonization, according to a collaborative initiative that monitors such efforts. That number represents a tiny fraction of the more than 10 million companies that would need to decarbonize their operations in order to comply with the Paris Agreement’s CO2 emissions goal. Moreover, no company in China, the world’s largest emitter, has approved science-based targets.

After China, the world’s two top emitters are the US and the EU. Together, these three sources account for more than 50% of global GHG emissions. Despite their tendency not to set science-based targets, companies in these countries are highly ambitious to reduce their carbon footprint in the future. Companies in China have the highest ambitions, motivated by rising public demand for environmental sustainability and by higher taxes on emissions. Companies in the EU are experiencing similar pressure to take action. For example, Germany plans to introduce a CO2 tax on fossils fuels (including gas) of €25 per ton of emitted CO2 in 2021, with a planned increase to €55 per ton by 2025. And Sweden has enacted statutory decarbonization roadmaps for specific industries.

Economic and Environmental Sustainability Go Hand in Hand

Although study participants indicate that companies are committed to reducing carbon emissions, concerns about incurring higher costs pose a major obstacle to taking necessary action in support of these good intentions. Nearly two-thirds of participants (63%) believe that decarbonization will increase their conversion costs (total manufacturing costs minus material costs) by 2030. Only 21% believe that they can lower their conversion costs through decarbonization by 2030. A similar picture emerges in connection with the development of investments and implementation costs for carbon-reduction applications: 63% of participants believe that these costs will increase during the next five years, versus only 18% who believe that they will decrease.

Unavoidably, some decarbonization measures will increase conversion costs or require additional investments. Nevertheless, by selecting the right measures, a company can implement win-win actions that help the environment and generate financial value. In general, decarbonization applications can yield a positive business case in one of three ways:

- Intrinsically. Many measures (such as installing compressed air systems) can reduce conversion costs by improving energy efficiency, repaying the investment within a reasonable time frame. Still, the payback time frame may exceed the two-year period that companies typically expect.

- Through Subsidies. For example, although installing better insulation in factory buildings reduces heating requirements, companies need government subsidies in order to recoup the investment within a reasonable time frame.

- Through Avoidance of a CO2 Tax. By optimizing its manufacturing footprint, a company can reduce travel distances in its logistics operations and may thereby avoid a CO2 tax. CO2 taxes are likely to rise quickly during the next few years—much faster than the time that will be needed to change production systems. As a result, companies that move fastest to optimize their footprint and systems to avoid carbon taxes will gain a competitive advantage in the near term.

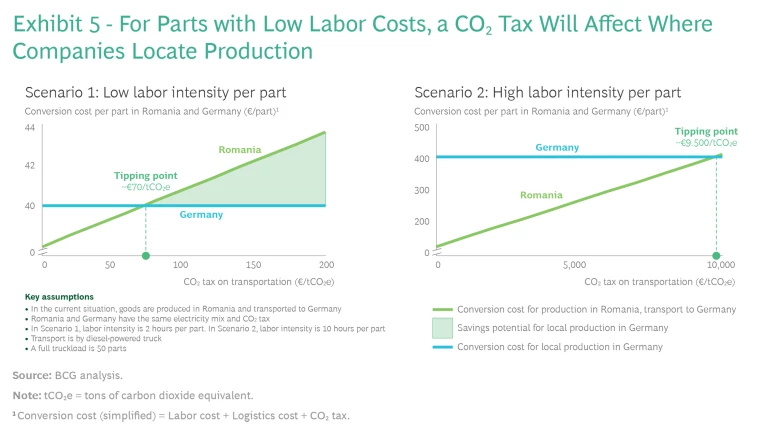

As of 2019, 46 countries (responsible for approximately 20% of global GHG emissions) had implemented CO2 taxes or certificates to promote decarbonization. The pricing of CO2e emissions varies widely among countries. Sweden’s tax of €114 per metric ton of CO2 (tCO2) is currently the world’s highest. The CO2 tax rate affects a company’s optimum manufacturing footprint. BCG has modeled the tipping point at which potential savings from tax avoidance make it economically attractive to relocate manufacturing operations from one country to another. (See Exhibit 5.)

The various assumptions underlying this model include the distance between the respective countries where the parts are produced and received, the transportation mode, the parts per truckload, the labor costs in the producing and receiving countries, and the labor requirements per part. In the example shown in Exhibit 5, the receiving country is Germany and the producing country is Romania. We calculated the conversion costs (including logistics costs and CO2 tax) for producing in Romania as the base case, and we calculated the costs for producing in Germany as a potential new production location, in both cases as a function of the CO2 tax rate on transportation.

For a part that requires low labor intensity (2 hours per part) to produce, the tipping point for the CO2 tax is approximately €70 per tCO2. If the CO2 tax exceeds €70 per tCO2e, producing in Germany entails lower conversion costs than producing in Romania, indicating a business case for relocating production to Germany. For a part that requires high labor intensity (10 hours per part) to produce, the tipping point is approximately €9,500 per tCO2e. Since the highest CO2 tax worldwide is €114 per tCO2, relocating production of parts with high labor intensity from Romania to Germany would not be warranted—the labor arbitrage benefits of producing in Romania significantly exceed the costs arising from current CO2 tax rates on emissions.

Management teams should move beyond debating whether decarbonizing operations is the right move for their company.

Our survey respondents indicated that their companies see regulation as critical to enabling further implementation of decarbonization measures, including changes to the manufacturing footprint. Approximately 60% of participants view governmental pull (such as subsidies) and push (such as a CO2 tax) as being the most important factor for motivating implementation of more decarbonization measures in their operations. Only 22% say that reduced investment cost is the most important factor, and just 9% point to stronger demand from customers.

Several companies have demonstrated that decarbonization measures can simultaneously improve business performance and help the environment:

- Bentley Motors has implemented an innovative energy management system that targets energy fissures and energy consumption by its plant’s boiler and compressed air system. The energy management system has reduced energy usage for the production of each car by two-thirds and for the entire plant by 14%.

- Coca-Cola is participating in an industry partnership in Sweden that reuses pallets. The partnership estimates that the reusable pallets will reduce costs by $700 million and waste by 25% in Sweden, as well as cutting transportation emissions and energy use.

- Dalmia Cement, a global leader in producing cement with a lower carbon footprint, sources 32% of its raw materials from industrial waste. The company’s CAGR of 23% for revenue over the past five years corroborates its belief that sustainability creates value. Further pursuing its strategy of converting waste into wealth, Dalmia recently announced that it plans to build a large-scale carbon capture facility with a capacity of 500,000 tons per year. The facility will be integral to the company’s goal of becoming the world’s first carbon-negative cement producer by 2040.

- Tata Steel has created an advanced analytics team that uses AI and machine learning to optimize production processes. The team has developed an algorithm to manage the heating process for liquid raw iron. Besides decreasing materials waste significantly, the team’s efforts have generated annual cash savings of €50 million.

Getting Started

Management teams should move beyond debating whether decarbonizing operations is the right move for their company. As Daimler, VW, and other leading players make commitment to decarbonization an explicit criterion for supplier selection, it is clear that every industrial company must take action on this front to remain competitive. Simply providing the “best cost” is becoming less relevant to winning business.

To successfully implement decarbonization measures, a company needs to adopt a structured three-step approach:

- Assess the carbon footprint. The company should conduct a structured assessment of the CO2 emissions that its operations generate, including production and logistics throughout its supply chain. The assessment should cover Scopes 1 through 3 of GHG emissions—direct, indirect from electricity, and other indirect. (For more on these scopes, see the sidebar “The Basics of Sustainability in Operations.”) To obtain an external perspective, the company should benchmark its carbon footprint against the corresponding footprints of its industry peers. Improved transparency is essential for defining specific reduction targets and measures. To quantify its emissions, a company should apply national or international standards, such as those established by the International Organization for Standardization or by the EU. This will enable the company to use its findings for official reporting purposes—for example, with respect to CO2 taxes or emissions trading systems, as these are in effect in the EU.

- Develop realistic targets. The company needs to set short-, medium-, and long-term decarbonization targets that are based on rigorous cost-benefit analysis and aligned with the aspirations and requirements of all relevant stakeholders, including employees, customers, governments, and shareholders.

- Define specific measures. The company should carefully select its decarbonization measures to ensure that they provide both environmental and economic benefits. In evaluating applications, the company should consider not only conversion cost savings, but also such financial benefits as opportunities to earn additional revenues. To facilitate its selection process, the company should compile a comprehensive list of potential use cases, including a preliminary cost-benefit analysis and potential technology partners for each application.

Industrial companies should regard efforts to decarbonize operations as integral to their strategy for maintaining competitiveness in the post-pandemic future. In recent years, as the effects of climate change have become increasingly visible, demands for action—by the public, by governments, and by leading companies—have grown louder and more specific. There is a strong possibility that these demands will intensify quite radically as stakeholders recognize the importance of environmental resilience in promoting a recovery from the current crisis. In view of the multiyear time frame required to successfully implement decarbonization measures in complex production systems and supply chains, companies should begin systemically ramping up their activities immediately. Indeed, the next few years may well be the turning point. As others have observed, we are the first generation to witness the effects of climate change and also the last generation with the ability to prevent those effects from irreversibly harming our planet.

About BCG’s Innovation Center for Operations

BCG’s Innovation Center for Operations is an ecosystem for exploring the factory of the future. The ICO’s objective is to support all operational functions, including manufacturing, engineering, and supply chain management. We offer a variety of resources, facilities, and expertise in support of Industry 4.0 implementation. Among these resources is a network of Industry 4.0 model factories in multiple locations. The model factories, which BCG makes available in collaboration with best-in-class partners, allow clients to experiment and assess Industry 4.0 solutions—such as collaborative robots, 3D printing, augmented reality, and big data—with real assembly and production lines and machines that demonstrate new technologies. Additionally, BCG experts can bring the ICO’s mobile labs directly to client sites to demonstrate potential impact and opportunities. The ICO seeks to improve companies’ competitive advantage by helping them realize benefits in productivity, quality, flexibility, and speed. The center reinforces our commitment to innovation, Industry 4.0, and the use of advanced technologies in operations.

BCG’s Center for Climate & Sustainability

We partner with clients across the public, private, and social sectors to align their strategy, operations, and stakeholder engagement with a low-carbon world. Our work is supported by BCG’s range of consulting experience across all industries and capabilities, as well as by our expanding reach of brands.